As recently as last month, OPEC (Organization of Petroleum Exporting Countries) and its representatives suggested that they had no intention of cutting crude oil production for the remainder of 2023. It was only a month ago that rumors swirled around whether UAE would leave the cartel to pursue its own long-term production growth aspirations. That was all turned on its head on Sunday, when OPEC (including UAE) announced a production cut, that when combined with Russia, will take 1.65 MMbls/d (million barrels per day) offline from May through year-end 2023. This is in addition to the 2 MMbls/d cut announced last October, which is still in effect.

As expected, crude oil markets applauded the move, with the front month WTI contract +6% as of the time of the writing, which is roughly where it has been all day at a price/barrel of just over $80. What made OPEC act now (there was no scheduled meeting), and what impact will this have on energy markets longer-term?

Saudi Arabia is the primary producer and de facto leader of OPEC, responsible for 36% of the 13-member group’s February 2023 output of 28.9 MMbls/d. They have expressed recent frustration at the price of oil, namely, the seeming disconnect between the physical market (where traders buy/sell oil for immediate use/delivery) and the paper market (futures contracts, which include speculators and hedge positions). Though certainly weaker than last summer, the physical market has held up much better than the paper market, suggesting market participants are trying to get in front of an expected economic slowdown that could curtail oil demand.

Separately, the Saudi’s have not appreciated the moves made by the Biden administration to use its excess supply to ease oil prices over the last couple years. The SPR (Strategic Petroleum Reserve), created in the wake of the 1970’s Arab oil embargo as a measure of national defense, was turned into a political lightning rod with the government releasing 221 MMbls over the course of 2022, drawing the inventory down to levels not seen since 1983.

To be fair, ingenuity and resilience shown by the domestic oil industry has positioned the US as an energy powerhouse, far less dependent on foreign imports when compared to the 1970/1980’s. A case could certainly be made that we don’t need 713.5 MMbls of oil (SPR capacity) sitting in salt caverns scattered along the gulf coast (for reference, the current inventory is 371.6 MMbls). Even so, in late 2022, the administration had hinted at partially refilling the SPR once prices reached the ~$70/bbl level. In the minds of many, including perhaps the Saudi’s, this would serve as a pseudo floor wherein the US could be counted on as a price supporter as opposed to the pressure they had applied over the preceding months.

Surely the Saudi’s might not have been thrilled when US Energy Secretary, Jennifer Granholm, came out two weeks ago saying plans to refill the SPR will take years, and likely won’t begin in 2023. Planned maintenance at two of the four storage sites and the fact that another 26 MMbls draw is scheduled between April-June (a Congressionally-mandated, federal budget-aiding measure passed years ago) makes a refill in the near-term simply impractical.

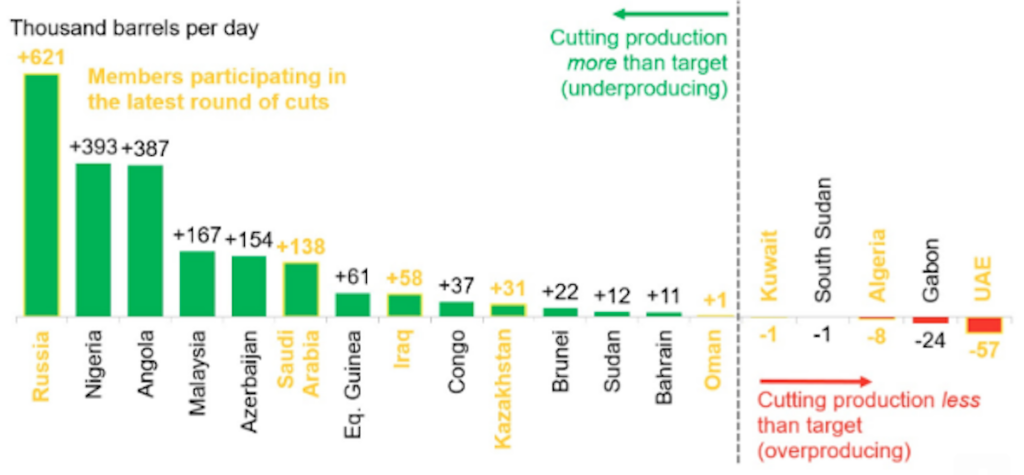

So perhaps the Saudi’s (and OPEC) had the motivation to make a move, but will it make more than a short-term difference? Let’s first take a look at what is being done. Not all OPEC members are participating in this cut:

Source: OPEC, *non-OPEC countries participating in the cut

The voluntary nature of this move is somewhat unique. It is worth noting that of the participating members, many are cutting from a position of strength, meaning they have spare capacity. In comparison, take the October announced OPEC+ cut; it included several members (namely Nigeria and Angola) that were producing so far below their quota, they could continue to grow production without hitting the newly announced cut threshold (meaning the nameplate 2 MMbls/d cut would never reach that volume in practice). This time around, only Russia is producing materially below their quota (which is voluntary anyway, given Russia isn’t an OPEC member). Russia had previously announced its own 500,000 bls/d cut to begin last month, and coincident with this OPEC announcement, they extended that cut through 2023. It is yet to be seen whether or not they will comply with their self-imposed sanctions, but they appear resolved as they seek to hit back over western-imposed export price caps affecting their own energy sector.

Source: BloombergNEF, as of 04.03.23

Ultimately, we believe this move will be more impactful in the short-term than the long-term. By cutting supply, OPEC is merely counteracting the negative demand sentiment surrounding crude. According to the US EIA (Energy Information Agency), implied domestic oil demand is still 8.7% below the high reached in July 2019. With many market commentators forecasting recession in the next 12 months, that deficit would only be expected to widen. This line of thinking is reflected in the paper markets referenced earlier; according to the CFTC’S (Commodity Futures Trading Commission) Commitment of Traders report as of March 28, large speculators were the least long crude going back to 2011 (which is another reason for the big price response in oil today – traders weren’t positioned for it). OPEC’s action sends a strong signal to the market that they intend to backstop the weakness typically witnessed in past economic contractions.

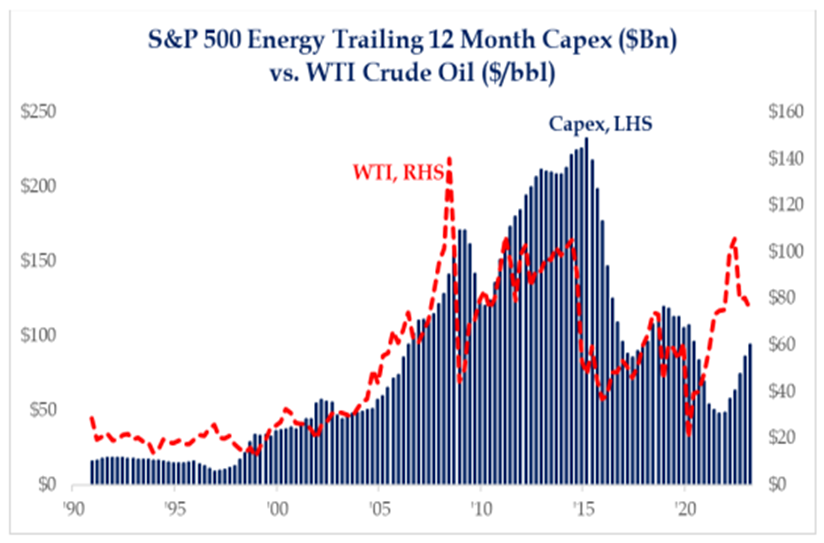

Longer-term, we believe structural undersupply borne by chronic underinvestment will support oil prices. After all, as quickly as OPEC can support markets by cutting supply, they can also bring it back into strong demand. What can’t be so easily manipulated is the type of long-cycle investment that has eluded global commodity markets over the last several years. This is seen perhaps most clearly here in the US, where investment has taken a backseat to shareholder-friendly cash return policies. Even with rampant oil service cost inflation, nominal capital expenditures still haven’t retaken 2018/2019 levels, much less the early part of the decade. This has global implications, as the US is now the largest producer of crude oil and liquids products.

Source: Strategas, as of 03.16.23

Source: Strategas, as of 03.16.23

Our view for crude oil and energy more broadly supports near-term frustration (recession narratives and risk-off fears overtaking even this impactful move from OPEC) eventually giving way to sustainable upside for the industry. With material energy transition likely to take years longer than originally believed, this should provide a nice runway for energy companies to produce resilient cash flows which they are now generally dividending out to shareholders. Having coordinated support from OPEC should help smooth what could be a bumpy forward 6-12 months.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services offered are through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-ACA-2304-5.