For many, owning a home is primarily about having a place to live, fundamentally a form of consumption. However, real estate is often viewed as a safe bet for building wealth. While calculating the true returns on a home investment can be complex, especially when considering financing and opportunity costs, there’s an often-overlooked benefit of owning a primary residence: replacing rent payments with equity-building mortgage payments.

This post will explore a frequently overlooked benefit of homeownership—replacing the need to pay rent—and how this can significantly impact your investment return, even in challenging market conditions.

The Scenario

Let’s consider a hypothetical situation:

-

- You purchase a $500,000 home with a 30-year fixed-rate mortgage with a required 20% down payment ($100,000, borrowing the rest at a 7% mortgage rate).

-

- Annual insurance costs are $2,000 (roughly the national average).

-

- Property taxes and upkeep are assumed to be 1% of the home price, expected to increase at 3% per year.

-

- Given these assumptions, total monthly housing costs are approximately $3,700 (excluding the down payment).

-

- The alternative option of renting an identical home is $3,000 per month, with rent increasing at 3% per year.

Initially, buying appears more expensive: you’d save the $100,000 down payment and pay $8,000 less in the first year by renting.

The Surprising Outcome

Fast forward 30 years, and let’s assume a near worst-case scenario: you sell your home for the same $500,000 you paid, representing no nominal price appreciation. This might seem like a financial disaster – a $100,000 down payment, higher initial monthly costs than renting, and no price appreciation. However, the surprise twist is that your annualized return on investment compared to renting is 5.5% after taxes.

How Is This Possible?

To understand this counterintuitive result, let’s examine the Internal Rate of Return (IRR) calculation:

-

- Initial Investment: $100,000 down payment

-

- Annual Expenses: For simplicity, we chose values to make the present value of homeownership costs (excluding the down payment but including mortgage, insurance, taxes, and upkeep) equal to the cost of renting over the 30 year period at a 5% discount rate; while rent is initially cheaper, the fixed-rate mortgage means much of your payment doesn’t increase over time, making home ownership cheaper later and washing out over the full period.

-

- Sale Proceeds: $500,000 after 30 years.

The key is that you’re substituting homeownership costs for rent, effectively turning a pure expense into a means of building equity.

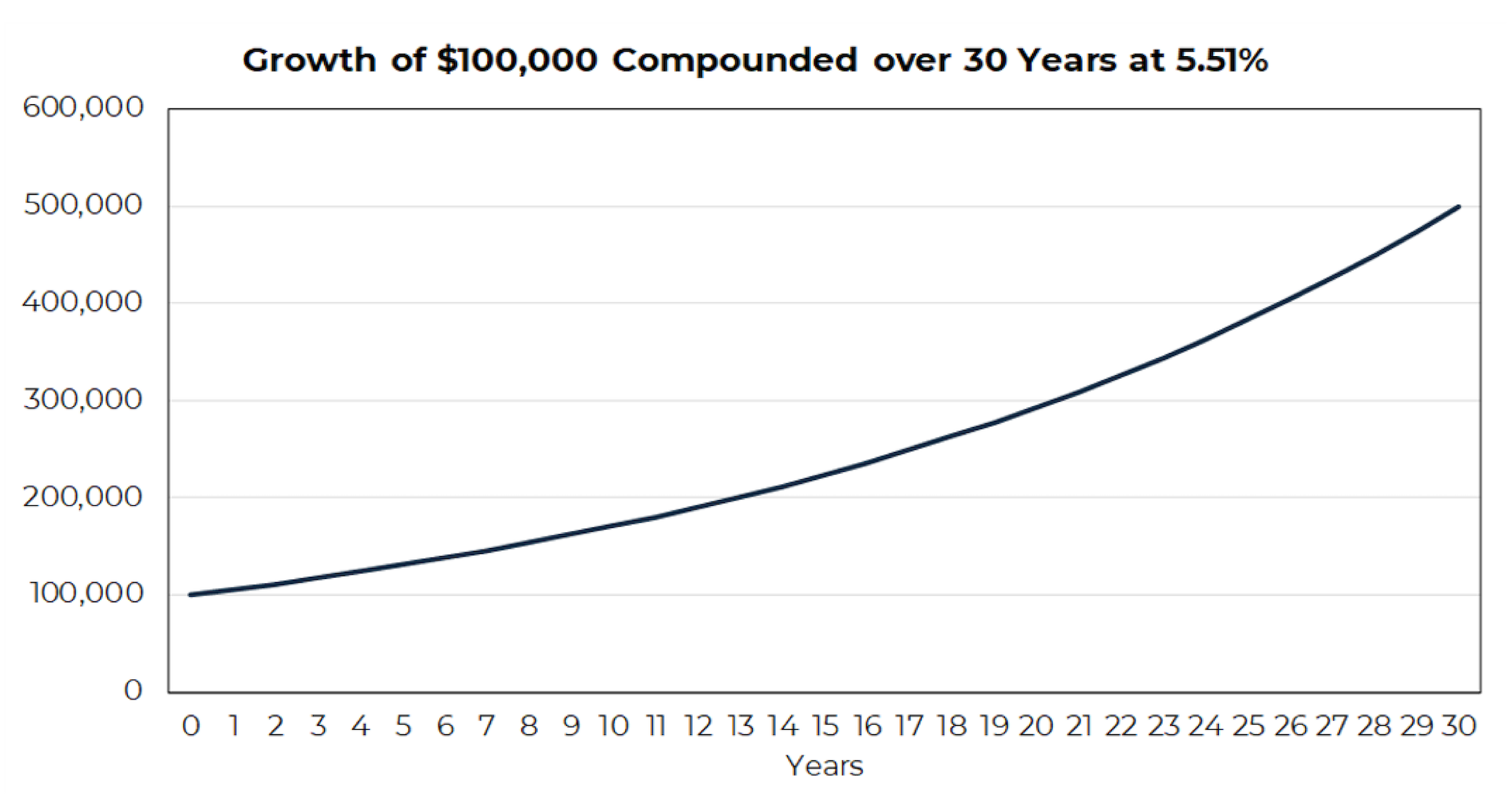

Let’s crunch the numbers. To calculate the return (IRR), solve for the rate (X) that equates the initial investment to the future value: $100,000 × (1 + X) ^ 30 = $500,000

Solving for X gives us approximately 5.5% despite no increase in the home’s value (chart showing this below). Given there is no no capital gain, there is also no capital gains tax, with the return driven by turning an expense (rent) into paying for the investment (turning into home equity).

Source: Aptus Calculations

Source: Aptus Calculations

Potential Upside Factors

Several factors can dramatically enhance this return:

-

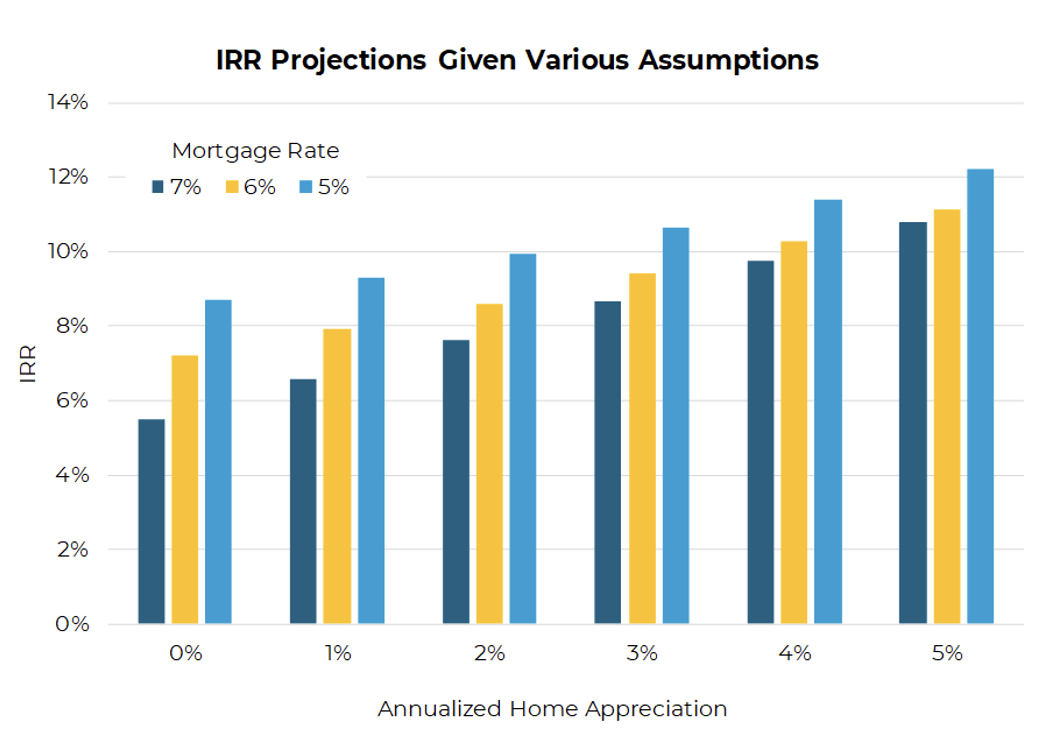

- Home Appreciation: If the home appreciated by just 3% annually (the lowest 30-year price increase for a median home since the 1960s per the Federal Reserve), the IRR jumps to ~8.6%.

-

- Interest Rates: A fixed-rate mortgage protects against rate increases and allows for refinancing if rates drop. A 5% rate instead of 7% would reduce monthly payments by almost 20%, increasing the IRR by nearly 3% to 8.7%.

Below are a variety of returns under various home appreciation and mortgage rate assumptions, using the same starting home ownership and rental values.

Source: Aptus Calculations

Source: Aptus Calculations

Potential Downside Factors

It’s important to acknowledge potential drawbacks:

-

- Elevated Mortgage Payments: Current high home prices and interest rates make mortgages unaffordable for many.

-

- Price-to-Rent is Out of Whack: In some areas, price-to-rent ratios are unfavorable compared to buying meaning the present value of rent is materially higher than owning.

-

- Illiquid Investments: Short-term ownership can be costly due to high transaction costs.

This analysis is most relevant (if not only relevant) for long-term homeowners. That said, should interest rates decrease in the future, potential long-term buyers might find more favorable opportunities despite elevated prices.

The Magic of Leverage

The key takeaway is the power of converting a recurring expense into an investment. This shift is amplified by fixed-rate mortgages, which protect against inflationary rent increases. While this example assumes a perfect balance between housing expenses and rent costs over 30 years, real-life scenarios may favor homeowners or renters at various parts of the business cycle.

Conclusion

Even in a flat-value scenario, leveraging a mortgage to finance a real estate investment can yield a respectable return if mortgage payments are within range of the renting alternative. By turning rent payments into mortgage payments, homeowners can build significant wealth over time. The ability to fix a large portion of housing costs with a mortgage, combined with the potential for appreciation, can make homeownership a powerful financial strategy. As market conditions evolve, particularly with potential decreases in interest rates, the opportunity for homeownership could become attractive even without a change in home valuations.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-34.