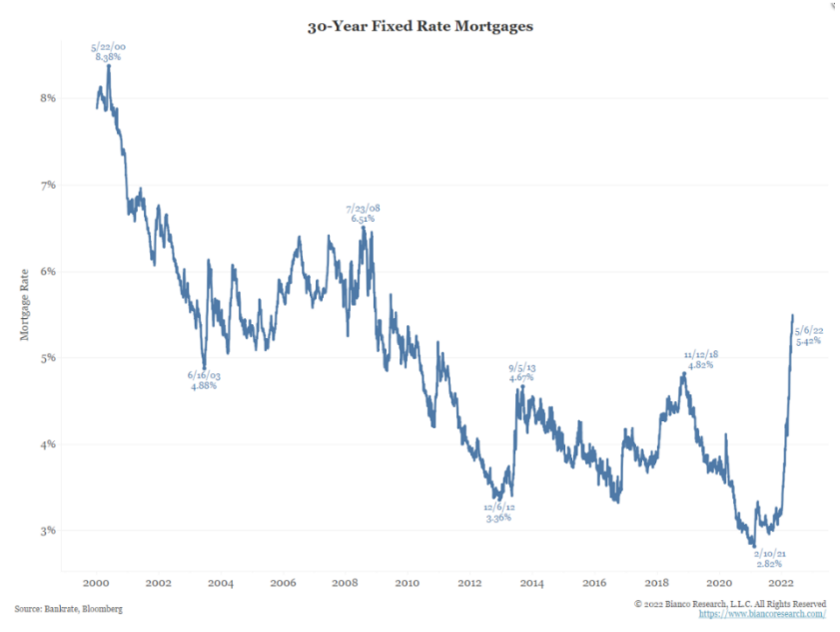

Strong demand for housing may give some flashbacks to 2007/2008, but this is not necessarily a bubble. We believe the work-from-home has shifted the demand fundamentals of real estate. New millennial home buyers are facing the highest interest rates in their adult lifetimes. While rates at nowhere near the crazy-high levels seen during the 1980s, the PERCEPTION of rates being high (not low) is JUST AS BAD.

Source: PSC. As of 4/30/22.

Source: PSC. As of 4/30/22.

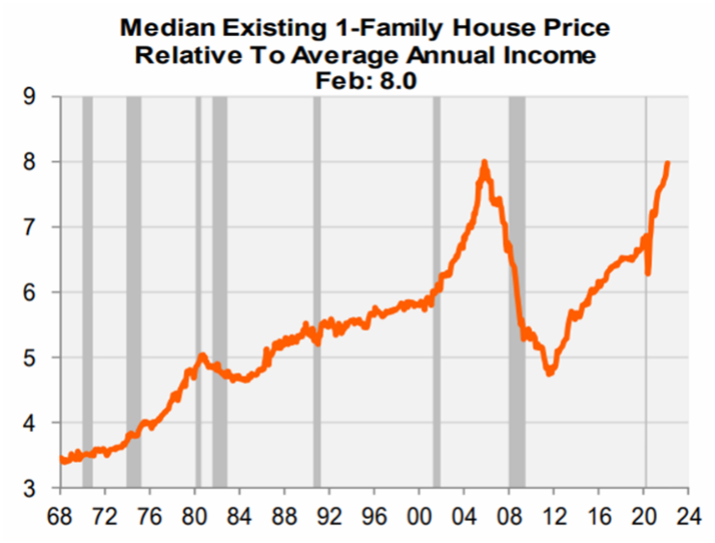

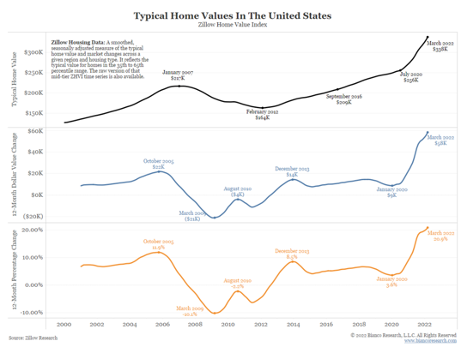

Mortgage rates are rising drastically as long-term Treasury rates have climbed to start ’22 making higher borrowing rates and monthly payments more expensive. This comes in the face of 36 months of rising US home prices. Prices have increased by 19% over the last year and doubled over the last 10 years. Our chart above shows the median family house price relative to average annual income which is back near the ’06 highs in the face of appreciating home values.

Affordability is Concerning… But…

Mortgage rate shocks hit home prices with a lag. Today’s shock should at least trim price gains back to their pre-outbreak pace. Every 100bps move in mortgage rates requires a 10% adjustment in home prices to keep payments unchanged. To put that in words, a median American household needed 34.2% of its gross income to cover mortgage payments on a median-priced home in January. A year ago, it was 29%.

Source: Bianco Research. As of 4/30/22.

Source: Bianco Research. As of 4/30/22.

If you compare the house you can afford with a $1,000 monthly house payment in early 2021 vs today it is down to $180k from $240k. On a $1000 per month budget, you now buy >30% less house!!

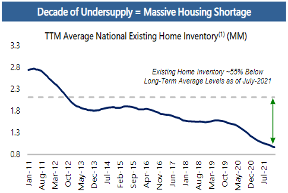

The Other Side of the Problem – Supply

We are facing a chronically undersupplied housing market. Since the GFC, home building has severely lagged the necessary trend to meet a growing American demand. Freddie Mac estimates that as of 2020, the US housing supply was short 3.8M units, with COVID having hurt construction. So, millions of new homes need to be built to catch up with demand. But it is estimated that only 600,000 new units will be added this year, and a max of 1.5M new annual starts going forward…barely enough to match new household formation.

Source: American Homes 4 Rent 2022 Q1 Presentation

Source: American Homes 4 Rent 2022 Q1 Presentation

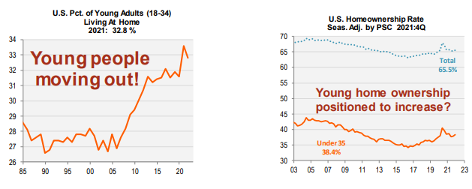

Young people, including some forced “home” due to the pandemic, are showing signs of coming back into the housing market – a demographic tailwind. We believe the millennial cohort of the population will continue to create support for the housing market as they purchase homes, especially outside of the big cities.

Source: PSC. As of 4/30/22. (Both graphics)

Source: PSC. As of 4/30/22. (Both graphics)

Home Prices Are Rising and Driving the Wealth Effect

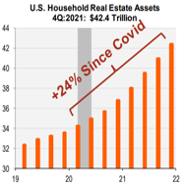

After considering the price appreciation from their house, the median American made more money on their house than at their job.

Source: Bianco Research. As of 4/30/22.

Source: Bianco Research. As of 4/30/22.

The Census Bureau calculated the median yearly wage in the U.S. to be $50,295. With home values appreciating $56,000 in the twelve months ending February, this is the first time in the history of this data series, which includes the housing bubble, that the yearly increase in home value has eclipsed median yearly salary. While this is unlikely sustainable, it is eye opening.

The implications from a rising wealth effect have been apparent across the US Economy. As housing prices are likely to cool (although not crash), real consumer spending suffers when house prices fall. Indeed, a -1% shock (all else equal) to real estate assets hits real consumer spending growth by up to -0.4%, over one year. While that doesn’t seem like a lot, spread over a couple hundred million people, it adds up!

Source: PSC. As of 4/30/22.

Source: PSC. As of 4/30/22.

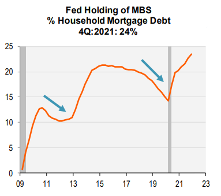

Lets be Honest… The Fed Created this Monster

The Fed has been accumulating a MASSIVE number of Mortgage-Backed Securities (MBS) since March of 2020 and now that the Quantitative Tightening (QT) program is starting, they will be letting lots of mortgages run off its balance sheet and may even outright sell some – putting upward pressure on their yields and the spread between a Treasury and MBS (currently about 260bps).

Source: PSC. As of 4/30/22.

Source: PSC. As of 4/30/22.

To Conclude:

To begin 2022, we’ve experienced the fastest mortgage rate spike of the last 30 years (+211 bps since the start of the year) – atop sky-high house prices – has driven housing affordability (i.e., incomes relative to the cost of owing a home) to its lowest level in 15 years. Despite robust job & wage growth, odds are home prices decline this year. So while home prices look vulnerable and may very well see declines …we believe a related financial crisis is not likely to be in the cards.

But if rates were to rise just 50 basis points more or home prices were to increase just 5% more, home affordability could be the worst on record. Solid credit is one big difference between now, and the last housing bubble. But, even with all the pessimism here, there is still a substantial housing shortage in this country. So while we expect home prices to succumb to the affordability crunch, that’s unlikely to have knock-on systemic significance for broader financial markets.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA- 2205-13.