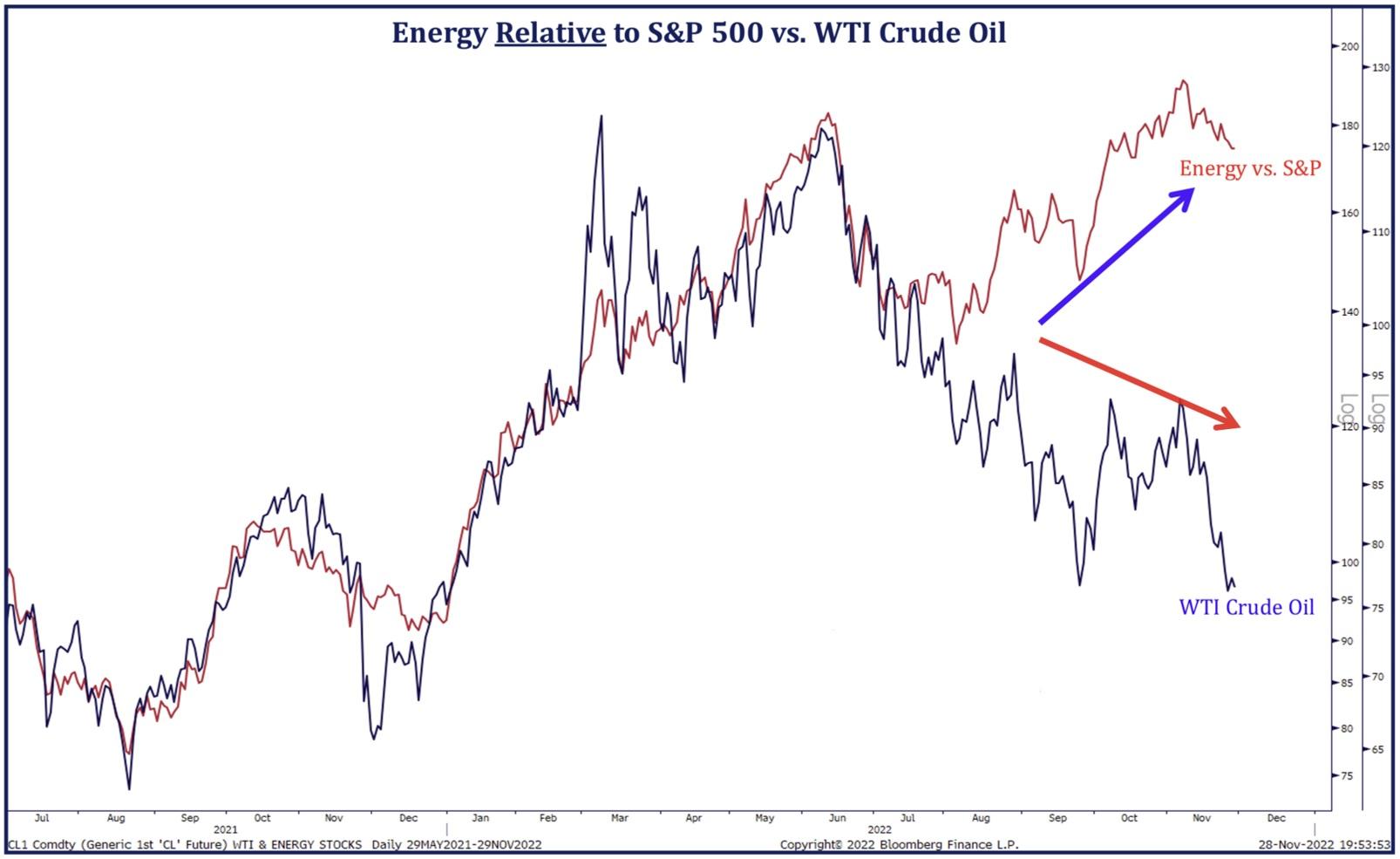

In the last two weeks, we’ve received several inquiries regarding energy equity outperformance relative to declining oil prices. Many people reference some version of the following chart:

Source: Strategas, 11/29/22

Source: Strategas, 11/29/22

For a commodity-driven sector, the dispersion since July 1 has been significant, to say the least.

Source: Bloomberg, LP, 11/29/22; XLE – Energy Select Sector SPDR ETF, CL1 – generic front month crude oil contract

Source: Bloomberg, LP, 11/29/22; XLE – Energy Select Sector SPDR ETF, CL1 – generic front month crude oil contract

(note: difference in price and total return represents roll yield from the downward-sloping crude oil futures curve)

We believe there are multiple forces at work driving this short-term phenomenon. First, energy equities are … equities. True, their input is a commodity, but their earnings are valued by the equity market. After years of equity multiple compression (driven in part of ESG concerns, governmental policy, and poor corporate management), energy equities have finally gained some traction as an investable sector. This has led to a long-awaited (though still relatively anemic) uptick in valuation.

Looking at Bloomberg consensus numbers, XOM went from 4.8x EV/EBITDA on 6/30 to 5.3x as of 11/29. PXD expanded from 4.4x to 5.3x over the same period. One could argue that valuation had simply gotten too cheap, in conjunction with broader market flows out of underperforming sectors like tech needing to find a home elsewhere.

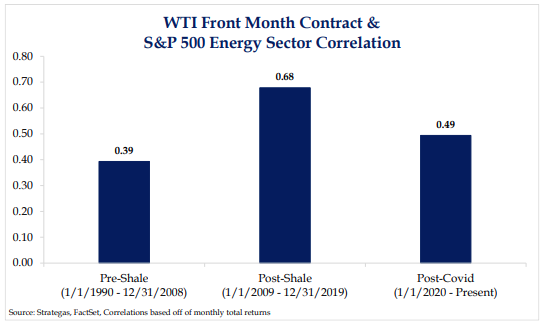

Secondly, since COVID, energy equities have lost some correlation to oil.

Source: Strategas, 11/22/22

Source: Strategas, 11/22/22

We would attribute this in part to the way management teams are using the cash flow they are generating. During the last period of sustained, elevated oil prices (2010-2014), companies were rewarded by increasing production, which required them to not only reinvest all cash flows, but to borrow more from ready-to-lend debt markets to do so. This ultimately led to poor returns, overburdened balance sheets and disappointed investors who essentially fled the sector. This time, domestic producers are substantially taking a more shareholder-friendly cash flow return approach, foregoing big production increases to reduce debt, pay dividends and buyback stock.

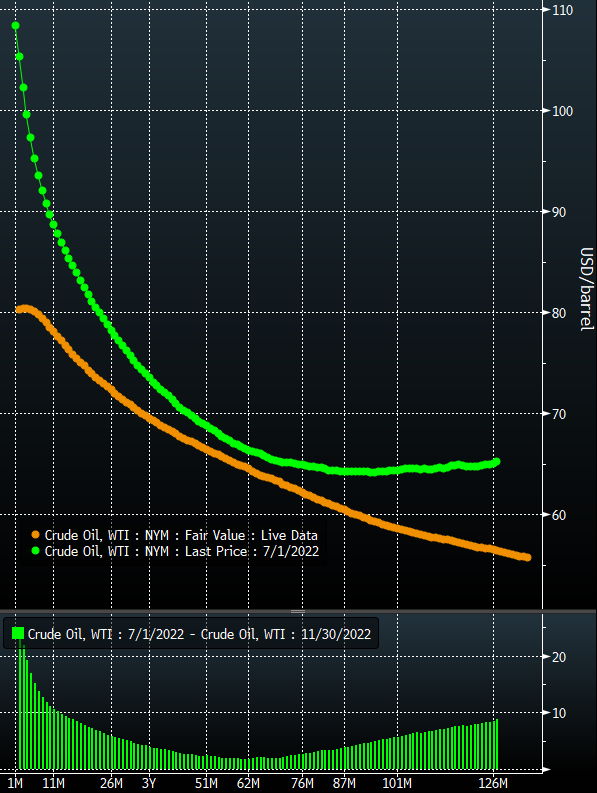

Finally, while the front month crude oil price (the one you see flashing on TV) has been plummeting, longer-dated contracts have stayed remarkably resilient. In other words, the crude futures curve has flattened out quite a bit. This is a near-term bearish signal, but when pricing a company’s future of cash flows over multiple years, investors are more concerned about the average price than the spot price.

Notice in the following graph, the current curve (orange) 1-24 month spread is <$8/barrel, while that spread on July 1 (green) was >$29/barrel! Concerns over global economic growth and COVID lockdowns in China have dented current demand, but a myriad of factors including tight global inventories, OPEC+ price support and a US government potentially switching from draining the Strategic Petroleum Reserve to refilling it, have proven to be a longer-term floor for crude.

Source: Bloomberg, LP 11/30/22

Source: Bloomberg, LP 11/30/22

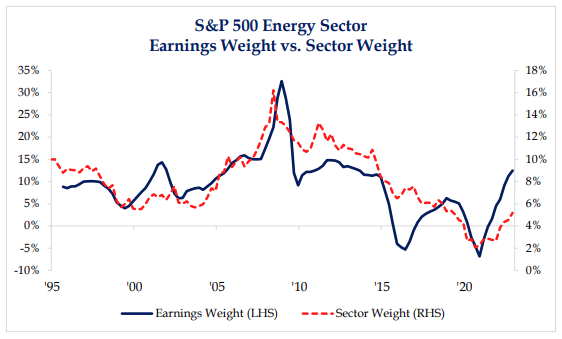

Regardless of the reason, the move in energy equities relative to oil begs the question, “Are energy equities now overpriced?” While they aren’t as attractive as they were 6 months ago (or especially 12 months ago), we believe they are still enticing for the long-term investor.

Looking at XOM again as an example of valuation, at 5.3x EV/EBITDA, it is nowhere close to its five-year average of 7.1x (same for PXD – 5.3x vs 6.6x). Moreover, while the sector has gained some traction this year in the eyes of certain investors who had put it in the penalty box, it can hardly be described as over-owned. Excluding the drop since the COVID downturn, at 5.2%, energy carries the lowest weight in the S&P 500 looking back 25 years (and compares to a historical average of 11% going back to the 1970’s). For further context, at 6.4%, AAPL has more influence on the index than the entire energy sector!

Source: Strategas, 11.30.22

Source: Strategas, 11.30.22

Of course, energy equities can’t stay disconnected from oil forever. Were the price of oil to find footing from its notable price slide, a return to positive correlation could also prove a tailwind for energy equities. Near-term demand concerns will undoubtedly fill the headlines, but we believe the longer-term, more structural forces of global undersupply and lack of adequate investment will provide support for oil prices for some time to come.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services offered are through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2211-23.