When the Buss family announced the sale of the Los Angeles Lakers for $10 billion, headlines and social media lit up. After all, they had purchased the team in 1979 for just $67.5 million. Many quickly did the math:

More than respectable, sure, but not exactly a championship-level performance.

That take completely misses the real story.

Like Real Estate, This Was Never Just About Price Appreciation

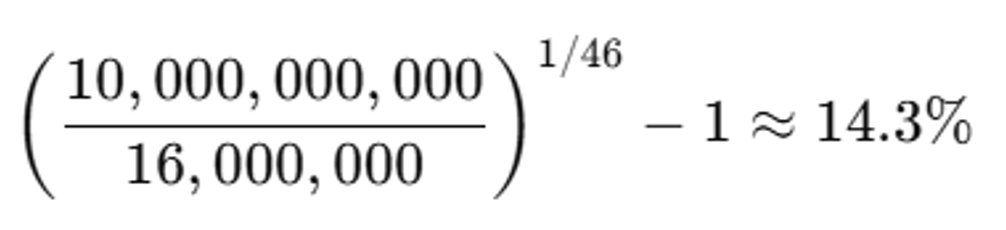

The framing assumes Jerry Buss paid $67.5 million in cash and waited for the value to rise. In reality, he only put down about $16 million. The rest was financed. That changes everything.

Ignoring some other key components (such as cash flow), the leverage alone changes the picture and pushes up the CAGR to north of 14%.

And that still ignores the most important factor: decades of cash flow from one of the most profitable franchises in sports. It’s a familiar dynamic to anyone who has built wealth through real estate knows returns don’t come just from appreciation. They come from leverage, cash flow, and time.

The Homeownership Example That Trips Everyone Up

Here’s a scenario that seems to trip up many investors not as familiar with real estate. Someone buys a $500,000 home, puts 20% down ($100,000), and finances the rest with a 30-year fixed mortgage at 6%. Assume monthly costs (mortgage, taxes, maintenance) are equal to rent, so there is no cash flow advantage either way after the purchase or before the sale.

If the home appreciates just 2.5% annually over 30 years, many would assume the return on the $100,000 investment is 2.5% (or less). But the actual result is far better.

After 30 years:

-

- The mortgage is paid off.

-

- The home is now worth approximately $1.05 million.

-

- The homeowner’s $100,000 investment has turned into full ownership of a $1.05 million asset.

That works out to an 8% annualized return, even though the home itself only appreciated at 2.5% per year.

Even more surprising, if the home didn’t appreciate at all and remained worth $500,000 after 30 years, the homeowner would still have turned $100,000 into $500,000. That results in a 5.5% annualized return with no price appreciation.

That’s the power of financing, equity build-up, and time. The Lakers situation isn’t all that different.

C.R.E.A.M.

Most importantly, the Lakers were not a passive asset. They generated meaningful operating income for decades through media rights, ticket sales, sponsorships, merchandise, and playoff appearances.

Jerry Buss made a relatively small down payment to control a valuable business. He let cash flow and time do the rest.

This was a classic example of wealth creation through:

-

- Smart use of leverage

- Steady income streams

- Long-term ownership

Appreciation was just one part of the equation.

It is also worth noting that the original deal included the LA Kings hockey team and The Forum arena, both of which were sold separately for additional value.

The Bigger Lesson

This isn’t just a story about the Lakers. It is a case study in how real wealth is created.

Whether it is a sports team, a business, or a real estate investment, the best returns rarely come from price appreciation alone. They come from consistent income, smart financing, and holding the right assets over long periods.

The Buss family did not simply buy a franchise. They operated it effectively, monetized it intelligently, and held it for nearly five decades. It was an active, strategic investment. And the true return was far greater than the 11% figure that keeps getting repeated.

Disclosures

Past performance is not indicative of future results. This material is not financial or tax advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed and all calculations may change due to changes in facts and circumstances.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2506-43.