A common debate in the world of investing revolves around the timing of market entries. While it is true that stocks can underperform cash, especially over shorter time frames, the long game tells a different story.

In this post, by highlighting the consistent and robust outperformance of stocks over longer periods, we aim to counter the view that timing the market is a surefire way to outperform. We’ll delve into historical data, specifically examining rolling returns over shorter 1-year and longer 30-year periods, to showcase why the adage “time in the market > tim-ing the market” is backed by real-world evidence.

A Shorter-Term View Acknowledges the Risk in Stocks

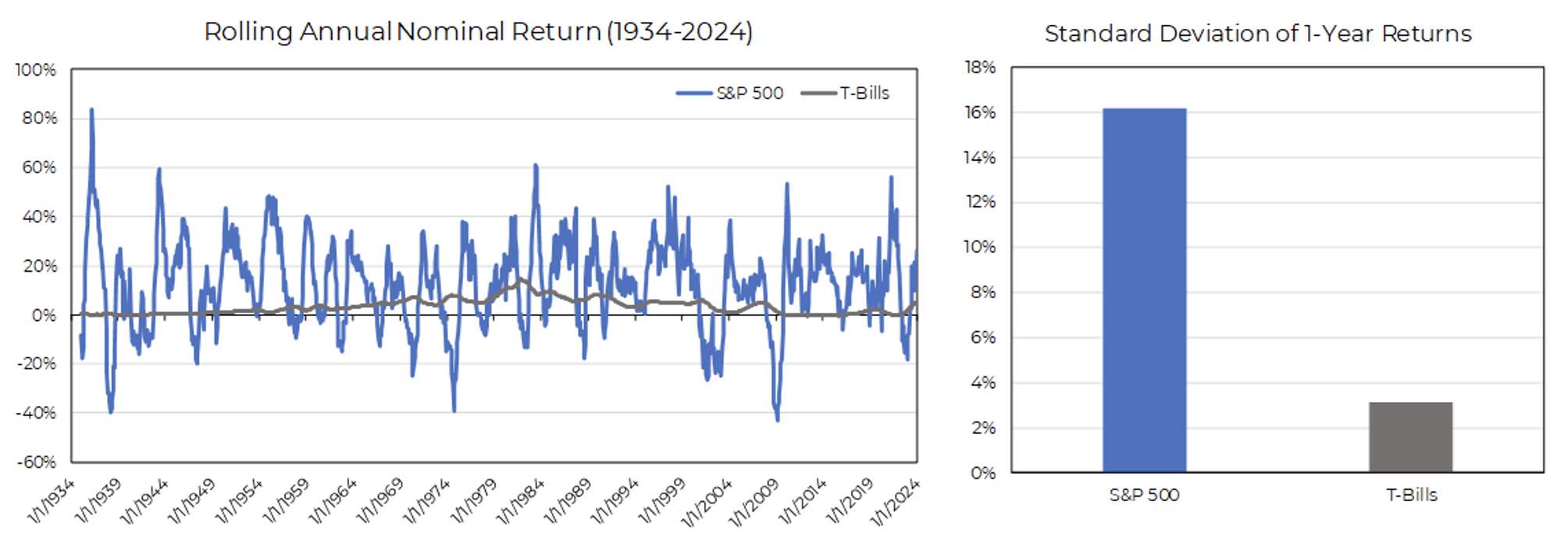

We start by acknowledging that stocks may underperform cash over shorter time frames. Examining historical data reveals that stocks have outperformed cash “only” 72% of rolling one-year time frames since 1934. However, it’s essential to recognize that short-term volatility is an inherent aspect of the stock market, and investors who focus solely on short-term results may overlook the bigger picture.

Source: Aptus as of January 2024

Source: Aptus as of January 2024

Surprising Stability: Are Stocks LESS Risky than Bonds over the Long Term?

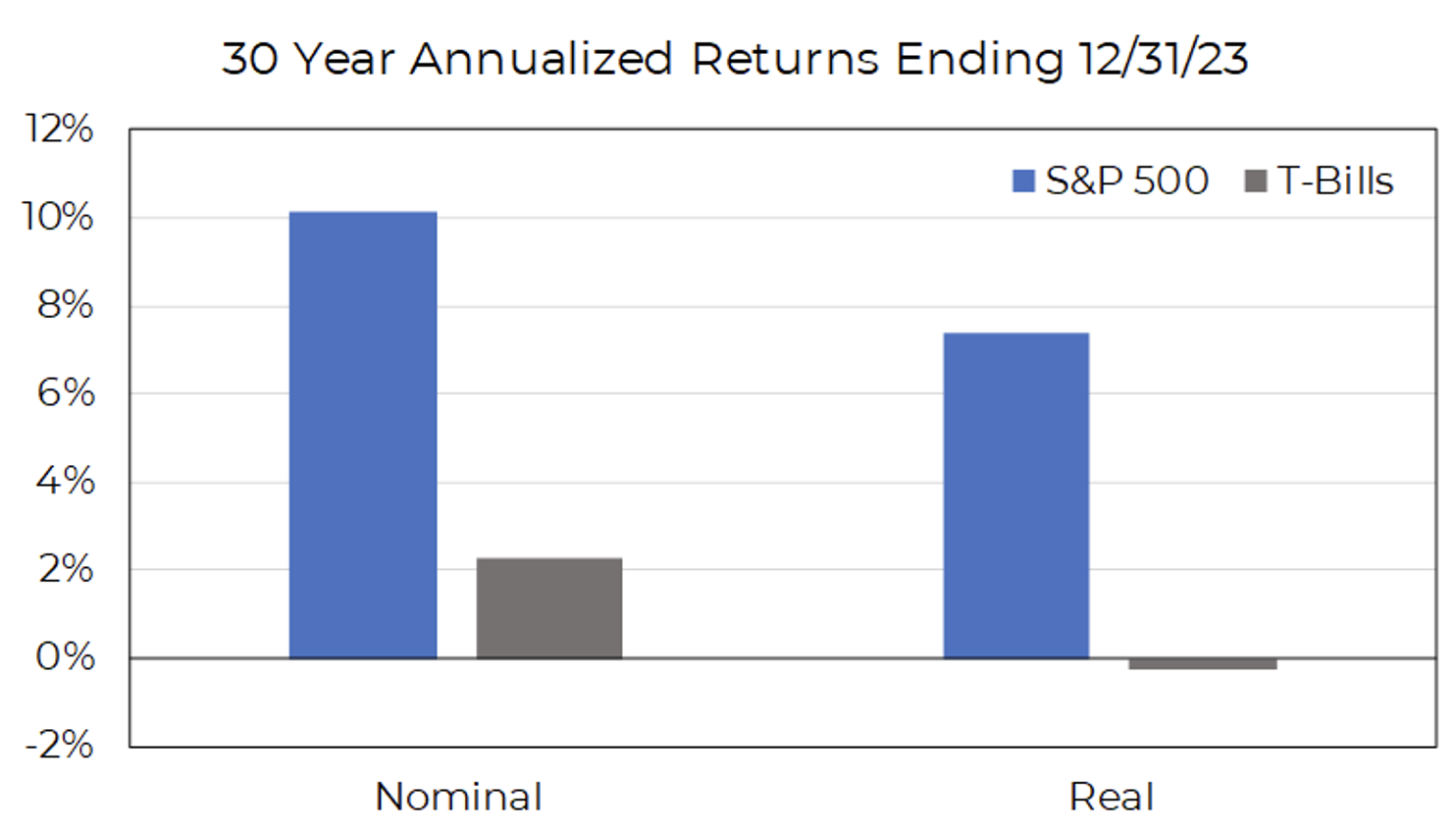

Despite the prevailing belief in the stability of traditional safe-haven assets, Treasury bills have, in fact, returned less than the rate of inflation over the last 30 years.

Source: Aptus as of January 2024

Source: Aptus as of January 2024

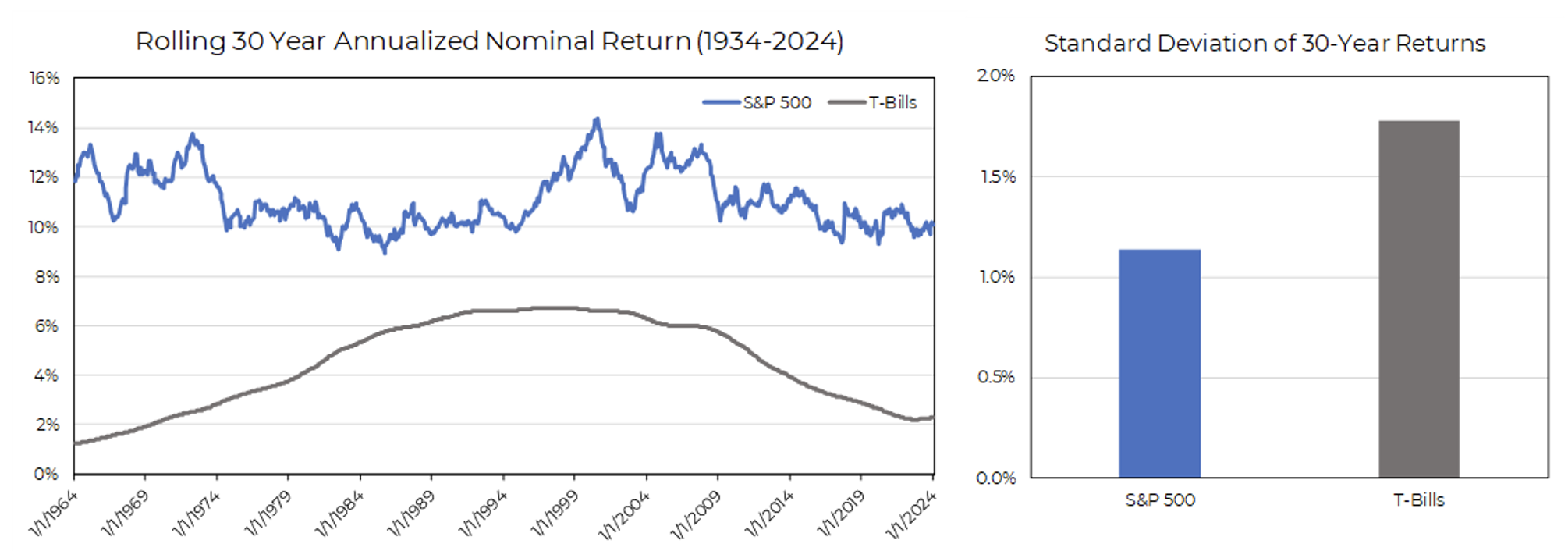

The true strength of stocks becomes evident when we extend our time horizon. Over any 30-year period since 1928, stocks outperformed cash by a minimum of 3%. Further challenging the notion that stocks are riskier over the long term is the often-overlooked stability of stocks over extended periods. Contrary to common belief, the standard deviation of rolling 30-year annualized returns for stocks since 1934 is lower than that of cash. This longer-term view emphasizes the importance of patience and enduring short-term fluctuations, for a much improved long-term outcome.

Source: Aptus as of January 2024

Source: Aptus as of January 2024

Conclusion

In the world of investing, it’s crucial to distinguish between short-term fluctuations and long-term trends. While stocks have outperformed cash in more than 2/3 of one-year time frames, stocks can and will underperform over shorter time frames. That said, the data overwhelmingly supports the notion that over the long term, stocks consistently outperform. Attempting to time the market is a challenging endeavor, and history suggests that being consistently invested in stocks is a more reliable strategy for wealth creation. So, let’s focus on the long game, stay invested, and let the power of compounding and time work in our favor.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2402-16.