Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and why:

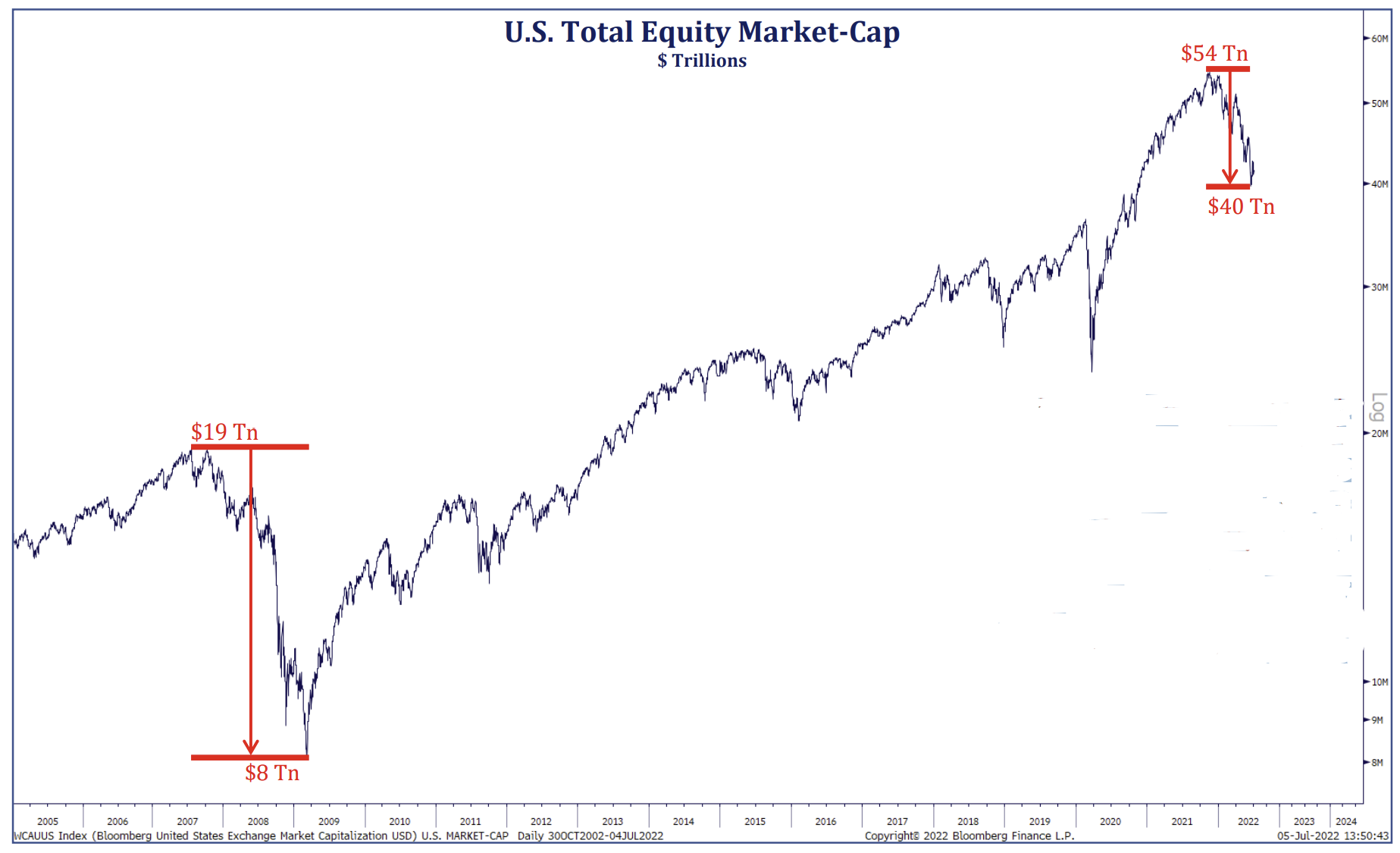

Dave: denominator a lot bigger but this bear is no joke, $14 trillion equity lost on paper

Source: Strategas as of 7/6/22

Source: Strategas as of 7/6/22

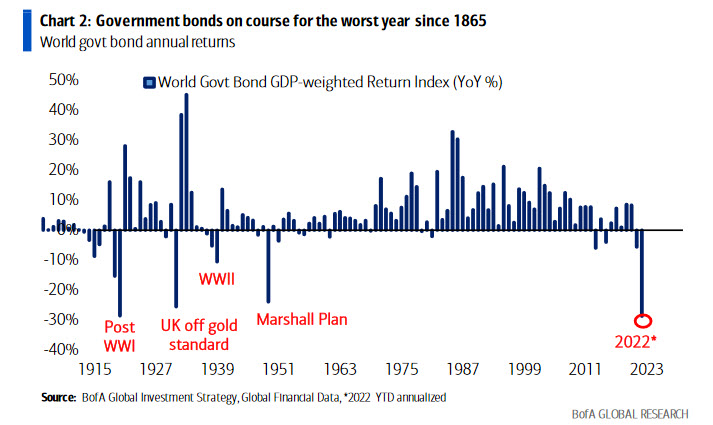

JL: 2022 has already carved out a place in bond market history

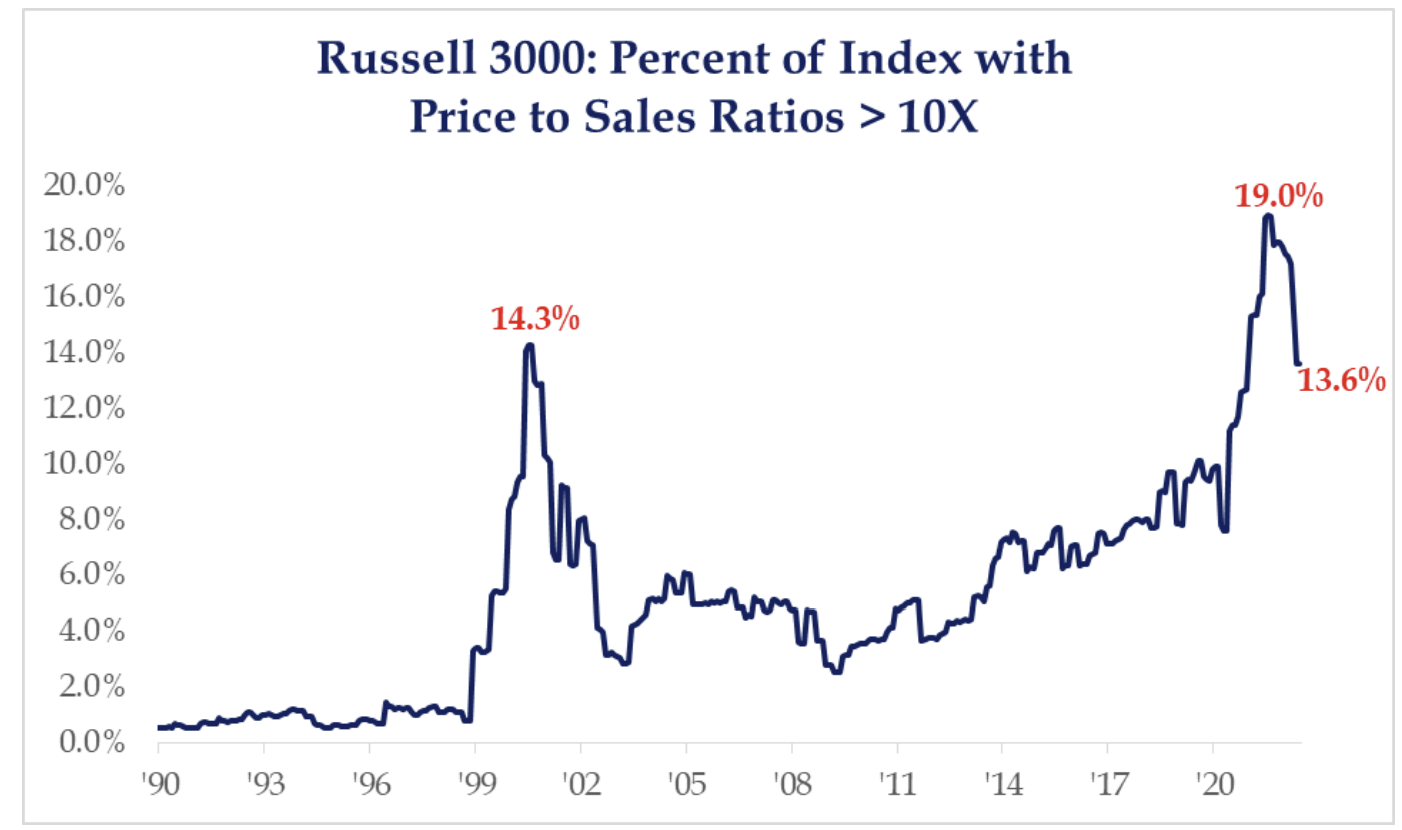

JD: some retracement from the Greg Oden highs but still a lot of stocks carrying high valuations

Source: Strategas as of 07.07.2022

Source: Strategas as of 07.07.2022

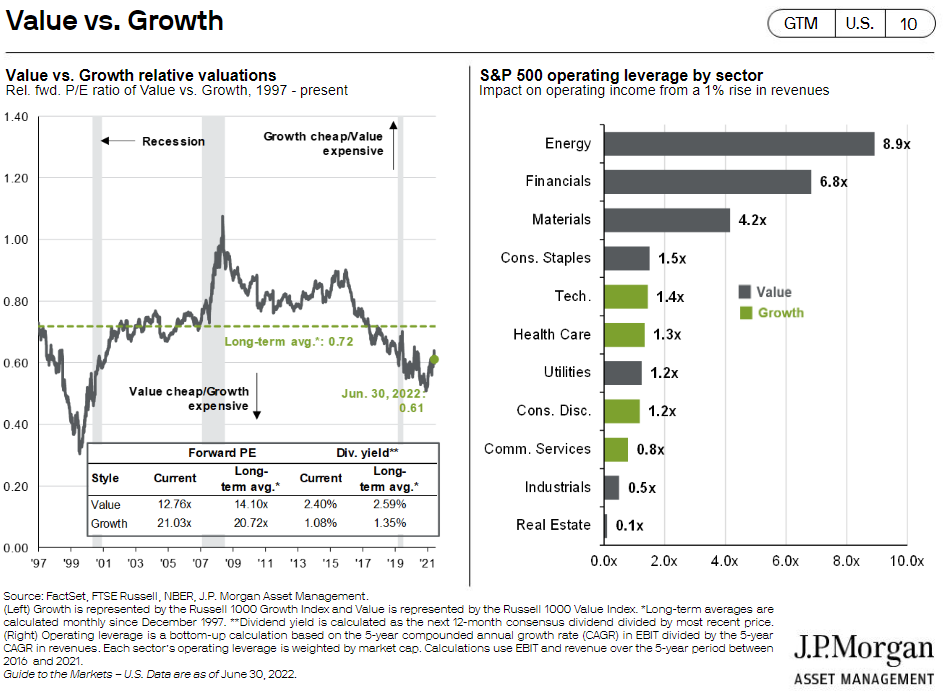

Brad: and though value has been better in the past year it’s still historically cheap vs. growth

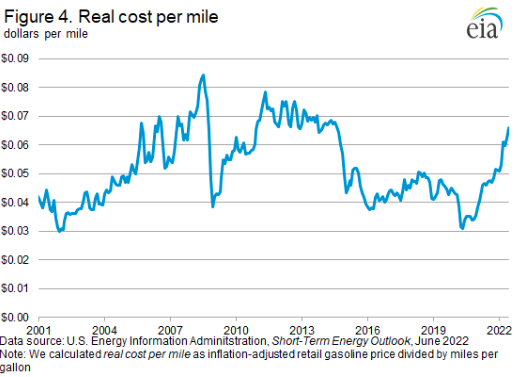

Joseph: fuel prices are all the rage but costs per mile aren’t exactly off the charts

Data as of 07.06.22

Data as of 07.06.22

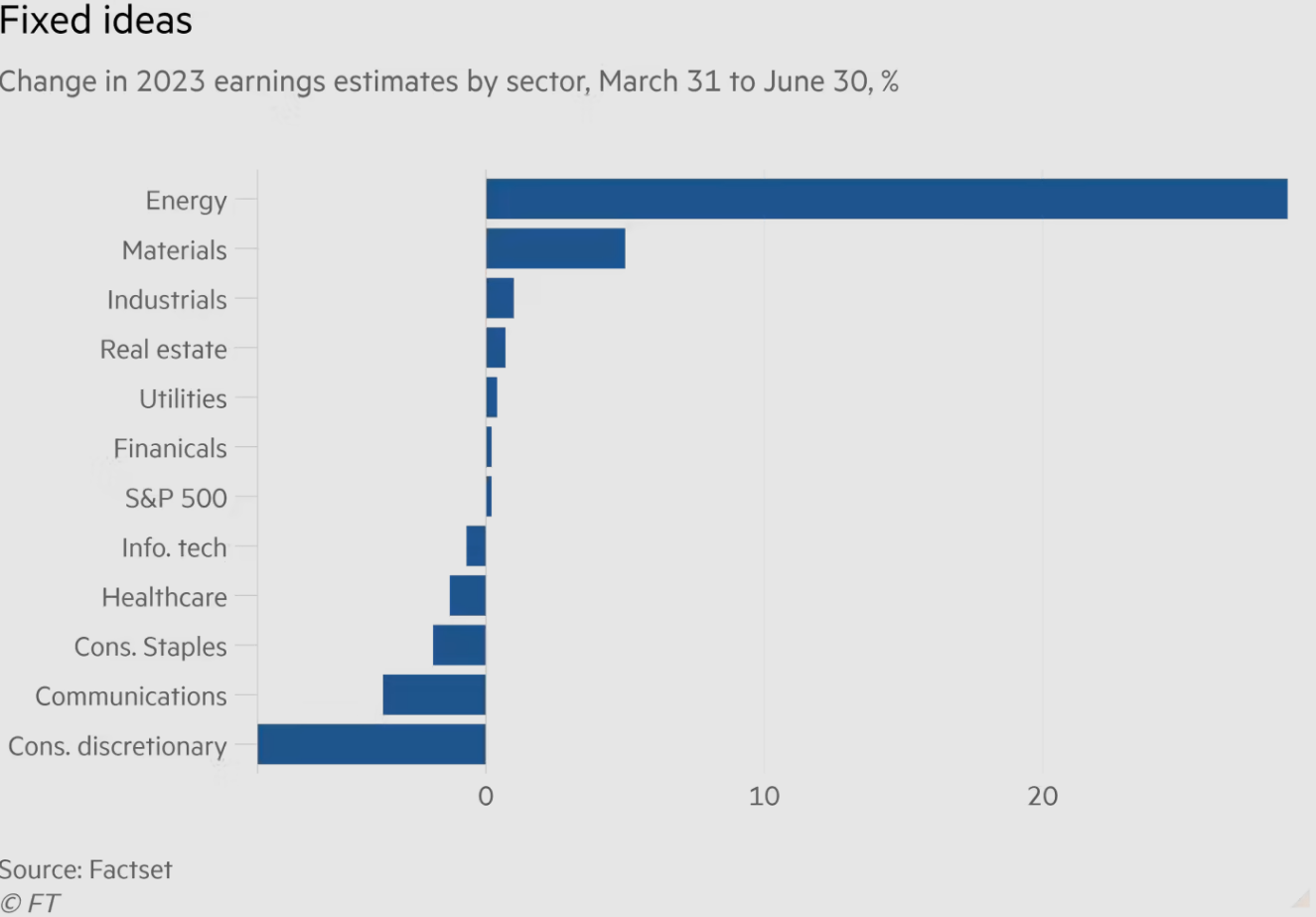

JL: wide dispersion of earnings revisions across sectors in Q2

Data as of 06.30.2022

Data as of 06.30.2022

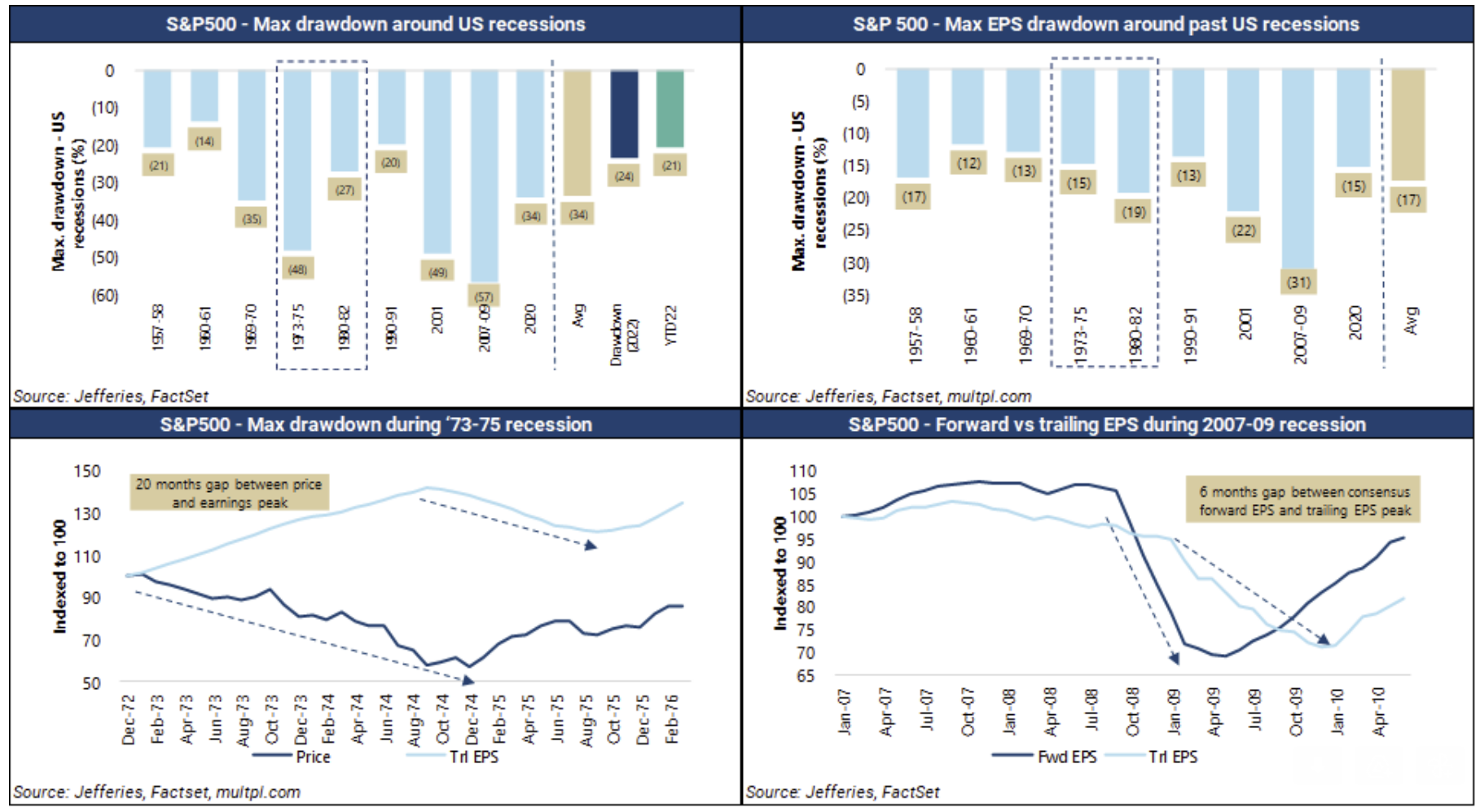

Dave: overall estimates have held steady but it’s worth studying past earnings recessions for clues

Data as of 07.01.2022

Data as of 07.01.2022

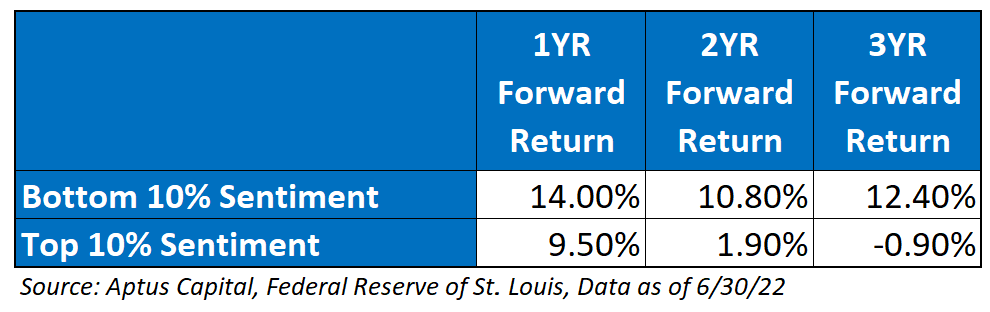

Dave: low sentiment readings offer hope that better days for equities lie ahead

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Russell 1000® Value Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000Ò Index companies with lower price-to-book ratios and lower expected growth values.

The Russell 1000® Growth Index is an unmanaged, market capitalization-weighted index that measures the performance of those companies in the Russell 1000 Index with higher price-to-book ratios and higher forecasted growth values.

The Russell 3000® Index measures the performance of 3,000 large U.S. companies. The Index is market capitalization-weighted, comprised of stocks in the Russell 1000 and Russell 2000 indices and represents approximately 98% of the U.S. equity market.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

The US Index of Consumer Sentiment (ICS), as provided by University of Michigan, tracks consumer sentiment in the US, based on surveys on random samples of US households. The index aids in measuring consumer sentiments in personal finances, business conditions, among other topics. Historically, the index displays pessimism in consumers’ confidence during recessionary periods, and increased consumer confidence in expansionary periods.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2207-10.