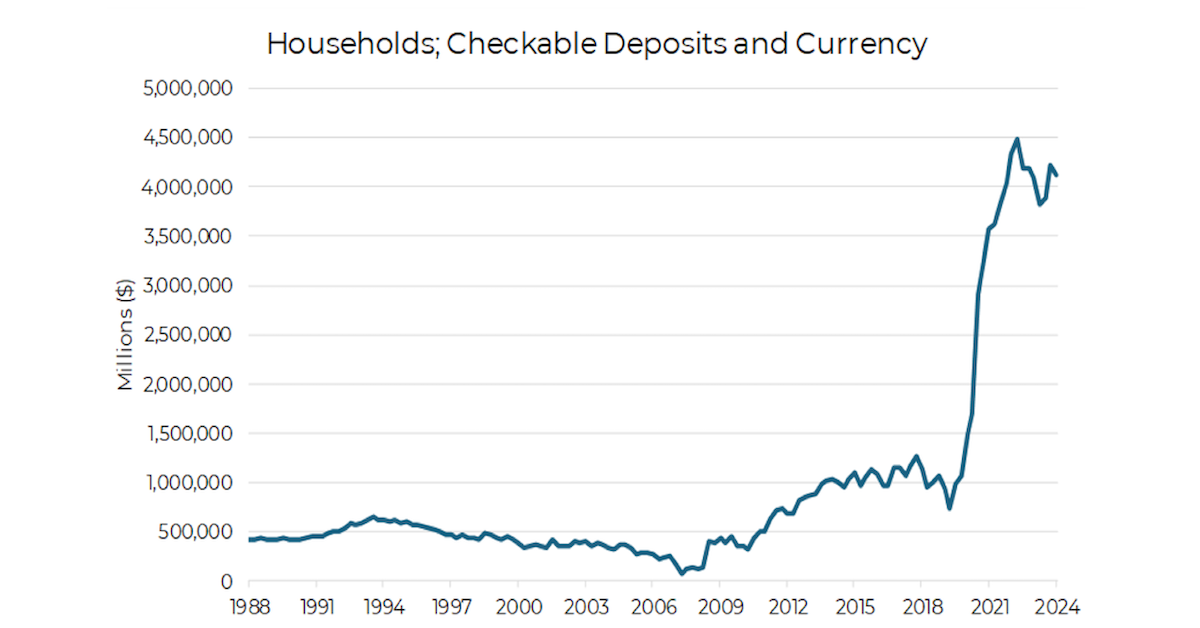

You’ve probably heard the phrase “cash on the sidelines” used in market commentary, often suggesting there’s a huge pool of money waiting to flood into the market. One reason this phrase persists is that the nominal amount of cash regularly hits record highs. Most recently, households have been holding more than $4 trillion in checkable deposits and currency—up from less than $1 trillion before COVID. This sharp increase can give the illusion that there’s an unprecedented amount of money “on the sidelines,” waiting to jump into the market.

Source: Aptus, Federal Reserve

Source: Aptus, Federal Reserve

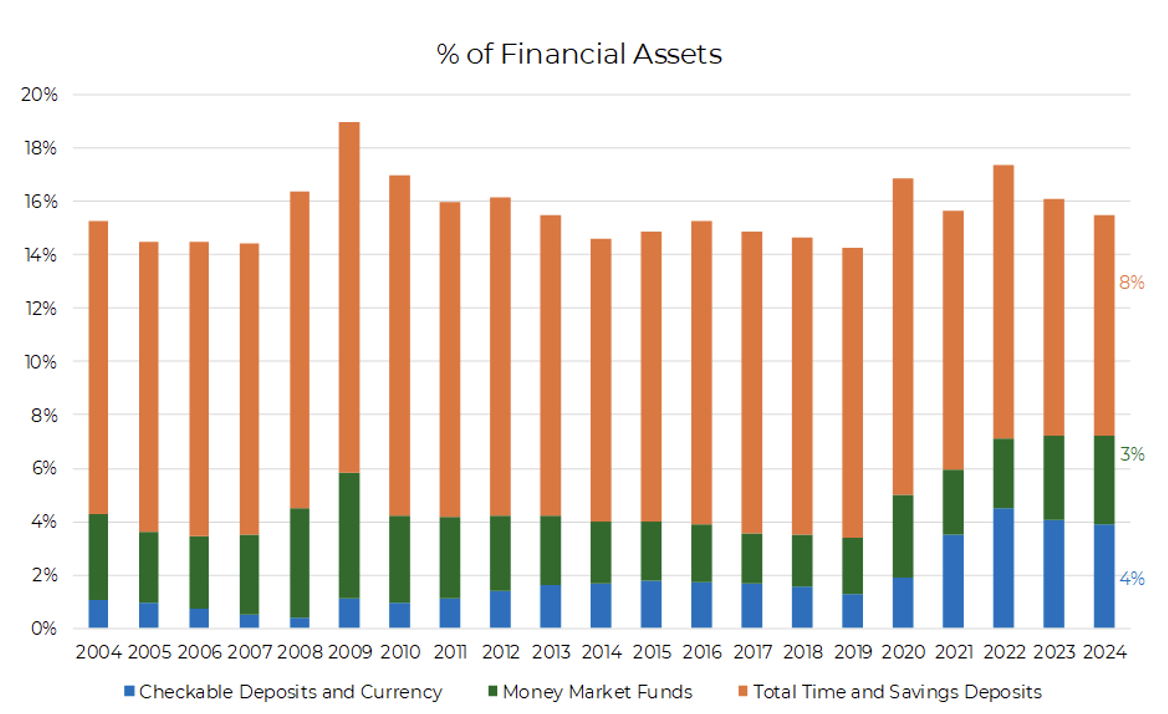

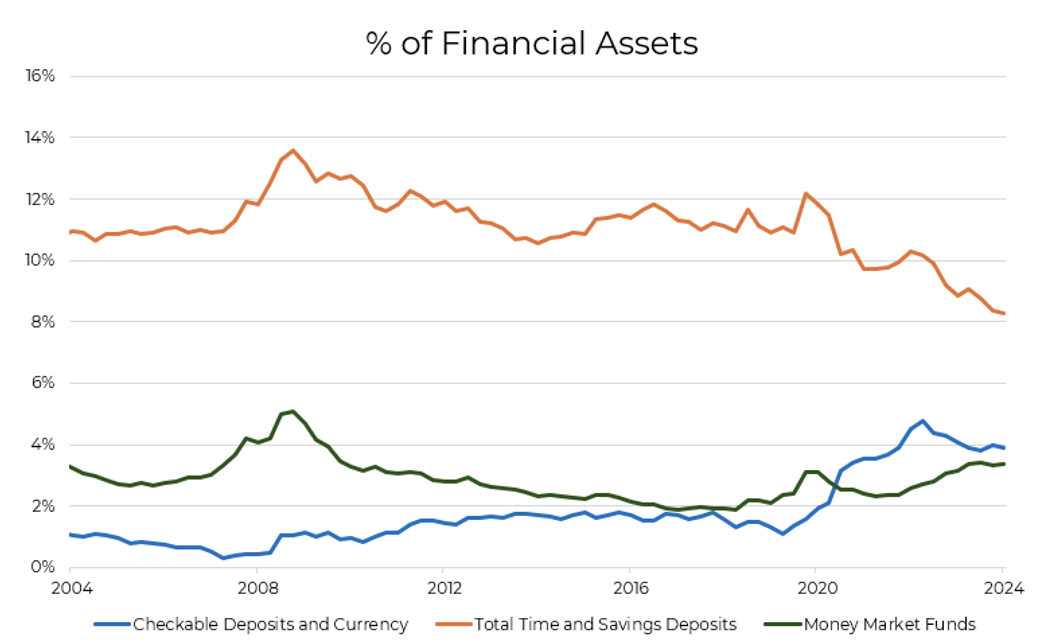

But when we look at the data more carefully, cash as a percentage of total financial assets has been remarkably steady for over 20 years at roughly 15% (+ or -) over time. What has changed is where that cash is stored. Over the last decade, checkable deposits and currency (the cash you can immediately access) have risen from about 1% to 4%.

The main reason? The zero interest rate policy (ZIRP) era. With savings accounts offering next to no return, there was little incentive to stash money in traditional savings vehicles, so people preferred keeping their money accessible in checking accounts, knowing they weren’t missing out on much.

Source: Aptus, Federal Reserve

Source: Aptus, Federal Reserve

In more recent years, we’ve seen a rise in money market funds and a continued decline in savings deposits. This shift comes as investors seek better returns in U.S. Treasury bills (T-bills), which have offered a yield advantage over savings accounts with the added bonus of being exempt from state taxes.

Source: Aptus, Federal Reserve

Source: Aptus, Federal Reserve

The bottom line? Cash is always moving, and the idea of “cash on the sidelines” isn’t as impactful as it might sound. The reality is much simpler: cash levels are roughly where they’ve always been as a percent of financial assets and any cash one person uses to buy something or invest is now in the seller’s hands, and so on. It’s not about some massive reservoir of unspent capital ready to propel markets upward. So while the phrase may grab headlines, the underlying reality is far less dramatic.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-25.