There is a constant pirouette of working, saving, and spending throughout our lives. Regardless of your career and net worth, we all attempt to elegantly balance our budget to achieve our lifestyle and savings goals.

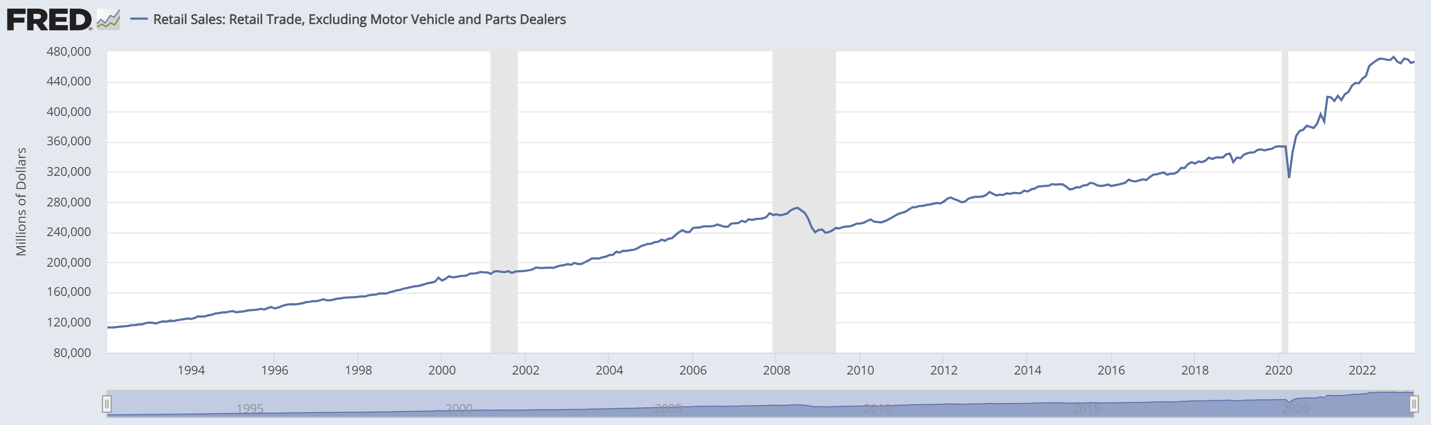

As illustrated below, the amount of spending since COVID has risen significantly. Spending at the household level as we all know fluctuates continuously. Yet, the balancing act in this environment is only getting more intricate, and it prompts a conversation about our own financial health and what we should be cautious of as our spending changes.

Source: The Federal Reserve as of 06.30.2023

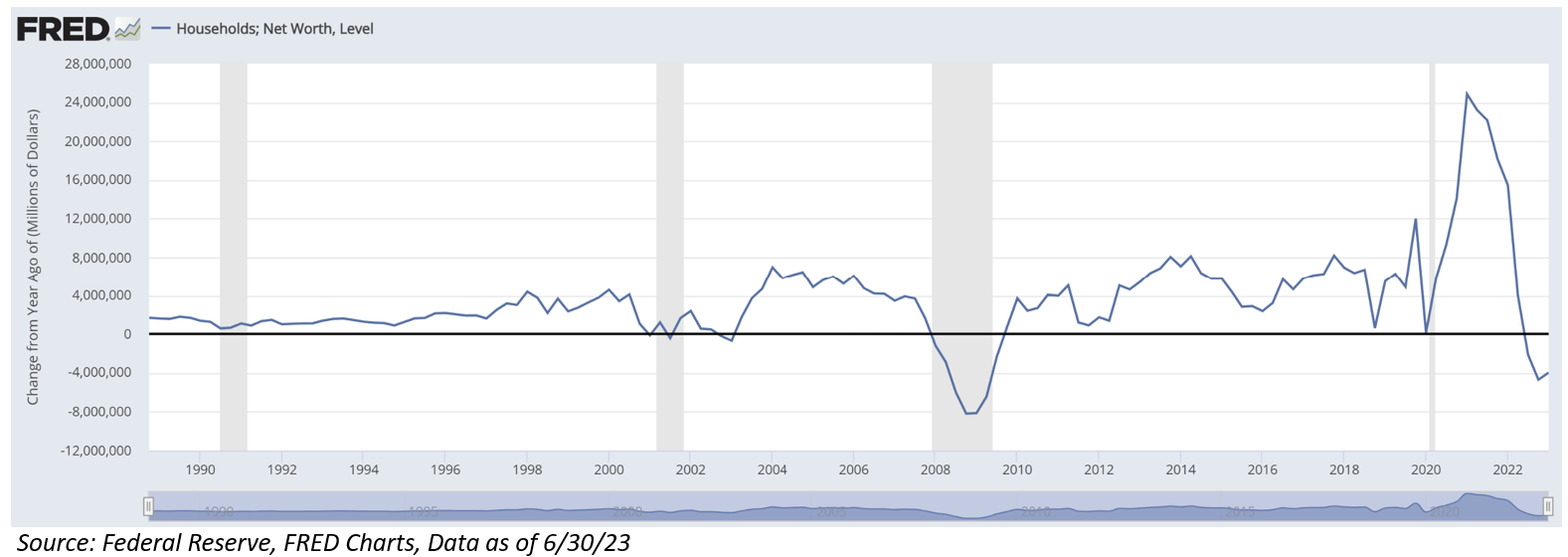

Source: The Federal Reserve as of 06.30.2023

What is Causing Us to Spend More?

A large part of the increased spending is that things are just more expensive. Inflation has been persistent here as of late and could remain elevated for multiple years. Fed Chairman Jerome Powell stated recently that the 2% target is not realistic until 2025.

Wages have also taken off during this period, which has helped offset the inflated prices.

![]()

Whether your income or spending has increased more is the million-dollar question. If the two are increasing lockstep, it may feel like you have a higher status in society, but you most likely will have a similar outcome. We all could take a lesson or two from Warren Buffett. A billionaire, who has lived in the same house since 1958 well before he amassed his fortune. We understand this is far from reality for most and even me, but the bottom line is more income leads to more spending.

Year Over Year Net Worth Changes

Although net worth remains strong relative to history, the change over the past year brings questions. This chart shows a steep decline in the year over year consumer net worth, the biggest decline in over 30 years.

There indeed was a significant increase in savings during the accommodative environment post-COVID from both fiscal and monetary policy. Also, things were closed, and it was hard to spend. So naturally the drop in net worth makes sense from where we came from. The main point is that you could be the exception to this trend if you start now. There is no better time than the present to start or refresh your balancing act.

Think Nutcracker and Not Stanky Leg

It is very easy to dwell on past personal financial mistakes. I may have made a few on the dance floor over the years, but I still get out there. Managing your budget is not easy, so don’t beat yourself up if you have seen your savings depleted over the past year.

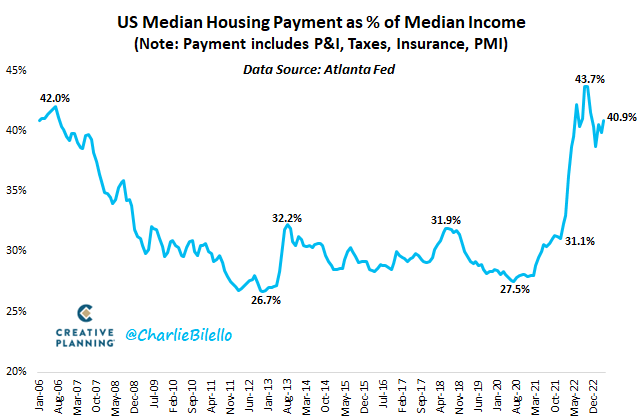

With that said we are in a higher rate environment with inflated prices, so tread lightly going forward. An example of that is to look at the median income vs. median house payment. In 2020, 27.5% of our income was spent on housing, at the end of 2022 that number was 40.9%. The difference one purchase can make on your ability to spend elsewhere or save here is elevated given this environment.

Source: Charlie Bilello as of December 2022

Source: Charlie Bilello as of December 2022

John Bogle founder of Vanguard delivered this story at a commencement speech for Georgetown University in 2007:

At a party given by a billionaire on Shelter Island, the late Kurt Vonnegut informs his pal, the author Joseph Heller, that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular novel Catch 22 over its whole history. Heller responds, “Yes, but I have something he will never have… Enough.”

The ability to enjoy your life, be prudent, and at the end of the day be comfortable is a never-ending balance. Ultimately, it is important to understand this environment is unlike what many of us have seen or vividly remember. Yet, if your goal post continues to move with your spending, the environment doesn’t matter.

There is not a one size fits all solution to finding your happy place where you can say you have “enough.” Most investment objectives are based on life goals and not benchmarks. With that being said, we think savings should not be positioned in a way that puts lifestyle at risk. Small steps can go a long way. Take those steps, do everything you can to avoid that one purchase that could derail you from what’s important. Take the extra time to find a way to elegantly find that equilibrium while life spins around you. It should lead to consistent compounding of your net worth that you can be proud of.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-10.