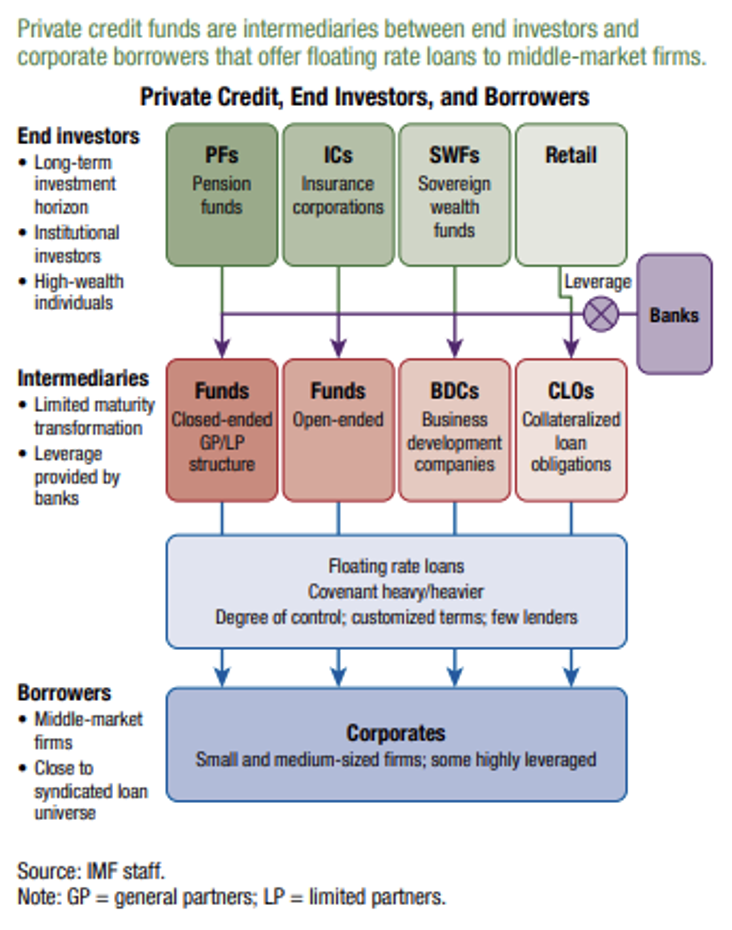

Though certainly not new, private credit has become increasingly topical within investment circles. While the term seems to invoke mystical feelings of IRR (internal rate of return, a metric often cited by fund sponsors) euphoria, at its core, it is simply an obligation between lenders and borrowers. So why then, all of a sudden, does private credit seem inescapable?

Let’s first take a step back. A company in need of debt financing — whether for ongoing operations, business expansion or corporate acquisitions — can turn to various sources of financing. One common source is a loan from a bank, which would then either hold the loan on its balance sheet or syndicate it to a group of similar investors. A large company can also issue bonds that subsequently trade in the public markets. Or the company can turn to private credit, working with a single lender to craft a tailored capital solution.

Source: International Monetary Fund, Global Financial Stability Report, April 2024

Source: International Monetary Fund, Global Financial Stability Report, April 2024

As noted, public markets have typically been reserved for the largest, most credit-worthy lenders. To warrant open trading, investors must have confidence in the viability of the underlying borrower and the liquidity of the issue. While such companies issue large nominal amounts of debt, the vast majority of issuers are much smaller in size, and unable to meet the requirements (either expressed or implied) of a public exchange. This cohort has traditionally been serviced by the banking sector, as banks carrying low-cost deposits use that capital to make riskier (though calculated) loans, realizing the net interest margin as profit.

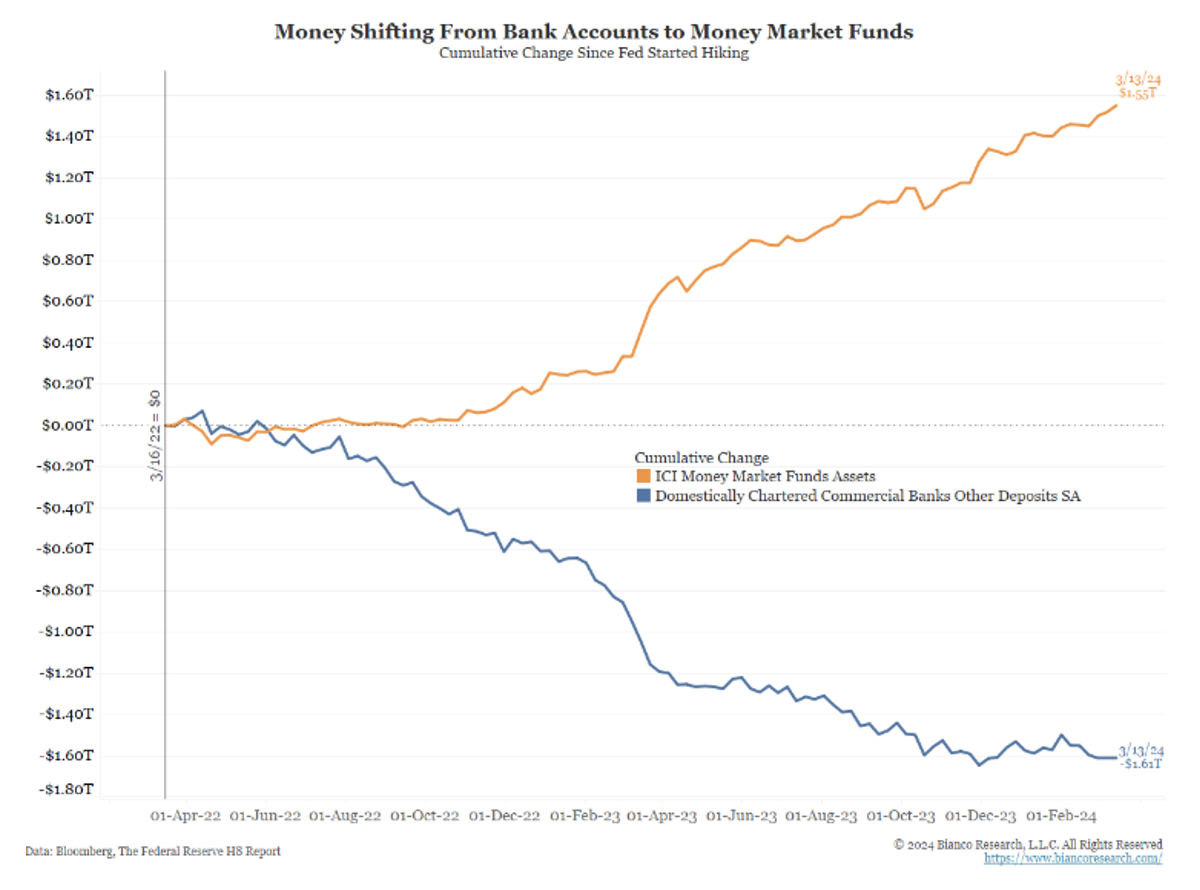

However, in the aftermath of the Great Financial Crisis, central banks focused rules and regulations on systemic banks, pushing lending into other areas of the financial system. This was further exacerbated by the Federal Reserve’s rate hike campaign in 2022, with higher rates drawing cash out of 0% checking/savings accounts into higher-yielding money market funds.

Source: Bianco, as of 03.15.2024

Source: Bianco, as of 03.15.2024

These trade winds have caused many to wonder whether banks are well suited to make such risky loans at all. Quoting Matt Levine’s May 1 “Money Stuff” Bloomberg Opinion column:

“’A banking system is a superposition of fraud and genius that interposes itself between investors and entrepreneurs,’ wrote Steve Randy Waldman in 2011; it allows society to use the money of risk-averse depositors to fund risky investments in growth. But it is possible that this magic no longer works: In a world of financial transparency and fast communications technology and flighty deposits, you can’t really expect to hide the risks of the banking system; you have to fund the loans with people who know they’re funding the loans.”

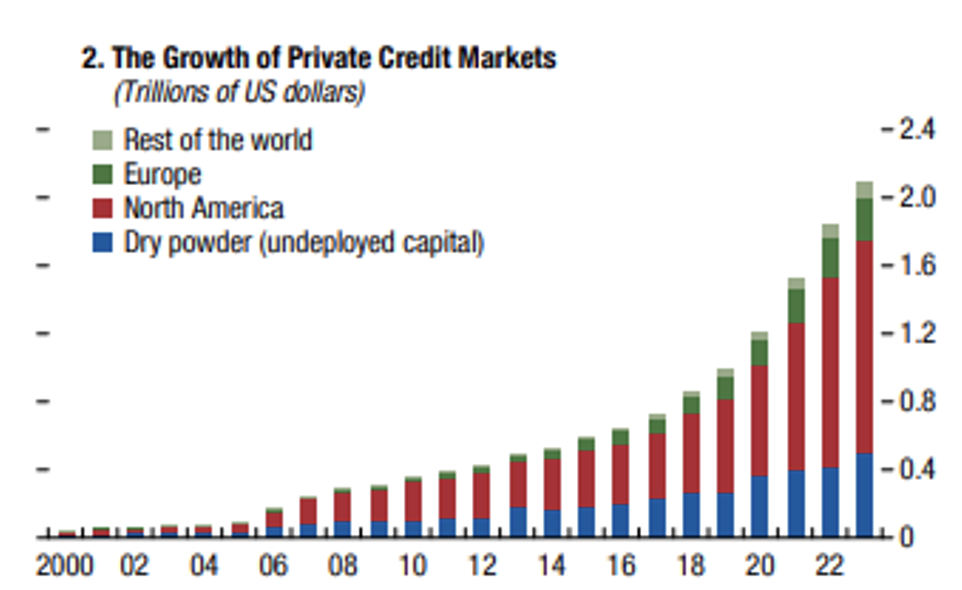

Therein lies the opportunity of private credit, which has emerged as a solution and grown in earnest. Between willing capital ready to calculate and absorb risk and the ability to structure loans tailored to correctly price that risk and accommodate borrowers, private credit is seemingly the more appropriate outcome to corporate America’s need for cash.

Source: International Monetary Fund, Global Financial Stability Report, April 2024

Source: International Monetary Fund, Global Financial Stability Report, April 2024

More recently, as bank lending standards tightened throughout 2022 and into 2023, private credit was there to fill the liquidity void. In that sense, one has to wonder whether it was part of the reason (though certainly not the primary driver) why we didn’t see the recession of 2023 which everyone forecasted. So private credit has replaced a portion of traditional banking, and helped keep Corporate America afloat, all while producing attractive returns for pension funds, insurance companies, wealth funds, and mom & pops alike – seems like a win/win?

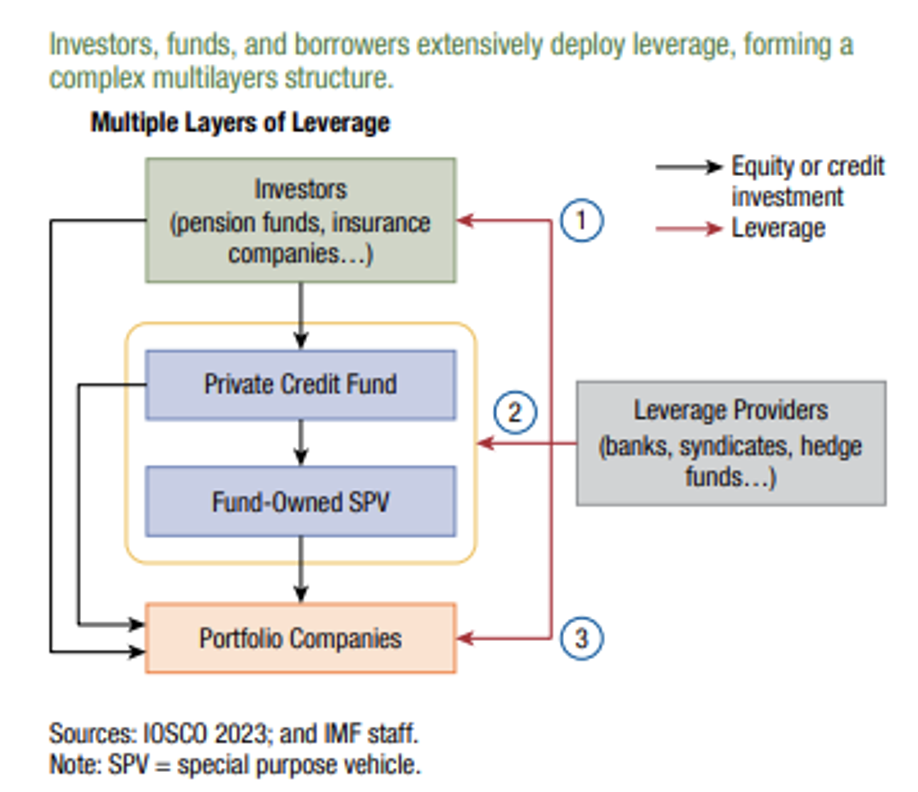

Time will tell if its burgeoning growth produces any unintended side effects, but two areas to watch are leverage and opacity. Leverage is the borrowing of cheaper funding to enhance higher-returning opportunities. Let’s say you have a prospective project that will cost $100 and yield 10% annual returns, and you can borrow 50% of that cost at 5% annually. Instead of making a 10% return on invested capital (ROIC), using leverage amplifies your return to 15% ($10 return, less $2.50 interest, divided by $50 cash outlay). Free money!

The problem is that this dynamic can also work in reverse. Using the same example, the $50 borrowed has a senior claim on cash generated from the prospective project. If the project only ends up returning $2.50, the interest paid on $50 gobbles up all of your return. Things look worse when considering the prospect of actually losing money.

Source: International Monetary Fund, Global Financial Stability Report, April 2024

Source: International Monetary Fund, Global Financial Stability Report, April 2024

Now consider this, the typical borrower here is a small to mid-size company that already has a leveraged capital structure. This credit may be coming in at any level of that structure, sometimes subordinate to existing borrowings. Furthermore, and here’s the kicker, sponsors often utilize leverage at the fund level to amplify returns. This drastically increases the probability that loan-level losses result in fund-level losses.

Moving on, the function of a public market is to provide real-time price discovery on that which is being traded. While one may argue the market isn’t perfectly efficient (thus the rationale for value investing), the current price is the collective best effort to value a security at any given time. As such, the known risks of owning a security are typically reflected in its price.

This isn’t the case with private credit. Loans aren’t traded, and sponsors aren’t required to mark assets to market (and if they are doing so, they are the ones setting their own marks). If you were running a fund, would you price all known risks into the carrying value of your loan? Or would you give yourself the benefit of the doubt?

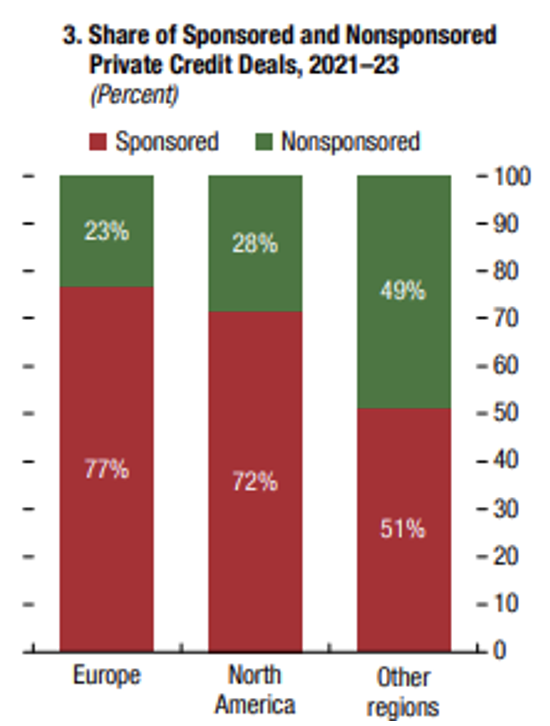

I’ll include one final bonus risk – the private credit system is intertwined with a mix of self-dealing. According to a recent IMF (International Monetary Fund) study¹, 81% of private credit assets are managed by firms that also manage private equity funds. As shown below, 72% of US deals are to borrowers with private equity sponsors. While not to suggest any nefarious activity, it isn’t farfetched to think that credit deals are being used to prop up invested capital within private equity.

Source: International Monetary Fund, Global Financial Stability Report, April 2024

Source: International Monetary Fund, Global Financial Stability Report, April 2024

¹ International Monetary Fund, Global Financial Stability Report, April 2024

In closing, we believe there are opportunities within private credit, but recommend investors maintain a discerning eye. Not all funds are created equal – look for sponsors that:

-

-

- Are smaller in size (though large enough to employ proper fund resources)

- Have a niche/specialty (some technical, legal, or sector-specific expertise)

- Possess unique deal origination opportunities

- Prioritize downside protection over maximizing returns

- You personally like and trust!

-

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-10.