Right now, the consumer’s money in their wallet doesn’t jiggle jiggle, it folds.

Everyone reading this has probably heard us continually state that the stock market is different than the economy, and that over longer periods of time, the consumer’s propensity to spend drives the economy. But, as we all know, the market is different – the market is more volatile – the market can look through the strength of the consumer, as it focuses on more ST macro headwinds. This is exactly what is occurring right now. Just because the consumer is flush with capital and a very unencumbered balance sheet doesn’t mean that the economy cannot fall into a recession. It also doesn’t mean that this is the canary in the coal mine that will not allow the stock market to drop.

In the immediate future, there are more important problems to tackle – multi-decade high inflation, a Fed transitioning from QE to QT, geopolitical uncertainty, record high gas prices – and not to mention a mid-term election. These are the factors that are creating the noise, i.e., volatility, right now.

Taking a step back, after recent earnings reports from COST, WMT, DG, TGT, etc., we have seen the real time effects of a change in investor sentiment as it pertains to inflation. The economy has seen a shift from goods to services, brand names to private label, and more. This has caused many people to talk about how dire it is out there for the consumer, that they are in a terrible position, which will obliterate demand.

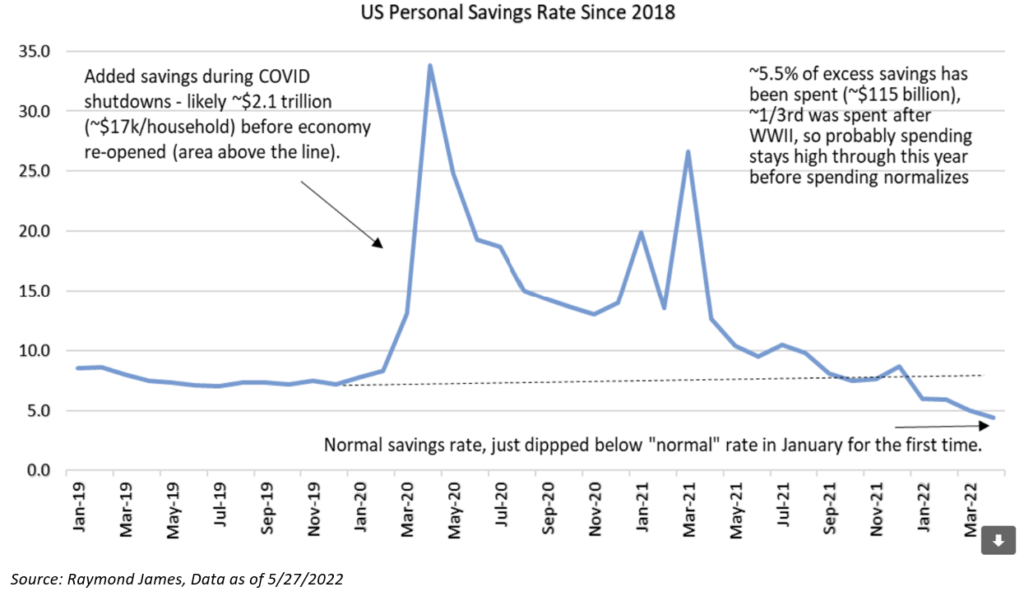

This irks me… a lot actually. I think there are some misconceptions regarding the personal savings rate and what it means. Thus far in 2022, consumers are spending more year-to-date than they typically do through April – but, this doesn’t mean that the consumer is tapped out. According to Raymond James, the consumer has only spent 5.5% of the excess savings that they amassed during the pandemic. The only other time that consumers had this large a boost of excess savings was during WWII – where they spent 1/3 of their savings. Personal savings, which have been decreasing, is an income statement metric, not a balance sheet metric.

Think about it – The income statement is your capital intake minus the expenses. If the expenses > capital intake, you must tap your savings account, i.e., balance sheet. If one starts the see their balance sheet completely deplete, then it becomes worrisome – we are no where close to that.

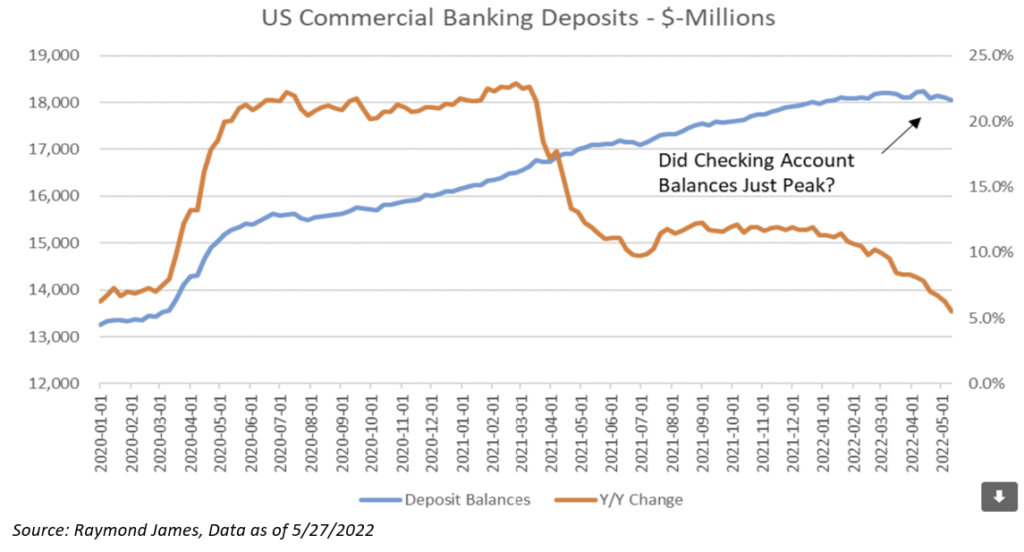

Banking deposits are up ~$2T from pre-pandemic levels. This figure has finally started to decline – which is part of the normalization process. This does not mean that the economy or consumer is weak. What it does mean is that demand is artificially high in aggregate, bringing down the savings rate (income statement), while the consumer cash continues to not jiggle jiggle, it folds (balance sheet).

The Income Statement

The Balance Sheet

The savings rate is going down, but the consumer continues to have a substantial amount of cash relative to pre-pandemic.

Yet, the strength of the consumer isn’t a saving grace in the face of multi-decade high inflation, especially in the short-term. That is why it is so important for the fed to do their best to regain credibility and navigate a “soft landing”. Longer-term, I believe that the consumer will spend the excess capital that they have on their balance sheets.

My takeaway from the recent earnings season isn’t that demand is slowing, it’s that the spending habits have shifted, as the sentiment around inflation becomes more apparent. That is normal consumer behavior, as they recognize that life’s mandatories – food, gas, and rent are at decade high levels and can impeded their LT purchasing power.

Bottom line, THE MARKET INVESTS IN THE CHANGE IN THE NEAR-TERM (SAVINGS RATE), AND THE LEVEL IN THE LONG-TERM (TOTAL NET WEALTH). My buddy Tavis McCourt gets the credit for that line.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA- 2205-24.