In the world of investment strategies, the 60/40 portfolio, with 60% allocated to equities and 40% to Treasuries, is the classic approach aimed at balancing growth and stability. But what if the stability component is less likely to help the next time equities take a hit? Let’s delve into the numbers and assumptions behind this challenging situation and explore a better way to protect your investments.

The Yield Movement Dilemma

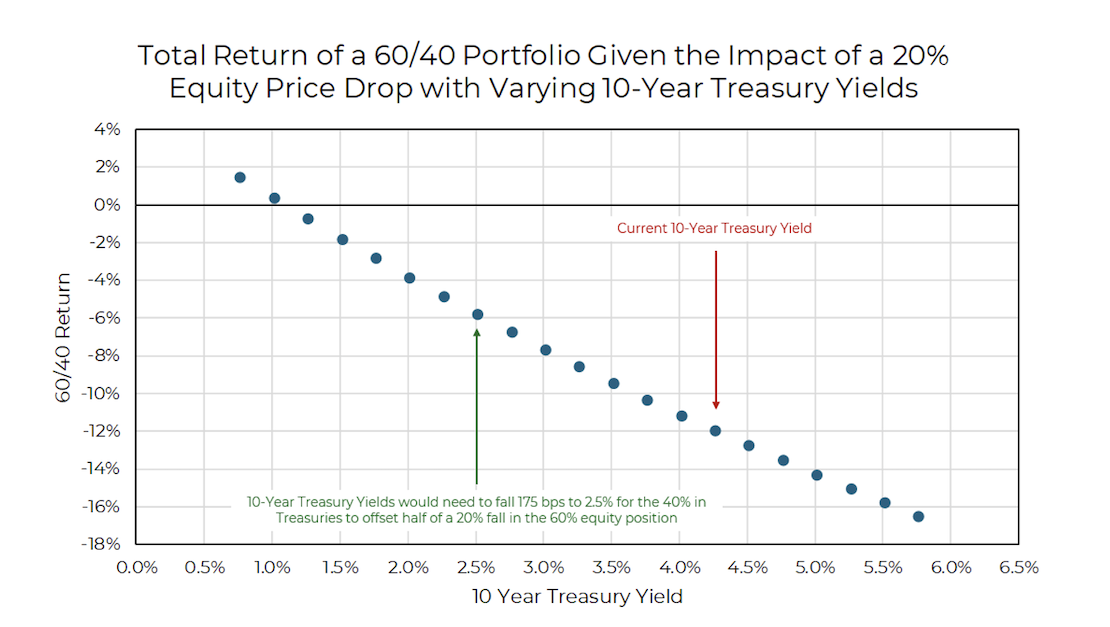

Consider a scenario where the 60% equity portion of the portfolio drops by 20%. This results in an overall portfolio decline of 12% (60% x -20% = -12%). To mitigate just half of this loss, the 40% in Treasuries would need to generate a return of 15% (40% x 15% = 6%). However, with the current 10-year Treasury yield around 4.25%, achieving such a return would require yields to plummet by 175 basis points (1.75%), down to approximately 2.5%.

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

Challenging the Assumptions

This sharp decline in yields from 4.25% to 2.5% seems overly optimistic, especially in the current economic environment as it is our view that:

-

- If equities drop due to inflation fears, it’s improbable that interest rates will fall; yields may stay high or even rise instead

-

- The Federal Reserve’s cautious stance on reducing rates too much makes a significant drop to 2.5% unlikely given recent pushback and the impact of low rates in recent years

-

- The Fed’s recent long-term projection for the Federal Funds rate (shared just last week via their long term dot-plot expectations) was just reported at 2.8%, making sustained Treasury yields lower than their projected Fed Funds rate improbable

A Better Solution: Put Options

Put options present a more effective means of protection against market downturns. These options act as insurance, enabling investors to hedge against stock price declines. Unlike the uncertain hope that Treasuries will drop in yield, put options provide a clear, reliable form of downside protection by allowing investors to sell or hedge their holdings at a predetermined price.

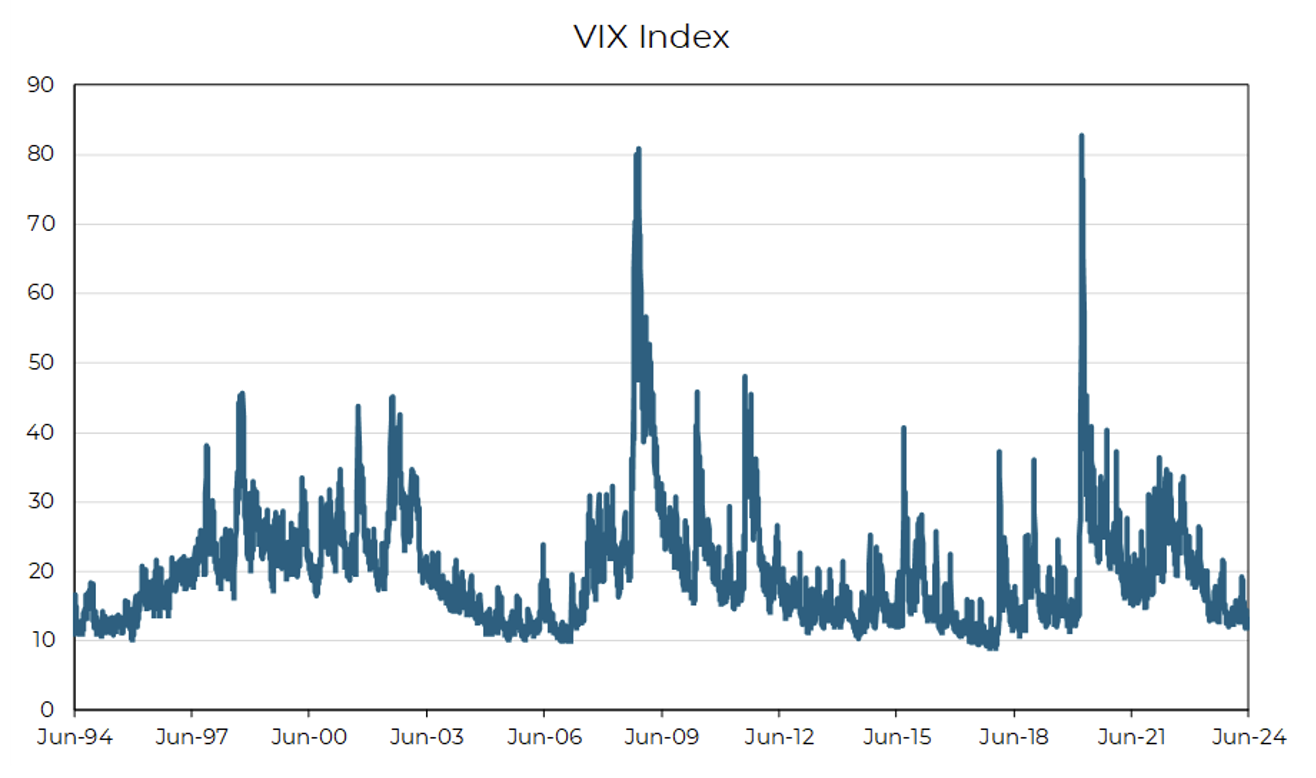

As a result, put options will consistently provide a negative correlation to stocks, which will not always be the case with bonds. Furthermore, the convexity, or protective benefit, of put options increases when market volatility is low and rising, as extreme outcomes are considered less likely when volatility is low. In a significant downturn, such as a 20% equity drop, the VIX (volatility index) would likely surge, increasing the value of put options through both the market decline (delta) and rising volatility (vega).

Puts can be particularly attractive when the cost of buying put options (i.e., the premium) is relatively low. This low cost reflects the market’s low expectations for volatility, as indicated by the VIX, which was recently at a historically low level of 12.5 (as of July 12, 2024). Low volatility expectations reduce the premium, making put options an economical choice for protection.

Source: CBOE, Bloomberg as of June 2024

Source: CBOE, Bloomberg as of June 2024

Assessing current levels of volatility to decide when and how much protection to buy can be a powerful tool for enhancing returns and adding protection. This approach is especially advantageous compared to buying protection at a fixed level on a regular basis, irrespective of pricing and opportunity. For more details on the benefits of being active when hedging with puts, you can read our prior post outlining the flexibility in next-generation hedged equity products.

Conclusion

While the 60/40 portfolio remains popular, its efficacy is questionable in today’s market conditions. The expectation that Treasuries will always offset equity losses is increasingly dubious.

Investors should understand these assumptions and adapt accordingly. We think that a) diversification, b) a thorough grasp of market correlations, and c) the inclusion of explicit protection through put options, are crucial for navigating uncertain times effectively.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

* Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flow.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-23.