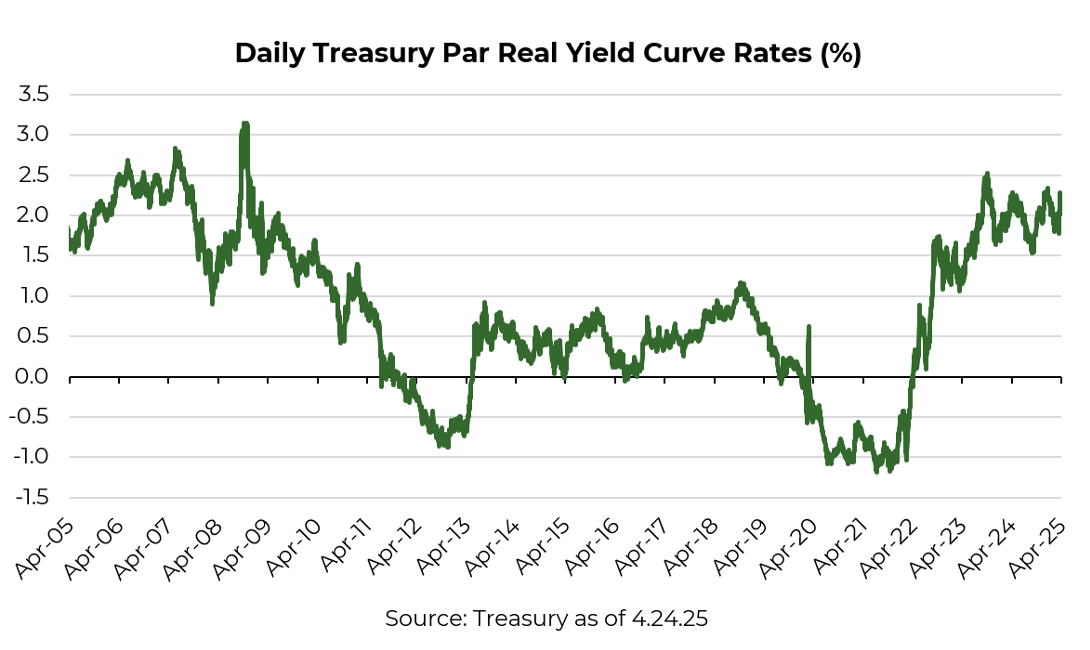

For over a decade, Treasury Inflation-Protected Securities (TIPS) offered little appeal—real yields were near zero, and inflation felt like a distant threat. Fast forward to today, and the landscape has changed meaningfully. Real yields on TIPS are now above 2%, making them one of the more compelling opportunities in fixed income.

And it’s not just about the higher yield. It’s about the shape of possible outcomes. With rising uncertainty around U.S. fiscal policy (tariffs, tax cuts, and shifting government spending patterns) there’s a growing case for both inflationary and deflationary risks. TIPS happen to hedge both ends, unlike traditional Treasuries.

What Are TIPS?

TIPS are government-issued bonds that offer a real yield (i.e., a return after inflation). Unlike nominal Treasuries, which pay a fixed coupon, TIPS adjust their principal based on the Consumer Price Index (CPI). If inflation rises, the principal increases; if there’s deflation, the principal can decrease, but only temporarily.

At maturity, TIPS are guaranteed to return at least their original principal (typically $100 per bond), even if there is cumulative deflation over the life of the bond. This deflation floor provides downside protection in a deflationary environment along with the inflation protection that nominal Treasuries don’t offer.

Here’s the relationship to keep in mind:

Nominal Treasury yield = Real TIPS yield + Break-even inflation

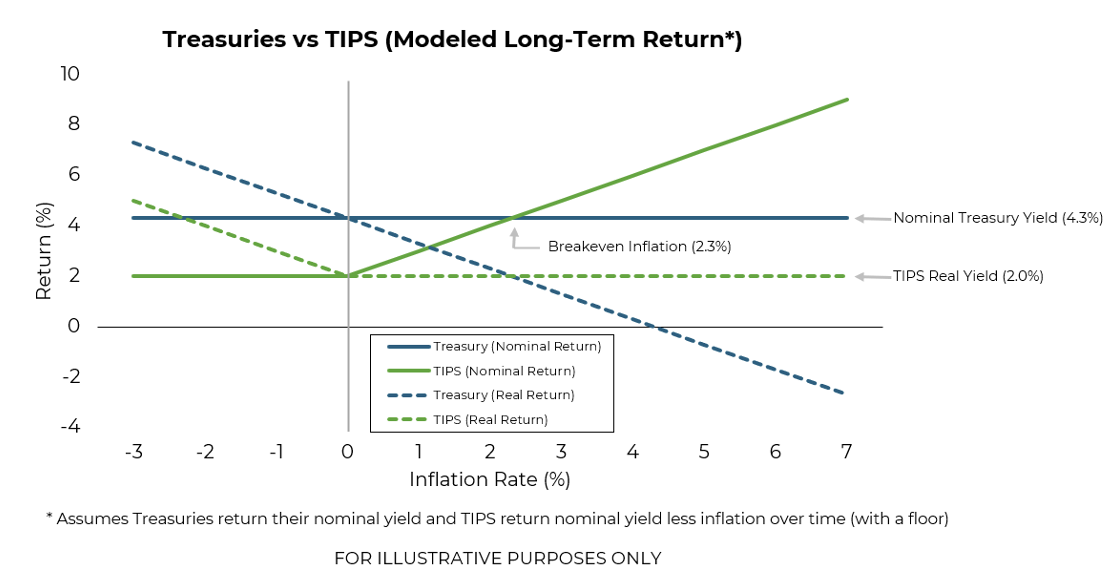

So if 10-year Treasuries yield 4.3% and TIPS offer a real yield of 2.0%, the market-implied break-even inflation is around 2.3%. If inflation ends up being higher than that, TIPS win. If it’s lower, nominal Treasuries win, but only by a maximum of 2.3% / year given the floor.

Return Profile: Nominal Treasuries vs. TIPS

Nominal Treasuries

Let’s say you buy a 10-year Treasury yielding 4.3%. That’s roughly what you’ll earn annually in nominal terms over the duration of the bond, irrespective of how inflation evolves. If inflation averages 3%, your real return is just 1.3%. If inflation spikes to 5%, your real return turns negative. If we enter a deflationary world, your real return increases.

TIPS

Today’s 10-year TIPS offer a 2.0% real yield. That means you’re earning 2.0% above inflation, irrespective of what inflation turns out to be. If inflation averages 3%, your nominal return will be 5.5%. If inflation is only 1%, your nominal return will be 3.5%. If deflation hits, TIPS have an embedded deflation floor: you’ll receive at least your original principal back at maturity, cushioning downside risk and maintaining a positive real return.

Why the Case for TIPS Looks Better Now

Just five years ago, TIPS were mostly a hedge against inflation with negative real yields guaranteeing a loss in purchasing power in real terms. Today, they’re a hedge with a positive carry. The case for owning them rests on three dynamics:

1. Real yields are attractive: 2.0% real is compelling by most historical standards, offering positive real returns with bond-like risk.

2. Tail hedging in both directions: With fiscal dynamics in flux (tariffs, tax policy, and large public debt) it’s reasonable to believe the tails (inflation or deflation) are fatter. TIPS offer some protection in both directions.

3. Break-even levels are modest: Markets aren’t priced for runaway inflation. If inflation surprises to the upside, TIPS benefit. If not, you’re still locking in a strong real return.

Conclusion

From the aftermath of the global financial crisis and all the way through the COVID era, TIPS were mostly about potential protection. Now, they’re about return and protection.

If you believe there’s a higher chance of policy-driven inflation, or if you’re just looking for a durable real return with low correlation to risk assets, TIPS deserve a fresh look. The current setup seems to offer one of the most asymmetric opportunities in bonds today.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-31.