Happy December! Historically, this part of the year tends to see minimal volatility, but, as we already know, 2020 and 2021 continue to be the exception – so why would this be any different?

Given the whiplash that many investors have endured during the last week, let’s recap:

Friday, November 26th (S&P 500: -2.14%) – The S&P 500 logged its worst day since February 2021, as the WHO officially announced that the Omicron strand was a “variant-of-concern”, as it has over 50 different mutations.

a. Thoughts: We can’t pretend to know much about the latest COVID headlines, but fortunately it’s the market’s interpretation of events we care more about. So, looking at it from a market perspective, we are watching a few things, as the next few weeks will be very important: 1) Is Vaccine/Natural immunity good enough against Omicron to keep global economic recovering and EPS moving forward? Is Omicron disruptive enough to create Delta like impact to supply chains? 3) Is Omicron severe enough to cause economic lockdowns until new vaccines distributed in 2022? (unlikely in our opinion).

b. Trivia: As the World Health Organization (WHO) named variants of the coronavirus, “officials turned to the Greek alphabet … When it came time to name the potentially dangerous new variant that has emerged in southern Africa, the next letter in alphabetical order was Nu, which officials thought would be too easily confused with ‘new.’ The letter after that was even more complicated: Xi, a name that in its transliteration, though not its pronunciation, happens to belong to the leader of China, Xi Jinping. So, they skipped both and named the new variant Omicron.” (h/t NYT)

Tuesday, November 30th (S&P 500: -1.95%) – Investors were caught off guard by two of Jerome Powell’s comments during the Q&A portion of his Senate testimony, namely that he would “consider” speeding up the pace of tapering and that it’s time to “retire” the word “transitory” when referred to inflation – the word transitory, was in fact, transitory. The market read these comments as hawkish.

a) Thoughts: We know high inflation is becoming a political problem, not just an economic problem. Getting hawkish on the taper allows the Fed to have a tough action on inflation while buying time for inflation to start coming down in 2022, as Powell expects, which minimizes the need to raise interest rates aggressively. Powell can then pivot back to his push for full employment.

b) If you have any question regarding our thoughts on this testimony, especially regarding asset allocation, feel free to reach out at [email protected]

What do These Two Items Have in Common?

- They were both idiosyncratic, i.e., unexpected and not related to each other.

- They created volatility in the market – one of Aptus’ favorite words outside of “rising rate environment”.

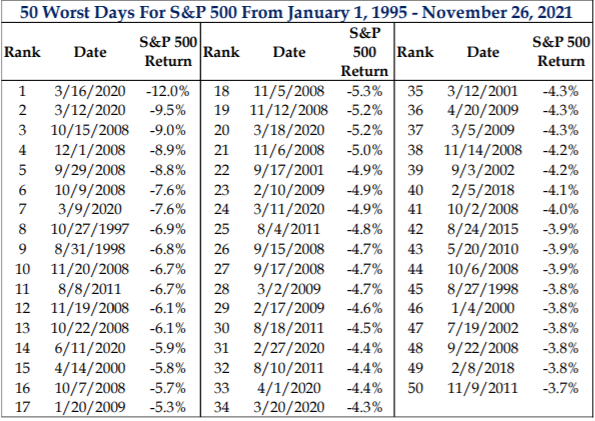

Let’s put this into perspective – neither selloff is even close to being in the top 50 worst days for the market. In fact, we are only 2% below all-time-highs (“ATH”). Historically speaking, this decline was not even close to cracking the top 50 worst days for the S&P since 1995. However, ranking 208 out of 6,775 trading days is still painful.

Source: Strategas, Data as of 11/29/2021

Takeaway

We are only 2% off of ATH. Our recency bias has us accustomed to seeing markets at these all-time highs, but that is atypical as stocks historically are at all-time highs only 30% of the time. The other 70% of the time, investors are trying to recapture previous highs – 20% of the time, markets are in a bear market drawdown of 20% or greater, which is likely a far higher percentage of the time than many investors realize.

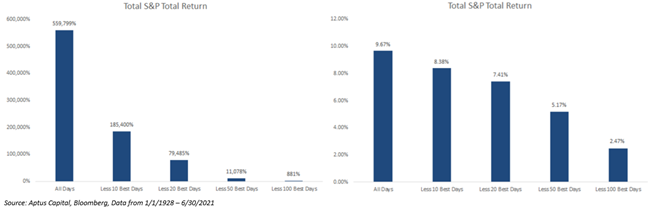

Although it’s easier said than done, ignoring the day-to-day gyrations in the market and headlines for rationalizations of sell-offs is often the best strategy. We would all love to time the market to miss the worst days and be invested only on the best days, but it is impossible. Most importantly, we believe the only way to reclaim lost returns is to stay in the market.

As the charts below show, missing just the ten best days over the last 93 years would result in annualized returns of 1.4% less than being fully invested.

Our Brad Rapking wrote on this last year, the benefits of a long-term perspective to get through the selloffs that are part of investing. As we like to say “The best strategy is the one you can stick to”…anticipating ways to help investors “stick” is a huge part of a durable investment plan. Like past headlines, today’s will eventually be in the rearview mirror and we believe your portfolio will be just fine.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2112-3.