In a recent post, Selling Puts as a Form of Risk Management, we explored using volatility indicators like the VIX to inform portfolio decisions. Building on that, this guide examines how VIX futures can provide insights into market sentiment and help make tactical decisions, such as determining when to take on incremental risk within a portfolio.

What Are VIX Futures?

The VIX, often called the “fear gauge,” measures expected volatility in the S&P 500 over the next 30 days. While the VIX itself provides a snapshot of near-term market sentiment, VIX futures offer a way to look further ahead, capturing market expectations for volatility over different time frames—like one month, three months, or even six months out.

VIX futures are contracts that allow investors to “bet” on future volatility levels at specific times. These contracts reveal the market’s collective outlook on volatility, giving clues about whether investors expect market calm or turbulence in the future.

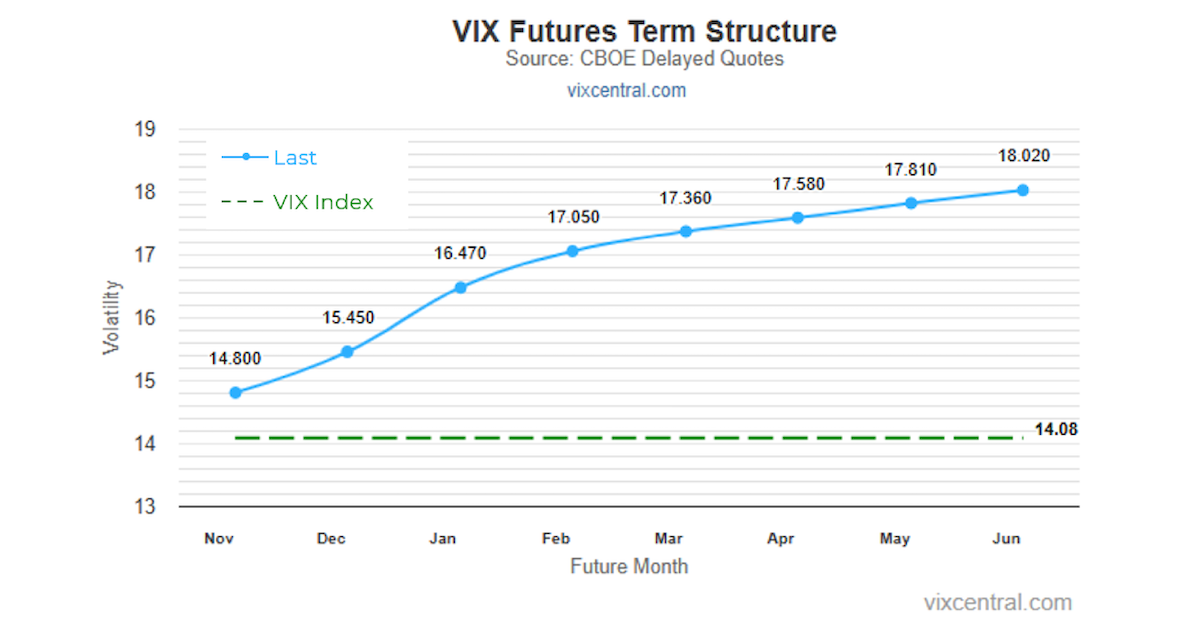

- Contango: Under normal conditions, VIX futures are in “contango,” meaning that longer-term contracts are priced higher than near-term ones. This upward slope reflects typical uncertainty, as the market generally assumes that, over time, volatility may increase (VixCentral.com – a great resource – shows the VIX curve in contango on 11/6/24)

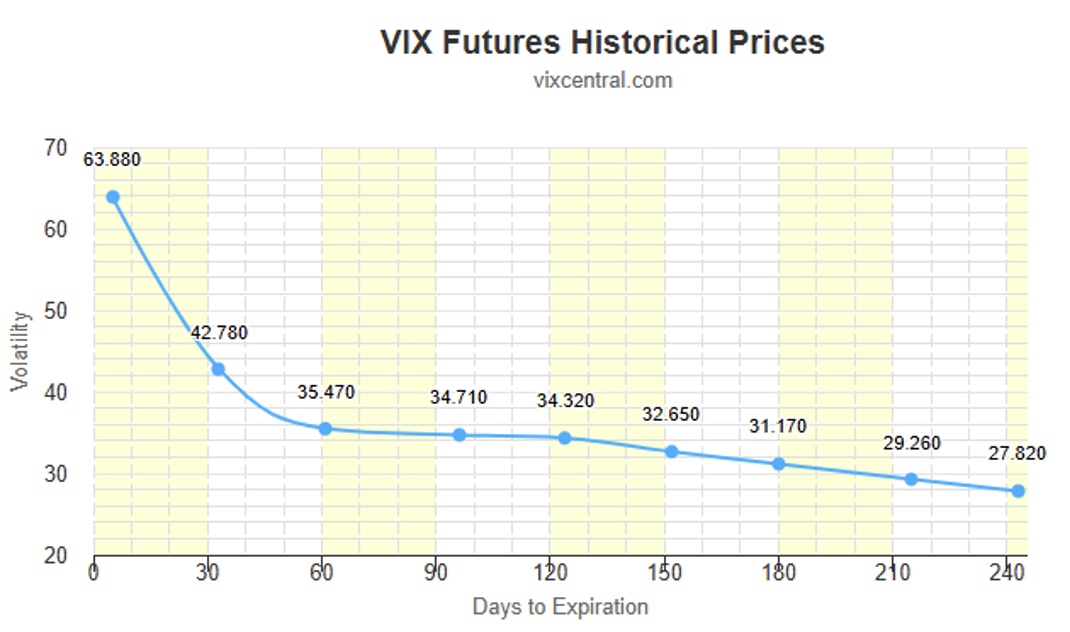

- Backwardation: When markets are stressed or fearful, however, the pattern can flip, and shorter-term futures may become more expensive than longer-term ones. This “backwardation” suggests that investors foresee high volatility in the immediate future, signaling heightened caution or market risk (VixCentral.com here shows the VIX curve in distress back in 2008 when Lehman Brothers collapsed)

Insights from the Data: IVTS and S&P 500 Returns

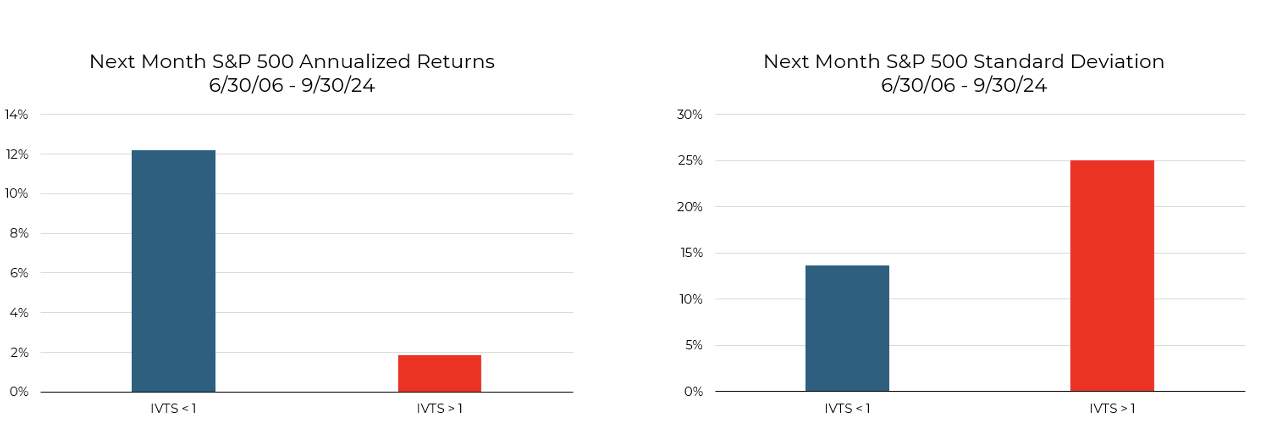

One helpful metric to gauge these shifts is the VIX/VIX3M ratio, also known as the Implied Volatility Term Structure (IVTS). This ratio compares the 30-day VIX with the longer 3-month VIX3M:

- When IVTS is less than 1 (upward slope), it often signals calm market conditions with a higher potential for returns and lower risk.

- When IVTS is greater than 1 (downward slope), it suggests a more cautious outlook, as investors see near-term volatility risk.

S&P 500 Returns When the Implied Volatility Term Structure (IVTS) is > or < 1

Source: Aptus, CBOE, S&P

Source: Aptus, CBOE, S&P

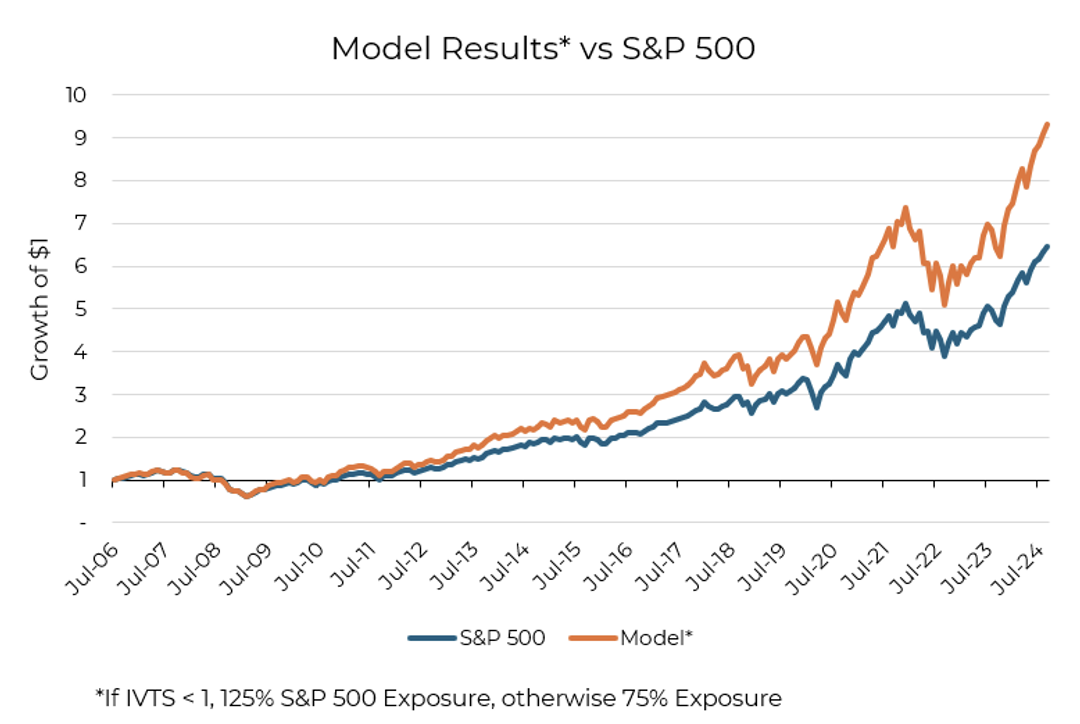

Developing a Model Based on IVTS Signals

Based on these findings, here’s a straightforward model for tactically adjusting equity exposure:

- If VIX > 20 and IVTS > 1, consider reducing stock exposure.

- Otherwise, consider increasing stock exposure.

Source: Aptus, CBOE, S&P

Source: Aptus, CBOE, S&P

This example offers a straightforward, data-driven approach to managing stock exposure based on real-time volatility signals. Ultimately, navigating market volatility requires both discipline and adaptability. By monitoring indicators like the VIX and IVTS, investors can gain valuable insights into market sentiment and potential risks, enabling more informed tactical adjustments. As the landscape of investment tools evolves, next-generation products are emerging that utilize volatility signals, offering innovative approaches to managing market exposure, providing unique return streams and portfolio solutions.

For those interested in exploring how volatility insights can be integrated into a portfolio, we invite you to reach out at [email protected] to learn more about solutions designed to build resilient and adaptable strategies across various market conditions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-15.