The returns witnessed by investors over the past few years have been an outlier. Entering the year, the 3-year annualized return for the S&P 500 was ~25% with the U.S. Barclays Agg. returning ~5%. In an environment where one has had strong returns, it makes one feel rich, naturally leading you to extrapolate further gains. More intriguingly, the highly valued, high growth stocks portion of the market has been hit the hardest.

Jason Zweig wrote about neuroeconomics in Your Money & Your Brain to show how financial decisions impact our brains. The brain scans have shown that the brain activity of a person that’s making money on their investments is indistinguishable from a test person – it literally makes people feel as if they are taking drugs. Investors need a bigger hit of adrenaline each time to get a bigger fix for the same emotional response.

It is our opinion that this is how leverage and speculation has the potential to cause financial ruin the market. That is why some of the most high-flying growth stocks have been hit the hardest this year – investors piled in at any valuation through FOMO. We have witnessed a valuation deleveraging event YTD.

As valuations quickly expanded over the recent years adding to returns, investors were just borrowing returns from the future. The more highly valued a holding is, the lower its return is likely to be down the road.

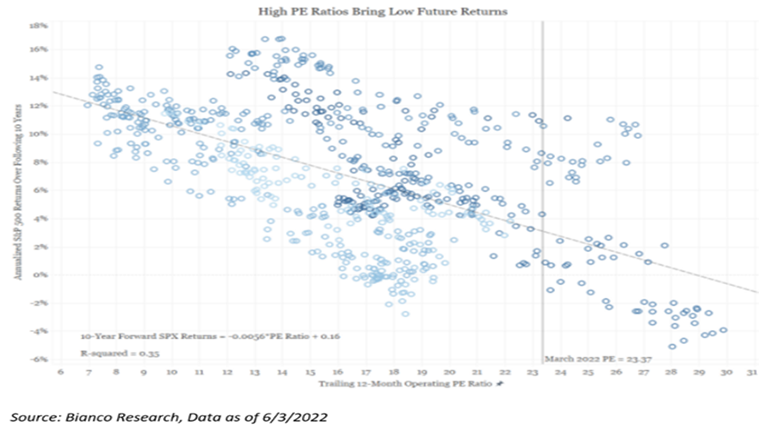

Perhaps this is a bit simplistic, but there is some truth to this line of thinking. The chart below shows the relationship between the S&P 500’s trailing 12-month operating PE ratio on the x-axis and the index’s annualized return over the ensuing 10 years on the y-axis. We entered 2022 at a valuation level that placed it in the 95% relative to a 50-year history, hence the title of our Aptus Annual Outlook this year – Investors May Need to Curb Their Enthusiasm in 2022.

Simply put, we feel higher valuations in the present generally coincide with lower returns over the following 10 years. The S&P’s P/E ratio began the year in the low 20s – historically this has coincided with annualized returns in the range of 2%-4% over the following 10 years. The S&P’s P/E ratio currently resides around 18.0x, which means that an investor can expect an annualized return closer to 6% over the following decade.

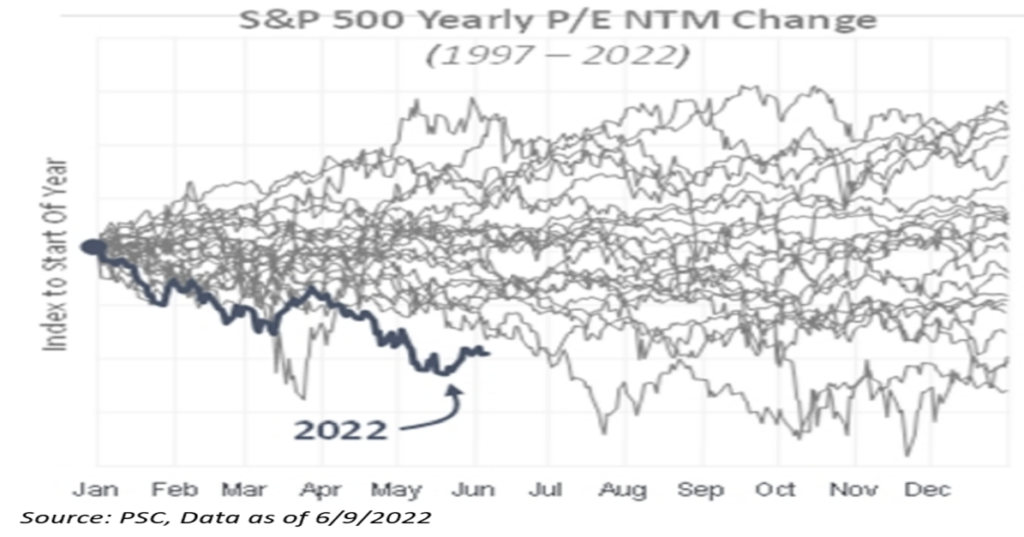

The return pain felt this year from the S&P 500 can be fully attributable to multiple compression. But the pain felt now, has helped create an environment which we think may be more fruitful in the future. Short-term pain for long-term gain.

This year could be deemed a “duration cleanse”, both on the equity and fixed income side.

As a note of caution, annualized returns have been as high as 11% and as low as -1% following similar valuations in the past. This is not meant to pinpoint exact returns moving forward but offer some expectation for the future based on current valuations.

My point here is that compounding capital can get messy in the short-term but tends to be a more consistent metric over longer periods of time. But, as we have seen, investors need to be prudent how the invest.

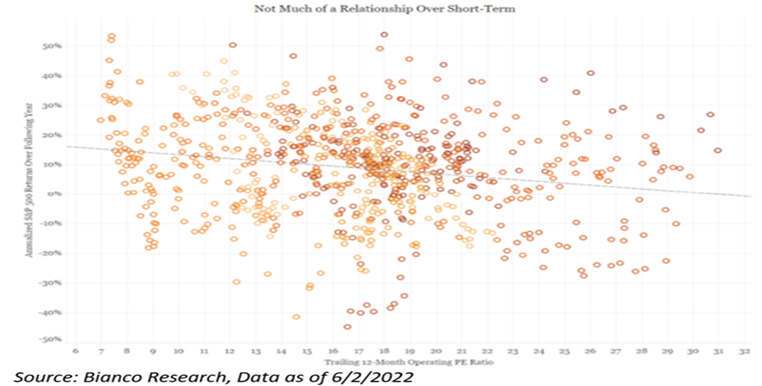

The relationship of valuation and return is much more random over the short-term. While the chart above shows annualized S&P 500 returns over the ensuing 10 years, the chart below simply shows returns over the following one year. Long-term investors might be able to set expectations based on current valuations, but short-term investors should not use this as a timing tool.

We understand that it has been a difficult beginning to the year, but sometimes, the best time to buy stocks is often when it feels the worst. This year has created an opportunity for long-term investors – there’s been a reset in valuations. Does that mean that a floor has been set in the markets? Absolutely not. But the valuations in this current environment are much more palatable than where they were to begin the year.

Let’s open that can of worms – is the market valuation at its bottom? Like I mentioned above, valuation is a poor tool on timing ST moves on sentiment. In fact, year-to-date, the market has seen its sharpest valuation decline in history. That begs the question – what all is priced into the market already?

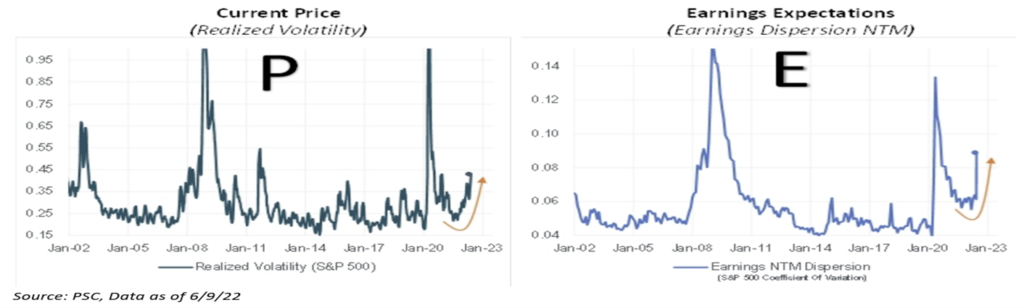

As of today, there remains a lot of uncertainty in the P/E inputs. Many of y’all have heard me discuss that this market has been more macro-driven than fundamental: War in Ukraine, QE à QT, rising interest rates, a more hawkish Fed, a mid-term election, and John Luke’s favorite….inflation.

We do not have a crystal ball to call a market bottom. Looking over the last decade, stocks have been a great purchase ~16x multiple. Is that the case this time? We don’t know. But what we do know is that this “valuation cleanse” creates a more palatable environment for future returns.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and collateralized mortgage-backed securities.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA- 2206-11.