The last decade has made that fact easy to forget, but eventually the market will remind us, and may be doing so now. Volatility is a feature of the markets. If you want the upside, you cannot avoid volatility. If you are positioned to feel no risk, you will also feel no upside. We call that “return-starved” risk management.

When stock prices drop, don’t buy the lie that the market is broken. It’s not. Your long term results are riding on how you behave during uncomfortable times. If you want to get what the market gives (within your risk allocation), you need to be able to handle periods of bad returns – they are inevitable when dealing with risk assets. Account values dropping is a tough pill to swallow, but investors’ reactions impact the outcome more than any other input, and to keep those in check, keep these items top of mind:

#1 – Higher valuations tend to mean lower returns in the future.

The Shiller P/E chart below is a decent indicator of the relationship between the aggregate return of stocks and the associated opportunity costs. In other words, future returns tend to be lower when Shiller P/E readings are relatively high and vice versa. In addition, higher valuations can lead to larger drawdowns. Both charts make sense intuitively and the data supports the reasoning. While lower prices hurt in the short run, they can work in your favor in the future.

#2 – The long-term direction of the stock market is up.

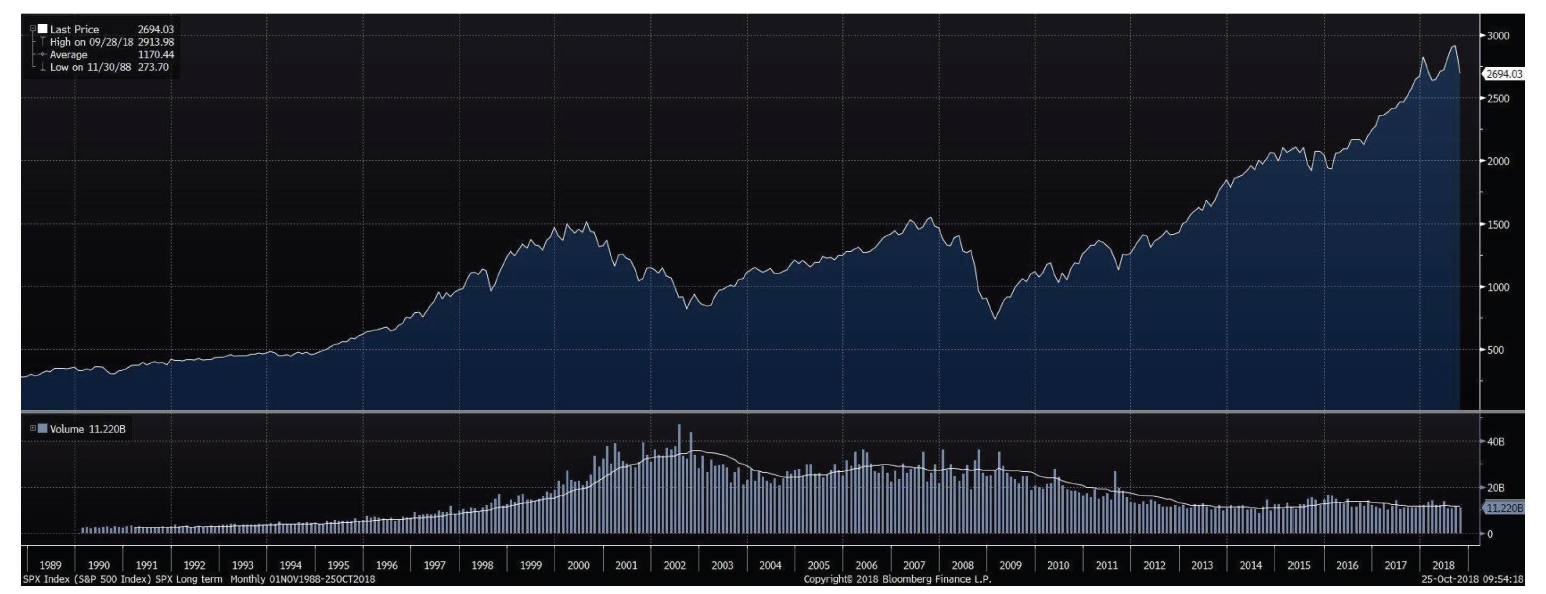

Zoom out on a historical chart of the stock market and it’s going from the bottom left to the top right. We believe that long-term trend will continue. Warren Buffett seems to think that as well. Most would consider him to be a decent investor: Warren Buffett says he’s buying stocks “because I think they’ll be worth quite a bit more money, 10 years or 20 years from now”

Source: Bloomberg as of 02.01.2020

Notice in the chart above, the long term results come along side short term discomfort from time to time. The emotions that come with falling prices lend themselves to in the moment behavior which can be detrimental to results and responsible for creating the behavior gap itself. Don’t sacrifice long term objectives for short term comfort.

The two points above are great reminders, but may not be enough to lean on during turbulent times. To help keep emotions in check, we construct portfolios to include strategies like trend following, value-dependent tail hedging, and defined risk. Are they perfect? No. But over the long-term, the evidence supports their ability to help deliver portfolio returns more attainable for investors. These exposures are designed for one reason – to minimize the behavior gap by building portfolios that are risk-managed but not return-starved. They are not designed to avoid all volatility, but are designed to minimize the chances of severe drawdowns. If you are positioned to side step all volatility, you’ll also side step the upside as well.

No matter how you approach portfolio construction, it’s important to remember: while short term volatility is uncomfortable and cannot be eliminated, the long term probabilities are skewed heavily in your favor. Months like October can make that hard to remember.