As we move into the second half of 2024, the outlook appears relatively positive. As we highlighted in last month’s 3 Pointers, when index returns were historically strong the first few months of the year, the remainder of the year also tends to perform well. Economic indicators suggest a soft landing, with inflation receding and the job market cooling without crashing.

Given this favorable backdrop, it might seem counterintuitive to think about portfolio hedging. In our view though, that makes this the perfect time to examine how your portfolio would perform in an environment where economic data and market returns are going in the other direction. Like how airlines do safety demonstrations before taking off, we want to think about the robustness of our portfolios and be prepared for an emergency while markets are calm.

The title of this piece addresses the most important question that you must consider when evaluating your hedges against those types of outcomes.

Who is Going to Pay You When the Market is in Turmoil?

Readers of prior Aptus write-ups have often heard us say “More stocks, less bonds, risk neutral”, but for those new to us, this piece will explore why we express skepticism towards the conventional (likely consensus) belief that bonds alone offer sufficient protection for a portfolio. When markets are going haywire, funds are experiencing outflows, volatility is spiking, and cash is king, who is going to be there to pay you for those bonds?

In our view, excess exposure to bonds can impede your return during bull markets, while their performance during periods of upheaval will not compensate you enough for that return drag. Let’s examine the performance of corporate and municipal bonds during significant market drawdowns:

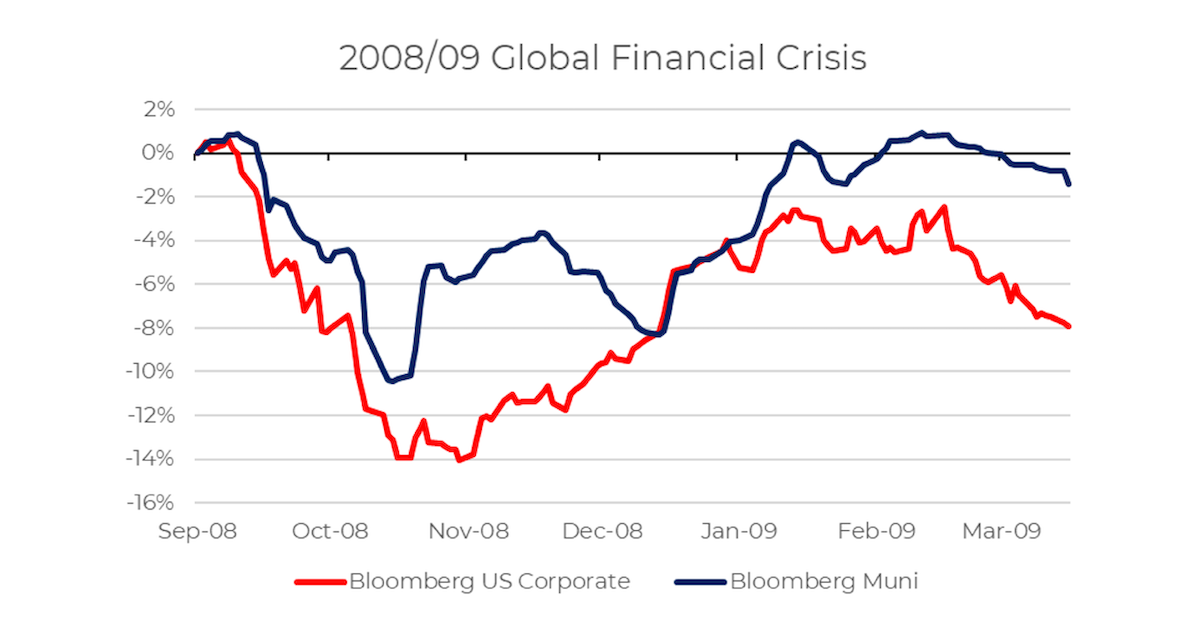

- The period following Lehman’s collapse (September ’08 – March ‘09)

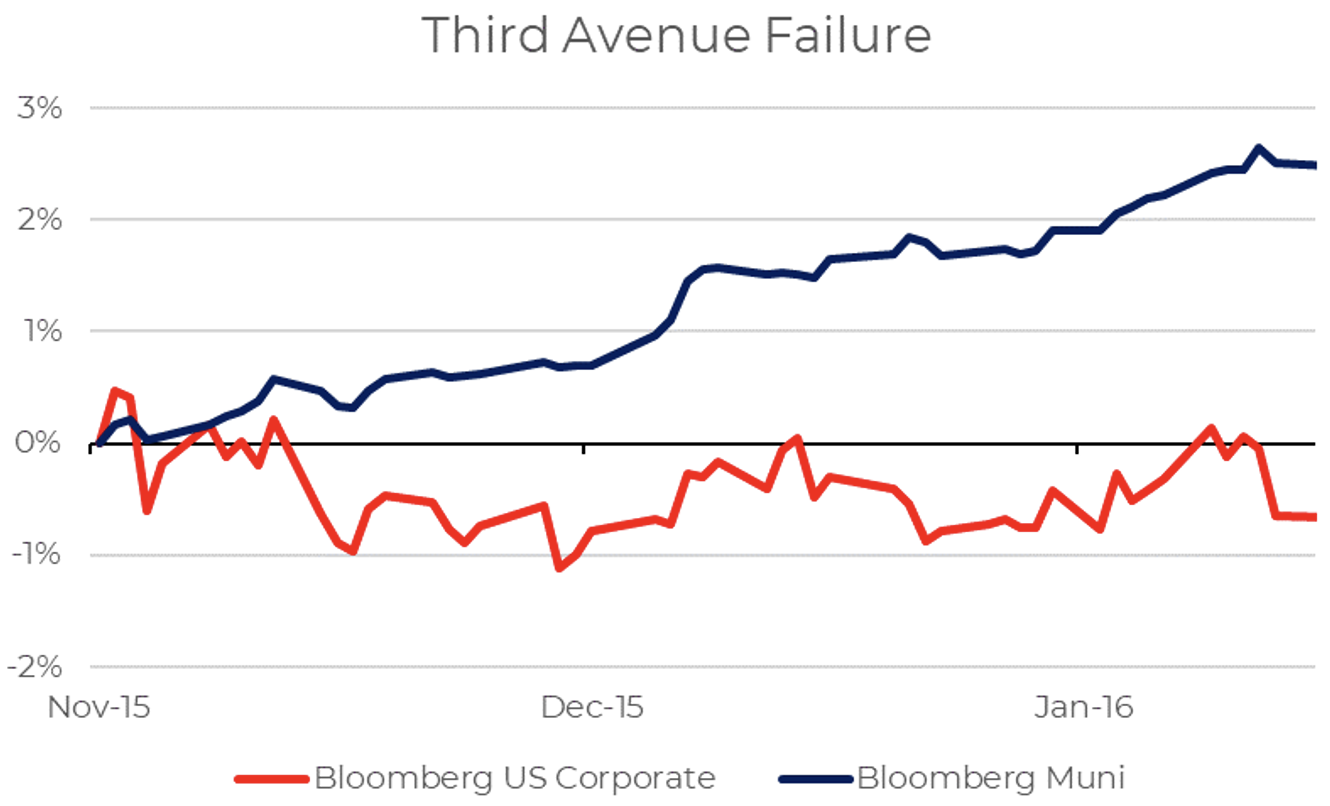

- The sell-off following the failure of Third Avenue (December ‘15 – February ’16)

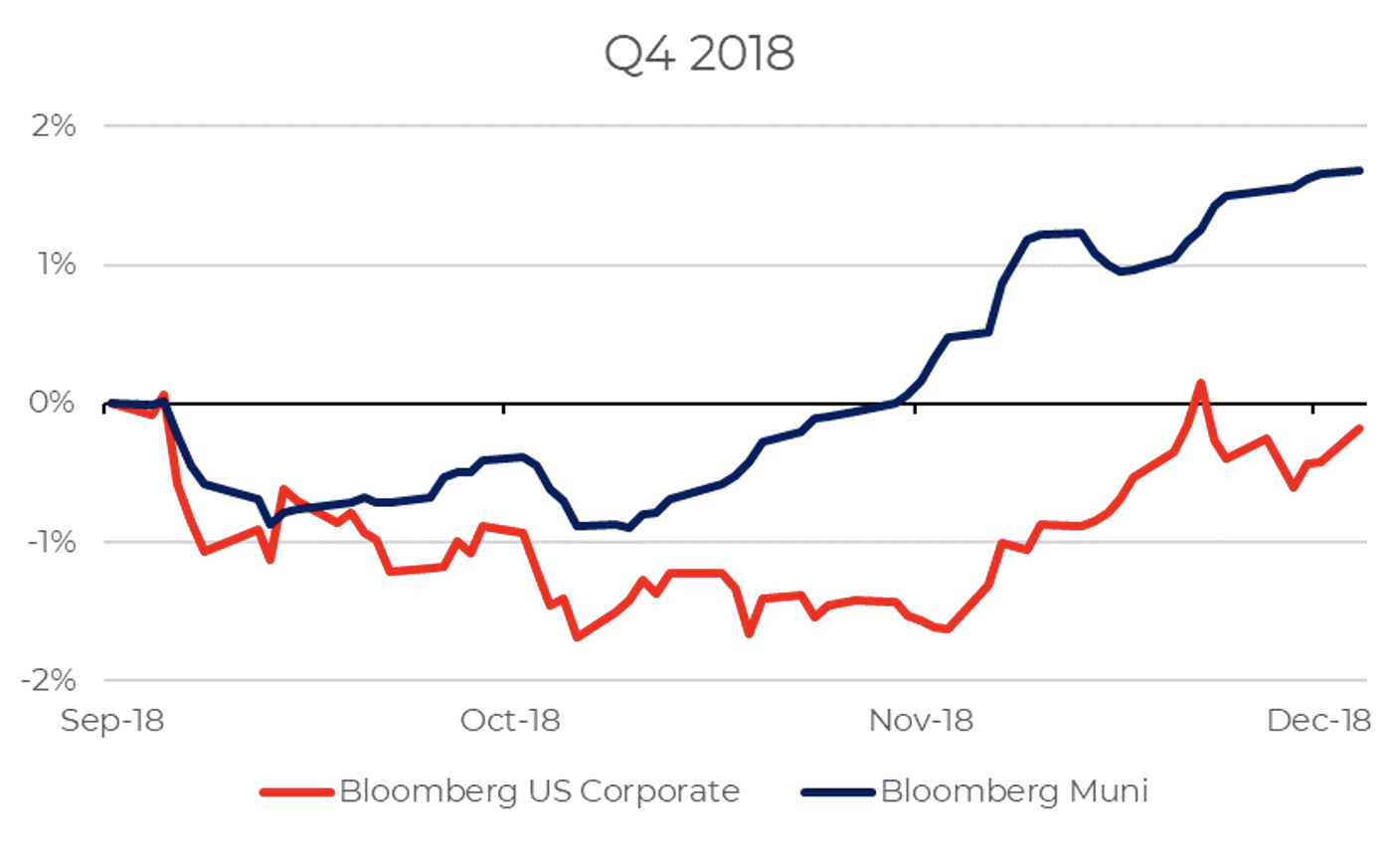

- The market selloff in Q4 2018 up to the “Powell Pivot” in January 2019

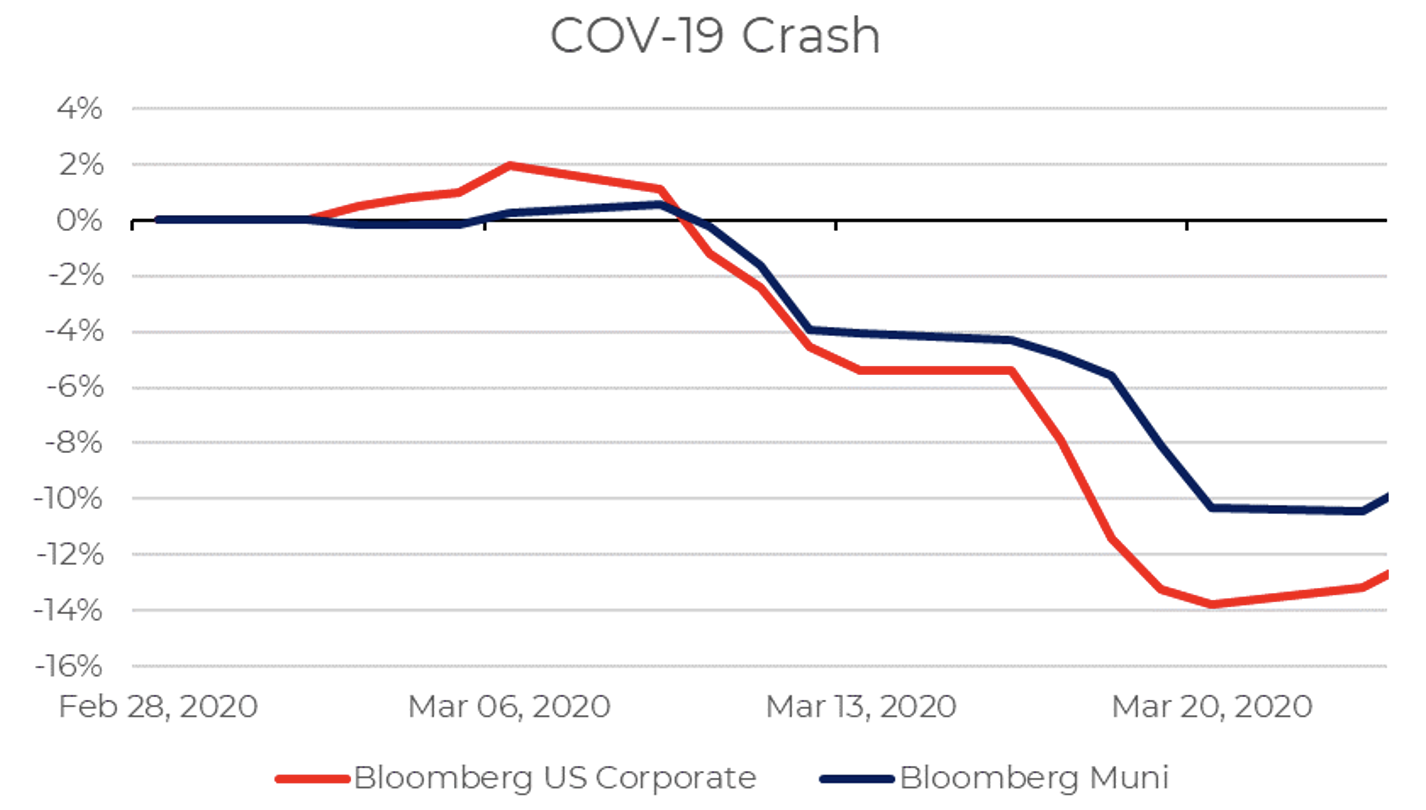

- The COVID crash (February 15 – March 24, 2020)

- The 2022 Bear Market

These instances show that bonds, commonly thought of as a “lifeboat” and considered safe havens, have been inconsistent on defense at best. In our view, the explanation is quite simple. If you want to monetize these positions (aka sell them to create cash), good luck finding someone to give you fair value when you need it most.

Lehman’s Collapse (September ’08 – March ‘09)

Third Avenue Failure (November ’15 – February ‘16)

Q4 2018

COV-19 Crash

2022 Bear Market

All Charts Source: Bloomberg as of 06.23.2024

Each of these five scenarios experienced a meaningful equity market drawdown and in none of these instances did we see both indices demonstrate a positive return. Common responses like “irrational markets”, “that was a black swan” or “who could have seen that coming?” often followed these periods, with most investors choosing to go back to what they were doing before.

In our view rather than outliers, these results make perfect sense if we consider the nature of bonds as financial assets. During crises, participants want cash, not assets. Managers facing net outflows must sell assets to pay redeeming shareholders. They sell what they can, not necessarily what they want to. Buyers, holding cash waiting for such opportunities, have no incentive to pay full par value for bonds, especially when they hold the negotiating leverage.

If you put yourself in the shoes of someone holding cash during any of these moments, what would you be doing? If you have cash you can deploy during these periods of market stress, you want a deal. After all, markets could always go down more, you expect to be compensated for taking on that risk. You are the gatekeeper for those looking to exit the market and hand off the risk of holding financial assets.

If your portfolio protection is only in the form of bonds, you are wagering that the gatekeepers will be incredibly kind to you during the exact moment that they have all the leverage. How likely does that sound? You may have no intention to sell yourself but remember, your portfolio is “marked to market”. That means that your portfolio value will go down due to the selling from everyone else who holds those same assets. Moreover, what if you wanted to buy more stocks to take advantage of the sell-off? Do you really want to be selling those bonds at a loss to create the cash to do so?

True Peace of Mind

Puts, on the other hand, function differently. They will go up in value when the asset they represent goes down. Importantly they offer a convex payout structure when that happens. Translating that statement into English, a helpful way to think about puts is the similarity they demonstrate to something like car insurance. You pay a certain amount in premiums, and should you get into an accident, your insurance will pay a lump sum to compensate you financially.

That is convexity in action, a nonlinear payout relative to the smaller premiums paid. There is a reason that they are called “options” to begin with. Should something unexpected happen in the market, you will have more choices because you have something that can potentially be converted to cash. You are holding protection that other market participants need and are incentivized to pay you for.

To wrap up, we do believe bonds have a place in a portfolio. They are less volatile than stocks and offer consistent cash flows over time. Our argument is against the conventional wisdom that bonds will with certainty protect a portfolio during periods of crisis. In fact, what the data shows is that bonds don’t offer the protection one might expect and can drag on long-term returns when markets perform well.

That is exactly why you hear us say “More stocks, less bonds, risk neutral.” It is not about taking on more risk, rather, it’s about creating portfolios that perform well in various environments and offer true protection during downturns. When you evaluate your own portfolio, ask yourself, who is going to pay you?

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2406-20.