Investing can be fun. Well, at least some days. Maybe a roller-coaster is a better description. The hardest part is finding a way to keep the train on the tracks by focusing on what matters. On one hand, we have the fear of losing money, driving people to be conservative, and on the other, greed can give investors an outsized risk they didn’t need to take on.

Investing behavior is rooted far beyond the surface of each person. We all come from different backgrounds, raised by different people, and have lived through our own distinct time periods. All these things and more factor into how we invest.

At the annual small talk family finance summit or what other people might call Thanksgiving; I was reminded of the challenging behavior gap we all face as we invest. In one corner, an uncle is talking about how things are about to crash. He spoke about how the national debt is going to capsize us. All his savings are in CDs. Later, outside, I spoke to another uncle, discussing blockchain and Ethereum investing. He had zero worries about our government or the most recent geopolitical issue; he was more focused on the momentum of crypto.

These two people grew up in the same household and are within 5 years of age, yet have completely different ideas in how they should invest. The point being that investing is very personal. Taking a step back to understand “the why” behind your investment, can hopefully drive how you invest.

Simplifying The Why

Consider the idea of training for a marathon. Prior to the race, you will need to start training 18 weeks in advance. Each week, you have a mix of different runs and a defined plan to ramp up to about 50 miles per week through 3-5 runs. Once you get to that point, which takes time and consistency, you are closing in on running 26.2 miles.

It is very hard to determine how to train for a marathon without understanding how many miles you need to run and the date you will run them. Even with that knowledge, running 26 miles is not easy. Goals-based training is the same as goals-based investing. Understand what the money is intended for, invest accordingly, try your best to consistently work toward that goal, and make tweaks based on your progress.

Managing Risk

“The biggest risk is always what no one sees coming, because if no one sees it coming, no one’s prepared for it; and if no one’s prepared for it, its damage will be amplified when it arrives.”

– Morgan Housel

While there will always be surprises, we want to prepare as best as we can for the unexpected. When big events move the markets, many investors have an instinctual urge to change their risk appetite. The problem is that big changes could significantly impact your long-term outcome. We have a saying that the best way to generate alpha is by mitigating risk. So, the first step to thinking about risk is understanding which factors we can control and which we cannot.

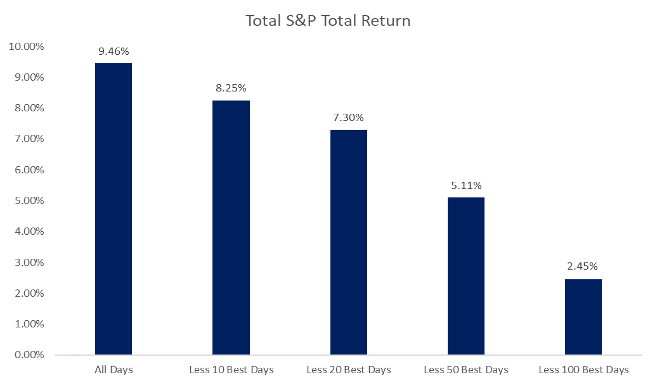

For example, while we know there will be big moves in markets, we cannot predict when catalysts for that change will take place. Managing risk by attempting to time the market can significantly impact how you compound capital. Missing out on positive days by being “risk-off” is a good way to introduce another risk to the equation: longevity risk.

Source: Aptus data as of 9/30/2023

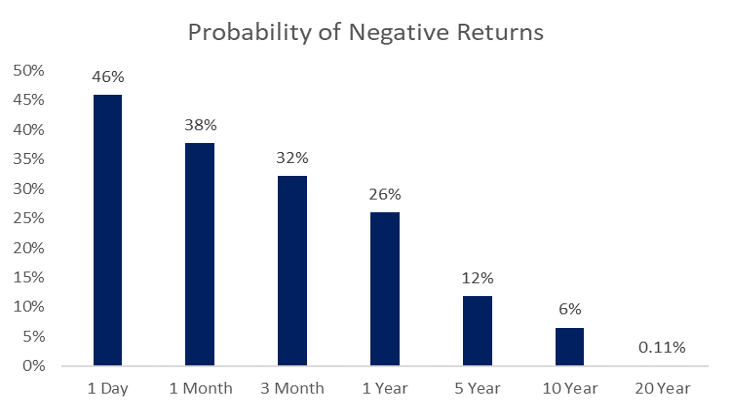

When you exit the market, you may miss some of the downturn (if you get that timing right), but with that, you have the potential to add other risks. By spending less time in the markets you’re increasing your probability of negative returns. As shown below, the more time you spend in markets the lower the probability you have that your returns are negative in the long run.

Source: Aptus data as of 9/30/2023

In our view, investors also tend to focus too much on the short-term “noise” in the market. There is usually a great deal of variability in the day-to-day, with different economic, geopolitical, and company-specific news constantly moving markets. Instead, focus on the end goal and getting a structure in place that gives you the best chances for success.

The right structure helps you avoid making big moves that may expose you to either missing out on those best days of the year or letting your emotions of short-term noise drive your long-term investing plan.

In my first marathon, I had a little too much enthusiasm. The first-half pace was almost twice as fast as the second-half. With that, I barely finished and had to make friends with the folks in the medical tent afterward. Don’t make that rookie mistake that will deter you from hitting your goals or, in my case, barely making it on life support.

When making changes to your risk, do your best to pace yourself and avoid letting over or underwhelming enthusiasm change your behavior. That behavior can easily lead to an inconsistent risk profile and, eventually, a bad outcome.

Team Over Players

As you start to ponder how you put together your investing and related risk plan, it is important to use every resource you can. As said much better in our Team Over Players post from a few years ago, it takes a cohesive group with different skill sets that complement each other to win championships.

The resources a financial advisor has at their fingertips can be the difference-maker to staying on track with your investment plan. That guidance can be the key to avoiding emotions getting in the way of long-term goals.

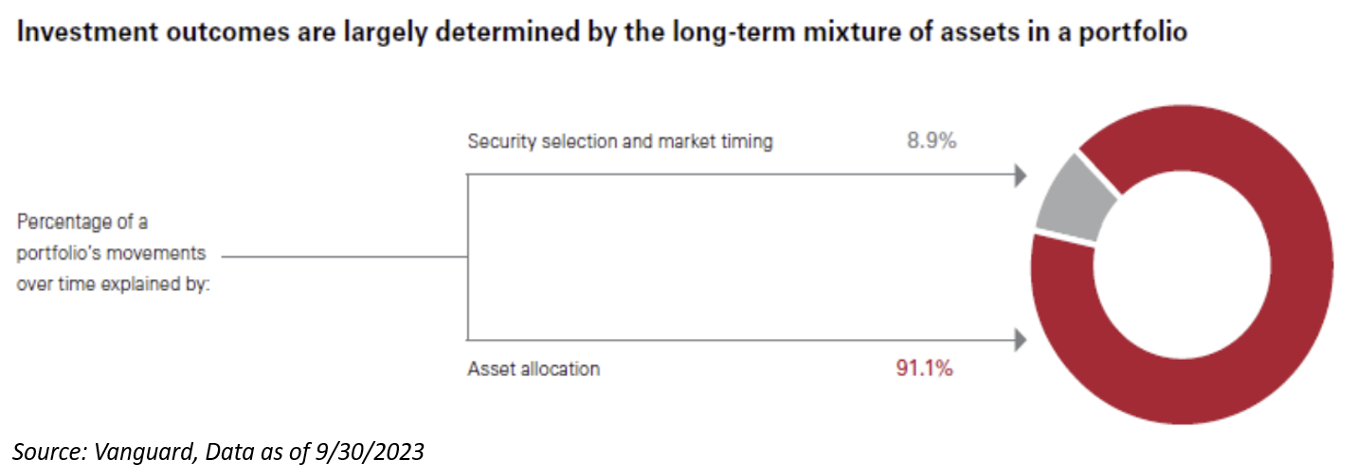

The seminal 1986 study by Brinson, Hood, and Beebower showed that asset allocation decisions were responsible for 91.1% of a diversified portfolio’s return pattern over time.

If I am building a house, I want expertise in electrical, plumbing, and framing to help build a proper structure. Your team to maintain a sound structure as you invest is just as important.

In Summary

There will be setbacks. The longer your time horizon, the easier it is to handle said setbacks. Avoid water cooler or Thanksgiving chatter to uproot your investing plan. Also, remember there are no shortcuts to running a marathon.

Your risk appetite will evolve over an investing cycle, just as your goals do. Your long-term goals cannot be achieved overnight; take the small wins where you can, and how you invest will be clearer each day.

In honor of the great Charlie Munger, Let’s end with a quote from him who says it best:

“Its so simple to spend less than you earn. Invest shrewdly. Avoid toxic people and toxic activities. Try to keep learning all your life. Do a lot of deferred gratification because you prefer life that way. And if you do all those things you will almost certainly succeed. And if you don’t… You are going to need a lot of luck. And you don’t want to need a lot of luck. You want to go into a game without any unusual luck.”

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2311-20.