I’ve been reminded of two things this month:

- It is a privilege to get to write about things we think matter. Thank you for the opportunity.

- The importance of communicating clearly.

I’ve recently been given a chance to help the varsity basketball team at Fairhope. We are a few workouts in. There’s some talent in the gym, which is fun to see, but so much of what I’d expect to be known is brand new to these players.

The Aptus roster isn’t strangers to the game of basketball. We probably take for granted the understanding of it we have. That’s become more clear to me. I can’t approach a drill, a guiding comment, or anything else on the court without simple and clear communication. You can’t expect to teach or coach through complexity until there is an established understanding of the basics. That’s what leads to the light bulb moments.

I’m not sure how many of these notes get read, or how many are worthy of your time…but I hope this one is. If for nothing else, to provide a simple rationale, clearly communicated, that supports the views held here.

We say things like ‘more stocks, less bonds’ all the time. My worry is the rationale behind it isn’t fully explained. We will scratch the surface of the explanation here, as that should be enough to make our point. I assure you we are working to keep this note short.

Attention Please

If you are reading this, you are lucky enough to hold the responsibility of stewarding assets.

We believe bonds are a trap, they are certificates of confiscation. Anything with a ‘fixed’ in the title, a ‘guarantee’ in the marketing material, or ‘annuity’ in the name should have such a high hurdle for inclusion in portfolios, it’s not even funny.

We believe your wealth will only be protected by owning assets that are considered risk assets…stocks would meet that definition. We strongly believe stocks > bonds, and the behavioral traps of higher interest rates or safer routes will only lead to unwanted longevity risk coming back to haunt investors in the future.

We build strategies specifically to help allocations while keeping an eye on potential for drawdowns. And I believe we are providing investors with needed solutions. This note does not intend to discuss our strategies. I simply want to communicate the basic reasoning behind our convictions.

We’ve realized that explaining the basics of how our economic system works is the place to start. Today, we are hoping to bring relevant meaning to all things we repeatedly say – we want light bulb moments.

So, how does our system work?

Selling a House

Let’s say you want to sell your house. A buyer comes in, puts down 20% of the asking price. A bank loans the remaining 80% of the value and 30 days later you get your money, and they get their house.

On the surface, everything is great for all three parties involved.

- Buyer: The buyer only puts down a fraction of the price.

- Seller: 20% is easier for buyers to come up with than 100% This should lead to more potential buyers and a higher selling price.

- Bank: The bank can create a loan with minimal cost and they are incentivized to make loans.

Both the buyer and the seller exit the transaction with goods they can use. You have money and the buyer has a house.

What’s overlooked is the difference between what existed before the transaction closed and what existed after.

You have money being exchanged for a house. The house existed at the beginning and end of the transaction. The money (or at least 80% of the value of the house) was created to settle the transaction. It was created when the loan occurred.

To say this clearly – money is created when new debt is issued.

Although the transaction above looks great on the surface, there is a cost. Said differently, there is a party that loses. It’s those that hold the currency. More supply devalues the currency already in hand.

The purpose of banks is to multiply money. They multiply it through credit…making loans. More loans = more supply of money in our system.

What backs all that money? Not gold, not cash. There are liabilities all the way down; that’s a topic for another note.

Money vs. Capital

That concept is incredibly important to think about as we continue. In The Fiat Standard, Saifedean Ammous uses ideas from the work of Ludwig von Mises to differentiate the two:

The central conclusion in The Theory of Money and Credit was that expansion of credit cannot form a substitute for capital. Capital is economic goods that can be used to produce other economic goods. Money can be traded for capital goods but cannot substitute them. The stock of capital cannot be increased by producing more claims on it.

Economic productivity is created from capital goods, not more money in the system.

Inflation Incentive

To add insult to injury, not only is our system designed to drive debt creation that devalues the units of currency currently outstanding, but other incentives for its orchestrators to continually force inflationary pressures.

I’m going to paraphrase Lyn Alden’s example in her book Broken Money for this illustration:

Suppose you bought the vacation home we discussed above for $300k. You owned it for 10 years and the money supply grew at 10% a year during that time. Fortunately for you, your house is a form of capital whose supply was constricted (it is harder to build houses than create money). This led to your house increasing in value along with the money supply. You sell it for $778k.

Notice: you didn’t improve your wealth through your home’s appreciation, you simply kept pace with money supply growth.

You sell for $778k and you have to pay 20% capital gains on the $478k of appreciation. That’s $96k of taxes and a whopping 32% of the original price you bought it for, or 12.3% of the current price.

The government has an incentive for inflation to occur, as capital gains taxes are not adjusted for the dilution of money supply. They get a bigger share of the transacted wealth if the dollar numbers are inflated.

The Fed and Deficits

Now, we should consider the backdrop we are faced with as investors.

In the past, we’ve discussed the increasing cost of our government’s debt and the deficits we are currently running. We have a greater supply of Treasuries hitting the market than ever before. We always ask, who is going to buy that supply? Before you answer, keep this in mind…

If you run a business and need capital, you can look to issue a bond. In a perfect world, you could issue a bond with a long time to maturity for the lowest interest rate possible. Let’s say you issue 10-year bonds and you are willing to pay 5% on those bonds.

No takers… now what?

Well, if you want capital, you have to raise the rate until you find a taker.

In our government’s case, these market dynamics cannot be avoided. This again begs the question…who is going to buy the bonds?

The Fed that’s who. Here’s what that looks like:

The US government is running deficits, and they need to be funded with Treasury bond issuance. Our government issues T-bonds to raise money to fund their operations.

The buyer of those bonds is the Fed…at least for the most part. The Fed is creating new bank reserves (that’s a fancy way of saying dollars out of thin air) to buy the bonds. This process is the same as your house transaction in that this process increases the money supply…that side of the transaction didn’t exist until the issuance of Treasury debt.

Money supply growth leads to inflation. As Ammous points out, from 1960 to 2020, the US grew the money supply at an annual rate of 7.4%. I’d say our backdrop looks a little different at this point. Do you think our money supply is set to shrink or expand?

Forget the bogus CPI headlines…we think your attention should be on money supply growth. We’ve said it before, you should start to think of our % deficit as the hurdle rate to protecting wealth. For example, if we run 7% deficits, we think that’s the required return to break even on your investment capital. It’s not the stated CPI number, as this post is not intended to incorporate how faulty that ‘measure’ of inflation is.

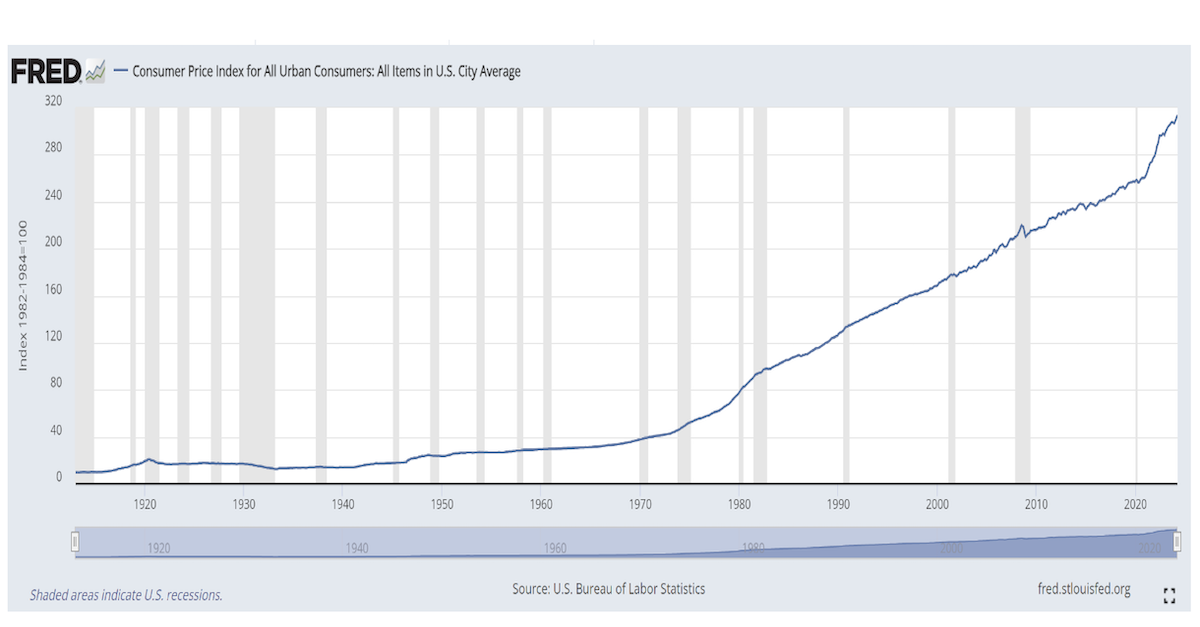

As a side note on CPI and the recent inflation focus…remember when they said it was transitory? Reality is, it’s never been transitory. Notice in the early 1970s when it took off. I wonder what happened there?

It’s Not a Doom and Gloom Picture

If you’re still with us and think this note is on the path towards a doom and gloom outcome, it’s not.

In our opinion, our country can continue down this path for longer than anybody believes. Continuing that path most likely leads to higher prices in risk assets. Therefore, risk assets are what we believe should make up the bulk of an allocation.

If a catastrophe hits the financial markets, we love the inclusion of hedges into portfolios, which is why we own them. Until then, the path of least resistance for risk assets is higher…let’s adjust our allocation accordingly.

Please re-read our December post: Taxation by Inflation

For a summary of the post, this is a relevant snip:

“Historically, our government has been a beneficiary of inflation, as large levels of debt have been inflated away. It’s much easier and less transparent to fund certain initiatives through non-transparent confiscation of purchasing power than it is with explicit taxation.”

Closing

In our opinion, the nature of our economic system and fiscal backdrop point to expanding money supply. Like kids trying to win at hoops, understanding the floor dynamics gives you an edge in knowing how to use the assets available to you.

As simple as it sounds, at least stocks can grow. They can grow revenues, earnings, margins, dividends, etc. They combine these attributes with the fact that their supply is much harder to adjust upward, relative to the amount of currency in supply. This combination is a weapon against the silent confiscation of purchasing power.

As investors, we are compensated for absorbing risks. I hope this note is a reminder of what the real risk is, and that we are positioning as best we can.

As always, thank you for your trust and please don’t hesitate to reach out with any questions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2406-1.