TBAC Seeks New Funding Ideas

The borrowing needs of the Treasury over the coming years are expected to drive an increase in issuance as the debt load compounds. The share of outstanding Treasuries held by its two largest investor types (foreign investors and the Federal Reserve) has been decreasing in recent years (supply has outgrown demand).

The TBAC (Treasury Borrowing Advisory Committee) is tasked with helping the Treasury make sound decisions in how they issue and manage the national debt. They focus on things like the cost of the debt, demand for the debt, liquidity management, and innovation within the product mix.

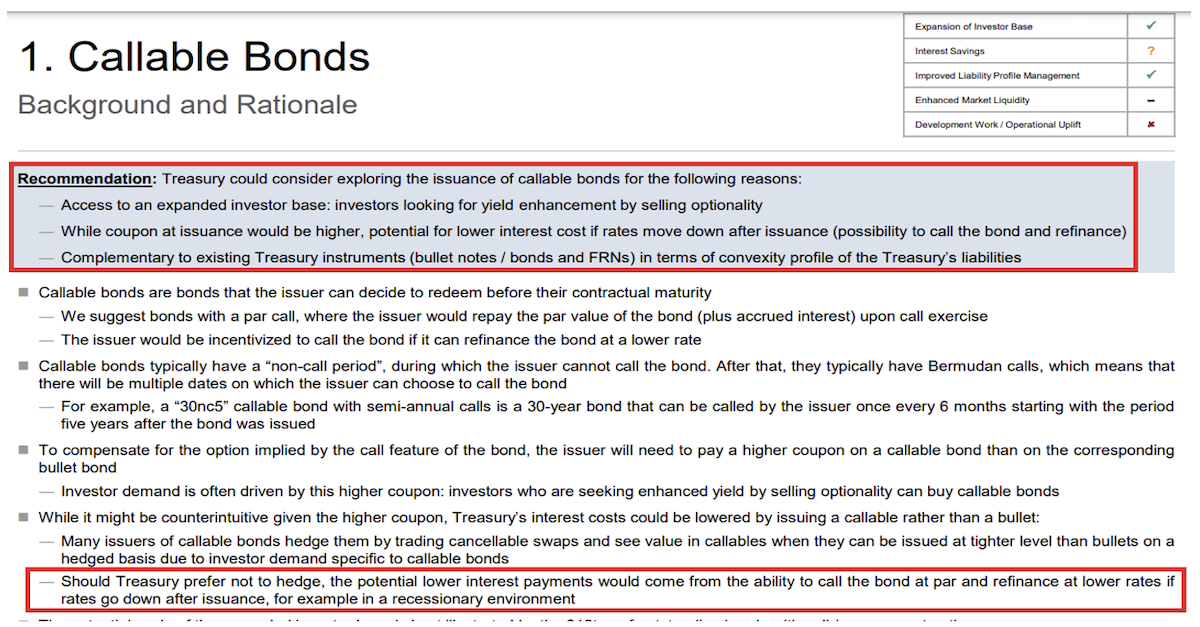

A recent post from the TBAC recommended looking into issuing callable Treasury bonds. The Treasury did issue Treasury callable bonds back in the mid-1900s although very few developed economies utilize the structure today.

Source: TBAC as of 05.11.2024. TBAC Paper May 2024

Source: TBAC as of 05.11.2024. TBAC Paper May 2024

A callable bond gives the issuer the right to call the bond away from the lender (bond owner) before maturity. To give up the certainty, lenders require an additional premium over a bullet bond to compensate for being short an option. The thought for adding the product to the issue mix is that callable bonds would allow an expansion of the investor base to investors who seek enhanced yield by selling optionality. Callable bonds and Mortgage-Backed bonds have similar characteristics (i.e., prepayment feature).

One of the big points from the TBAC was that callable bonds would potentially allow the Treasury to lower its interest costs during recessionary environments when the Treasury could benefit from calling the bonds and refinancing at potentially lower rates.

As you can probably gather from the commentary, this seems to us like a two-step ploy. One, to broaden the investor base of Treasuries given the increase in supply issues, and two, another “hope” for lower rates to refinance the debt. What if rates don’t go back to 0%?

If the Treasury begins to issue callable bonds at higher rates compared to bullets given the embedded option and rates don’t go down, all they did was raise the cost of the US debt load.

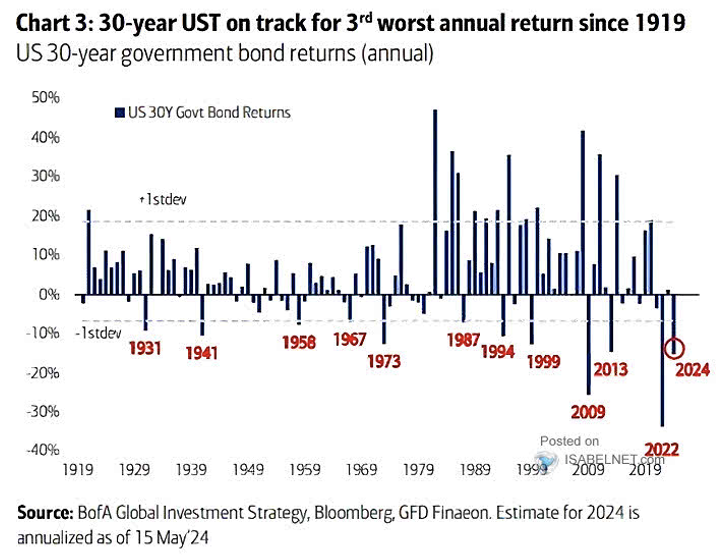

Tough Stretch for 30-Year Treasuries

Long Treasury bonds have faced a brutal period of high inflation and rising interest rates over the past three years, a kryptonite environment for long bonds. Many investors have tried to call the top in yields and banked on a US recession where the Fed will cut rates and bring yields lower. Such an environment could buoy bond prices and create appreciation in long-duration bonds.

Source: BAML as of 05.20.2024

Source: BAML as of 05.20.2024

The resilient US economy and the uptick in the supply of bonds post-pandemic have made the traditional playbook less effective. We continue to expect long-term bonds to underwhelm (especially in real terms) given the outlook for continued inflation and volatility.

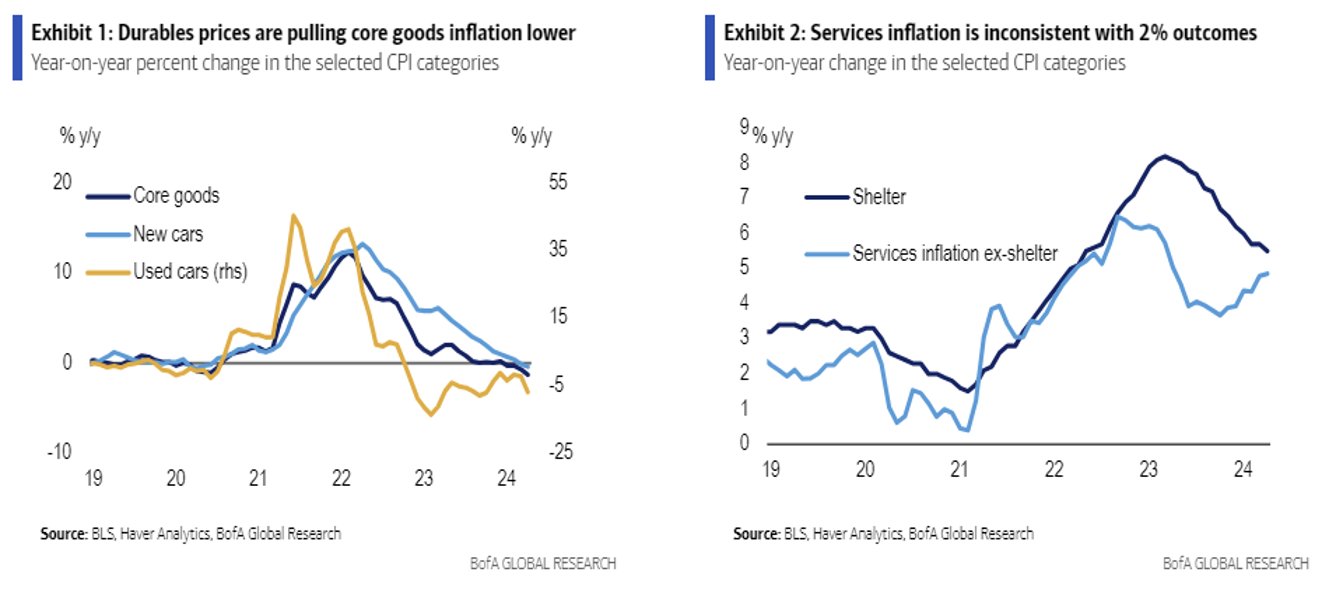

Service Inflation Continues to Cause Problems

Last week brought a somewhat encouraging CPI print following a rough start to 2024 for inflation measures.

Source: BAML as of 05.20.2024

Source: BAML as of 05.20.2024

Unfortunately for the Fed, core service inflation remains sticky, up 0.4% m/m and 5.3% y/y, reflecting persistently strong rent and owners’ equivalent rent (OER). Core services inflation (ex: rent/OER) decelerated from 0.6% to 0.4% last month. We will continue to closely monitor the change within goods disinflation, which has been one of the key drivers of improved inflation data and looks to be bottoming.

The Fed will likely take some comfort from last week’s inflation data. Data points to moderate-to-solid growth in economic activity while supporting their outlook for further disinflation. It should also leave them comfortable thinking their policy stance is restrictive and working to cool inflationary pressures. If the Fed signaled that the bar to rate hikes was high at the May FOMC meeting, then it is at least as high now, if not a touch higher.

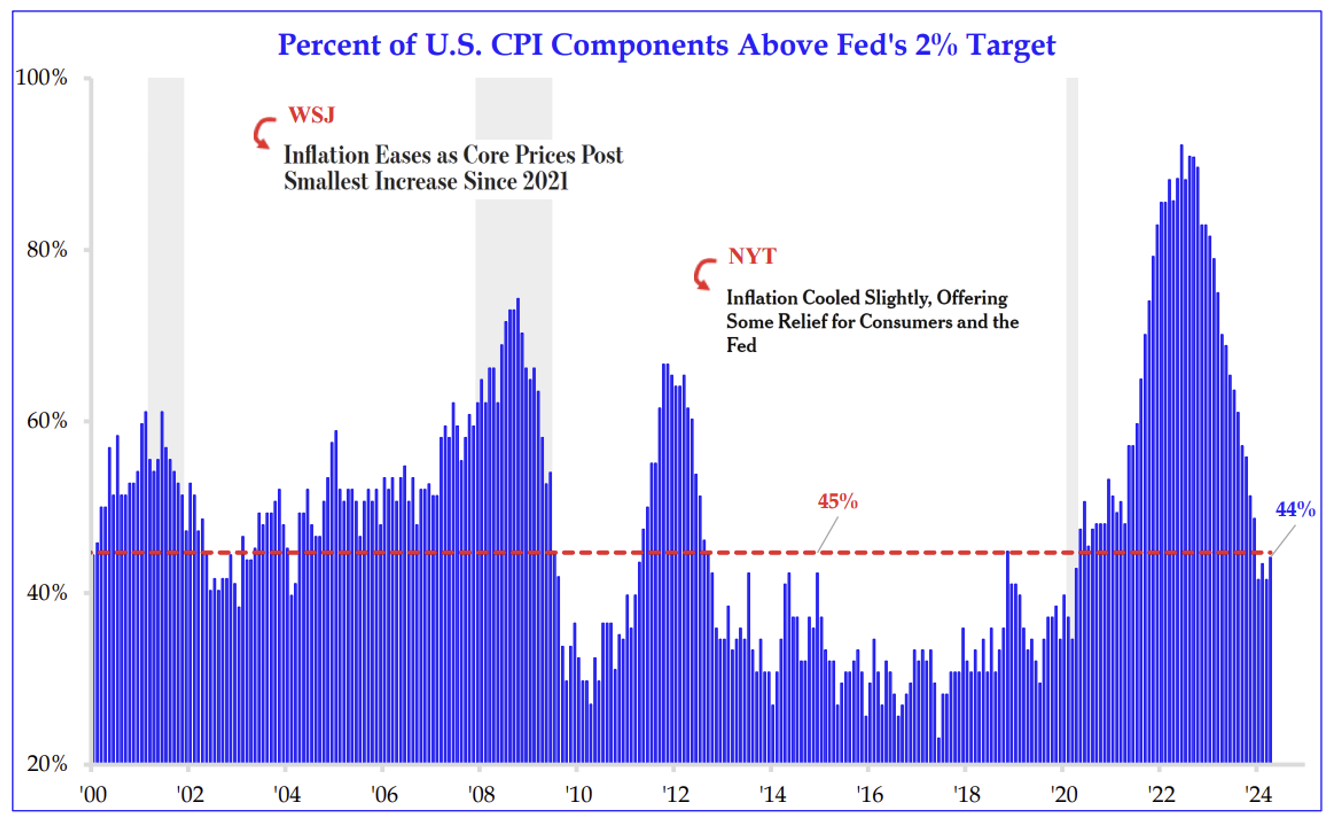

Inflation Pressures are Narrowing, But Still Broad

Source: Strategas as of 05.20.2024

Source: Strategas as of 05.20.2024

In terms of the CPI components, inflation pressures above 2% have cooled from the peak in 2022. We continue to believe that the broadness of inflation, service inflation, and shelter inflation are running at levels that are associated with inflation at closer to 3% than 2%. While the number has improved, we continue to believe that rates need to sit at current levels for longer to continue to finish the job.

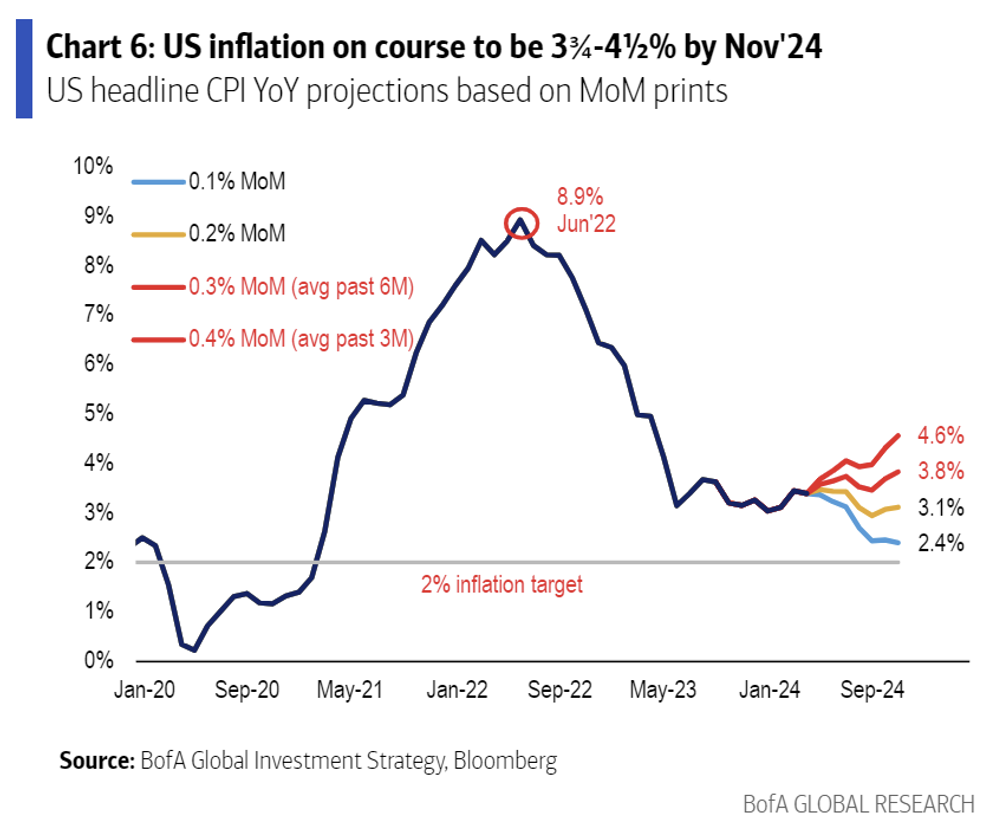

Path to 2%

Bank of America put out an interesting visualization on the path of inflation. They show a few different protections for CPI based on various month-over-month prints. As you can see, unless we start to see negative or 0.0% m/m prints, it’s unlikely that inflation will drop below 3% before November.

Source: BAML as of 05.20.2024

Source: BAML as of 05.20.2024

Given that inflation is a lagging indicator, as the Fed waits for data to confirm it’s time to cut, it will likely be too late.

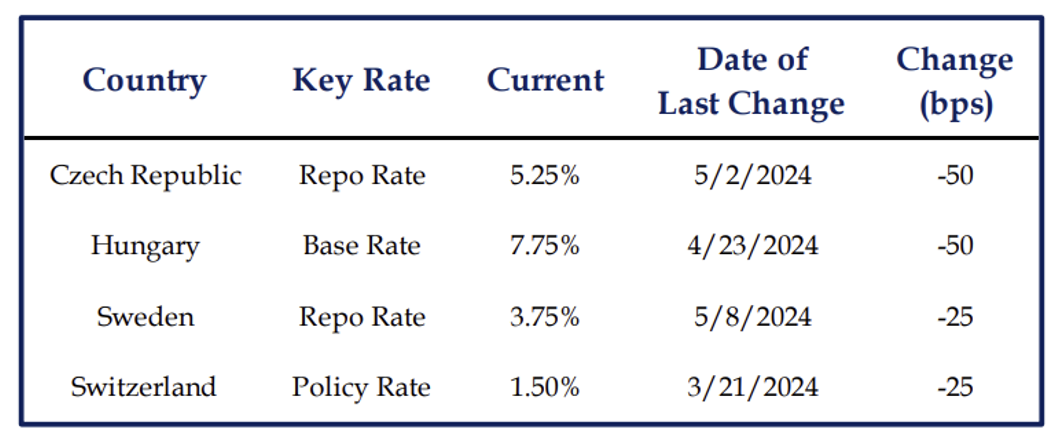

Across the Pond… Rate Cuts are Coming

Four European central banks have recently cut policy rates.

Source: Strategas as of 05.20.2024

Source: Strategas as of 05.20.2024

The ECB appears poised to join them soon and more aggressively (3-4 cuts priced in by year-end) than the Fed is likely to (1-2 cuts priced in by the year-end). It’s unlikely we get into an environment where foreign central banks cut drastically and the Fed sits on hold…something to consider.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-18.