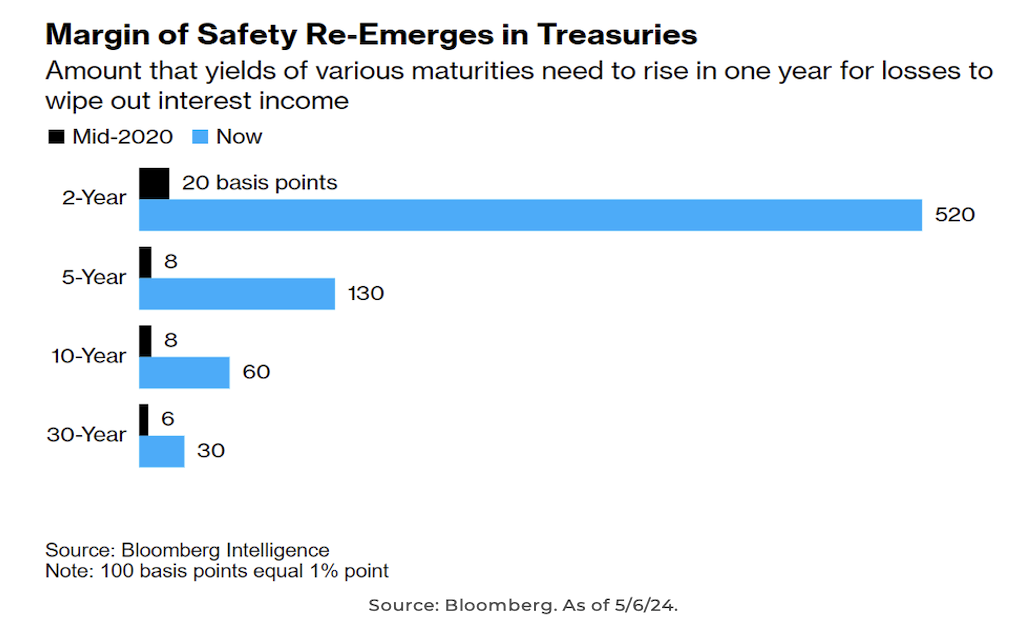

Short Term Treasuries Offer Higher Income and Stability vs. Long Duration

As interest rates have moved higher, the front end of the curve is offering a combination of high nominal income and interest rate protection. As the graphic shows, 2yr Treasury yields would need to rise ~520 bps for the negative price return of the bond to offset the income earned.

Given the yield curve inversion as well as the risk of longer-term bonds facing higher term premiums in the future, we continue to prefer shorter-term durations for fixed-income investors.

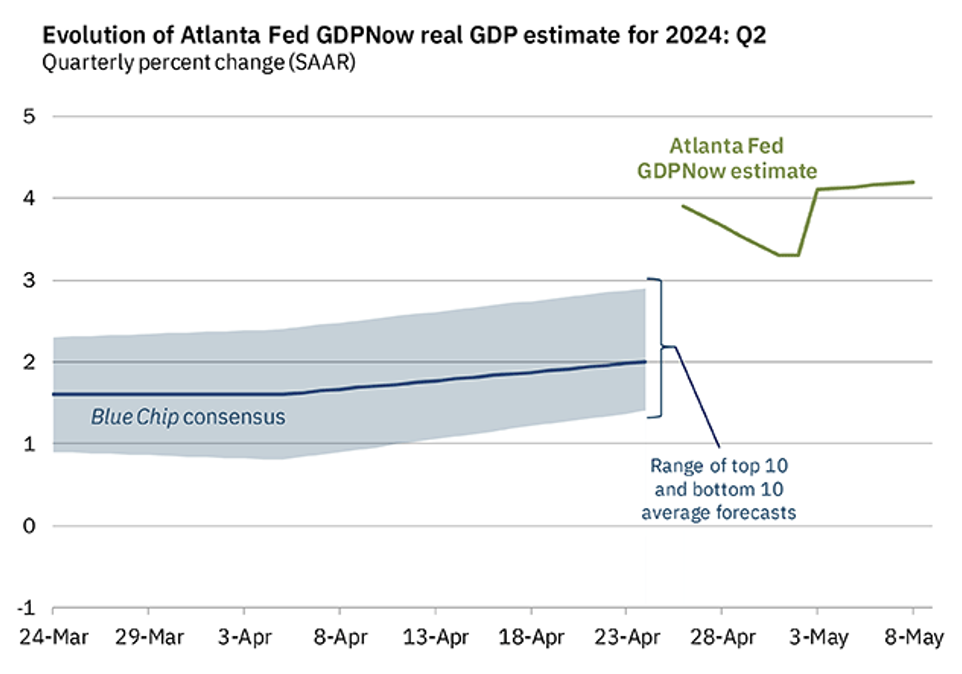

Q2 GDP Looks Pretty… Pretty Strong

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 4.2 percent on May 8, up from 3.3 percent on May 2.

Source: ATL Fed as of 05.08/.2024

Source: ATL Fed as of 05.08/.2024

To the disappointment of many, the weaker Q1 GDP print looks to be more from timing and seasonality than anything more sinister.

Refresher on the Q1 Print

U.S. Real GDP in Q1 came in a few weeks ago lower than expected at 1.6% q/q. Consumer spending was strong at 1.7%, housing at 0.5%, capex at 0.4% which was offset by lower inventories at -0.4%, net exports at -0.9%, and government at 0.2%.

We’ve heard from numerous parties that the economy is being kept afloat by government spending. However, real government spending was up only 1.2% Q/Q in Q1, down from +4.6% in Q4 and +5.8% in Q3 (in 2023). At the same time, real final sales to private domestic purchasers were up 3.1% Q/Q, compared to 3.3% in Q4 and 3.0% in Q3.

The math does not add up to a weak private sector. What has been problematic is the strong dollar which created a shift in purchases of capital equipment from domestic to foreign producers (which was displayed in the net export number of -0.9%). We have a big, broad, diverse economy. Not every sector or region grows at the same pace. Capital spending is what will drive growth forward in the quarters ahead and appears to be on the upswing.

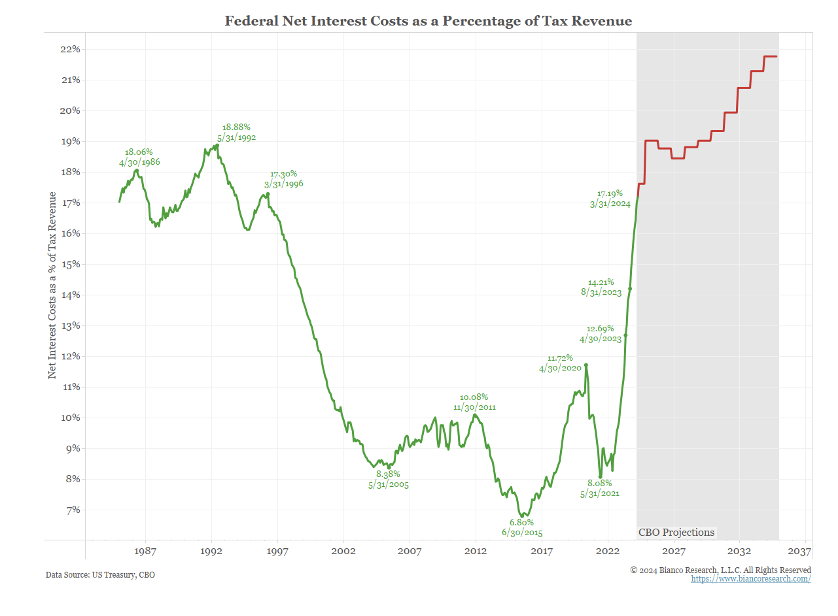

US Debt Problems

US debt growth appears to continue going down an unsustainable path.

Source: Aptus as of 05.08.2024

Source: Aptus as of 05.08.2024

The Congressional Budget Office (CBO) projects America’s debt-to-GDP ratio will rise to 106% of GDP (which is greater than WWII levels) by the end of the decade. This comes with no end in sight. The total deficit is forecast to average ~5.5% of GDP until 2030.

Source: Bianco as of 05.08.2024

Source: Bianco as of 05.08.2024

Net interest costs, which are currently around 3% of GDP (& 17% of Tax Revenues), are expected to continue drifting higher. Elevated interest rates lift the cost of borrowing and if held too high could be a drag on economic growth.

Source: Bianco as of 05.08.2024

Source: Bianco as of 05.08.2024

We continue to believe the multiple dynamics within rate markets could continue to create volatility and disruption in markets given the importance of US bond markets on the global economy. Greater volatility in interest rates is another driver that could keep rates higher.

High Mortgage Rates Require Creativity

The 30-year mortgage rate stood at 7.18% for the week ending May 3. The graphic shows the difference between the current mortgage rate level and the average homeowners’ outstanding mortgage rate.

Source: Stifel as of 05.08.2024

Source: Stifel as of 05.08.2024

A recent headline from Freddie Mac caught our eye. Freddie Mac is seeking regulatory approval to expand its footprint into guaranteeing second mortgages. This move could drive down costs for Americans seeking to borrow against the equity in their home.

Given that many homeowners have locked in rates well below market rates, refinancing doesn’t make sense. Another option would be home-equity loans, or revolving lines of credit secured by their houses.

Freddie Mac is exploring mortgage-backed bonds that would be collateralized by these loans which would likely lower funding costs for lenders and result in cheaper rates for customers.

This could be another source of liquidity for American consumers to tap, given the significant run-up in home values. Freddie Mac estimates that the share of mortgaged homes that have significant equity stood at ~46.1% at the end of 2023 which is up from 26.7% in the third quarter of 2019.

High-Yield Spreads Hover Near Lows

HY spreads below 300 bps offer bond investors very little margin for safety. Over the past 5 years, high-yield spreads have averaged just over 425 bps.

Source: Fred/ICE as of 05.09.2024

Source: Fred/ICE as of 05.09.2024

In a surprise to most, high-yield bonds have navigated the COVID pandemic and surging interest rate environment better than expected. Given the shorter duration profile typically associated with high-yield bonds, their exposure to rising rates was limited compared to their Investment-grade counterpart. We’d use caution in the space as tight spreads will limit the buffer if issuers experience an uptick in defaults or are impacted by a “higher for longer” scenario.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-11.