Treasury yields are once again higher this morning with the 10-year Treasury hitting its highest yield in 15 years. It’s currently at 4.32% which matches yields last visited in 2007. The 10-year yield has risen since it hit an intra-day low on Monday, climbing to 42bps this week, 3.90%. The 2yr yield has risen “only” 20bps this week, so some curve re-steepening is occurring.

The 10-year Treasury yield has risen 172 bps since August with all but 7 bps of that move driven by real rates. Although inflation expectations have risen over the last month, they are about flat since early August when the 10-year yield was at 2.6%. The real yield on the 10-year TIPS security has risen to 172 bps from 7 bps in less than three months’ time. Financial conditions are tightening as real yields rise… just what the Fed wants.

Source: Bloomberg. As of 10/21/22

Source: Bloomberg. As of 10/21/22

The Fed is expected to take policy rates more than 200 bps above expected inflation, more than double the peak of the last cycle. With fed funds futures topping 5%, the expected peak policy rate is now 2x the peak of the last cycle. Even considering that inflation expectations are about 100 bps above the average of the last cycle, a peak real policy rate of 230 bps (5% minus a five-year expected inflation rate of 2.7%) is more than double the ~90 bps peak of the previous cycle. The power behind the psychology of inflation is real!

Four Fed officials are set to speak today. This will be the last round of Fed speak until the November 2nd FOMC meeting. That leaves the market to focus on any new economic data. We expect them to reiterate 75bps in November and desire to see inflation move lower before slowing down / pausing the hiking cycle.

As far as data goes, the biggest releases next week will be the first estimate of third quarter GDP which is expected to post a robust 2.3%. Current expectations for fourth quarter are looking for a more dramatic slowdown to 0.6% as the rapid series of rate hikes starts to work into the economy. The other big release next week will be the Friday Personal Income and Spending Report for September. The inflation series in that report will get the most attention. The PCE deflator is expected up 0.3%, matching the gain in August and 6.3% YoY vs. 6.2% the prior month. Core PCE is expected up 0.5% vs. 0.6% in August with the YoY rate moving higher, to 5.2% vs. 4.9%. So, no reprieve on the inflation outlook is expected for the September prints.

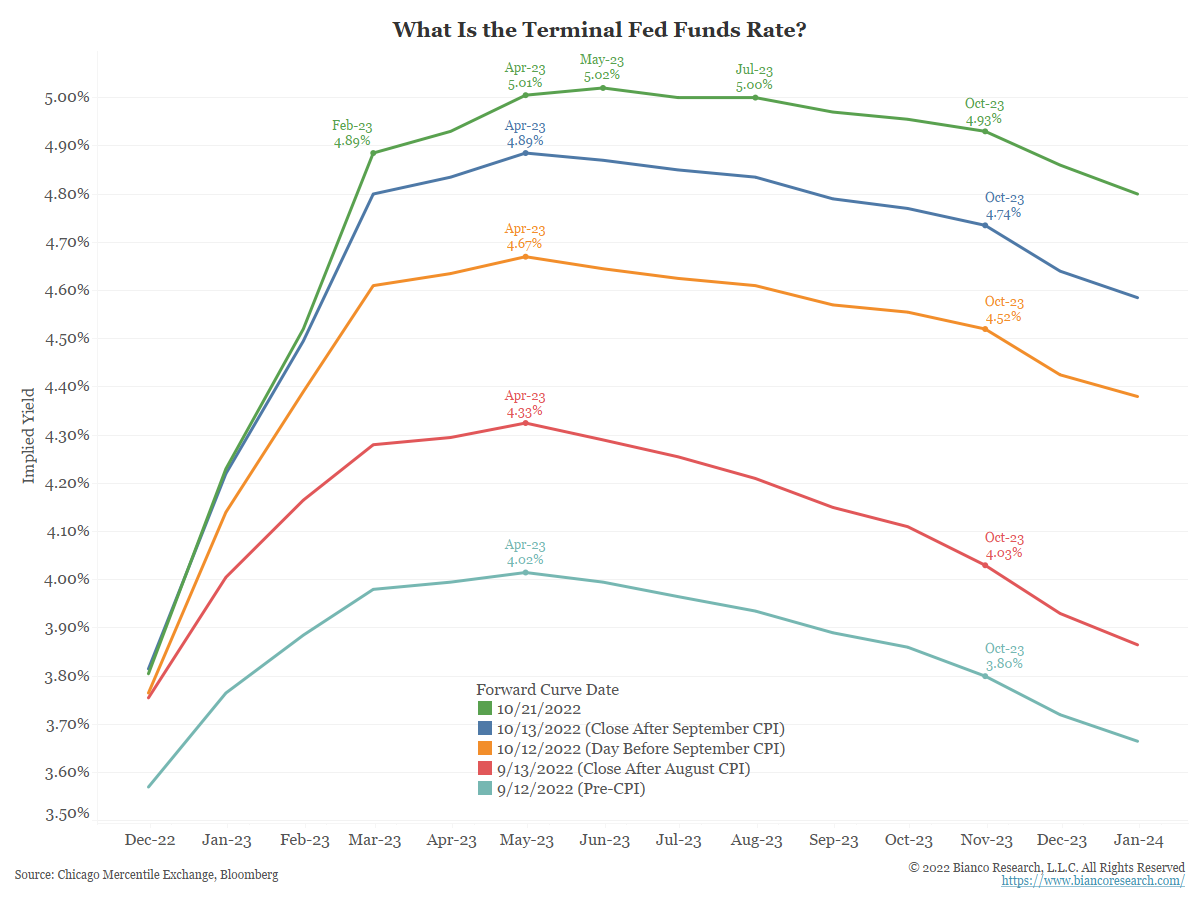

The Terminal Rate Keeps Moving Higher

How does the funds rate get to 5%? The market has priced a 98% probability the Fed hikes by 75 basis points on November 2nd, to a range of 3.75% – 4.00%. The market is pricing another 75% chance of 75bps again in December. If this happens, it would put the funds rate at a range of 4.50% – 4.75%, just one 25 basis point hike away from 5%. It would also mark the 5th consecutive 75 basis point hike this year.

Source: Bianco. As of 10/21/22

Source: Bianco. As of 10/21/22

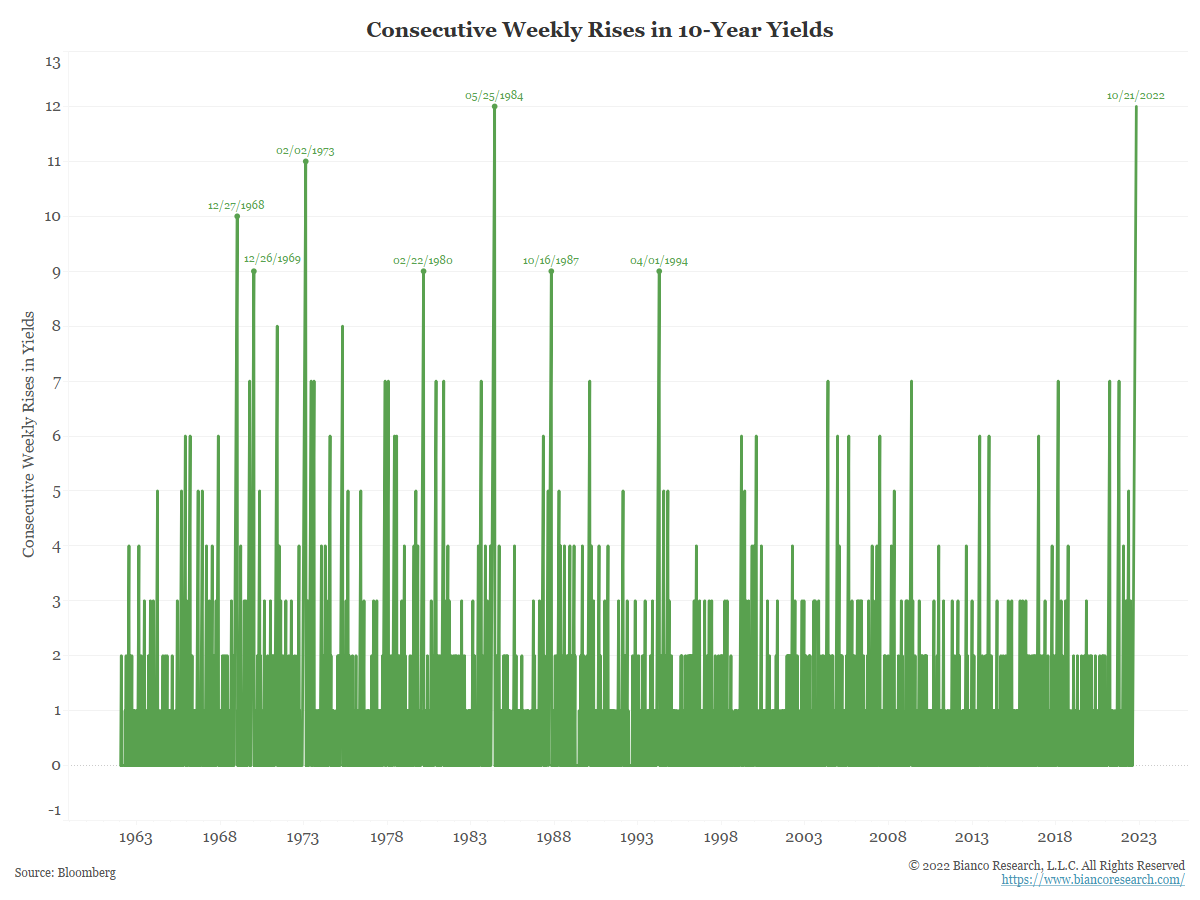

The Yield Train is Rolling … Another Week, Another High

Following today, we’ll have seen 12 consecutive weeks of higher 10-year Yields which would tie with May, 1984 for the largest such streak since data began in 1962.

Source: Bianco. As of 10/21/22

Source: Bianco. As of 10/21/22

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2210-26.