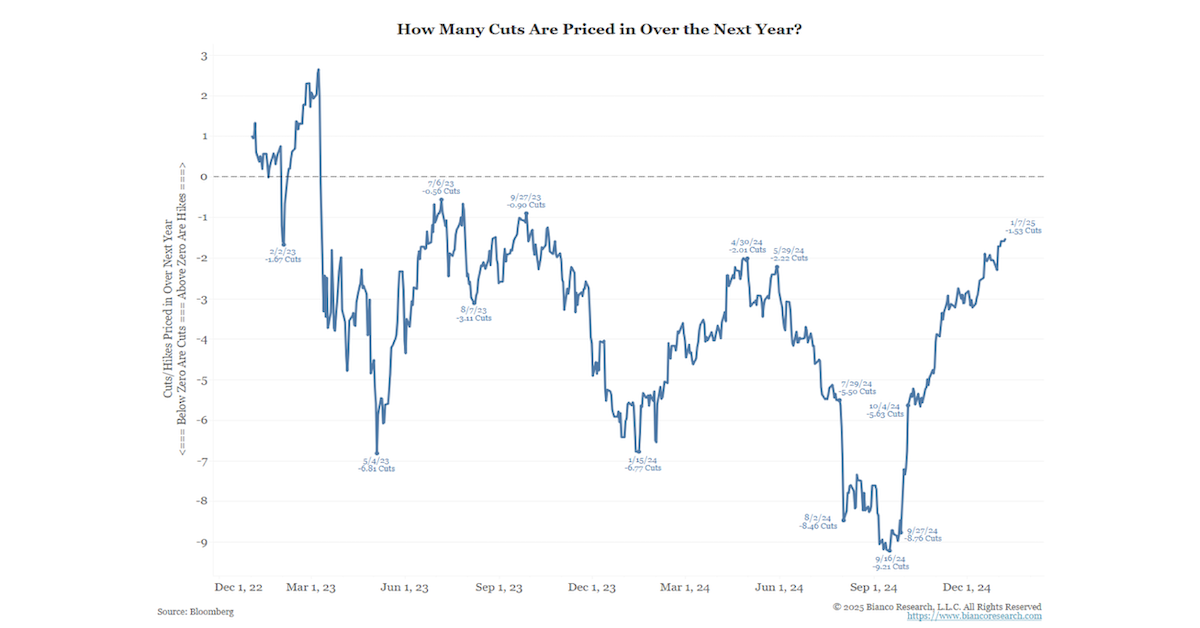

The market is currently pricing in 1.53 cuts for 2025 (Fed says 2). As we’ve said before, we believe the FOMC has gotten its rate closer to neutral. This positions them to patiently sit back and monitor the economy and incoming data, specifically related to policy change impacts from the Trump 2.0 agenda.

Source: Bianco as of 01.08.2025

Source: Bianco as of 01.08.2025

Ultimately, the economy (and inflation) continues to show resilience, creating less need for cuts (recession premium is being priced out). Inflation continues to flatten out/turn higher, which is potentially problematic as the disinflationary forces so helpful in ’24 have somewhat stalled. We will get our first jobs number on Friday to set the mood for 2025 labor market expectations. We do see the Fed being quick to act if we see any notable spike in unemployment this year, which would prompt more cuts than the market is expecting (not base case but certainly plausible).

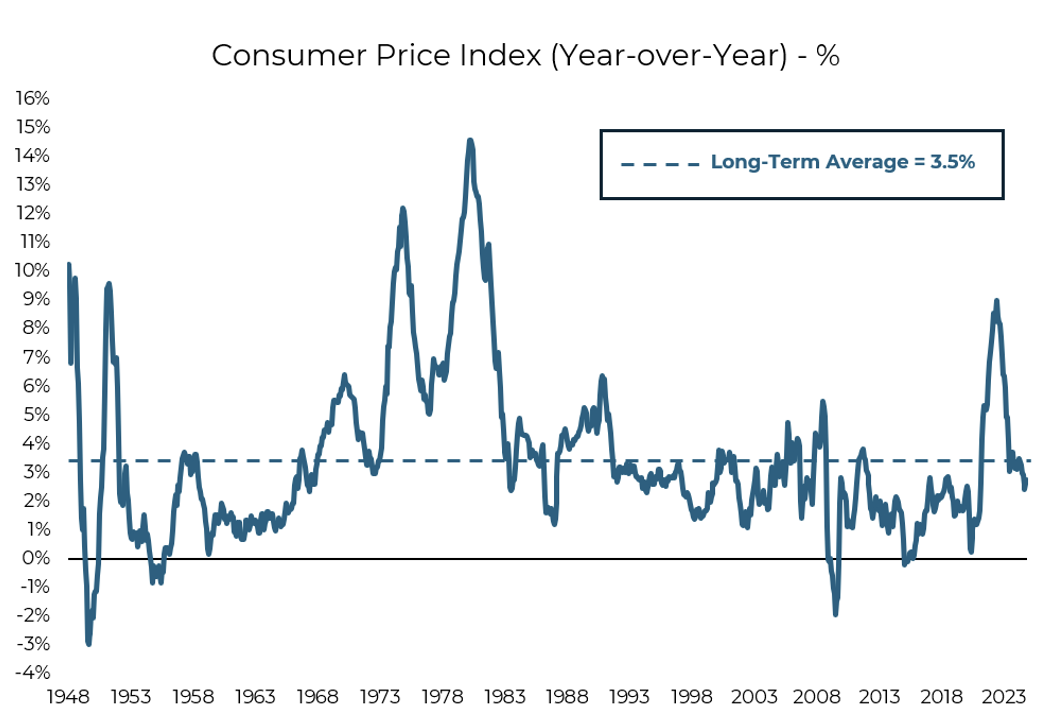

Inflation Rate Unofficially 3%

We’ve believed all along that the prospects for a soft landing were tied to getting inflation back to “tolerable levels”. We didn’t think inflation needed to fall back to 2% and in fact, 3% would probably be acceptable (long-term average has been 3.5%). While authorities would never admit it, actions speak louder than words given that over two years later, central banks are still seeing prices rise faster than their targets.

Source: Aptus as of 01.08.2025

Source: Aptus as of 01.08.2025

The “last mile” of disinflation is still yet to come. To sell above-target inflation to markets, central banks need “plausible deniability”. Since they don’t want to admit that 3% inflation is OK (although it is – especially given the starting point two years ago and the historic average), they need a credible reason to point to it drifting lower.

A key part of US inflation stickiness comes from housing, and US officials have a nice story to explain why, looking forward, shelter prices should keep disinflation on track. Everyone knows US shelter inflation is heavily lagged – reflecting market conditions 18 months ago. As long as we are not seeing a rebound in private rents (timelier than official data, the Fed can say) inflation can eventually meet its target.

So far, even with the passage of time, most Fed watchers are giving officials the benefit of the doubt. Eventually, that argument loses credibility if prices keep moving the opposite way. As the saying goes… “Fool me once, shame on you; fool me twice, shame on me.”

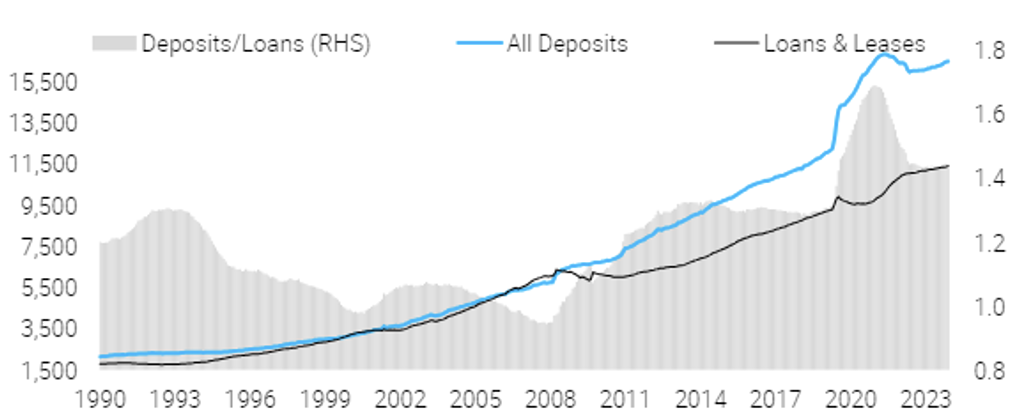

Private Lending to Keep Inflation Elevated?

The hangover of Money Supply growth (M2) from 2020-21 remains on bank balance sheets in the form of heightened deposits. Banks have been earning attractive returns from depositing the funds at the Fed rather than lending them out and receiving the overnight rate. It is not a given that these deposits stay at the Fed when a positive yield curve at the short end meets up with expanding private credit demands, as seen from late 2021 to late 2022.

Source: TS Lombard as of 01.07.2025

Source: TS Lombard as of 01.07.2025

Adding to the potential for banks to turn Fed deposits into loanable funds is the Trump administration’s stated aim to offer regulatory relief on bank capital, perhaps lowering high-quality liquid asset (HQLA) ratios. Remember inflation is financed…the first round was by the government, the next could be the private sector riding the tailwinds of Trump 2.0’s business-friendly administration.

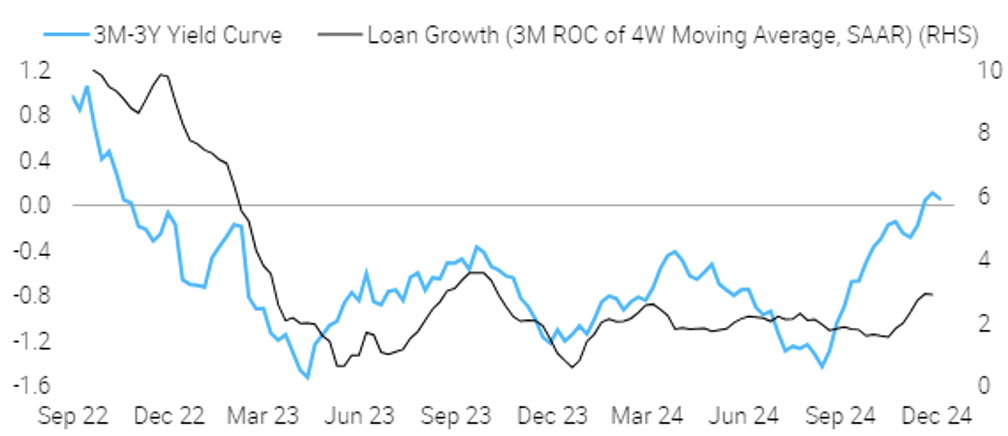

Appears to Already Be Happening!

With that said, we are already seeing an uptick in loan growth with the 3M-3Y yield curve turning positive. The more positive it is, the greater the profit incentive for banks to lend.

Source: TS Lombard as of 01.07.2025

Source: TS Lombard as of 01.07.2025

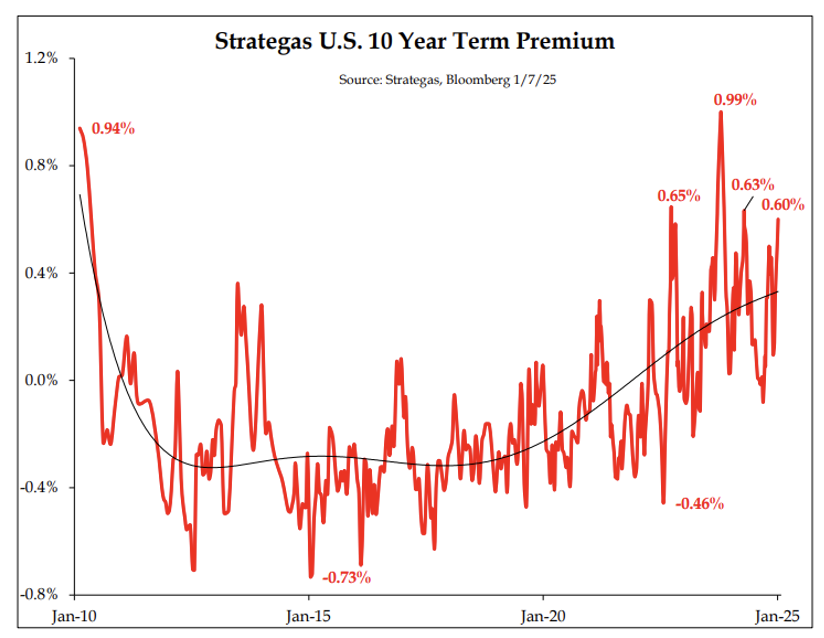

Term Premiums Continue to March Higher

The term premium on 10 year Treasuries is now about 60 bps. We hit as high as 100 bps in October 2023, so it’s not impossible to push higher. Term premia rise for fundamental reasons (higher inflation volatility, higher supply), but sometimes they also rise because of market positioning (i.e., shorts get offsides).

Source: Strategas as of 01.07.2025

Source: Strategas as of 01.07.2025

We’d attribute the recent move higher in yields to a collection of factors:

-

- Strong real growth

-

- An uptick in inflation expectations

-

- Fewer rate cuts expected

-

- Less foreign demand

-

- Expectation for an increase in supply of longer-term debt (vs. just rolling T-bills)

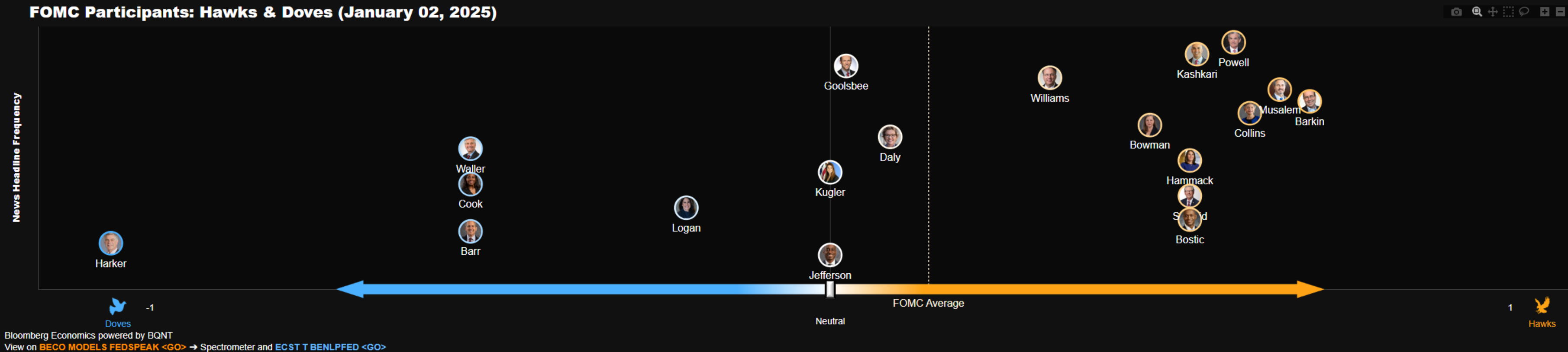

Four New Fed Voters in 2025

The composition of the Fed is as follows: there are seven governors nominated by the U. S. President and confirmed by the Senate, including Chairman Jay Powell. They all vote at each of the FOMC meetings. The remaining five members are, most of the time, an annually rotating set of regional Federal Reserve district presidents elected by their constituents. The New York Fed president is the only permanently voting member in that “regional” group.

Next year, the five regional bank presidents on the committee are:

-

- John Williams, New York (permanent voter)

-

- Austan Goolsbee, Chicago (leans dovish)

-

- Susan Collins, Boston (leans hawkish)

-

- Alberto Musalem, St. Louis (leans hawkish)

-

- Jeff Schmid, Kansas City (leans hawkish)

Richmond’s Thomas Barkin, Atlanta’s Raphael Bostic, San Francisco’s Mary Daly, and Cleveland’s Beth Hammack will roll off the voter roll in 2025. Hammack was the lone dissenter on the committee’s decision to lower its rate target on Dec. 18, preferring no change.

The new voters on paper are arguably slightly more hawkish than the members they are replacing, shown below in Bloomberg AI’s scale of hawkishness/dovishness. The graphic is based on analyzing the words each FOMC member uses, not necessarily the perception of their policy beliefs.

Source: Bloomberg as of 01.07.2025

Source: Bloomberg as of 01.07.2025

As we move into the new year, we are sure to see fresh data and in turn different reaction functions from the new members which could impact the Fed’s easing cycle.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-18.