Source: BofA, Data as of 1/27/01

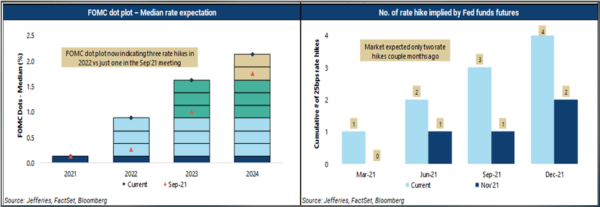

As expected, the Fed kept rates in the 0.00-0.25% range during the January meeting. Chairman Powell pointed to a high likelihood of a rate hike being “relatively soon” based on the continuation of the strong labor market (unemployment at 3.9%) and high inflation (headline inflation at 7%) – both aspects of their dual mandate. Powell didn’t rule out a hike at every meeting in ’22 (going into the meeting, the market had priced in 4 hikes in ’22, now it’s closer to 5) and he also didn’t rule out a 50bps hike in March – which, we believe, is the microcosm as to why the market sold off during the meeting (the Fed hasn’t hiked rated 50bps in one meeting in 22 years). Powell indicated the rate hike would start the beginning of a steady hiking cycle. A bit to our surprise, Powell was more dovish on the Fed’s Balance Sheet positioning. Following the press conference, the yield curve flattened, and stocks swung lower as the market comes to terms that the Fed is serious about rising rates and likely faster than they did in the 2015-2018 hiking cycle.

Source: Bloomberg LP. As of 1/26/22. (2 yr Treasury Note reflects market pricing in more rate hikes.)

What Was the Market Response?

- Real yields continue to get less negative

- Yield curves are flattening (2s/10s, 5s/30s)

- US dollar has regained its strength (EM headwind)

- Value outperforming growth relative (oil)

- Europe equities outperforming US

Fed’s Statement on Reducing its Balance Sheet:

- Quantitative Tightening (QT) will be a secondary policy in tightening. Hikes are the primary tool. We thought the Fed would be more aggressive on the balance sheet in lieu of hiking rates considering their thesis on inflation crashing back lower at the end of the year.

- QT will start after liftoff. Not specified but we expect 1- 2 quarters after liftoff. Powell iterated this would be a very transparent process.

- Fed is sensitive to maintaining funding markets (repo) and a well-functioning Treasury market. They wrote in several caveats to their notes such as, “maintain securities holdings in amounts needed to implement monetary policy efficiently and effectively in its ample reserve regime.” Aka if things start getting dicey, we will stop.

- Fed Primarily intends to hold Treasuries, in the long run. We’d expect some clarity on this statement regarding timing, but we’d expect the MBS portfolio to decrease.

Our Key Takes Away on the Balance Sheet Comments:

While Powell’s commentary was ultimately more hawkish regarding rate hikes, it was more dovish regarding the balance sheet. Powell’s guidance likely cut the tail risks the market had placed on the possibility of a flat-out asset sales from the balance sheet. While the balance sheet reduction will likely start earlier than last time and be faster, asset sales appear unlikely unless inflation remains stubbornly high. Powell promised more clarity on the balance sheet over the next couple months as the committee meets and comes to a conclusion.

Labor Markets are Tight

Powell was extremely happy with the uptick in the jobs market and the 3.9% (December) unemployment number. He mentioned the difficulty of companies to find work due to the factors of the pandemic (concerns of virus, care for children, retirements due to asset valuations). We are seeing substantial wage pressure, plentiful job openings and an elevated quit level. The Fed is hopeful labor participation improves overtime to ease the pressures.

The main takeaway:

- The current labor “box” of the Fed’s mandate has been checked given the strong jobs market.

- Powell believes the labor market is strong enough to tolerate more/ faster hikes as the economy is in better shape than during previous hiking cycles.

Inflation

We all know Inflation is well above trend and certainly a thorn in the side of the Fed, even more from a political perspective. The drivers were originally mostly caused by the pandemic but are becoming broader based. Like we mentioned above, wage inflation is hot, hitting the highest pace in decades, and this is worrisome. We will not dive too much into the inflation picture (you’ve gotten enough of that from me!) but we will get PCE tomorrow and CPI on 2/10 as another look into the data. The one notable change on inflation from Powell’s press was his admittance that inflation now compared to last month is slightly worse.

“Since December if anything, inflation is marginally worse.” Powell said. He revised his estimate of core PCE for ’22 has moved up a couple tenths and the estimates are clearly moving to the right.

Current Market Volatility

Powell was asked about the recent stock market volatility and if the drop in markets had shifted the Fed’s stance. Powell noted the Fed does not see the stock market action as impacting decisions. He reiterated mandate of employment and price stability… aka Fed isn’t there to keep S&P 500 elevated. The data says it’s time to hike rates and remove accommodation.

Bottom line

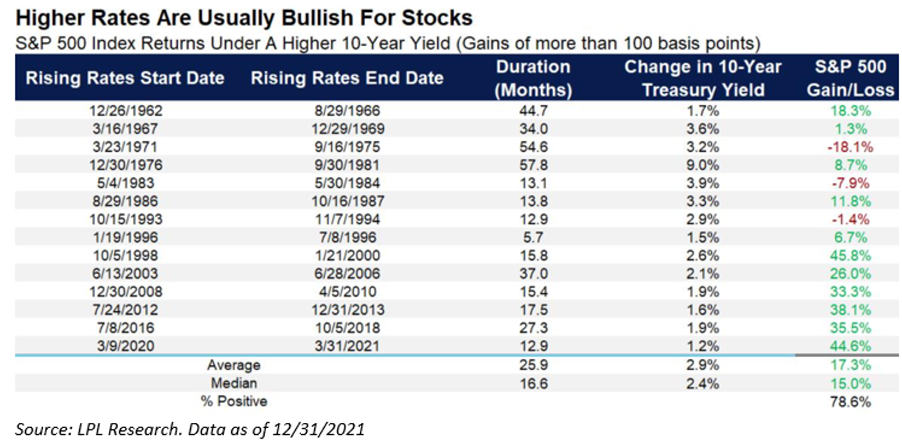

There is a good chance that the anticipation of rate hikes will end up being worse than the increases themselves – I’d love to repeat this comment. Back in 2016, the markets fell in front of a rate increase move by the Fed – January and early February 2016 saw an 11% pullback in the S&P 500. Once the Fed started the tightening, market participants fear eased, and stocks had a great run in 2016 and 2017 at the same time rates were moving up.

We take some comfort that the bond market still thinks the economic expansion can continue as the yield curve is flat but nowhere near inverted, even after pricing in aggressive rate hikes. We are still in a low-rate environment and will likely remain low throughout 2022, unemployment is low and personal balance sheets remain strong. While rising rates we think could pressure the market multiple (especially as real rates rise) that means we should 1) Continue to brace for more near-term volatility and 2) Continue to avoid high-growth/high P/E areas of the market as a continued decline in multiples will hurt those sectors.

History indicates that 2022 could end on a better foot than it started. U.S. stocks have historically performed well when the Fed raised rates, as a growing economy tends to support corporate profit growth and the stock market. Stocks have risen at an average rate of 9% during the 12 Fed rate hike cycles since the 1950s and delivered positive returns in 11 of those instances.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2201-32.