It’s no secret that the underlying market dynamics have changed over the past month due to geopolitical forces potentially causing a slowdown in global growth. In our 2022 Market Outlook, we told investors to focus on growth because we knew that we’d get some type of multiple compression this year, given the stage of the economic recovery. To begin the year, we witnessed a deleveraging event that brought valuations down. But now, due to the crisis in Ukraine, we’ve started to see growth expectations turn lower. For example, over the weekend, we saw a few different sell-side shops decrease their GDP expectations –both domestically and globally.

Couple this with higher-and longer-than-expected inflation readings, the national media has been throwing the “R” word around a bunch. Given the media’s attention to political correctness, we know that this is not the “R” word that initially comes to mind –because that word should never be used. But this “R” word, in the investment world, is much like saying the number in between 6 and 8 at the craps table –you just don’t say it when you’re on a heater. I’m not the most politically correct person, so I’ll say it –recession.

Why is there a Potential for a Recession?

First, what constitutes a recession? In 1974, economist Julius Shiskin came up with a few rules of thumb to define a recession: The most popular was two consecutive quarters of declining GDP. A healthy economy expands overtime, so two quarters in a row of contracting output suggests there are serious underlying problems. This definition of a recession became a common standard over the years.

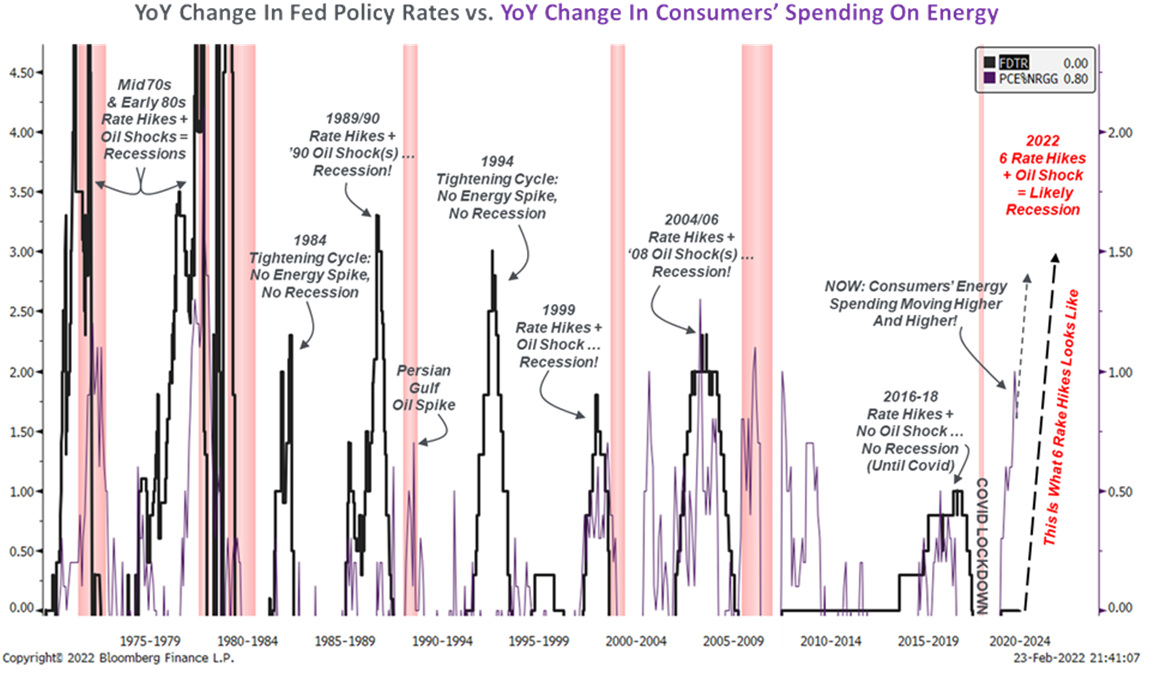

One of the reasons that investors have difficulty predicting recessions is that there is no magic formula. There aren’t that many recessions to analyze and every cycle is different. That said, observing all of the recessions since the 1970s shows one clear point –that recessions are typically preceded by two things: 1) a tightening cycle; and 2) sharply higher oil prices. Even after acknowledging that those two factors are the most influential, there are no magic levels of how high rates or oil has to go to give us a recession.

Now, the below chart isn’t easily digestible –so let me walk you through it. First, we’re looking for increases in Fed policy rates and oil prices, specifically year-over-year changes. The Y-Axis is cut off at zero because I’m not worried about declining Fed Funds rates and Energy pricing. Look at each Fed tightening cycle and how much the Fed hiked over a 12 month period (left scale). Next, take a look at the purple line, which plots the annual change in consumers’ spending on energy as a share of their total spending.

Yes, many current events should make one cautious. But having to wait to begin tightening cycles, numerous central banks will likely have to forge ahead with higher rates (despite the uncertainty). Higher rates plus higher commodity prices are increasing the odds of a recession. We are combining this with an already overwhelmed global supply chain, as bottlenecks developed and core goods inflation skyrocketed in 2021. Any additional supply shocks (e.g., food, energy, China factory production) would be particularly unwelcome. But that doesn’t mean that we are guaranteed a recession –like I said –there is no magic elixir.

The U.S. economy remains in a “full-employment” position –we just witnessed a great NFP figure on Friday. The Fed will tighten to stop inflation from becoming entrenched broadly in future expectations -Fed Chair Powell was clear on this fact. Even if just some of the inflation we’re seeing lasts, simple Taylor Rule models indicate interest rates should move higher (i.e., the Fed is behind the curve). Secondly, wehave never had such a healthy consumer –unencumbered balance sheets with plenty of firepower to spend -pending the willingness.

What is the Market Telling Us?

The simple answer is to look at The Fed futures rate expectations –it’s been commonly noted that the market expects five (5) rate hikes in 2022, but what is often overlooked is when the market is pricing in a rate cut. And here recently, the market has seen an increase number of projections of a rate cut between June 2023 –December 2023. So, that alone, can offer insight of what the market is trying to tell us.

The more complex way is to look towards the U.S. yield curve. The yield curve tends to be many investors’ North Star when it comes to indications of a looming recession. The message of the U.S. yield curve (flattening but not inverted) still seems to be that a soft landing is possible. But this is getting more tenuous, and it’s going to have to be a joint effort between the Fed and the private sector. The Fed cannot bring inflation down by themselves without tightening substantially, hence, the private sector needs to decouple the supply side fears.

Conclusion

With the domestic labor market still solid, and job openings elevated, we believe that a U.S. recession is unlikely in the near future. Yet, it would be foolish not to acknowledge the shock to consumer-spending power from geopolitical uncertainty & surgingcommodity prices, especially with wages flattening. U.S. job gains are likely to slow in a full-employment economy. Thus, we are getting more worried. Specifically, Strategas increased the odds of a 2023 recession to 35% from 30% previously. Their “Base Case” remains that next year will see a mid-cycle slowdown –50% odds, with an upside surprise case that would involve productivity and growth remaining robust (15% odds).

Remember, there is no magic elixir to calling market recessions. In the end, recessions don’t just come out of nowhere. You always SLOW before you contract. We’ll continue to monitor PMIs and its affect on the market. Luckily, we believe our portfolios remain ready in case there is a correction or even a slowdown. The “R” word does not scare us.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

The opinions expressed are those of Aptus’s Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-09.