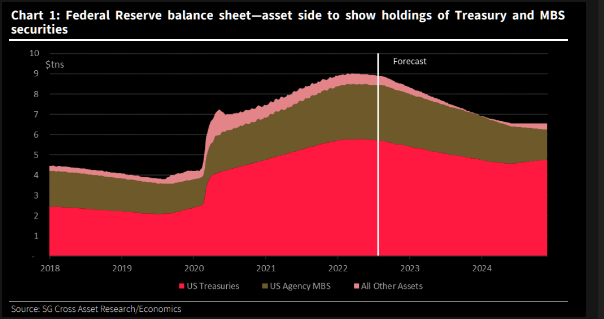

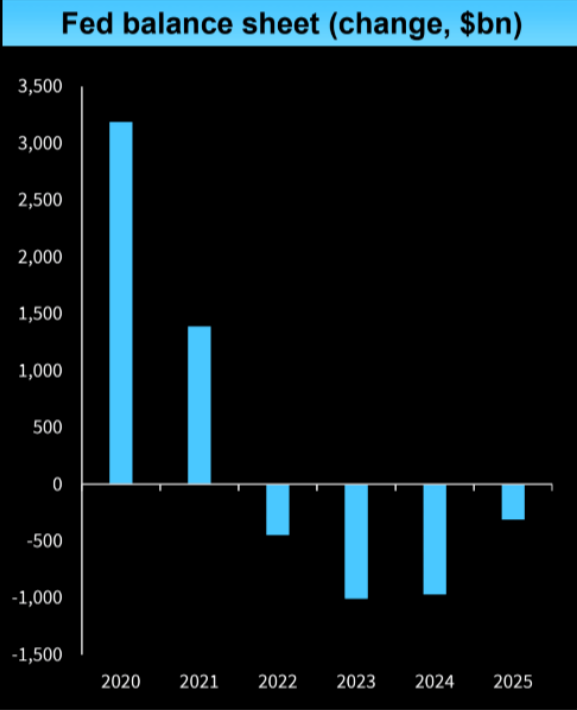

The balance sheets of global central banks have grown drastically in the last 15 years. The United States balance sheet alone grew from ~$4 trillion to ~$9 trillion over the pace of 2 years during the pandemic. The surge in liquidity has had a drastic effect on financial assets. While CB balance sheets are often confusing and intimidating, the main takeaway for investors should be: is the balance growing or shrinking?

The prospect of the Fed shrinking its bond portfolio, a policy known as Quantitative Tightening (QT) has been a standing concern for investors. This story of this year has been centered around the tightening of financial conditions via rate hikes and QT due to stubbornly high inflation. Thus far into the cycle, the tightening has come mostly from the FOMC raising the Fed Fund Rate.

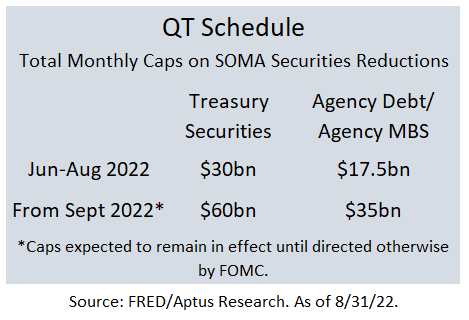

While QT started back in June it has flown under the radar due to technicalities, leading to little implication for financial conditions. The pace of QT is set to double in September (schedule below) and we believe the implications for the market and liquidity are being overlooked.

The QT Pace is Doubling

In September, the Fed is bumping up the pace of QT from $47.5bn to $95bn per month. The process of QT works as such: the maturing principal is allowed to roll off each month up to the cap limit (shown above), and any amount exceeding the cap is reinvested back into the Fed’s portfolio. Maturing Treasury securities are redeemed either mid-month or month-end, which are the same periods when newly issued Treasury securities are settled. This is intended to allow investors to easily roll over their maturing holdings into newly issued Treasuries. This design is to limit negative market implications/ duration mismatches.

What is the History of Past QT?

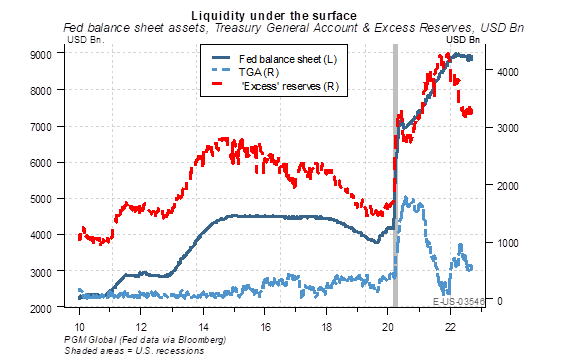

Looking back to the QT experience from 2019, it’s reasonable to pose the question of how long can the balance sheet roll off last? Currently there is ample liquidity available in the market. As the balance sheet shrinks, things can change rapidly as could be seen back in 2019 where liquidity rapidly and unexpectedly became a scarcity of reserves in the system and led to market disruptions (followed by a Fed Pivot). As the Fed seeks to curb inflation, we do believe that the shrinkage of the balance sheet along with rate hikes is important to normalize policy and likely will cause the economy to slow – the question is, how long can it last?

Source: Soc Gen/ The Market Ear. As of 8/22/22

Source: Soc Gen/ The Market Ear. As of 8/22/22

Source: Pavilion. As of 8/29/22

Source: Pavilion. As of 8/29/22

Will QT Impact the Markets?

The most important question in regard to QT is how much duration will be transferred from the Fed’s balance sheet to the market along with the timeline. So far, there’s been no duration transfer as (1) the Fed has been getting rid of zero-duration securities, (2) the Fed’s runoff has been offset by reduced financing needs (due to elevated TGA balances).

This simply means that the Treasury did not have to issue more debt to the public to fund itself.

Source: Barclays. As of 8/25/22

Source: Barclays. As of 8/25/22

In actuality, the net issuance of coupon (longer duration) securities has actually declined, which has essentially neutralized the effects of QT on the Treasury market. This has limited the market implications on term and risk premia (i.e., the market hasn’t been caught off guard or had a negative impact from a financial condition perspective). Put differently, the reduction in Treasury’s financing needs has essentially offset the effects of QT at least until this point. We think this will continue to be the case for 2-3 more quarters. That said, MBS (mortgage-backed securities) sales would result in a more immediate duration transfer and could change our assessment on the implications.

MBS – The Canary in the Coal Mine?

We think MBS sales are becoming a legitimate risk, given the fact that mortgage refinancing activity has noticeably dropped this year and is now at the lowest levels since 2000. As a result, mortgage runoff (i.e., people are paying their mortgages off slower because rates are higher and their mortgage rate is “in the money”) is likely to fall below the Fed’s $35bn/month cap, which will slow the speed of balance sheet reduction.

The Fed could respond by selling MBS assets up to their monthly cap. This would put pressure on low-coupon (2%-2.5%) mortgage securities which the Fed owns (these are the most duration-sensitive securities, as no one with the option will refinance their mortgage to a higher rate). While this is less likely to meaningfully impact current mortgage rates (which are priced off of current 4%-4.5% coupon securities), it would likely put pressures on bank balance sheets, given they have significant exposure to the same low-coupon securities currently held by the Fed. We believe the Fed could take this step as early as Q1 ’23, especially considering the recent easing in financial conditions.

Can the Fed Afford Higher Rates?

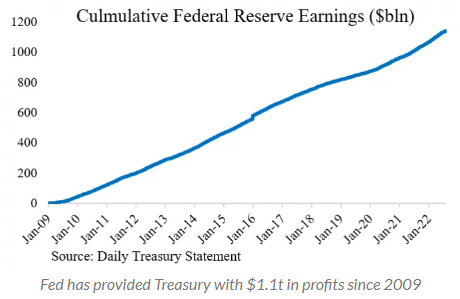

A common question we’ve heard is, can the Fed afford higher rates? In reality, we think the Fed will soon show negative net interest income from its portfolio, although it won’t impact their policy. The Fed earns interest income from its bond holdings but pays interest expense on its deposits (reserves) and repo borrowings (RRP). The net earnings are remitted to Treasury and have totaled over $1.1t since 2009 (see graph below):

Source: TGA/ FedGuy.com. As of 8/22/22

Source: TGA/ FedGuy.com. As of 8/22/22

Like any other bank, the Fed’s asset portfolio is comprised of longer dated assets (bonds), but its liabilities are shorter dated and reset with changes in the Fed’s policy rate. At approximately a 3.5% rate (which we expect the FFR to be >3.5% by year-end), the Fed’s interest expense would exceed its interest income.

While most for-profit businesses would have a problem if their liabilities exceed assets, not the Fed! The Fed utilizes a special form of accounting which allows monetary policy to continue uninterrupted. The Fed will continue to pay its interest expenses (against its liabilities), but will finance them by creating a “deferred asset”. The deferred asset is an IOU the Fed writes against its future income (from the bond portfolio).

The Fed will eventually have positive net interest income again when it cuts rates. Those earnings will first go towards repaying the deferred asset then being remitted to the U.S. Treasury as described above.

So, what happens if the Fed sells an asset and loses money (like an MBS security)? Another “deferred asset” is created! As any Accounting 101 student knows, in reality, when a real business takes a loss, they write down their equity but for the Fed, it’s a different story!

Bottom Line

QT, thus far, has been a non-event as the Treasury works down its sizable balance of tax receipts (the TGA account), offsetting the vast majority of the summer QT schedule. Now, the Fed is scheduled to double the pace of its QT beginning this month, without the aid of a bloated TGA balance – likely having larger implications on market liquidity.

In addition, another large buyer of bonds – banking institutions – have seen deposit growth begin to stall as inflationary pressures are high, forcing consumers to increasingly draw down on their deposits (taking away the funds that banks use to purchase bonds). Simply put, these tailwinds are set to end, and the shrinkage of the balance sheet will reinforce tighter Fed policy. On top of that, we think asset sales (MBS) are back on the table come next spring. We believe this combination of tightening (rate hikes + QT) will have implications for a variety of financial markets.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2209-3.