I’ve been reading Edward Chancellors book The Price of Time over the last couple weeks. It’s a bit dense but found it thoroughly interesting and informative. Basically the entire book walks through the importance of interest and the role it has played in forming our capitalistic society (or questionably, the fake capitalism since the GFC). If you are looking for something educational but interesting, I recommend it.

A few notable quotes, then on to the present market:

“The spirit of capitalism was transmitted across networks of credit that connected lenders and borrowers through bonds of mutual self-interest…. Referred to capital as ‘interest’, in the sense of taking a stake. From a technical viewpoint, capital consist of a stream of future income discounted to its present value. Without interest, there can be no capital. Without capital, no capitalism.”

“Interest is the barometer of trust, rising and falling over the course of the cycle. Too much trust is a dangerous thing.”

“Bad lending had to be nipped in the bud. The best method – the sole method – to contract the entire credit currency in this or any other country is to raise the rate of interest.”

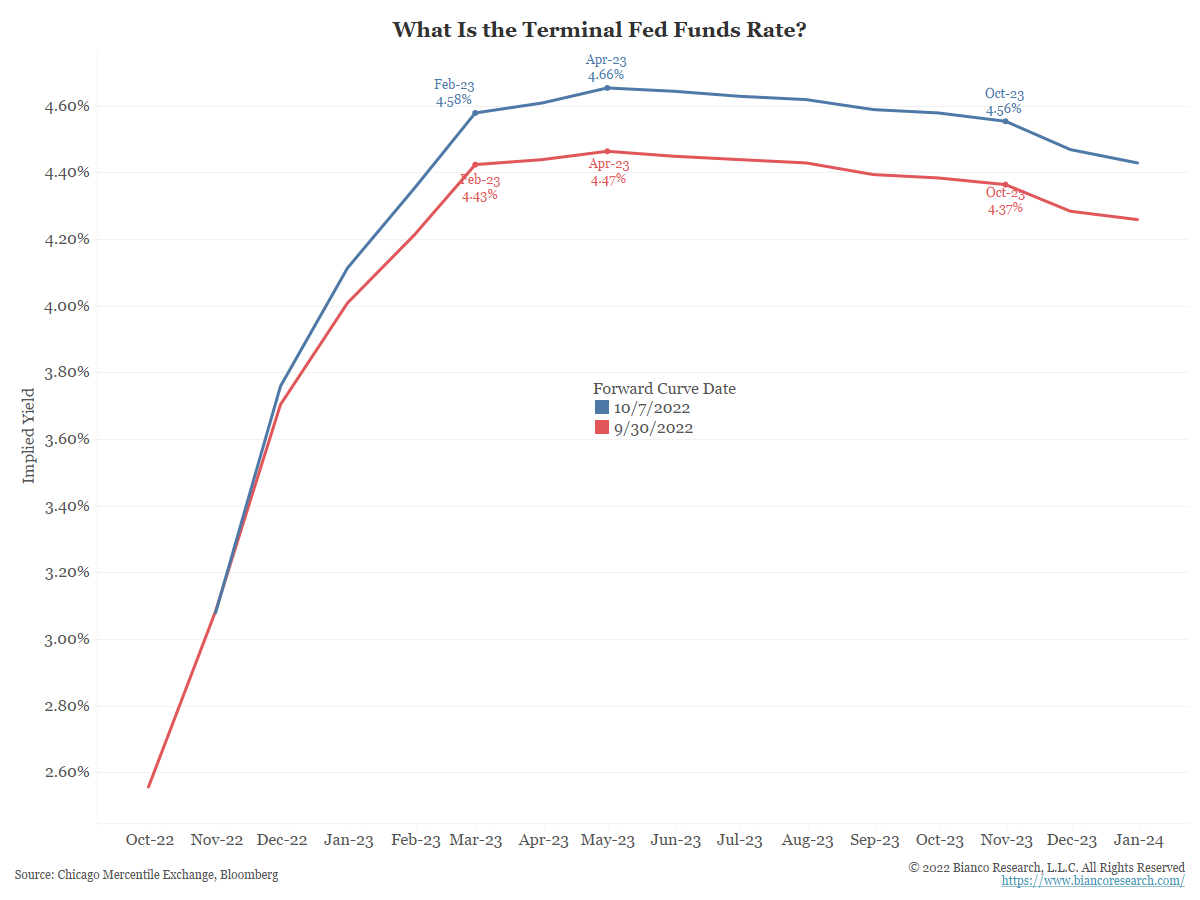

Terminal Rate Keeps Increasing

Source: Bianco, as of 10/07/22

Source: Bianco, as of 10/07/22

The Fed’s terminal rate can be assessed via the fed funds curve (shown above). The red line is the level at the close on September 30th. The blue is the curve as of October 7th.

The terminal rate, or where the Fed is expected to stop hiking, has increased ~20 bps this week. Now at 4.66%, it is straddling the 4.50% and 4.75% ending points for the Fed. Remember the updated Fed Dot Plot!? The market is finally getting the picture that we are headed there.

Bottom line, the Fed is expected to hike to a range of 4.50% and 4.75% and largely stay there until late 2023. We do not see rate cuts anytime soon.

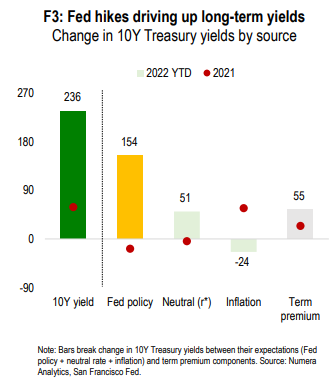

Why are Yields Rising?

Source: PSC, as of 9/30/22

The chart to the left decomposes the change in 10- year yields between their components and the graphic above shows a more simplified version of the components. A bonds yield is simply the combination of the expectation for short-term rates over the coming decade (or life of the bond) plus the term premium (the extra compensation required by investors to hold long-term debt until maturity). The left graphic breaks down the contribution of each component to the change in 10Y yields in 2021 and so far the YTD (the 10yr yield started 2022 at 1.51% and is 3.94% as of today, up ~236bps YTD). Expectations of short-term rates capture beliefs around Fed policy covering things such as long-term growth, the neutral rate of interest, and inflation. Most of this year’s increase in rates comes from the expectations of tighter Fed policy. The term premium also increased, as investors demand insurance against elevated inflation risks.

The chart to the left decomposes the change in 10- year yields between their components and the graphic above shows a more simplified version of the components. A bonds yield is simply the combination of the expectation for short-term rates over the coming decade (or life of the bond) plus the term premium (the extra compensation required by investors to hold long-term debt until maturity). The left graphic breaks down the contribution of each component to the change in 10Y yields in 2021 and so far the YTD (the 10yr yield started 2022 at 1.51% and is 3.94% as of today, up ~236bps YTD). Expectations of short-term rates capture beliefs around Fed policy covering things such as long-term growth, the neutral rate of interest, and inflation. Most of this year’s increase in rates comes from the expectations of tighter Fed policy. The term premium also increased, as investors demand insurance against elevated inflation risks.

In addition, the impact of quantitative tightening on long-term yields is highly uncertain, as this is the first time the Fed will meaningfully scale back its balance sheet. In principle, an increased supply of Treasuries should continue to lift the term premium.

Source: Numera, as of 10/7/22

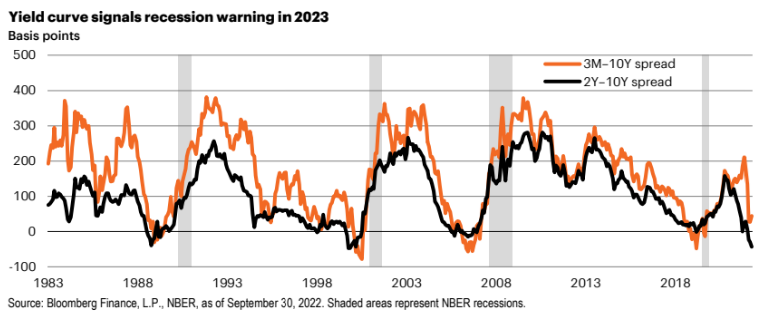

3M/10Y Next to Invert

Source: Bloomberg, as of 9/30/22

Source: Bloomberg, as of 9/30/22

The 3 month /10 year Treasury spread is often quoted by the Fed as the most effective recession indicator. It has typically preceeded downturns by 10-12 months. This curve still has NOT inverted. Should the Fed raise rates as expected in November (75bps), this part of the curve, which has flattened, fast will likely invert unless we continue to see the long end rise in tandem with the front end, which brings us to the next point.

The Curve Inversion isn’t Deepening…

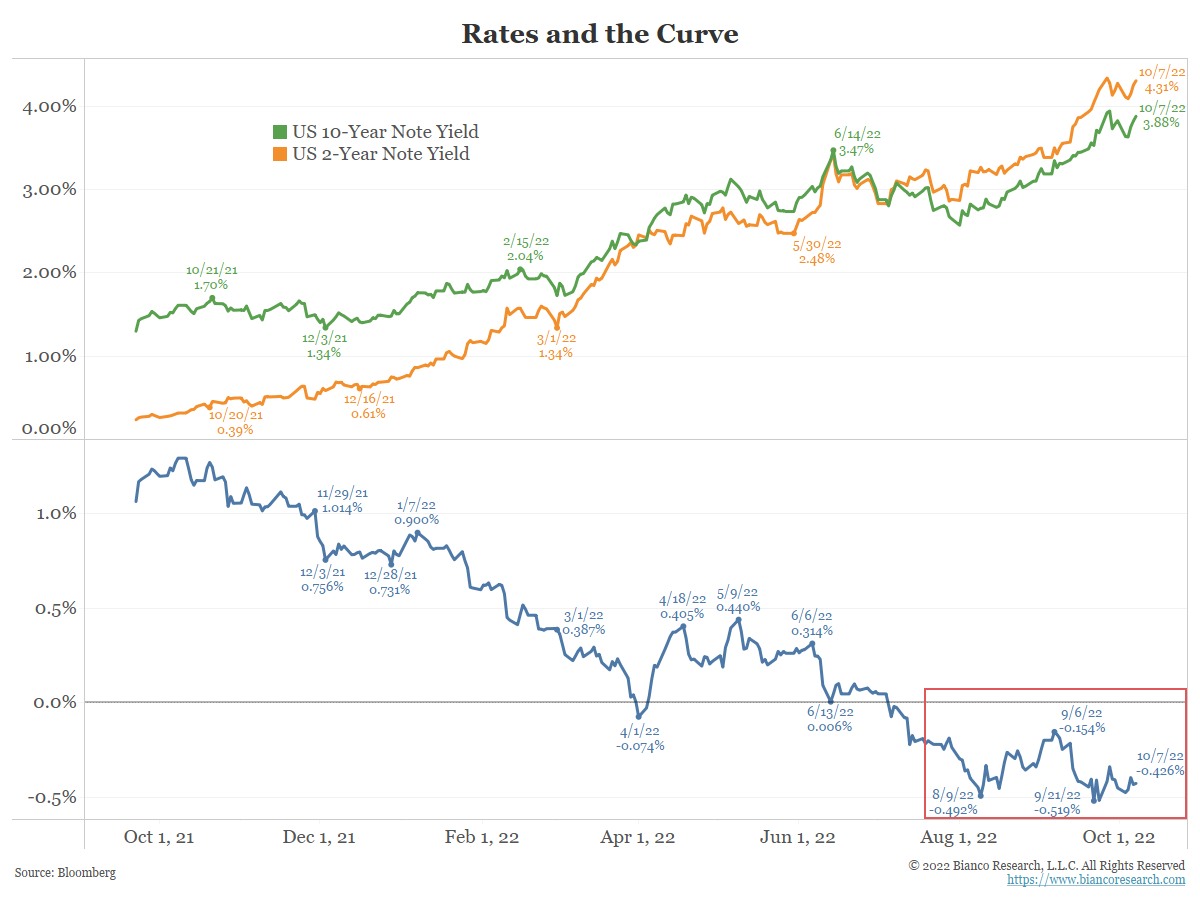

Source: Bianco, as of 10/07/22

Source: Bianco, as of 10/07/22

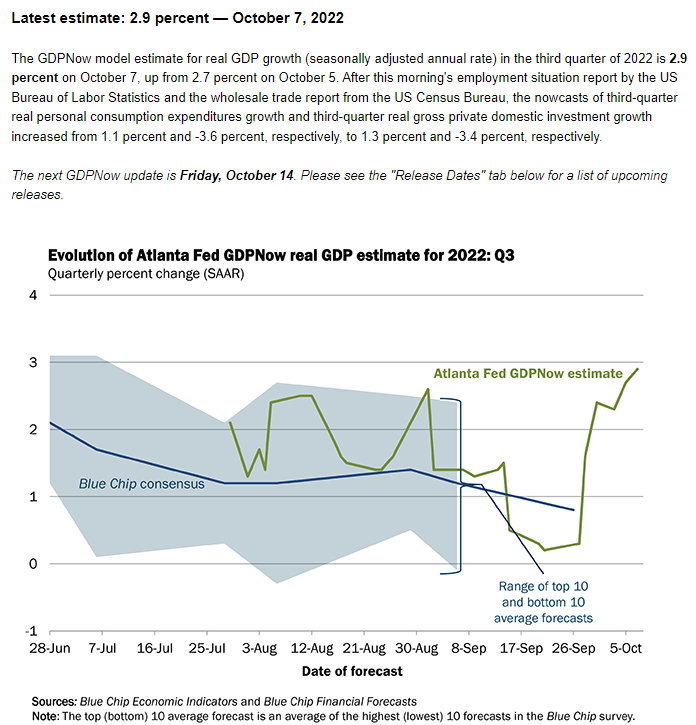

As the 2-year yield (orange) keeps climbing, it has pulled the 10-year yield higher. The yield curve (blue, bottom panel) has remained range-bound (red rectangle) and, contrary to what most believe should be happening, isn’t inverting more deeply. The reason the yield curve has remained range bound is that the economy is not breaking. The labor market is also not breaking (showcased by last Fridays job number/ unemployment rate). In addition, last Friday, the Atlanta Fed updated its GDPNow forecast for Q3 2022 and projects GDP will expand by 2.9%. Snip below from the Atlanta Fed’s website showcasing their “GDPNow” survey.

Source: Atlanta Fed, as of 10/07/22

Bottom line: unless the economy breaks, we don’t expect to see the flight-to-quality rally that inverts the yield curve to the extremes of -75 bps or more seen during large risk off panics.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

The 2 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 2 years.

The 10-2 Treasury Yield Spread is the difference between the 10-year treasury rate and the 2-year treasury rate. A 10-2 treasury spread that approaches 0 signifies a “flattening” yield curve. A negative 10-2 yield spread has historically been viewed as a precursor to a recessionary period. . The 10 Year-3 Month Treasury Yield Spread is the difference between the 10 year treasury rate and the 3 month treasury rate.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies, and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2210-17.