Powell’s comments and the market response yesterday were noteworthy. The equity market rose (SPX +3.05%) while bond yields rallied across the yield curve following Powell’s Brookings Institute presentation. The market was positioned for a hawkish speech and instead we heard a more dovish than expected speech, catching players offsides.

Powell came across much softer during this presentation/Q&A when compared to the past press conferences, where he alluded to pain on the horizon for the average citizen as the Fed tightened policy and likely caused a recession. This time around, Powell seemed to think a more “softish” landing was still possible.

The bottom line is, the market took Powell as optimistic.

Many of Powell’s past aggressive comments were replaced with nuance and explanations, which we have not heard for some time. Some of the specifics regarded how the Fed is thinking about inflation looking ahead, and their overall risk management philosophy (i.e., how they think about the implications of over hiking and implications of persistent inflation). So, while the scope of the message wasn’t dissimilar to the previous messages, the delivery had some notable differences. We will lay out our key takeaways below.

The first notable difference was Powell’s emphasis on the importance of employment in determining future policy. This sets up the endgame for policy (i.e., rate hikes). As employment comes back into balance, the Fed may be done tightening, although in our opinion, still far from cutting rates. So, while this comment wasn’t deliberately dovish, it does give Powell & Co an out for next year.

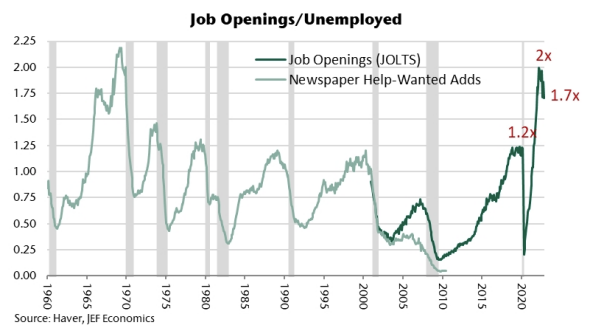

Powell gave us an idea of when he would consider the labor market to be back in balance. It’s not the unemployment rate, but job openings. The JOLTS number has instantly become first tier. It came in slightly above expectations earlier today. More on this below.

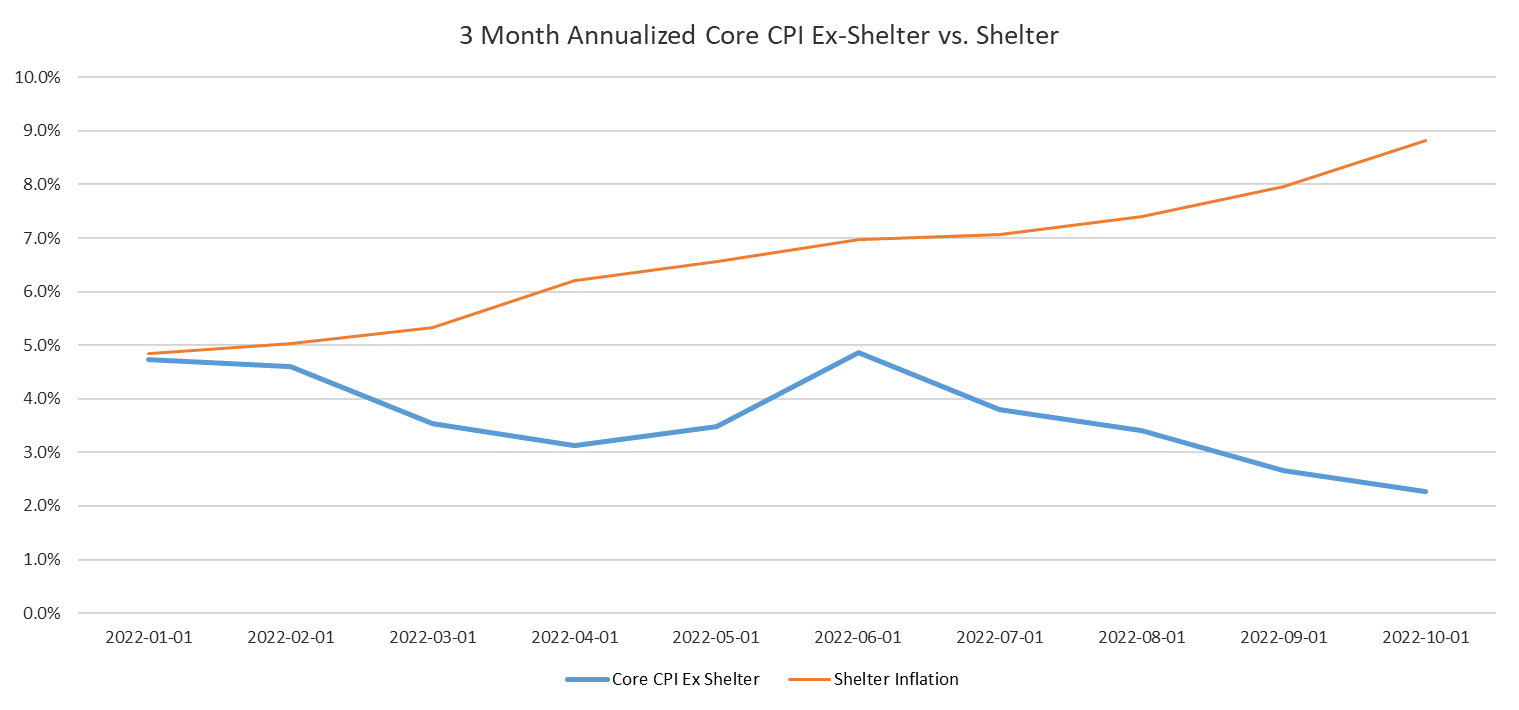

Powell recognized that the Fed looks at the breakout of core CPI between shelter, goods, and services. He also recognized that their measurement of shelter inflation is lagged, and that forward-looking real-time rents are “collapsing” (his words). This is important as it’s clear the Fed knows that shelter inflation will likely decrease at some point in the future, possibly substantially. Asking rents peaked in March 2022 and are already below 5% y/y. This is good news for the inflation outlook.

Source: Raymond James, as of 11/30/22

Source: Raymond James, as of 11/30/22

Powell also acknowledged that goods prices are decelerating, as spending preferences continue to shift on top of caught up supply chains.

There was recognition that service inflation is stickier. He did point out a few details on how the Fed views the data but most importantly, wages are the primary driver of services inflation, which he expects should continue to decelerate as the labor market softens.

Bumping up the Inflation Target?

Powell implied that the Fed does not need to see 2% inflation next year to think that the Fed has restored price stability. He acknowledged inflation as the lag of monetary policy and trailing effects of housing and rents. This sets the stage so that the output gap is negative, goods inflation continues along its path, and employment moderates. The Fed will be okay with something like 3-4% inflation (Williams also has said this) next year. This comment, in my mind, was a game changer. The Fed beat the transitory drum for 18+ months (up until early ’22) before retiring the word.

Monetary policy lags and longer-term consequences of aggressive rate hikes are uncertain but, in our opinion, this comment reignites the transitory logic…just give it another year and it will go down (we hope!). The implications of this are noteworthy and will be a big focus of my 2023 Outlook. Stay tuned.

JOLTS – The New CPI!

Source: Jefferies, as of 11/30/22

Source: Jefferies, as of 11/30/22

Circling back to our comment above regarding the importance of JOLTS, we got an updated print yesterday morning (before the presser). Job openings moved in the right direction in October, but still have a very long way to go. Job openings declined by 0.4M m/m to 10.3M. That still translates to 4.3M more job positions than unemployed individuals. The ratio of vacancies/unemployed dipped from 1.9 back to 1.7 which matches this year’s low set in August.

Although the decline is welcome news after last month’s increase, job openings have basically been moving sideways since the summer, which does not inspire a lot of confidence. The profit resiliency – which was also highlighted in GDP data this morning – explains why the Fed is having such a hard time convincing firms to stop hiring. There is more work to be done here.

In Summary

Why did the market is rally on this news? We believe it’s because Powell laid out the endgame. Before yesterday, we really didn’t know what would satisfy the Fed.

Powell had said it was something like material evidence that inflation is coming down, which is vague. By tying their measurement to the labor market in this speech, Powell took some of the uncertainty out of monetary policy. Now we know what they’re looking for: the market likes certainty.

The next big question comes to the inflation profile we see in 2023. Will it come down meaningfully or will it remain sticky? If the Fed’s goal is 2%, it must not only get there but stay there. The longer the Fed Funds rate stays in restrictive territory, the more economic damage it is likely to create. Will the Fed start to lower rates (from 5-5.25% terminal) if inflation in ’23 moves down meaningfully or will they continue to fear a repeat of the 1970’s stop and go policy? This will drastically impact earnings and long term growth of our economy. Time will tell.

Looking ahead we expect a +50 bp hike on Dec 14th and a terminal fed funds rate of 5-5.25% in early 2023. In addition, we don’t expect the Fed to cut rates until late ’23 at the earliest.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2212-2.