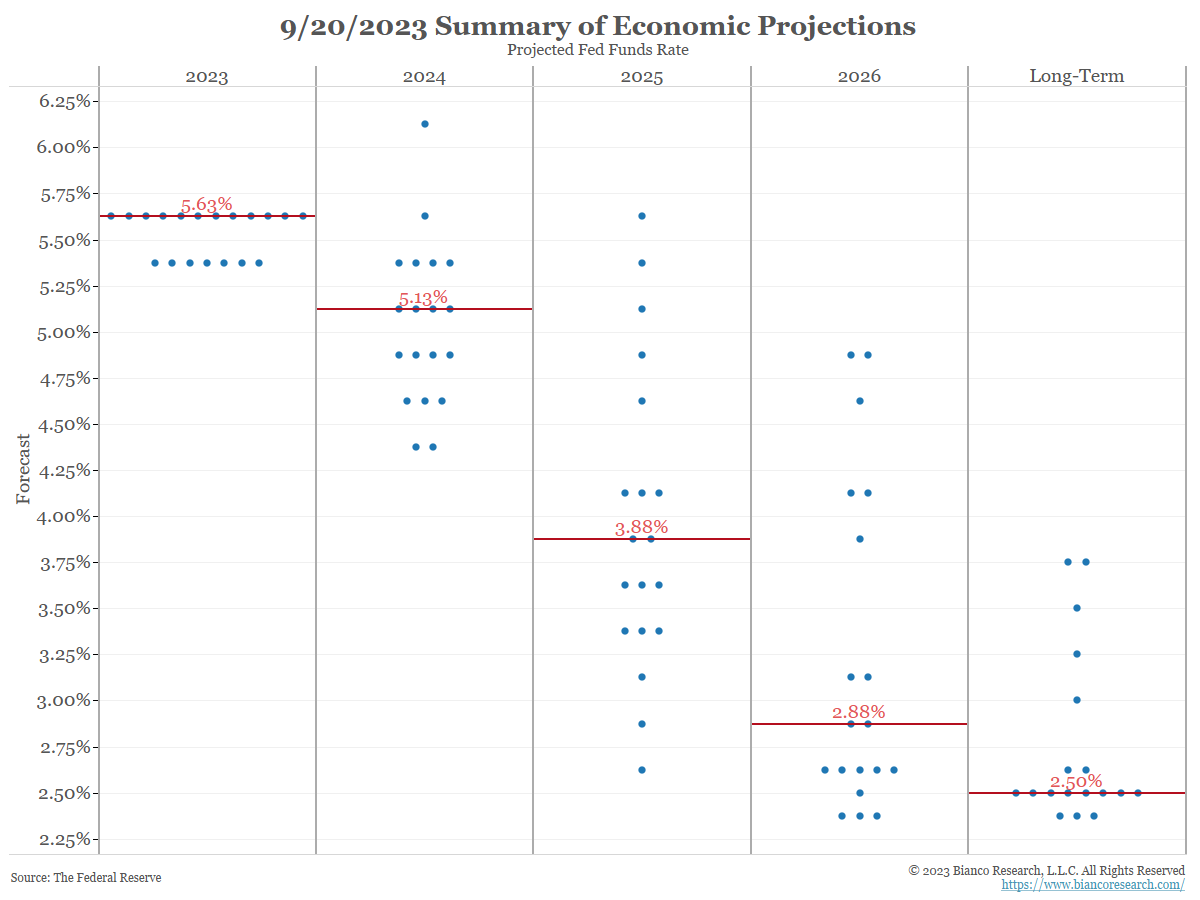

The recent Fed meeting brought an update to the 2024 median for the Fed Funds rate. It was pushed higher with the top dot now 6.1%, up from 5.9% in June. If growth persists, several FOMC members see the funds going a lot higher than the market expects.

Source: Fed/Bianco as of 09.20.2023

Source: Fed/Bianco as of 09.20.2023

The updated Dot Plot last week took away two rate cuts from 2024 compared to the June update. Back in June, the dots suggested we could have 100 basis points of cuts in ’24; however now they show only 50 basis points of cuts. Most participants (12 of 19) suggest there will be one additional rate hike in 2023. This would raise the Fed Funds rate to the 5.5%-5.75% range.

Keep in mind, these dots in terms of their forecasting reliability have proven to be of little value historically. That said, the data is important from a messaging perspective and tells a clear story of higher for longer. Policymakers now seem interested in gathering more data before making another move.

In regard to employment, the Fed lowered the median unemployment rate to peak at 4.1%, rather than 4.5% as in June. That is only a 0.3% net increase from today’s level. Not a bad “sacrifice ratio,” considering the tightening work this cycle.

We viewed the underlying message from the meeting as…the Fed is happy where rate policy is sitting currently. It’s the first time in recent memory that they haven’t been chasing inflation but are in line to be slightly ahead of it.

The hiking cycle might be close to done but higher for longer is here to stay. Ultimately, where policy goes from here depends on the data and economic performance. We can expect the market to continue to chop at each data point, no relief yet!

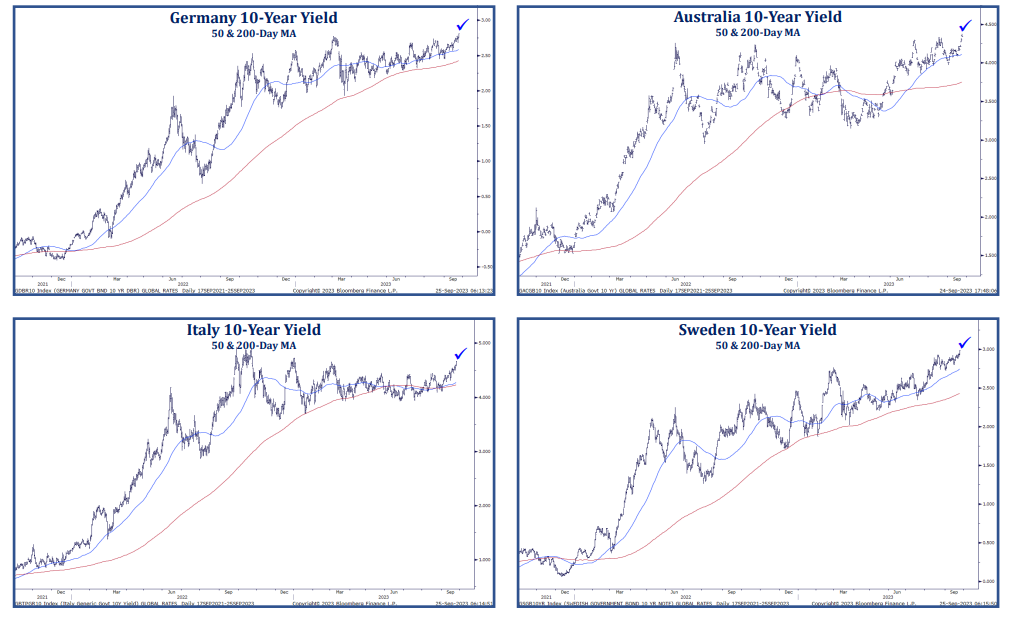

Global Rates are Rising

The surge in Central Bank rate hikes, on top of stickier-than-expected inflation, has led to a continual sell-off in duration across the globe. The aggressiveness of the Fed has pulled rates up globally.

Source: Strategas as of 09.25.2023

Source: Strategas as of 09.25.2023

In addition, there has been a re-evaluation of how many times the Fed will cut in 2024, as well as where policy settles after the cutting cycle. All of this on top of higher supply and less intervention likely pressures/keeps yields higher.

Echoing recent comments from a bond market update post, rising rates aren’t necessarily bad for markets but the pace at which they rise really matters (think back to the March banking crisis). On that note, in Q3, the 10-year Treasury is up nearly 70bps. The recent rise in rates has come quickly and deserves monitoring as we make new highs in long-term rates across most DMs.

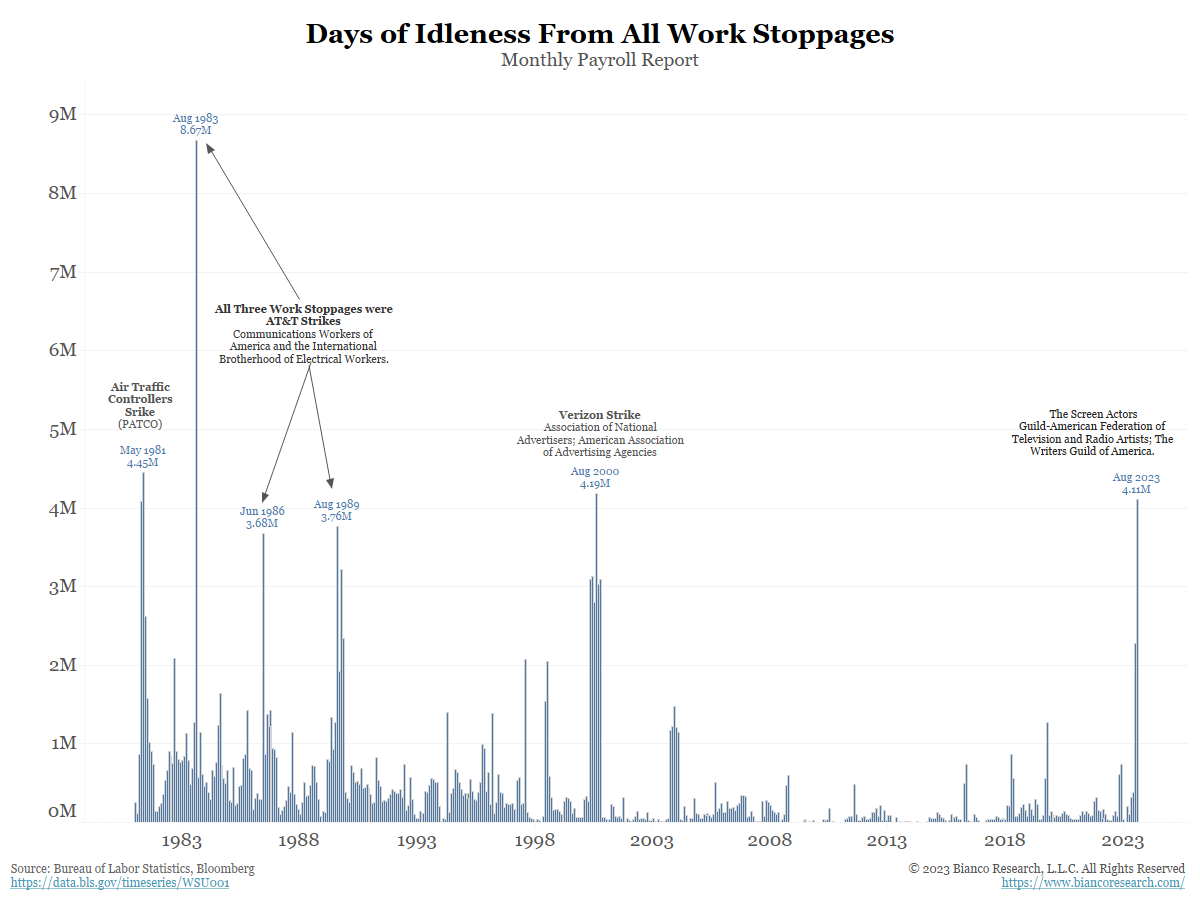

Labor’s Power is Rising

The overheating labor market has been a primary factor in the Fed’s policy decisions. We remain in an environment where labor supply does not meet labor demand.

Source: Bianco as of 09.25.2023

Source: Bianco as of 09.25.2023

While restrictive monetary policy has helped avoid a wage-price spiral (so far), we can’t ignore the headlines concerning labor strikes and lofty union demands.

A critical question remains…has the post-pandemic labor market structurally changed? If there indeed has been a shift with regards to the bargaining power in favor of labor, we can expect “stickier” inflation and higher interest rates as a result.

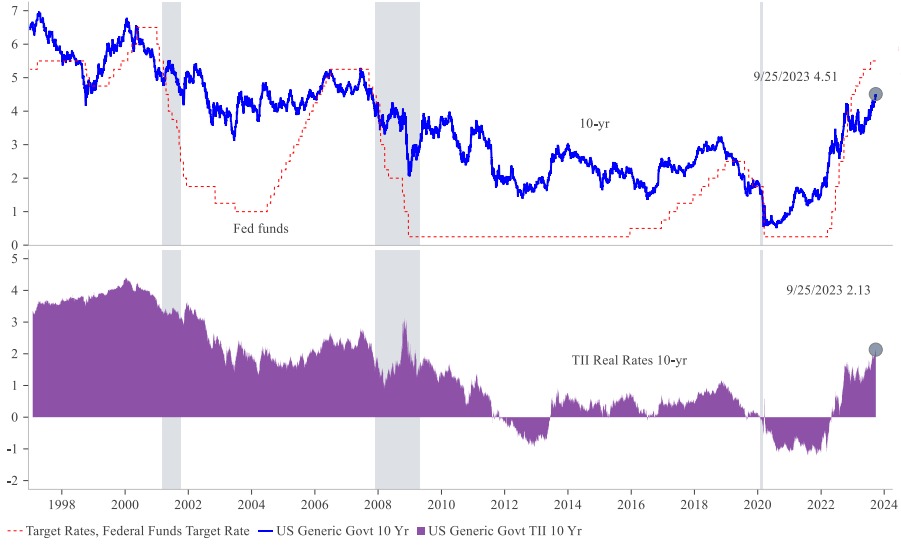

Higher Real Rates Will (Eventually) Slow Growth

Real rates continue to rise, as Fed policy remains high and inflation trickles lower. As the graphic shows, the last 10 years of real rates has been an anomaly compared to history.

Source: Strategas as of 09.11.2023

Source: Strategas as of 09.11.2023

The last 10 years, real rates have been close to zero and even negative (i.e., financial repression). While real rates are back firmly in positive territory, the process of slowing growth will take time.

We all must pause when we hear commentators pitch doom and gloom because rates are higher. We were all spoiled by the last 10 years of financial repression and declining interest rates. Now, there is a cost to capital.

We believe this is actually a good thing, as investors and allocators must wisely decide how to allocate their capital. Simply put, the normalization process won’t be easy, but we do think that investments having strings attached gives our economy the best chance to grow and succeed into the future.

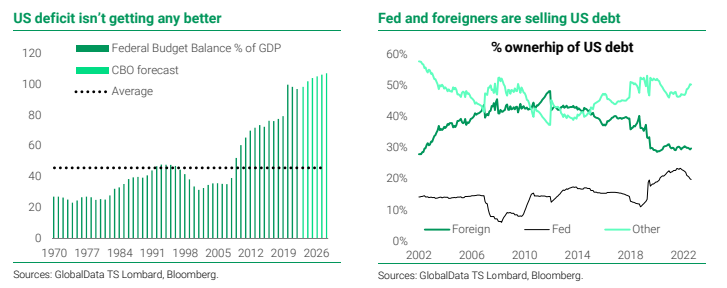

Who’s Going to Buy All the Debt?

The shift from QE to QT signifies a price-insensitive buyer being removed from the market and the debt supply will need to be bought by someone. So, who is buying all the debt?

Source: TS Lombard as of 09.26.2023

Source: TS Lombard as of 09.26.2023

Back in 2012, foreigners owned almost 50% of USTs. That figure now sits at around 30%. The decrease in holdings must be scrutinized as some of the decline is due to foreign officials such as China, Saudi, and Japan reducing their exposure, but it’s also partially due to the devaluation of holdings as interest rates have risen (yields up, bond price down) while supply has continually grown. With less investment from foreign investors, US households have been helping to fill the gap.

In 2022 ~3.6 million accounts were opened at TreasuryDirect, the online portal that retail investors can use to buy Treasuries directly from the government. We have seen similar activity in 2023 where households have continued to buy throughout the

Fed’s hiking cycle, despite the large fixed income selloff. In total, we estimate households have purchased ~$1.5 TRILLION in US Treasuries.

While this has been impactful, we do think there needs to be a resolution regarding the deficits. With a ~9% Deficit and interest expense soaking up 14% of tax receipts, something has to give!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-27.