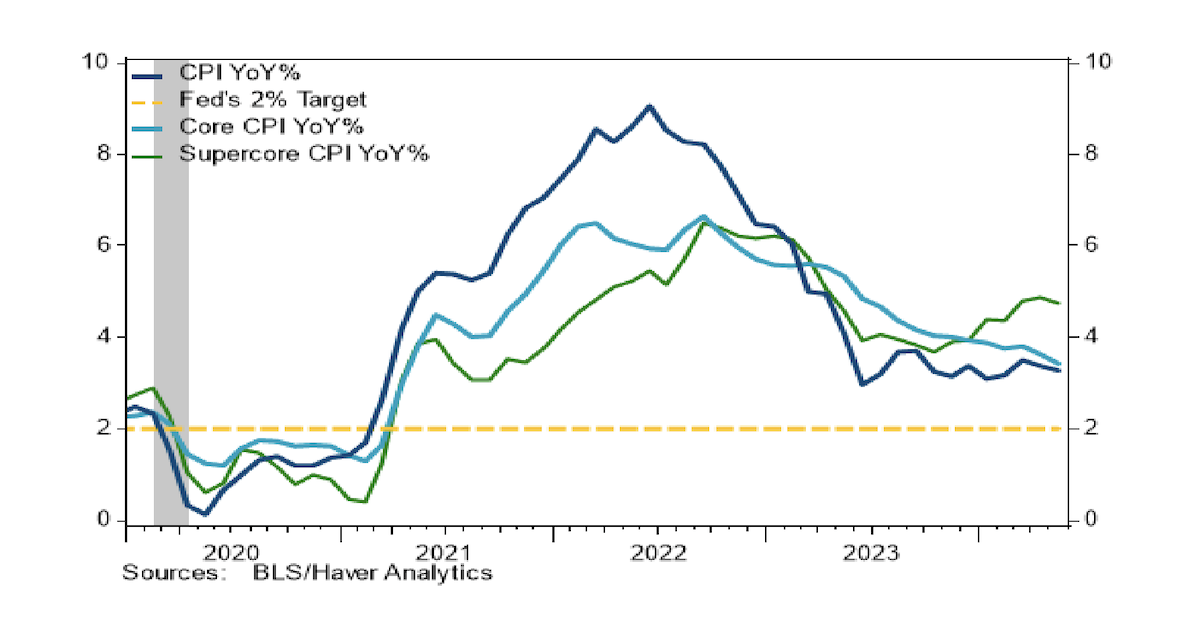

We see today’s print to be one of the first encouraging inflation prints for the Fed. The broader softness across components could point to a continuation of the slowing inflation data. May Core CPI came at 0.163% M/M (2% annualized), which was well below estimates. May Headline CPI came in flat.

- CPI MoM (May) 0.0% vs 0.1% est.

- CPI Ex-Food and Energy MoM (May) 0.2% (0.163% unrounded) vs 0.3% est.

- CPI YoY (May) 3.3% vs 3.4% est. (3.4% prior)

- CPI Ex-Food and Energy YoY (May) 3.4% vs 3.5% est. (3.6% prior)

Source: Stifel as of 06.12.2024

Source: Stifel as of 06.12.2024

This was the lowest core print since August 2021 and headline print since July 2022. We believe this print gives the Fed confidence they can be more dovish in their commentary following the strong payrolls and wages last week. In addition, supercore inflation (core services excluding shelter CPI) fell 4bps, its first decline since last fall.

Components within the transportation category were one of the larger drivers for the month’s decline given that used car prices, insurance prices, and airfare declined nicely.

Shelter/ OER continues to lag, slightly rebounding over the month. The disinflation process for rents has stalled since reaching 0.4% last August. Given that shelter makes up 34% of the CPI basket, it will be critical to see rents continue to moderate.

The market quickly reacted with Fed Funds futures now pricing in 2 cuts in 2024, with an 85% of the first cut in September and a 100% chance of a cut by November. Equity markets rose nearly 1% and bonds rallied across the curve.

We’d note that today’s print is just one number although the downside surprise is encouraging. We must also keep in mind that YoY Core inflation is still running >3%, which we think is still concerning enough to wait for further confirmation before cutting.

FOMC Update

Maintain target rate at 5.25-5.50% and maintain balance sheet roll-off status quo.

Source: FOMC as of 06.12.2024

Source: FOMC as of 06.12.2024

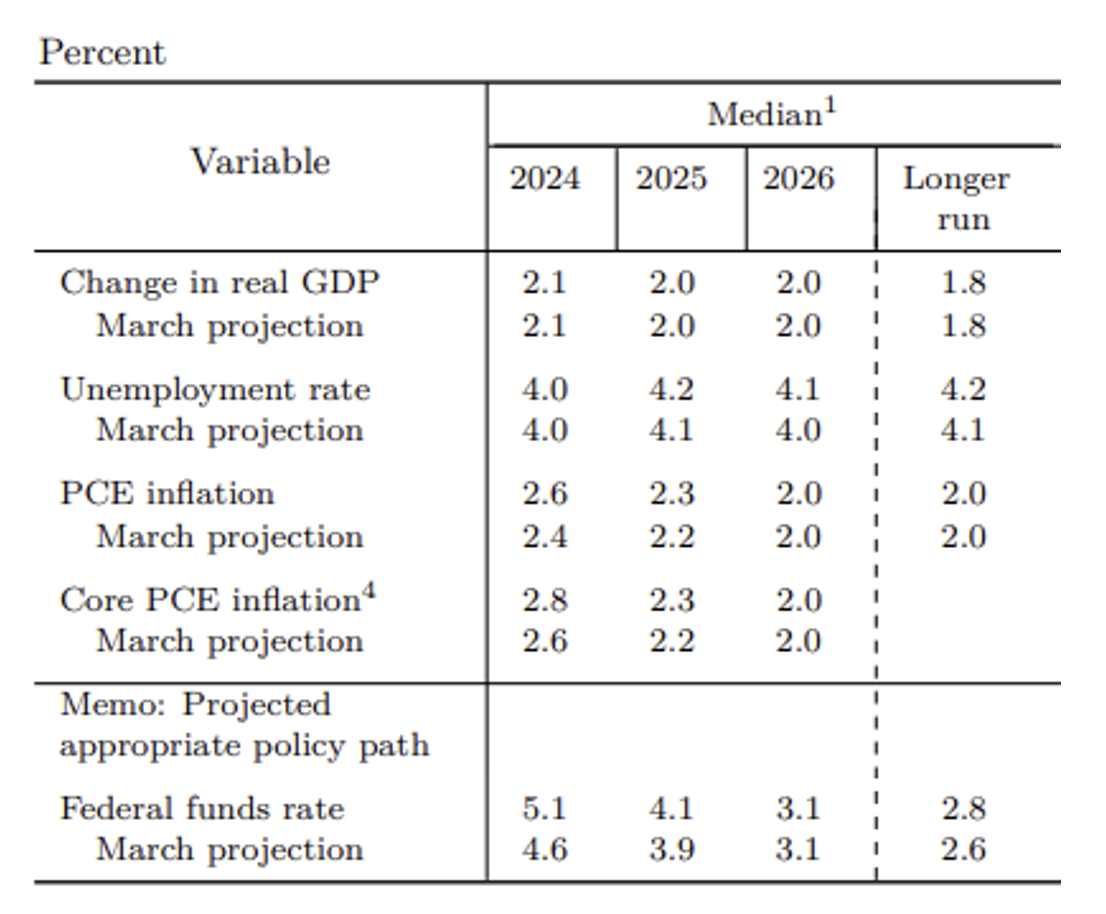

Change to Dots:

- One cut in ’24 (rather than 3 from last SEP, Summary of Economic Perspectives)

- 4 cuts in ’25 (up from 3 from last SEP)

- 3 cuts in ’26 (unchanged)

- Longer run Dot increased to 2.80% (from 2.60% in March)

Inflation Forecasts:

- 2.8% Core PCE for ’24, 2.3% in ’25, and finally coming back to target of 2.0% in ’26

Unemployment Forecasts:

- Long run Unemployment up 0.1% to 4.2%. Ending 2024 at 4.0% (currently at 4.0%)

The economy made considerable progress on labor and inflation. Inflation has eased substantially but is still too high. Economic activity has expanded at a solid pace.

Need to see inflation sustainably moving to 2% before adjusting policy. Bottom line, need to see more good data. Continue to make decisions meeting by meeting based on the data.

Labor market conditions back similar to pre-COVID trends: “relatively tight but not overheated”.

Rates aren’t likely to return to pre-pandemic levels, which were very low by recent historical measures.

The labor market strength could be overstated.

Key Takeaways

The Fed now is projecting just one rate cut in ’24 vs. three expected back in March. They did however forecast additional cuts for 2025. This means we’re getting to the same station just taking a different train with fewer rate cuts this year but more next year.

We believe the Fed will continue to monitor the data closely and make decisions accordingly, which they’ve clearly communicated. As they get more confident that inflation is anchored, they will amend the pace of their cutting schedule (barring issues in the labor market where we’d expect quick cuts).

Right now, the data has maintained strong enough to maintain status quo, and while policy is restrictive it’s still hard to tell “how restrictive” as the economy continues humming along.

Overall, the tone of the meeting was moderately dovish with an optimistic tune that we see a continuation of today’s inflation data. If we see more data come along similar to today, we think they likely speed up rate cuts to keep policy from becoming overly restrictive. The Fed is not waiting for something to break and will moderate policy as the data confirms it.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2406-14.