June CPI Reaction

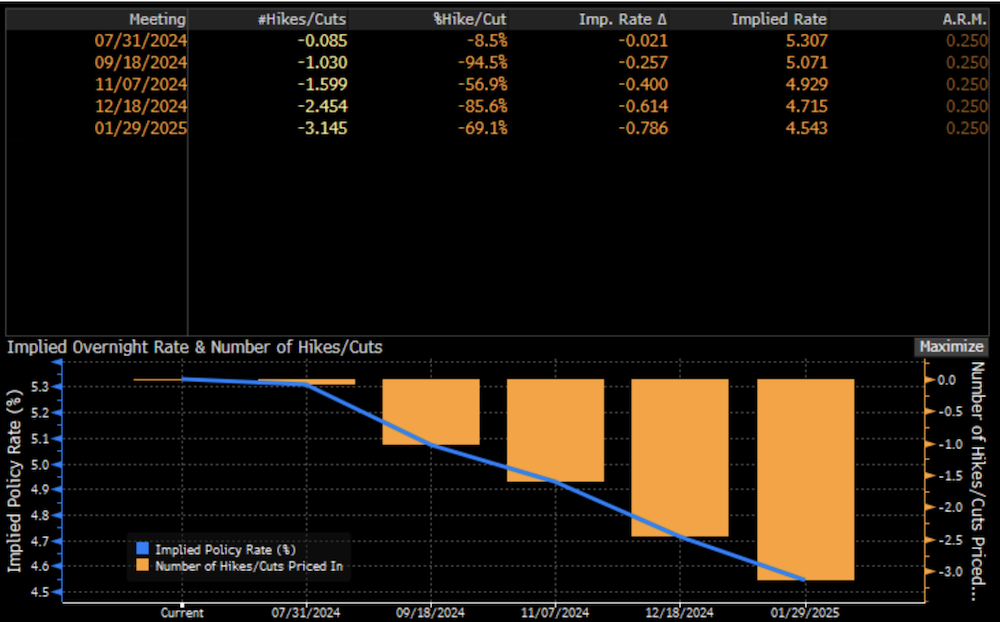

In response to the CPI print, markets are now pricing in an 8.5% chance of a July cut, a 94.5% of a September cut, and an 85.6% chance of at least 2 cuts by the end of the year.

We think the market should not ignore the signal here. We’re seeing a softening of labor, a recent downside in growth, and inflation/wage data confirming it’s time to cut. The market could be underestimating the Fed’s ability to cut even after the market has increased its expectations for cuts this year.

The inflation print today seems to prove the hot data to start the year was mostly an outlier. It appears we’ve resumed the disinflationary trend lower, great news for the Fed.

Source: Bloomberg as of 07.11.2024

Source: Bloomberg as of 07.11.2024

As economic data continues to slow, the implications are passing through to cost measures (and to the labor market where UE is drifting higher). We imagine the Fedspeak will turn more dovish, and the more promising data (data-dependent decisions as Powell states) all but guarantees a September cut. We honestly wouldn’t be surprised if the Fed went ahead with 25bps in July.

Source: Citadel as of 07.11.2024

Source: Citadel as of 07.11.2024

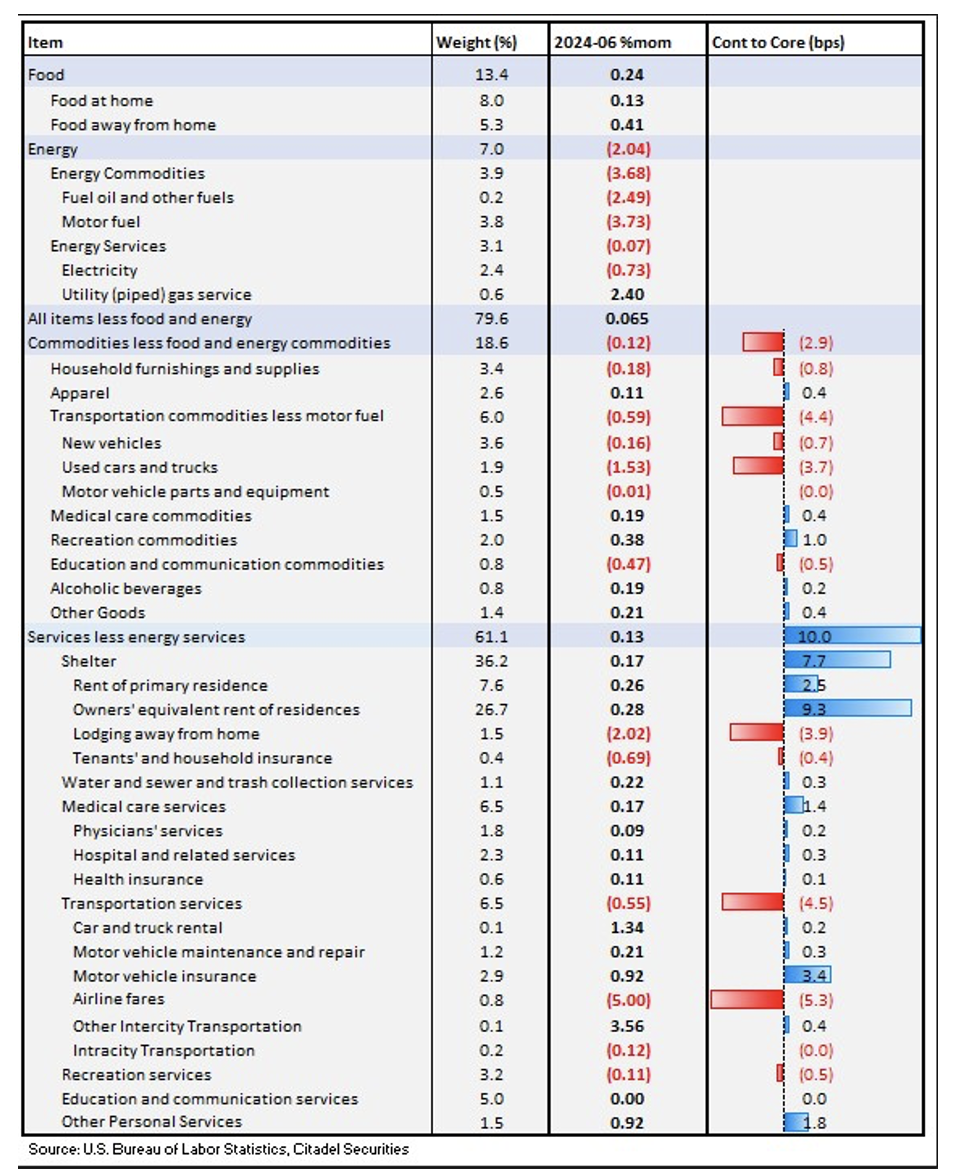

It was encouraging to see shelter inflation slow. The largest category within services (shelter) rose only 0.2%, making its smallest gain since the summer of 2021. OER also rose only 0.3%. The report showed weakness in all of the ‘discretionary’ components.

Transport services, lodging, airfare, and used/new cars are all negative. Core 3m annualized at 2.1%, core ex shelter 0.6%, core services ex shelter 2.0%.

All in all, this was a great report for the Fed. Services moved lower, goods continued their decline. Volatile factors like energy and food fell during June. We think the Fed will have seen enough data to begin the cutting process. The question now is, how soon and how many cuts will be made in 2024?

Components of Inflation

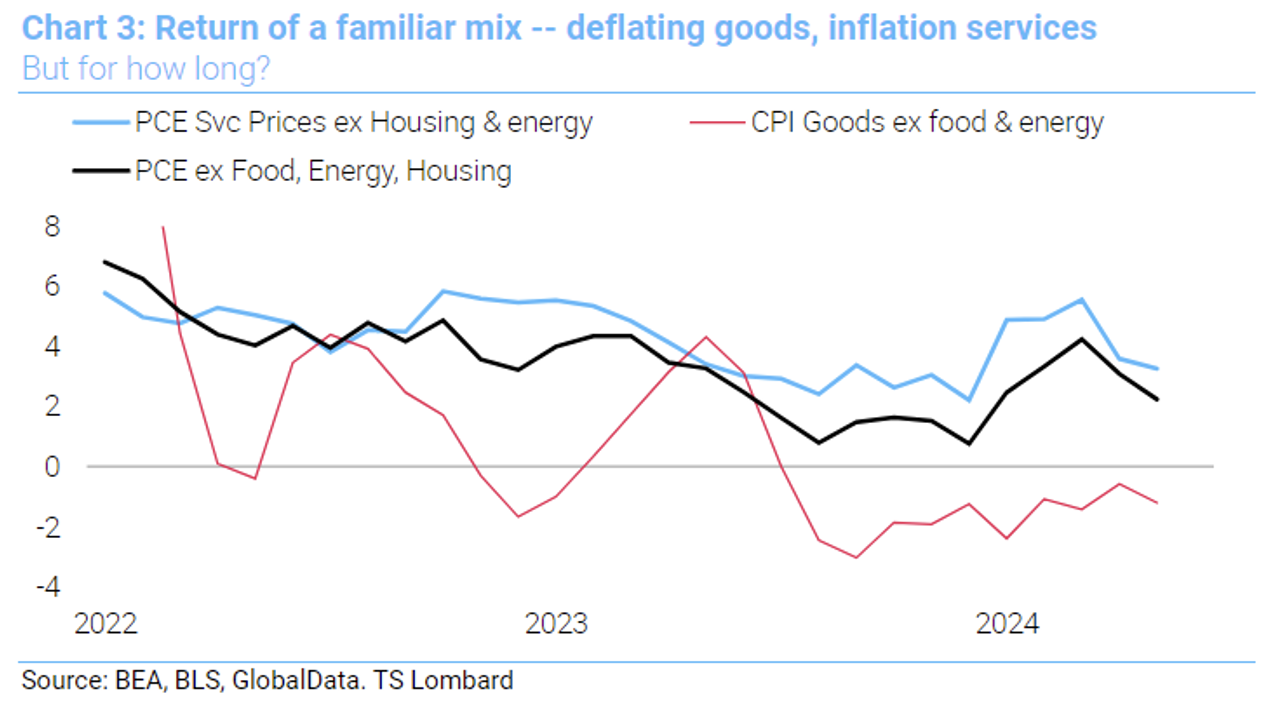

Even before this report, inflation had made progress and crept closer to the Fed’s 2% target. Digging into PCE, prices ex-food, energy, and housing are up only 2.2% YoY, although it is good deflation (-1.2% YoY) driving the result. Service inflation (ex-housing and energy) is still running above 3%.

Source: TS Lombard as of 07.08.2024

Source: TS Lombard as of 07.08.2024

Encouragingly, service inflation has decelerated in the past two months. The problem is that the pace of goods deflation likely can’t sustain the pace we’ve seen in the last 12 months, and we’ll need to continue to see improvement in service inflation.

The good news for markets is that the Fed’s inflation target revolves around PCE (typically 50bps lower than CPI), which is sitting at 2.6% YoY. If the Fed is okay to declare victory at 2 point-something versus exactly 2%, we think the potential for a soft landing improves and we’re getting closer to cuts.

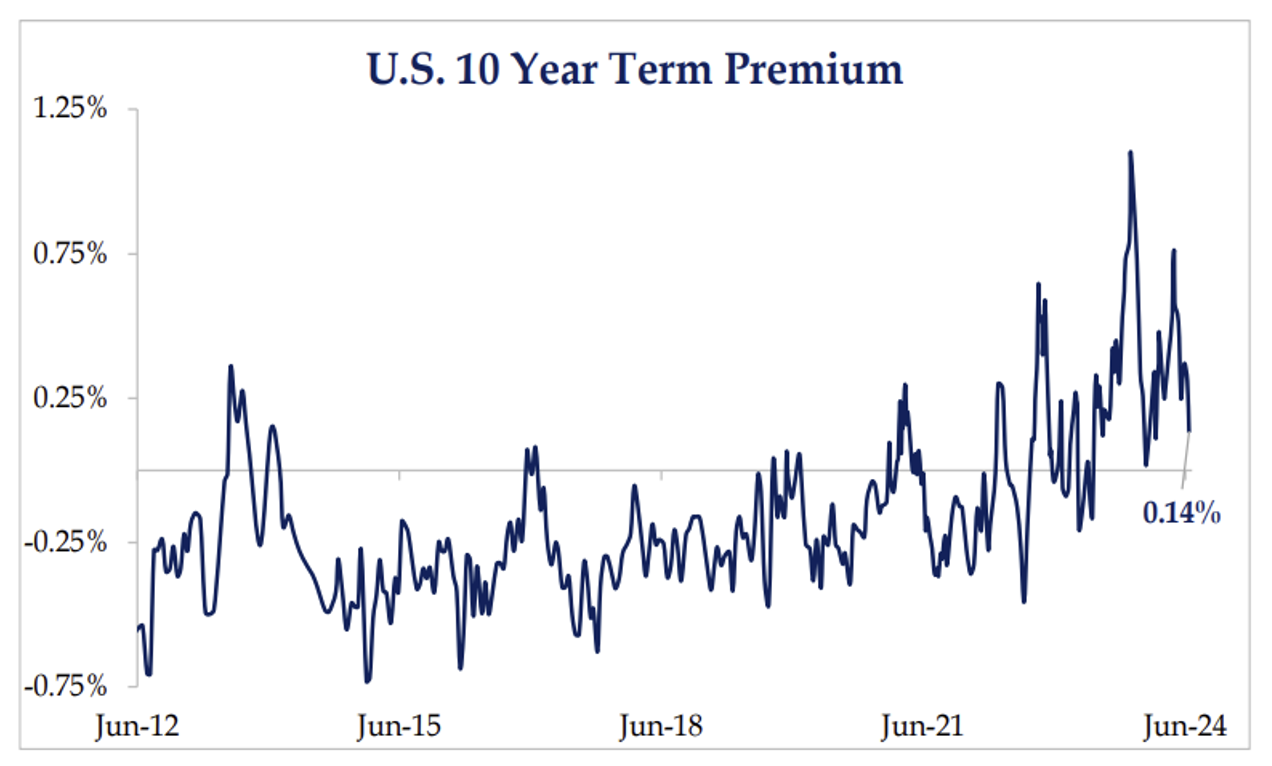

Compressed Term Premiums: Headwind to Future Price Return from Long Bonds

The Term Premium is the extra yield investors should demand to hold longer-maturity bonds, versus rolling over shorter-maturity bonds, to compensate them for the uncertain growth and inflation risks (it’s an esoteric calculation figure).

Typically, when term premiums rise, risk assets face pressure given that spikes are associated with more bond volatility. Term premiums are historically more elevated during periods of high/ volatile inflation (i.e., the 70s/80s).

Source: Strategas as of 07.01.2024

Source: Strategas as of 07.01.2024

The lower term premium has helped the Fed keep control over the long end of the yield curve. This has been assisted by heavy Treasury issuance on the front end of the curve, which has limited the supply of longer-duration bonds.

Looking ahead, as the US continues to run massive fiscal deficits, it seems inevitable that the market will begin to require larger term premiums on longer-dated bonds. While there are many strings the Treasury/Fed can pull to keep this number from growing too drastically, a simple return to average would push longer-term yields higher and, at minimum, decrease the price return even were the Fed to cut the Funds rate.

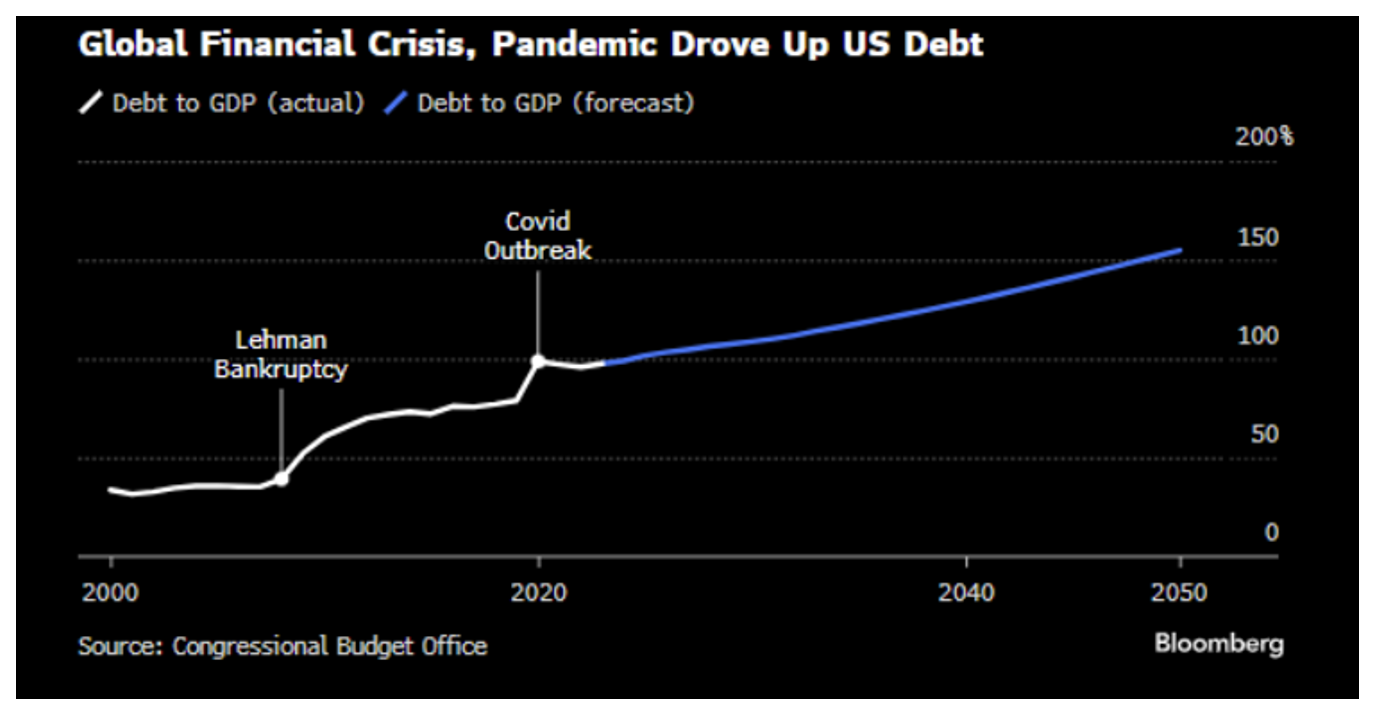

US Debt Levels Set to Rise… Drastically

To keep consistent, I felt the need to throw in the Debt to GDP projections from the CBO. These projections are scary as is but keep in mind they don’t consider a recession or any event that would create further unplanned gov’t spending (i.e., they are likely understated).

Source: Bloomberg as of 07.08.2024

Source: Bloomberg as of 07.08.2024

The debt snowball continues to spiral with no end in sight. Obviously, fiscal prudence isn’t politically popular so we continue to expect more of the same – spend today and kick the proverbial can down the road. We couldn’t be more convinced that our investment philosophy of more stocks, less bonds, risk-neutral positions our clients to better attack a regime that will be sure to prove challenging for many allocators who are opposed to facing the fact that duration isn’t a diversifier.

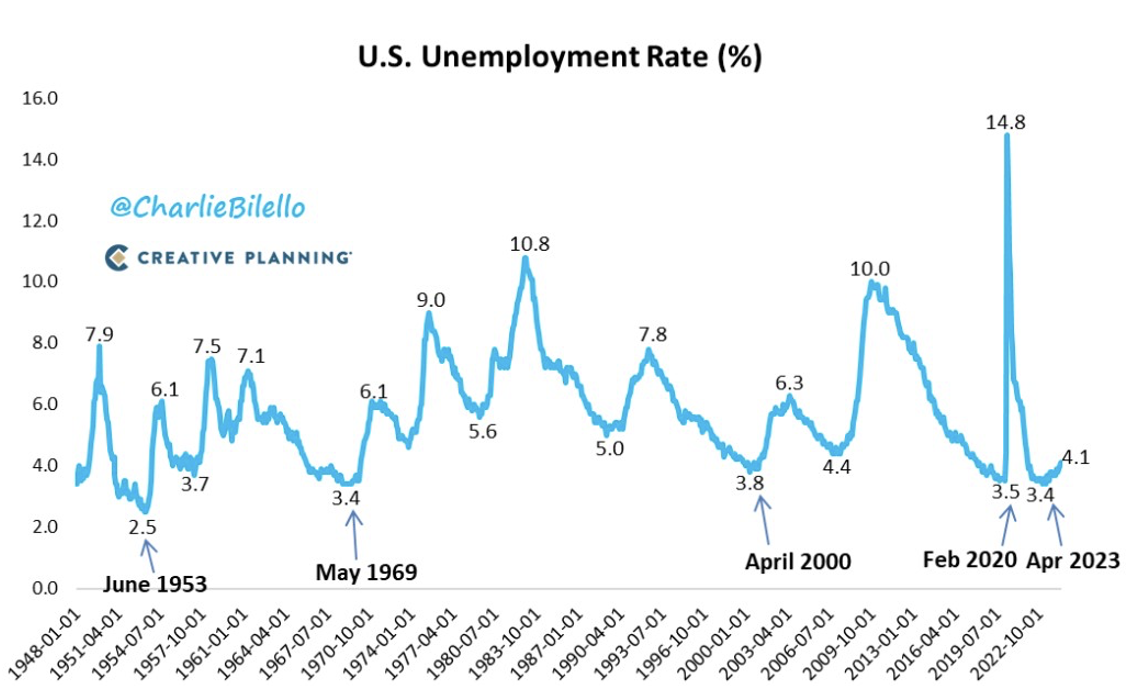

Unemployment Rate Ticks Higher: Cracks Forming in the Labor Market?

Last Friday we got another round of employment data. The unemployment rate rose to 4.1%. The workweek was unchanged at 34.3 hours & labor force participation ticked up to 62.6%. Wage data is coming down and is roughly in line with the 2% inflation target.

Source: Charlie Bilello as of 07.10.2024

Source: Charlie Bilello as of 07.10.2024

As the data continues to soften, we are becoming more convinced the first-rate cut could come earlier than December.

More Thoughts on the Labor Market and Implications on the Funds Rate

Employment is a lagging indicator, and if we were to see companies start shedding their workforce, that could be the basis of a true recessionary dynamic. Job losses create a negative feedback cycle where consumer confidence and spending fall, and this triggers further rounds of redundancies, which creates a dangerous feedback loop.

Over the last couple of years, companies were incentivized to retain staff levels because there were millions of unfilled job vacancies, and profit margins surged during the pandemic, limiting pressure to cut costs. Today, however, the situation looks shakier. Because staff shortages have disappeared and profit margins normalized, we appear to be closer to a tipping point in the labor market where we could start to see unemployment drift upward.

Thus far, the jobs market has remained strong, but were we to see further softening we’d expect the Fed to react quickly with rate cuts.

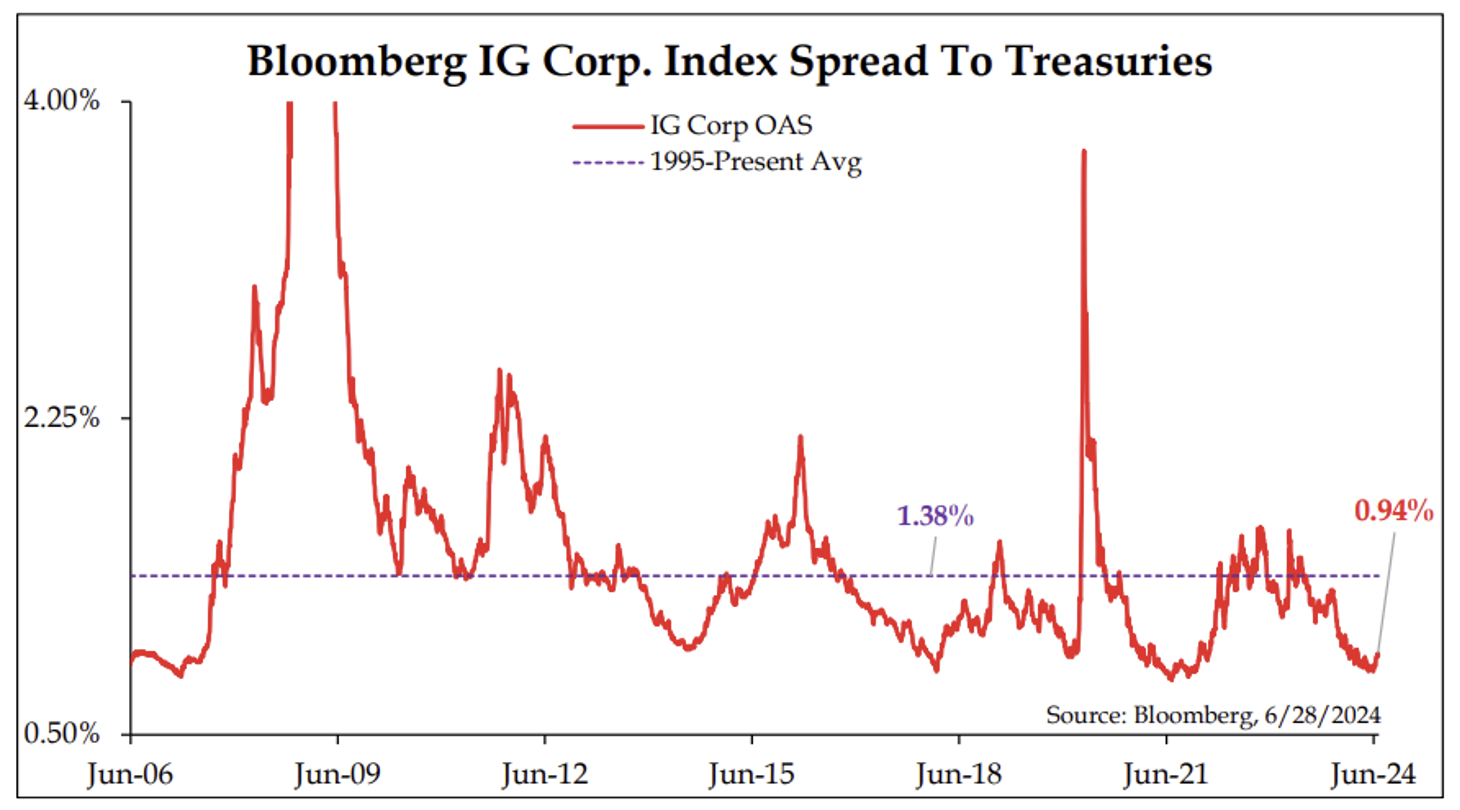

Corporate Spreads Remain Tight

Corporate spreads have tightened to ~40bps below the 25-year average. Low supply and nominal yields have attracted buyers into the space, given the higher interest rate environment. Total Return for a bond is the price return + income return +/- the spread component.

Source: Strategas as of 07.01.2024

Source: Strategas as of 07.01.2024

Corporate bond buyers hoping for big price returns from interest rates dropping will likely have a decent headwind from spread widening, especially if cracks in the economy appear.

While nominal rates are more attractive today than we’ve seen in years, we’re a bit cautious regarding the current spread environment, especially for longer-dated bonds.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-19.