We continue to believe the first Fed rate cut will be in September and this move will likely start a sequence of cuts. With that being said, we don’t see the case for a jumbo -50bp cut. The Fed’s Jackson Hole meeting at the end of August deserves special attention for any additional clues on the FOMC’s reaction function. We wouldn’t be surprised to get a dovish tone given the last meeting’s emphasis on the dual mandate (inflation & employment).

“So economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.” Fed Chair Powell reinforced in his press conference that there were two-sided risks when considering adjustments to the target Fed Funds rate.

Source: Bloomberg as of 08.08.2024

Source: Bloomberg as of 08.08.2024

The recent sharp decline in equity prices has led to talk of an emergency move by the US central bank ahead of its planned mid-September vote. Barring a big financial disaster, that isn’t going to happen. US central bankers are nowhere near as bearish, or as knee-jerk, as investors seem to be on America’s economic prospects. I think one of the worst things the Fed could do here is overreact with an emergency cut based on a few choppy market days (mostly due to ex-US forces/ bad market positioning by speculative investors) and normalizing (but not terrible) economic data.

Source: ATL Fed as of 08.08.2024

Source: ATL Fed as of 08.08.2024

Keep in mind that stocks are still nearly up 10% on the year! In addition, the Atlanta Fed’s GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 2.9 percent on August 6, up from 2.5 percent on August 1. Hardly recessionary.

As of right now, the market is pricing in a little over a cut and a half for September and ~ 4 rate cuts for the rest of the year. This is prone to change abruptly based on the incoming economic data and commentary from the Fed. Stay tuned for Jackson Hole!

Is the Labor Market as Bad as the News Tells You? We Think Not

As we’ve pointed out many times, this cycle has not been normal. We see a couple of things that complicate the interpretation of the Sahm Rule. Firstly, there is a big divergence between the household and establishment data. The jobless rate comes from the (much weaker) HH survey. Payroll employment, the establishment survey, looks very different (stronger). Given rapid immigration, we think the payroll signal paints a better (less sinister) picture of the labor market.

Source: TS Lombard as of 08.04.2024

Source: TS Lombard as of 08.04.2024

The second is the strong labor force. Growth has made a big contribution to the rise in the unemployment rate. Again, this is partly an immigration story (at least the immigration that is counted) but it is also about rising participation. If the unemployment rate is rising because the labor force is growing quickly, it is not clear that this will likely set off a recessionary dynamic, because it is not such an obvious cause of reflexivity.

Speaking of reflexivity, history shows that when US unemployment rises 50bps, we should expect it to hit (at least) 200bps. When employment is declining (key to triggering the Sahm Rule), people lose their jobs (or become fearful of losing their jobs), spending goes down leading corporate revenues lower, then leading to further rounds of cuts in employment and further cuts in spending. Even small employment cuts can lead to larger ones (i.e., reflexivity).

This is not what we are seeing.

While hiring has slowed (largely because job openings have been filled and the labor market has normalized) the labor force is still growing, which means a higher proportion out of work. Could this cause reflexivity? Possibly, but the dynamic seems weaker than when people are getting fired. Spending doesn’t plunge in a non-linear way, but it could lead to consumers becoming more cautious.

Activist Treasury Issuance (ATI) ≃ Stealth QE

Two former Treasury officials, Nouriel Roubini & Steve Miran, co-authored a paper that claims the Treasury has been offsetting Fed tightening actions with a form of stealth QE recently named “Activist Treasury Issuance, or ATI”. The basis of their argument is focused on the fact that approximately 80% of the net Treasury issuance over the past 12 months has come in the form of T-bills (<12-month debt).

They argue that high issuance of Treasury Bills is appropriate during times of financial or economic crises (GFC/Covid) but it is not appropriate for an environment where unemployment is low, economic growth is strong, inflation is above target, credit spreads are secularly tight, and equity markets are at/near all time highs. It is particularly dangerous to use this device as a market-impacting tool during an election year, setting a peculiar precedent moving forward (remember, the Treasury Department is part of the Executive Branch).

Source: https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/635102_Activist_Treasury_Issuance_-_Hudson_Bay_Capital_Research.pdf. As of 07.31.2024

Source: https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/635102_Activist_Treasury_Issuance_-_Hudson_Bay_Capital_Research.pdf. As of 07.31.2024

The concentrated issuance of Bills instead of longer-term debt has offset Fed tightening actions. By issuing shorter-term debt, the Treasury has lowered the interest rate risk taken by the market which typically requires more balance sheet capacity to absorb (and can negatively impact risk assets). ATI has lowered the supply of longer-term Treasury bonds/notes and in turn compressed yields on the long end of the curve (i.e., the negative term premiums we’ve been highlighting). To the authors’ calculation, these issuance actions have reduced 10y UST yields by 0.25% which basically means the US has been employing a soft form of Yield Curve Control. They also indicate that if the Fed reversed this issuance quickly it could have a 50bps impact on the long end.

In my opinion, this won’t be the last of this strategy we see. Increased liquidity can impact markets and risk asset prices. While not only was this move a shift from the Treasury’s mandate to manage the Treasury debt at the lowest cost to the taxpayer (i.e., they’ve been issuing in the most expensive part of the curve), it also has been impactful on markets and arguably worked against the Fed’s tightening regime.

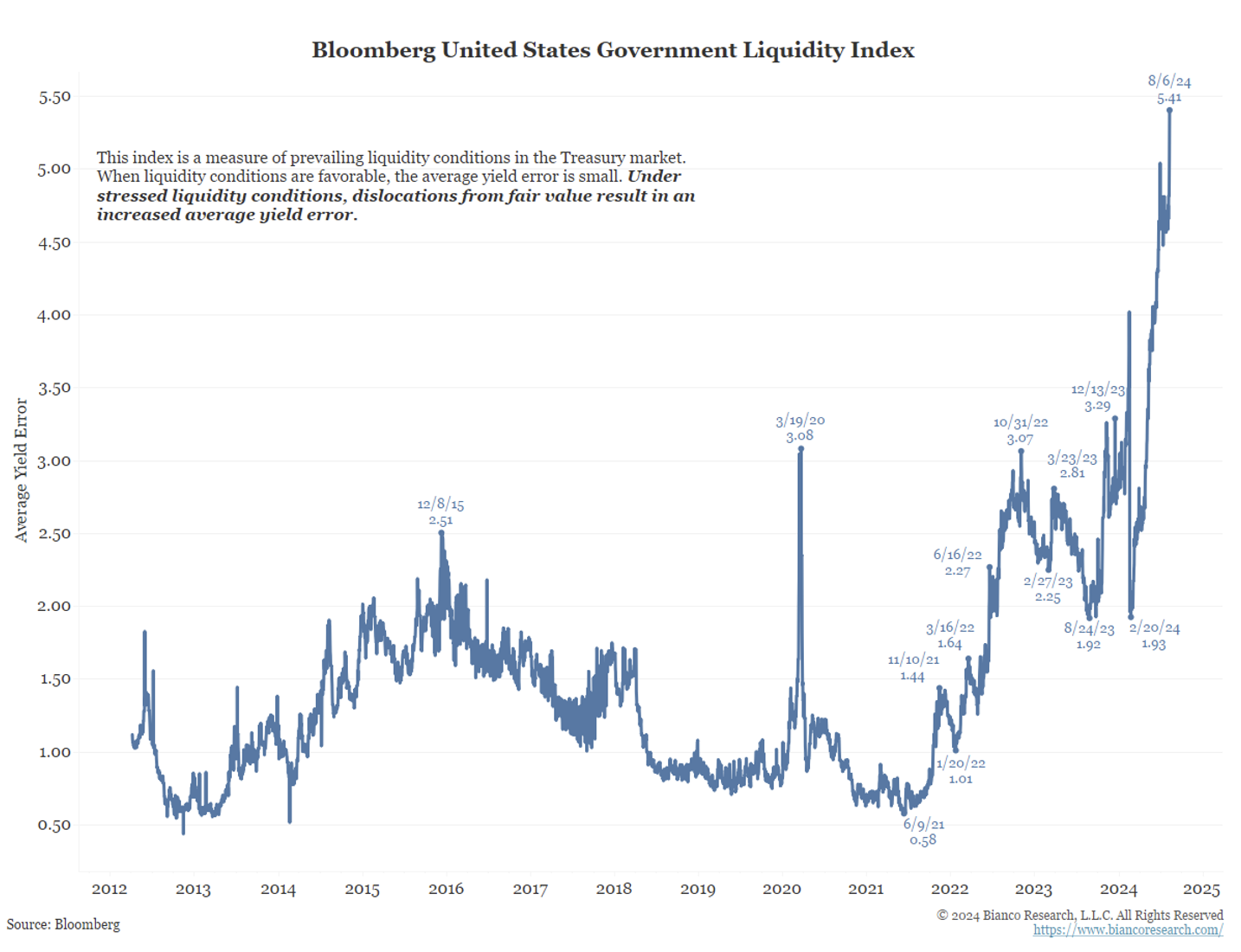

Treasury Liquidity Sours… Combo of Market Vol & Lower Yields Enticing Less Buyer

The chart below shows the Bloomberg U.S. Government Liquidity Index. A rising value indicates worsening liquidity in the Treasury market. The liquidity index has been signaling worsening liquidity in 2024 but, given the stress in the Treasury market from Monday, this measure rose to the highest level since the Great Financial Crisis.

Source: Bianco as of 08.07.2024

Source: Bianco as of 08.07.2024

There was a 10-Yr Treasury Note auction this week which was the 3rd worst auction in the last seven years. When issued, the yield on the notes was 3.929% (what Wall Street expected) and the draw was 3.96% (the actual yield that the notes were auctioned off). The difference between the two numbers is the auction’s tail. Contrary to whatever one has been saying, there was NOT a slug of buyers rushing in to buy longer-time bonds post the recent rally in yields. I expect this to continue.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-16.