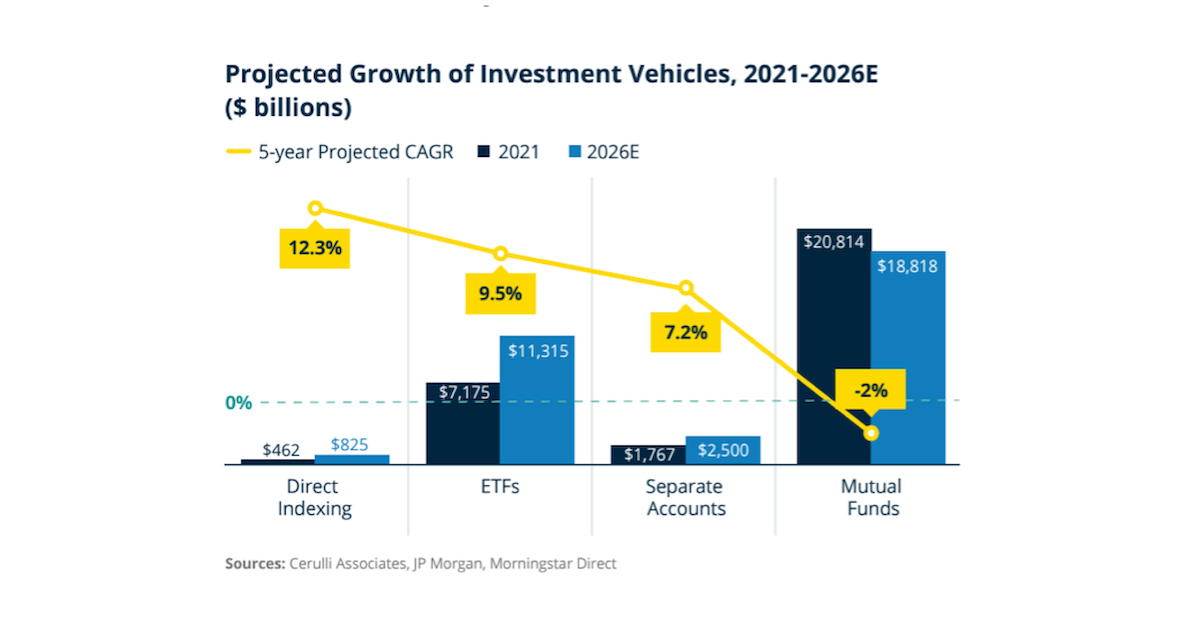

There has been much ink spilled on the topic of the explosive growth in the ETF space over the last few years. For this author who came into the profession when the mutual fund was still King (and I still had hair), it has been astonishing to watch that regime shift. Interestingly though, there is another form of investment that is on track to grow even faster than the move towards ETFs over the next five years and that is direct indexing.

In early 2023, Cerulli Associates projected the AUM of direct indexing strategies to land at $800 billion in assets by 2026, from $446 billion in 2022. And 9 months into 2023, their data showed nearly $100b of that projection had occurred…the trend seems pretty robust.

That would result in direct indexing representing 33% of the retail separate account market. One of the statistics that stood out to us was that Cerulli noted that 63% of advisors are currently serving clients with $500,000 or more in investible assets, and yet only 14% are aware of direct indexing or recommend it to their clients. Given those facts, we wanted to take the opportunity to write a quick primer on direct indexing. We’ll discuss where it works, where it doesn’t, and some things to consider when evaluating a direct indexing provider.

The good news is that the concept of direct indexing is straightforward. A provider will give you exposure to an index of your choice and use individual securities to best reflect that index. For instance, if you chose the S&P 500, a provider would typically choose around 130-150 stocks to replicate the performance of that index with as little tracking error (in English, get you as close to the same return) as possible. Why are people going to the trouble of doing all of this when you could just buy a single ETF and call it a day?

Well, if there is one thing investors hate more than losses, rate hikes, and fees…it is taxes. The beauty of direct indexing is that by using the individual positions to engage in “tax loss harvesting”, the objective is to create realized losses while also maintaining exposure to your chosen index. If markets are broadly moving up, stocks that aren’t performing can be sold with any realized gains being offset by the losses. In periods of market declines, any realized losses can be carried forward for future years which creates a “tax asset” while remaining invested.

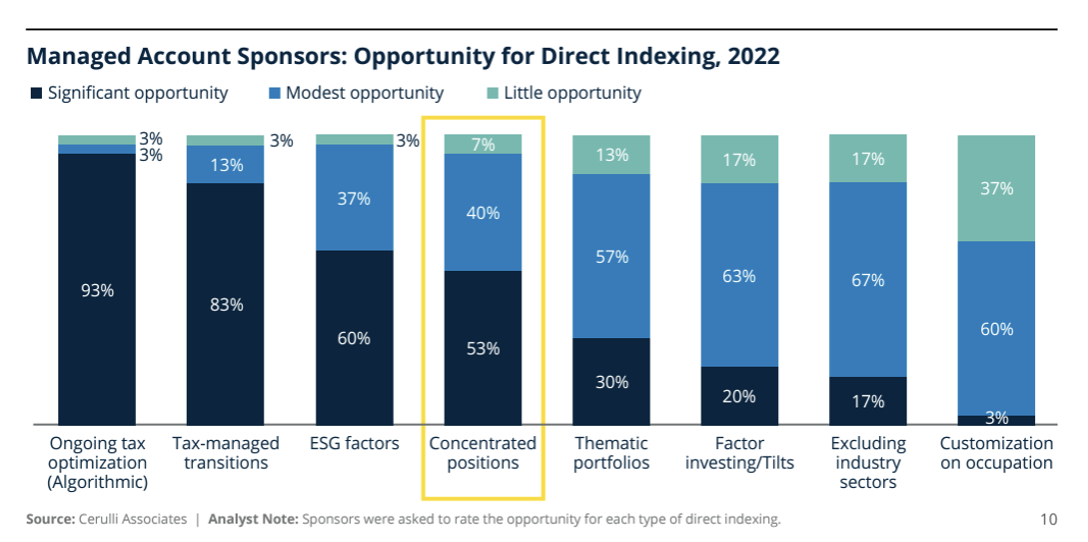

Direct indexing can be helpful in several financial planning scenarios. In situations where a client is bringing in large amounts of highly appreciated stock positions, those stocks could be incorporated into a transition strategy where losses can be used to offset the realized gains from diversifying out of those positions.

In a year like 2022, those plans can be accelerated to reduce the concentration risk of the holdings and make an adverse market environment beneficial for the long-term positioning of the client’s portfolio. Perhaps an advisor is working with a client who has meaningfully increased their earned income and the client is now much more tax-sensitive.

A direct indexing strategy offers control over realized gains and losses that an active manager of an SMA or mutual fund strategy cannot provide. Bottom line, direct indexing has been an excellent innovation for investors who need to think about achieving their return objectives in as tax-efficient a manner as possible. Below is a helpful graphic from Cerulli that provides some insights on where sponsors see opportunities to apply the approach.

With all of that in mind, no investment strategy is appropriate for everyone and in the case of direct indexing, there are situations where there is little benefit to utilizing the strategy. The most obvious example would be tax-deferred accounts where any distributions would be taxed at ordinary income rates. In those cases where index exposure is the goal, there is no need to complicate the portfolio with so many positions. Simply utilizing the most appropriate ETF to gain the sought-after exposure should be sufficient.

In conjunction with that, it should not be an automatic decision to put non-qualified assets in such a strategy either. While nobody relishes the idea of paying taxes, if the client is in a lower income bracket or their account balances are at a level where realized gains aren’t expected to be much of an issue, then employing this strategy needlessly complicates an investor’s portfolio. One of the tremendous benefits of index ETFs is that they provide instant diversification with just one position. The advantages of that simplicity should not be overlooked.

Another consideration for advisors and their clients is that there is no catch-all solution for mitigating taxes and gaining index exposure. One of the risks of tax loss harvesting is the tracking error that might arise from utilizing the strategy. As a simplified example, if stock ABC is sold for a small realized loss, it cannot be purchased for 30 days in any client accounts (even retirement accounts) as part of the wash sale rule. If that stock were to see a meaningful upside reversal during that period, that could result in tracking error to the benchmark and negatively impact the client’s return.

While tax loss harvesting can provide a way to reduce a client’s tax burden, there are limitations and risks to employing it that advisors should be aware of before making a recommendation. Elm Wealth has put together an excellent explanation of these risks in their paper “Direct Indexed Tax Loss Harvesting: Is the Juice Worth the Squeeze?” which is well worth the read. They argue that a more optimized solution would be to utilize ETFs as a solution to harvest losses while maintaining a purer exposure to the index. Our own Brian Jacobs here at Aptus has also put together a phenomenal piece on this topic: The Inherent Tax Efficiency of the ETF Structure.

With both the benefits and limitations of direct indexing outlined, we would like to offer a few considerations for advisors as they evaluate potential direct index providers. Direct index providers should be able to explain their process for harvesting losses while mitigating tracking errors. When the positions are sold, what securities does the provider use as a substitution to remain invested? What is the process for avoiding wash sales and can they provide a track record?

In cases where clients are bringing over-concentrated positions to be incorporated into a direct indexing sleeve, the provider should provide an estimated tracking error due to the position and an estimate of the realized gains needed to reduce the tracking error to the index. Clients and their advisors should be able to see the daily changes in the portfolio and be able to monitor what the realized gain/loss position is to avoid any surprises before filing.

Considering the incredible growth in direct indexing, familiarity with the strategy will likely become a core expectation of prospective high-net-worth clients. Bringing this all together, advisors who understand direct indexing and the tax benefits of employing such a strategy can set themselves apart from their peers. For many high-net-worth investors, tax planning is one of their core concerns, and advisors who can educate their clients on direct indexing and how that will fit into the broader financial plan will have a distinct advantage in earning and retaining those clients.

Understanding where the strategy works and where it will cause more problems than it is worth provides tremendous value, along with being able to evaluate which providers will be most appropriate given their client’s needs. While we would expect to see a continued healthy rate of adoption, the benefits and limitations need to be clearly understood.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-10.