September 11th

We take a moment at Aptus today to remember the lives lost on this tragic day 23 years ago. We are grateful for the men and women who make the enormous sacrifice to keep our nation safe. Never forget!

August CPI Update

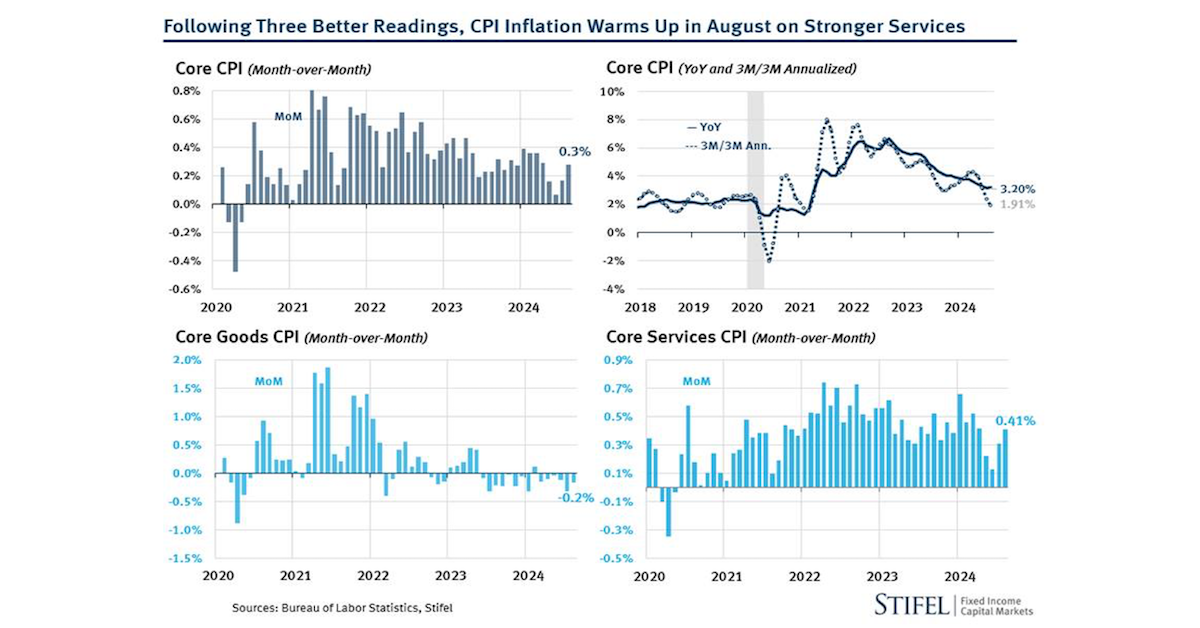

This morning U.S. CPI rose 0.2% m/m (2.5% y/y) & core (ex-food & energy) was +0.3% m/m (3.2% y/y) in August.

- Core CPI +.28% MOM

- Core Goods -.04% (Good deflation continues to help ease inflationary pressures)

- Core services inflation +.31% (shelter accounted for 76% of core service inflation)

- Supercore services was +.33% (3m annualized at 1.9%)

Source: Stifel as of 09.11.2024

Source: Stifel as of 09.11.2024

The celebrated June dip in shelter inflation looks to be challenged, with the continued move lower that many (including the Fed) had called for could be in question. We all know shelter inflation needs to drop to bring inflation back to target, so this is big given the data continues to lag. More timely rent data (Zillow Rent Index for example) has already slowed considerably.

Overall, this is a frustrating report for the FOMC, as components that have shown a disinflationary impulse are slowing (pop in shelter; how much lower can goods inflation go?). The risk now is that inflation overshoots to the downside as the Fed is forced to delay cuts until the data (which is lagging) rolls over and it’s likely too late.

In our opinion, the report this morning pretty much guarantees a 25-basis point cut next week. That said, given the level of real rates, (policy well above neutral) a 50-basis point should remain on the table.

Source: Bloomberg as of 09.11.2024

Source: Bloomberg as of 09.11.2024

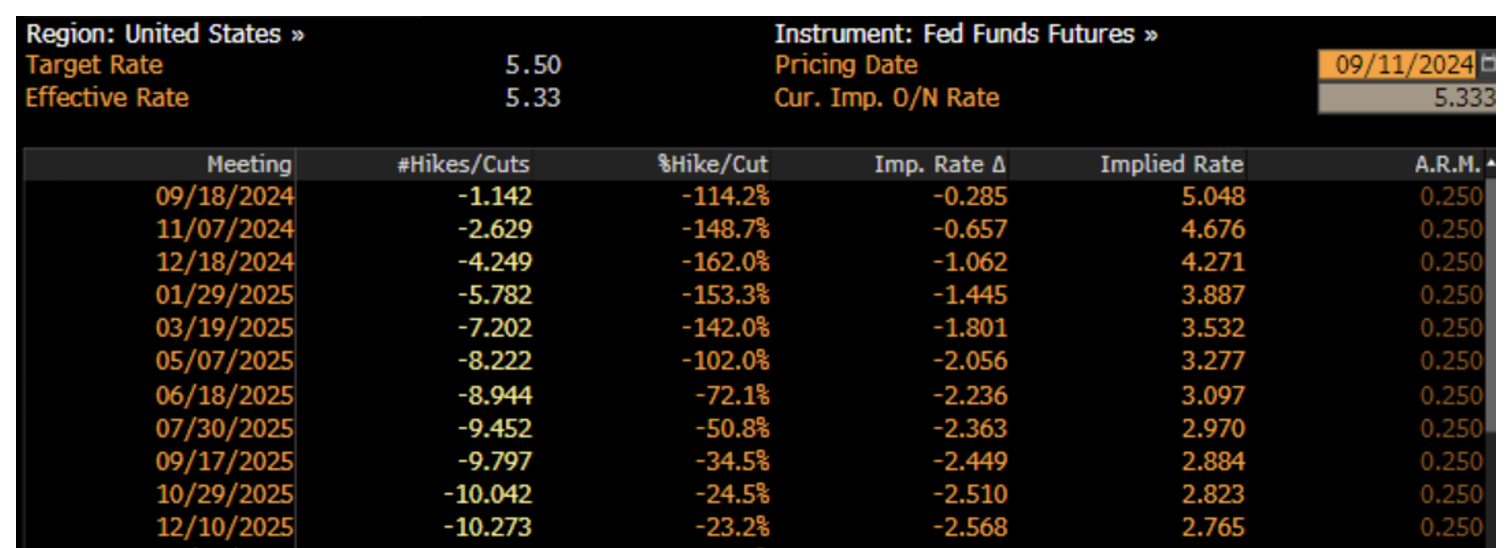

On that note, the market is pricing in just over a 25bps cut for next week and roughly 4 cuts for the remainder of the year. Given there are only 3 more meetings (including September), the market is pricing in a 50bps cut at one of the other two. The projection for accelerated cuts is bringing back memories of the hopium we’ve seen multiple times during this cycle.

Minus 818,000 Revision to NFP Job Report

Over the past 12 months, we’ve gotten conflicting data between the household survey and the payroll survey for overall U.S. employment trends. This has equated to a data quality issue that complicates the analysis. The payroll survey continues to show strong numbers, while the household survey has been notably weaker, with a widening gap.

The payroll survey counts people with multiple jobs. In contrast, the household survey does not, and there are a variety of other differences as well, which post-pandemic remote work and gig work might be amplifying to some degree.

Back on August 21st, the BLS revised job numbers downward by 818,000 or about 30% for the 12-month period from April 2023 through March 2024. This is the biggest downward revision since 2009. They still estimate that jobs were created, but 818,000 shy of the previously reported cumulative number of 2.9 million.

This revision wasn’t good, but at least it helped to narrow that gap and resolve some of the discrepancies between the two reports.

Significant Cutting Cycle Priced into Rate Markets

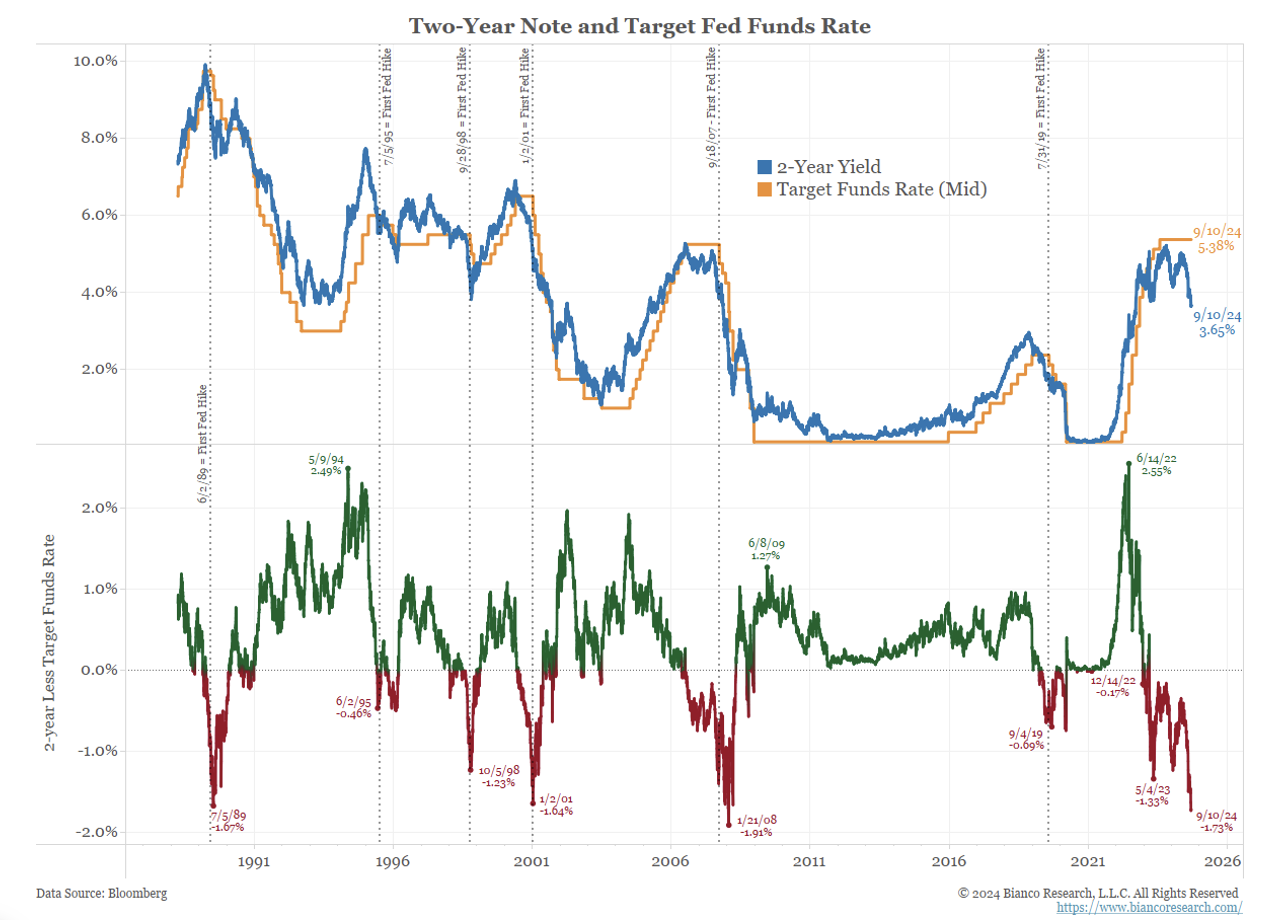

The bond market is signaling the most significant shift in monetary policy since the 2008 financial crisis over the next two years. The gap between the 2-year Treasury yield and the Federal Funds rate sits at -167bps—the widest negative differential since January 2008’s level of negative 182bps.

Source: Bianco as of 09.11.2024

Source: Bianco as of 09.11.2024

The 2-year/FFR spread has already priced in about six to seven rate cuts (150-175 basis points). The 2-year/FFR spread has been negative since December 2022, so it has been expecting cuts for over 20 months – the longest string before the first cut on the record. Could the market continue to get in front of itself, creating potential for yet another head fake? Time will tell!

Debunking Where Inflation Comes From

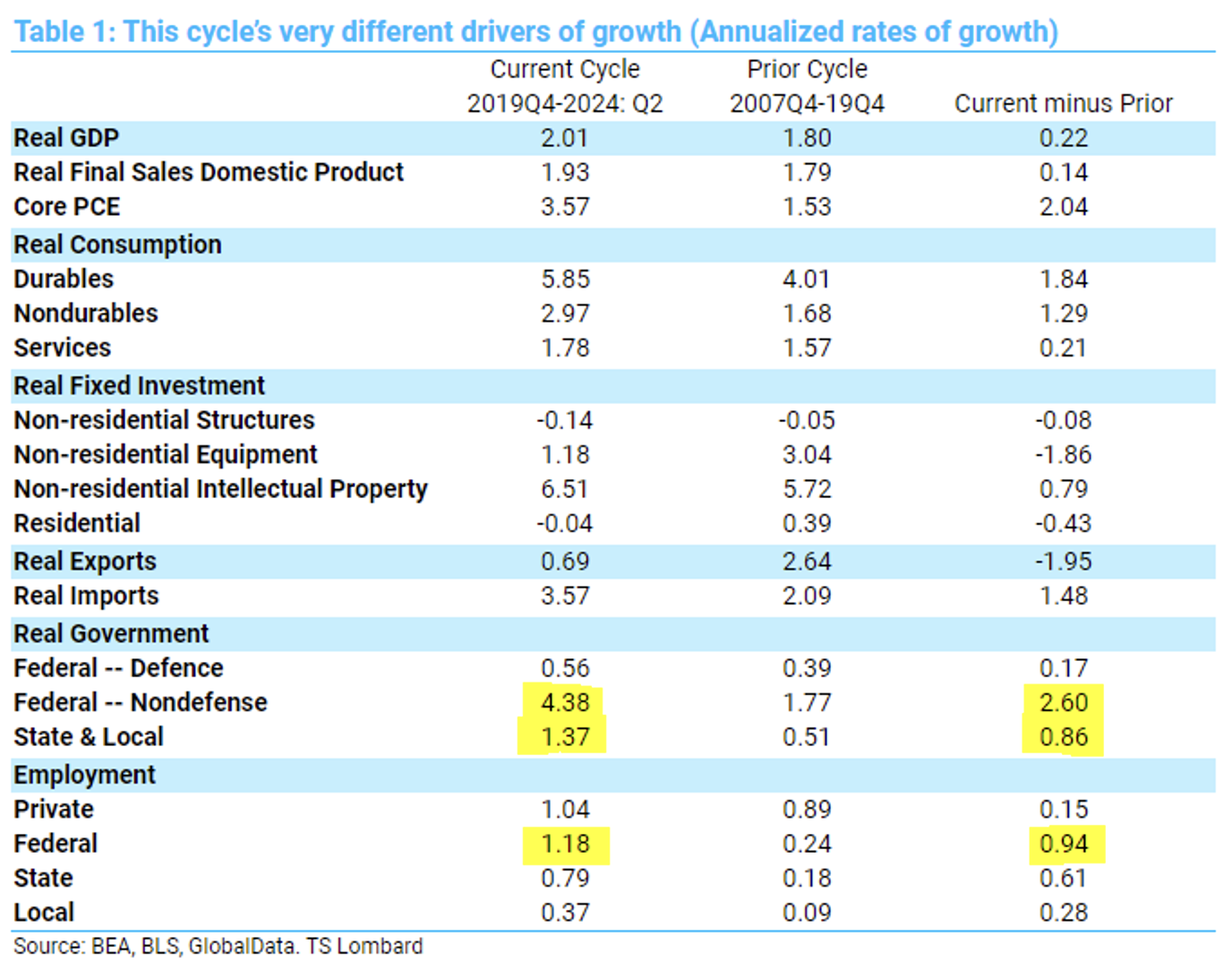

As we’ve mentioned many times, we strongly believe the inflation this cycle was largely caused by the government spending in response to the pandemic.

Source: Strategas as of 08.16.2024

Source: Strategas as of 08.16.2024

A large contributor to the inflationary aspect of an economy was driven by real non-defense government spending (4.38% annualized rate this cycle vs. 1.8% in the prior cycle) and this also includes higher growth in government employment (1.18% vs 0.24%). Government spending always leaves a higher inflation footprint, even more when the employment footprint is expanding faster than the private sector. Strong goods consumption (5.85% vs 4.01%) was also a hallmark of this expansion, but most of that demand leaked into real imports, which grew at a 3.6% annual rate in this cycle vs 2.1% in the prior one (i.e., buying foreign goods).

The underlying higher inflation profile in the current cycle, despite the same growth rate as pre-COVID, is owed to increased federal spending and hiring, shown by the study above using BEA/BLS data completed by TS Lombard.

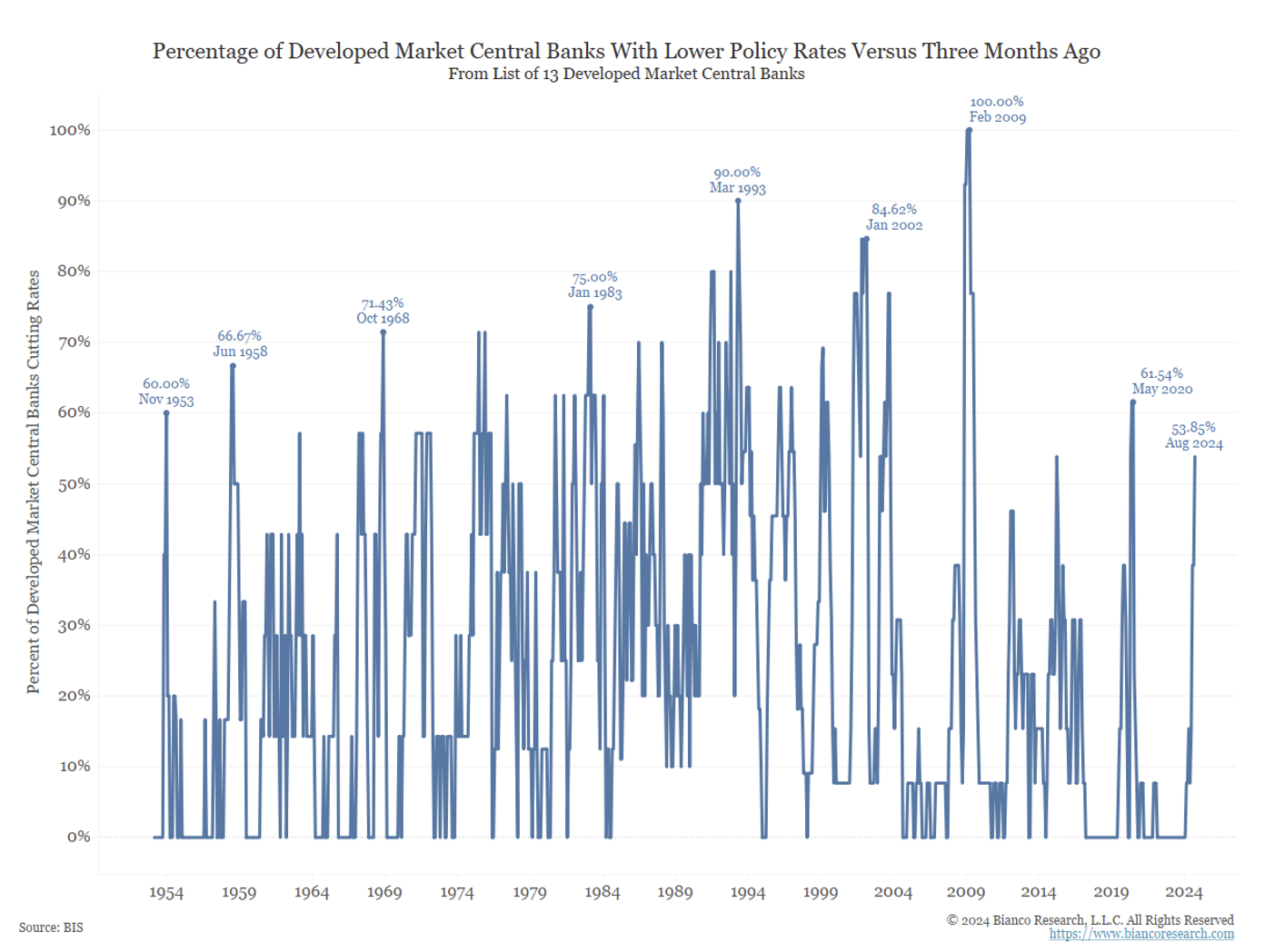

Global Cutting Cycle Underway

The world is moving towards a cutting cycle. Roughly 54% of developed-market central banks have already cut rates over the past three months. The European Central Bank, the Bank of England, the Reserve Bank of New Zealand, Central Bank of Sweden, Denmark, Switzerland, and Canada all cut rates at some point over the past three months.

Source: Bianco as of 09.09.2024

Source: Bianco as of 09.09.2024

Japan has been the only developed-market central bank to raise rates. The US looks set to expand the group of central banks cutting rates come next week!

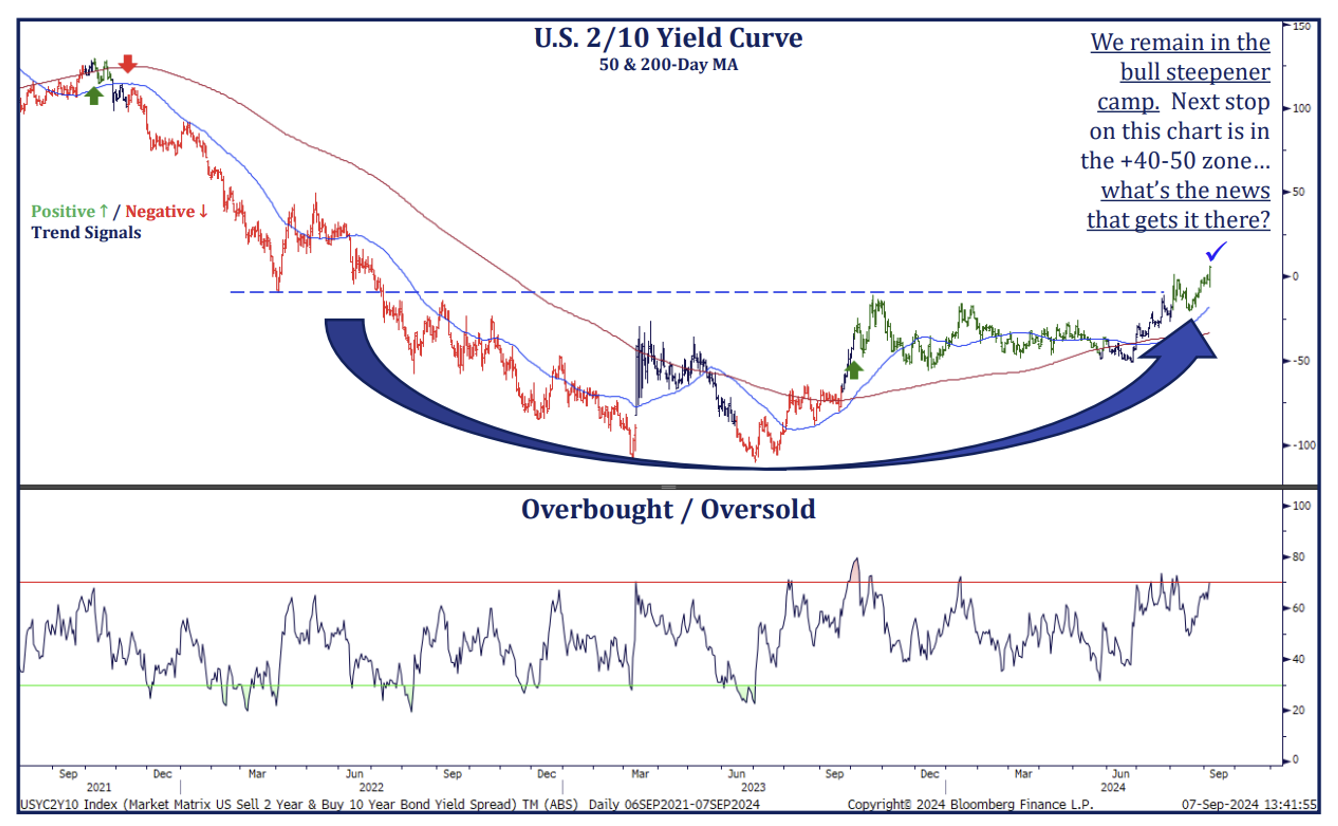

Curve is Uninverting

The yields on 10-year bonds were lower than those on 2-year bonds for over 520 days before finally normalizing (upward slowing curve, albeit minimally).

Source: Strategas as of 09.11.2024

Source: Strategas as of 09.11.2024

This marks the longest stretch of curve inversion between the 2/10s. Yield curve inversions are an anomaly since investors should get higher returns for holding debt longer, and are typically viewed as an indicator of an incoming recession.

Given this cycle has been anything but normal we wouldn’t be surprised if this past indicator yields different outcomes this go around. We are happy to see the curve normalize, and expect the reversion to continue as the Fed cuts interest rates.

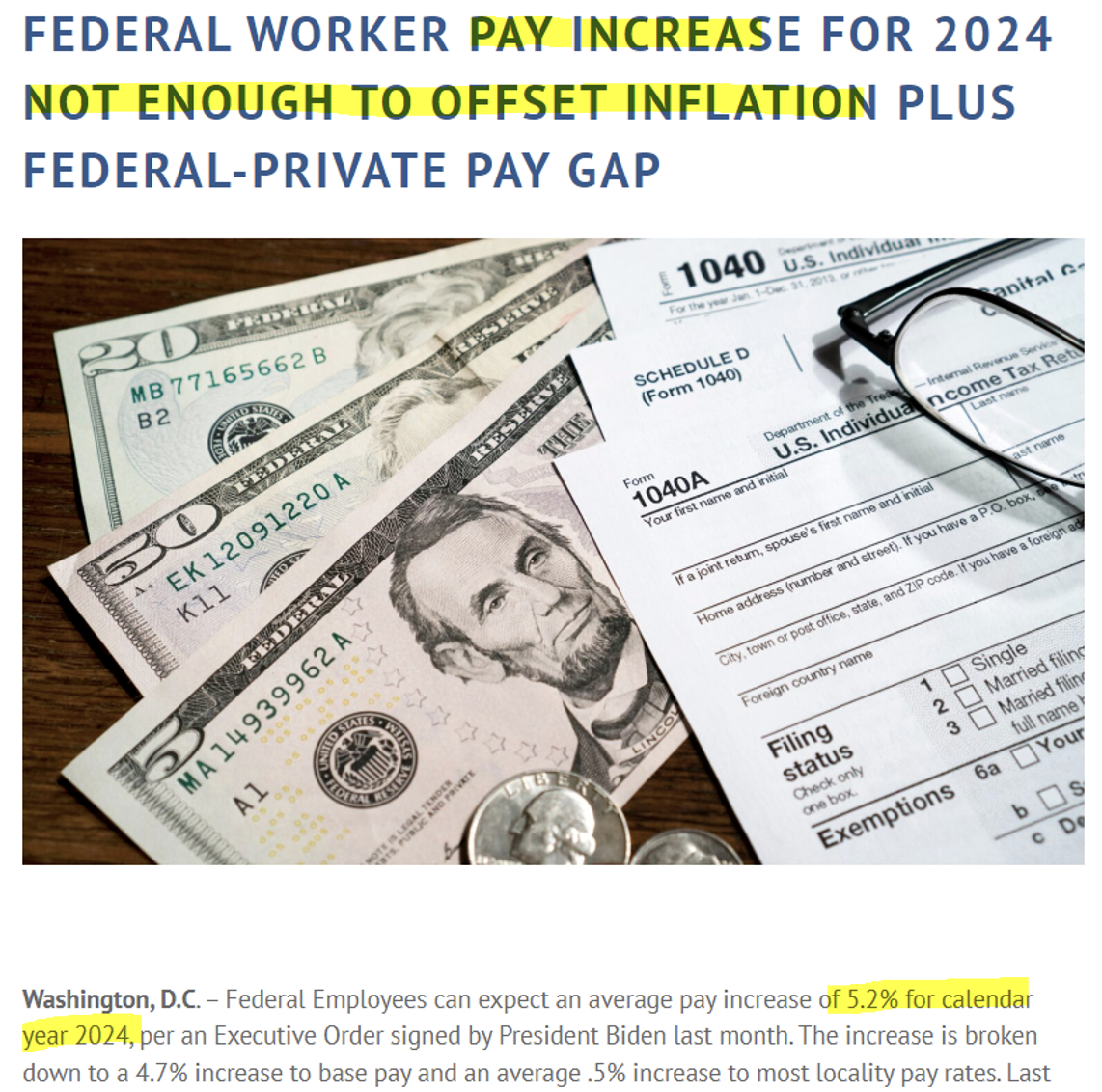

Federal Wage Increases Not Enough to Offset Inflation

Below, see an interesting article from NFFE discussing how federal employees’ wage increases are not keeping up with inflation (5.2% pay increases).

Source: NFFE as of 09.01. 2024. https://nffe.org/press-release/federal-worker-pay-increase-for-2024-not-enough-to-offset-inflation-plus-federal-private-pay-gap/

Source: NFFE as of 09.01. 2024. https://nffe.org/press-release/federal-worker-pay-increase-for-2024-not-enough-to-offset-inflation-plus-federal-private-pay-gap/

The government would be the one to tell us that its wages aren’t keeping up with the inflation, while the other side of their mouth they are telling us inflation is back at 2%!

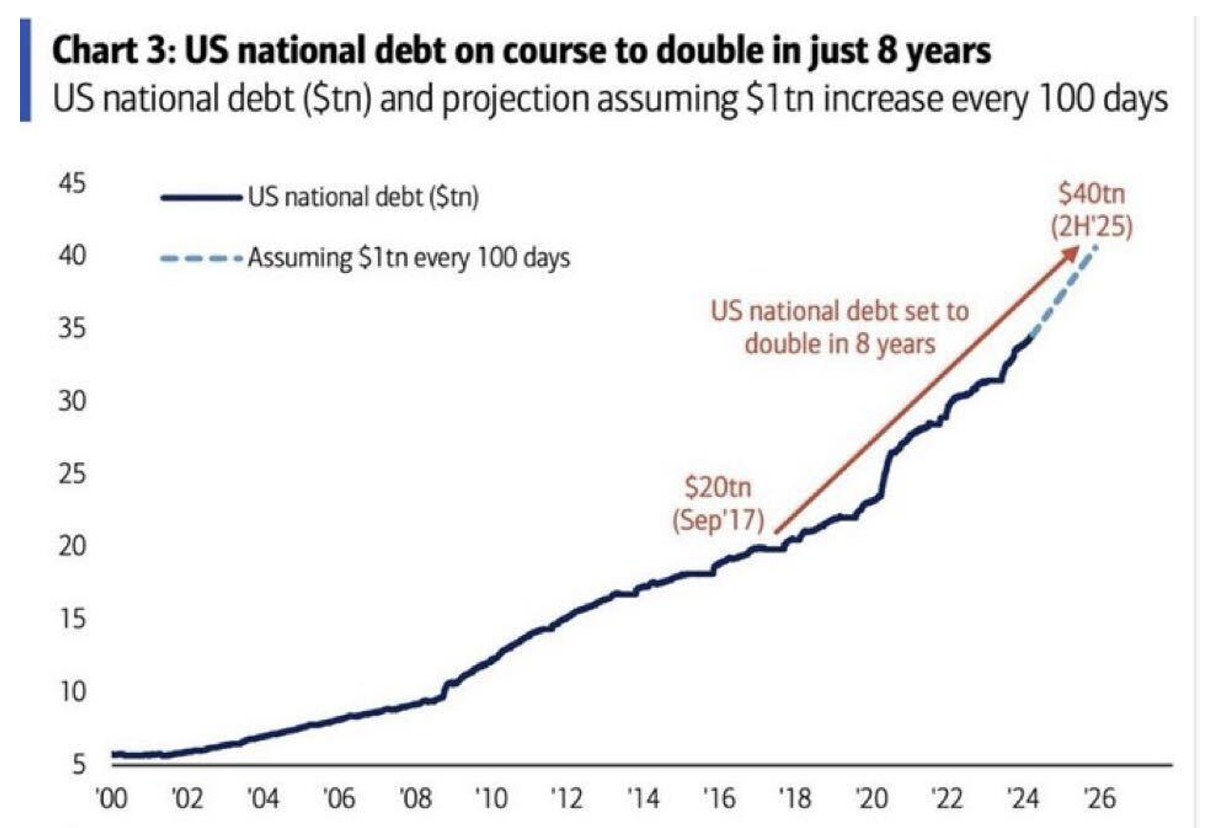

National Debt to Double in 8 Years

Always a fun one… sure it’s a bit of fodder for the bears given it doesn’t include the growth in nominal GDP but undoubtedly concerning.

Source: BAML as of 09.09.2024

Source: BAML as of 09.09.2024

$1 trillion increase every 100 days doesn’t seem sustainable… and that is in an environment where unemployment is low, and the economy is growing! How to Comprehend a Trillion Dollars

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-14.