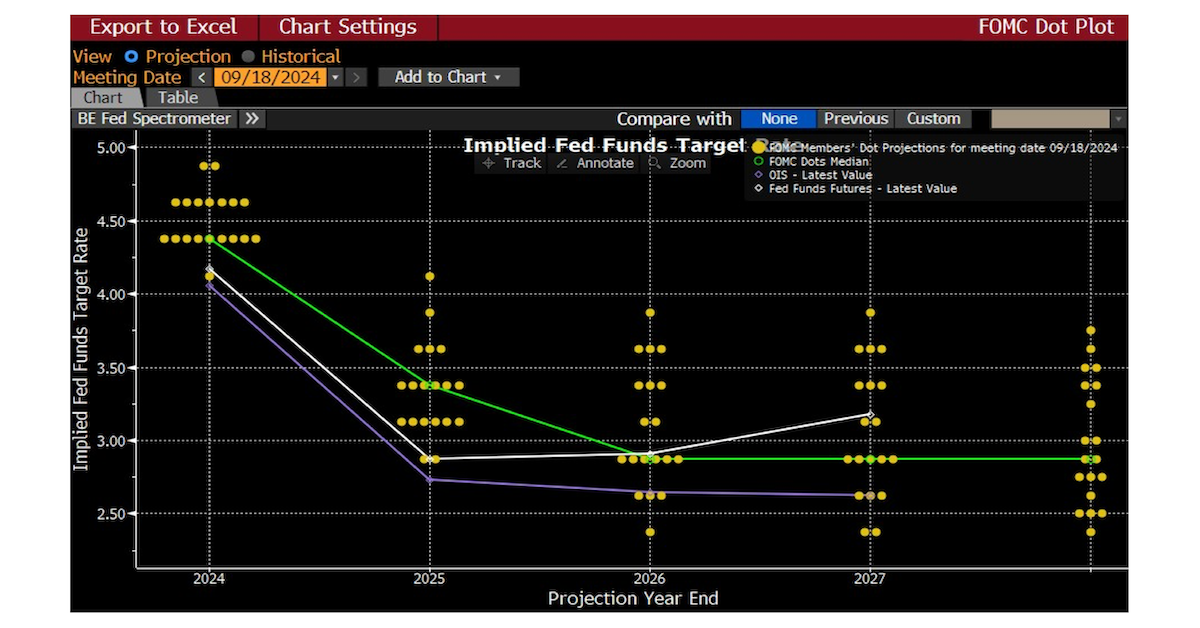

The debate between 25 or 50bps has been settled. It appears that markets strong-armed the Fed to front-load their first cut, where today they cut the funds rate by 50bps. This moved the target rate range from 5.25% – 5.50% to 4.75% – 5.00%. The updated 2024 rate forecast (i.e., dot plot) now sees nearly another 50bps of cuts in 2024, with the Fed Funds rate ending the year at 4.375%.

There are two remaining Fed meetings in 2024: November and December. Today’s rate cut was the first since March 2020 and comes two and half years after rate hikes commenced. Fed Governor Michelle Bowman was the sole dissenter, not surprising as she has been vocally one of the most hawkish members.

There were several changes to their statement. They stated inflation is “making further progress” updated from “modest progress” in June. Their message also reflected shifting concerns from inflation to the labor market. They characterized job gains as having “slowed” from June’s “moderated” framing.

They also added that “the Committee has gained greater confidence that inflation is moving sustainably toward 2%.” We take this as an additional sign that concerns are shifting from inflation to jobs.

Source: Bloomberg as of 09.18.2024

Source: Bloomberg as of 09.18.2024

After lifting the long-run dot from 2.562% to 2.75% in June, they nudged it higher again to 2.875%. That’s the third straight increase in the so-called neutral rate forecast which had been at 2.50% since 2019. It’s a recognition that the post-pandemic economy is unique to the pre-COVID economy where prices and growth have been higher.

The increase in the neutral rate remains well below the new Fed Funds rate and is expected to remain so until 2026, indicating restrictive policy is expected to remain in place through next year. That will obviously be subject to incoming labor market data that may pressure the Fed to cut more aggressively if further cooling occurs. On the other hand, if inflation remains sticky, it could slow the pace of 2025 rate cuts.

On the inflation front, with the cooling inflation picture during the summer, the Fed lowered their 2024 core PCE forecast from 2.8% to 2.6% reversing their increase in the June forecast which came after the first quarter uptick in inflation. We are currently at 2.6%. After last week’s CPI and PPI reports the market expects core PCE to tick up to 2.7% YoY despite a benign 0.2% MoM expectation (a low comp of 0.1% MoM is rolling off from last year). The 2025 and 2026 forecasts were kept mostly the same as June’s at 2.2% and 2.0%, respectively.

As for the labor market, the Fed’s new forecast is for the unemployment rate to tick up to 4.4% at year-end, vs. 4.0% in the June forecast. That’s not surprising given the August unemployment rate was 4.2%. Given the larger rate cut, the Fed obviously sees a risk for more labor market weakness before the cuts stem the slowing. For 2025, unemployment is forecast to remain at 4.4%, and at 4.3% in 2026, both revised higher since the June forecast. In saying that, as job openings decline and the labor force increases (immigration), the unemploymant rate should naturally drift higher.

On GDP, the Fed marked it at 2.0% for 2024 vs. 2.1% in the June forecast. Given the Atlanta Fed’s GDPNow model is forecasting a 3.0% growth rate for the third quarter (and we had strong growth in the first half of ’24), it would take quite a bit of weakening in the fourth quarter to result in 2.0% clip for the year. The pace is expected to remain at 2.0% in 2025 and 2026, which is unchanged from the June forecast. The GDP projections, while weaker in 2024 than we expected, reflect ongoing economic strength so far in 2024. The Fed is keeping their soft-landing call.

Summary

Overall, there was much uncertainty as to whether the Fed would cut 25 or 50bps. The Fed delivered a 50bps cut with another 50 expected by year-end. The June forecast of four 25bp rate cuts in 2025 remains, but the 2026 cuts were reduced from four to three. Today seemed like the Fed was making up for not cutting in July. Powell did note that had they known then the data about to come out, especially the downward revisions to payrolls, they would’ve cut in July (hindsight 50/50 as JD says!).

I think the recent Fed’s actions of guiding yields lower, today’s 50bps cut with the promise of more, and the most recent run of (stronger) data, suggest the risk of recession is greatly reduced. Rates appear to be moving from restrictive to neutral. The question moving forward is what is neutral… is it 2.9% like the Fed is saying or is it more like 3.5%? We’d argue it appears to be the latter. Looking forward half-point cuts should not be seen as the pace and as the title says, “the first cut is (probably) the deepest”.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-20.