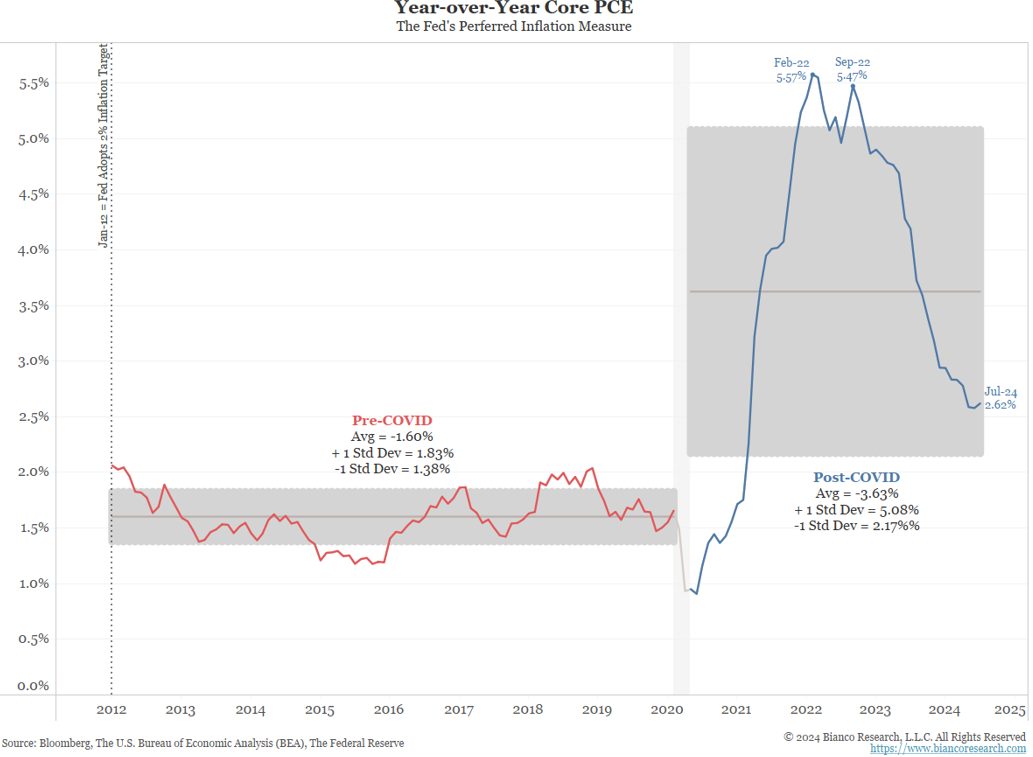

Post Covid Inflation

Source: Bianco. As of 9/24/24

In a recent op-ed, Jim Bianco argued that recessions and financial crises can create change across an economy. In 2020, we had both a financial crisis and a recession, significantly reshaping the economic landscape and the mechanisms that support it.

Since then, we started a new post-Covid inflation cycle (blue) that is higher and more volatile.

It would be hard to argue that this economy is not different from the 2019 economy (pre-Covid). Several areas have contributed to this change: the widespread adoption of remote work, mass immigration, deglobalization, changing spending attitudes (YOLO mindset), aggressive fiscal policy, politicization of the Fed, strategic Treasury debt issuance (spiked T-bill issuance), and the psychological impact of 40-year high inflation.

Given how much has changed in such a short period, we believe investors need to understand that this cycle of rate cuts is fundamentally different than previous cutting cycles.

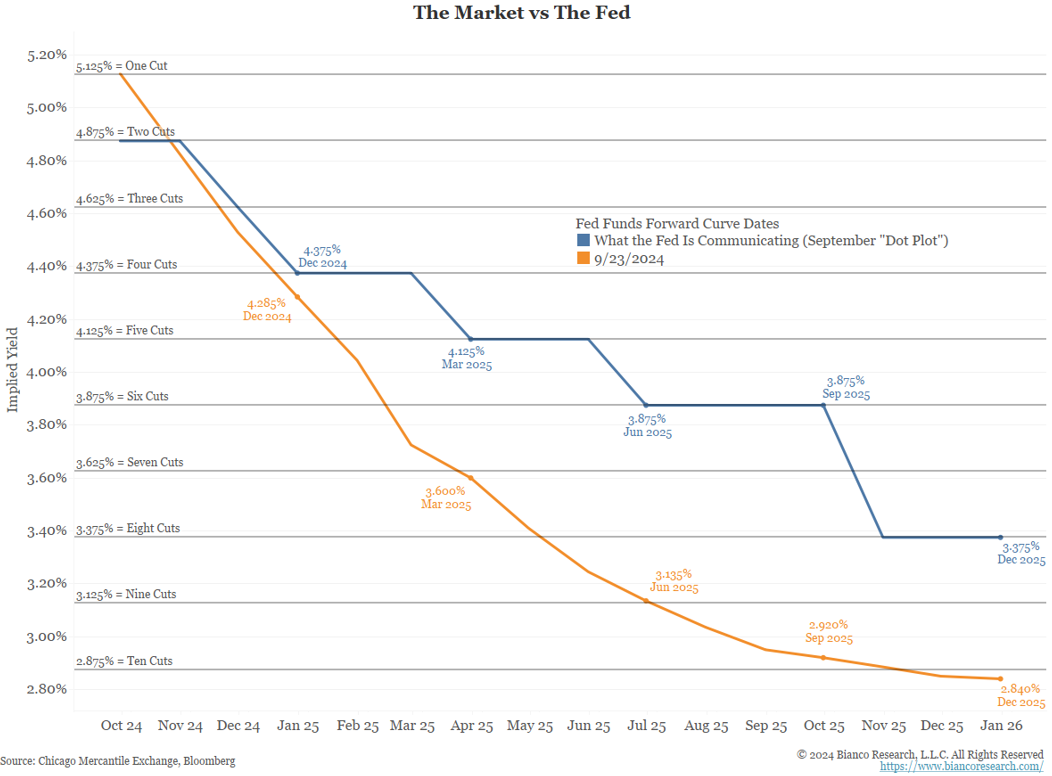

Market vs Fed

Source: Bianco Research. As of September 22, 2024.

The Fed expects to lower the federal funds rate by 200 basis points through the end of 2025. However, the market anticipates a 250 basis point reduction over the same period.

So, if the fed funds rate approaches 3.00-3.25%% by the end of next year, where should the 2-year note trade? Historically, the 2-year rate has been 42 basis points wide of the federal funds rate.

- 125% (midpoint) + 0.42% = 3.545%

As of today, September 26, 2024, the 2-year yield is 3.60%, just six basis points above this level, suggesting that the market has already discounted all expected rate cuts.

But what about the 10 year? The historical spread between 10 and 2-year treasuries has been around 100 basis points.

- 60% + 1.00% = 4.60%

Today, the 10-year yield is 3.80%, about 80 basis points below where history would imply. This discrepancy indicates the market is pricing in even more aggressive easing then the Fed’s current projections.

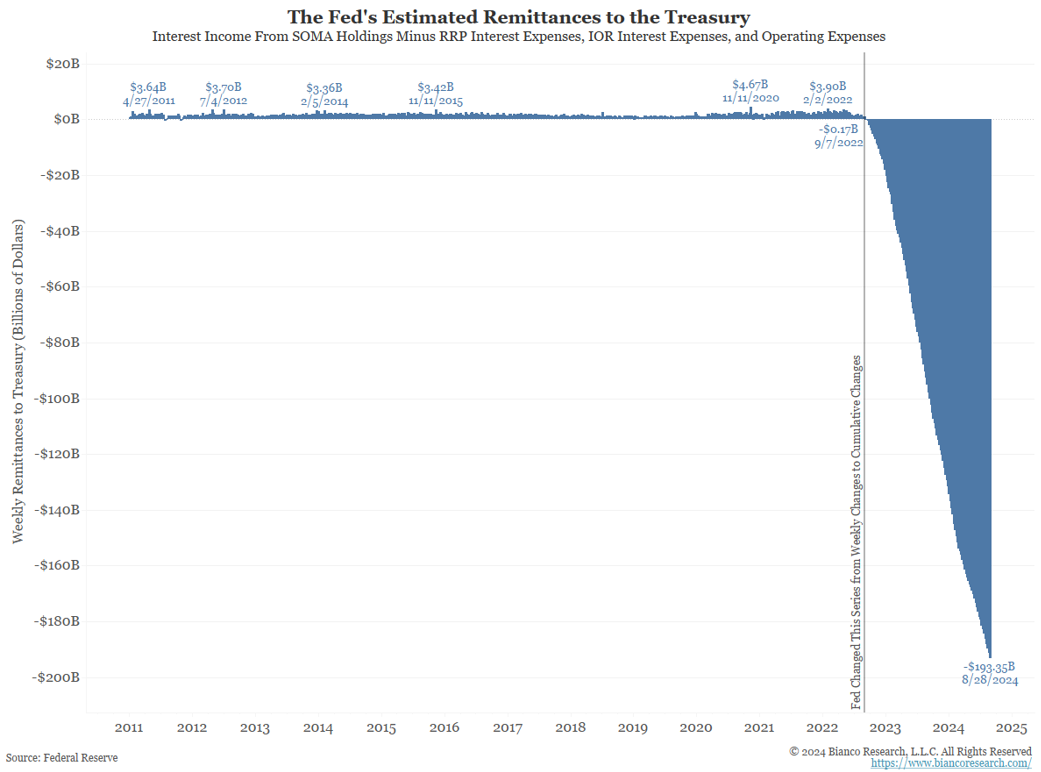

Fed Losses Piling Up

Source: Bianco. As of 9/18/24.

Source: Bianco. As of 9/18/24.

With the Fed’s interest expense rising and the interest income they receive from their SOMA portfolio remaining relatively constant, they have been operating at a loss since September 2022. The US Federal Reserve used to be highly profitable and would send tens of billions of dollars of remittances to the U.S. Treasury every year, but collectively they are now losing money. The increase in interest rates while their balance sheet of bonds didn’t reprice to higher rates near as quickly is the cause for this.

As interest rates decline, there will be less pressure on the Fed as the rate they pay on reserves declines and comes closer to the rate they are receiving on their bond portfolio. One thing I think most market commentators didn’t appreciate was the effect this had on markets as billions of losses were basically papered over by the public sector instead of being felt by the private sector.

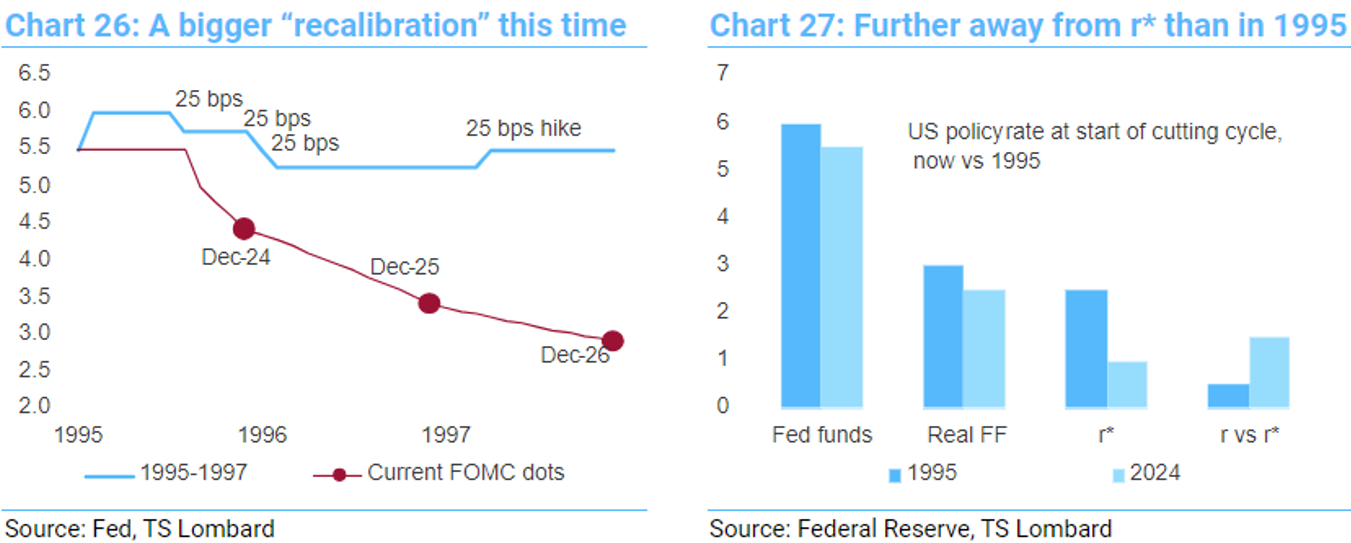

1995 Style Recalibration

Source: TS Lombard. As of September 24, 2024.

Despite the 50bps cut earlier this month, it could take a while for the Fed to return monetary policy back to neutral. The FOMC’s latest “dot” plot shows US rates will not approach the central bank’s estimate of a neutral level (r*) until 2026. That would be an extremely slow and gradual easing cycle by past standards.

With the Fed now hyper-focused on the employment side of their mandate, and acutely aware of the risk posed by reflexivity in the labor market, it would take only a slight wobble in the employment data (such as decline in payrolls) to trigger a more forceful response. That is what happened in 1995, during Greenspan’s textbook soft landing. Although the US economy dodged a recession then, it was a decline in payrolls that panicked the Fed into action.

What is more likely in our opinion is a midcourse “recalibration” in monetary policy – rather than a full monetary reversal – with the central bank cutting interest rates back to neutral after a period of deliberately restrictive policy.

The big difference comparing 1995 to today is that the current Fed thinks it is much further from the neutral rate. FOMC commentary puts nominal r* in the 2½-3% range, which is more than 200bps below the current policy rate. In contrast, the Greenspan-led in 1995 thought interest rates were just 75bps above neutral, which matched the depth of their eventual cutting cycle. Given the bias in how today’s FOMC views its policy stance, it is likely that officials will cut interest rates faster – and by more – than the Greenspan Fed.

We still think investors are underestimating the resilience of the US economy. Even if there is a recession, it is likely to be mild by historical standards. Like the mid-90’s the US economy is free from deep underlying macro-financial imbalances and we should see continued support from fiscal policy. In 1995, by contrast, the Greenspan Fed had to consider how significant fiscal tightening might reduce r* over time. Today we have the opposite situation, where structurally easier fiscal policy is likely to have raised r* compared to pre-COVID levels.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-28.