The FOMC has eased 75 bps since September, but financial conditions have tightened about 25 bps since then due to the runup in real yields (the 10 year has backed up 80bps). Conditions are still “loose”, but not as loose as one might typically expect after 75 bps of rate cuts.

The Fed emphasizes the “neutral rate” (or R*) as the anchor for its monetary policy. They currently estimate R* at 2.9%, however, market-based pricing suggests R* is likely closer to 3.5% or even higher. This reflects a stronger-than-anticipated economy. The upward shift in R* is consistent with rising long-term rates and is supported by the resilience of growth despite higher interest rates.

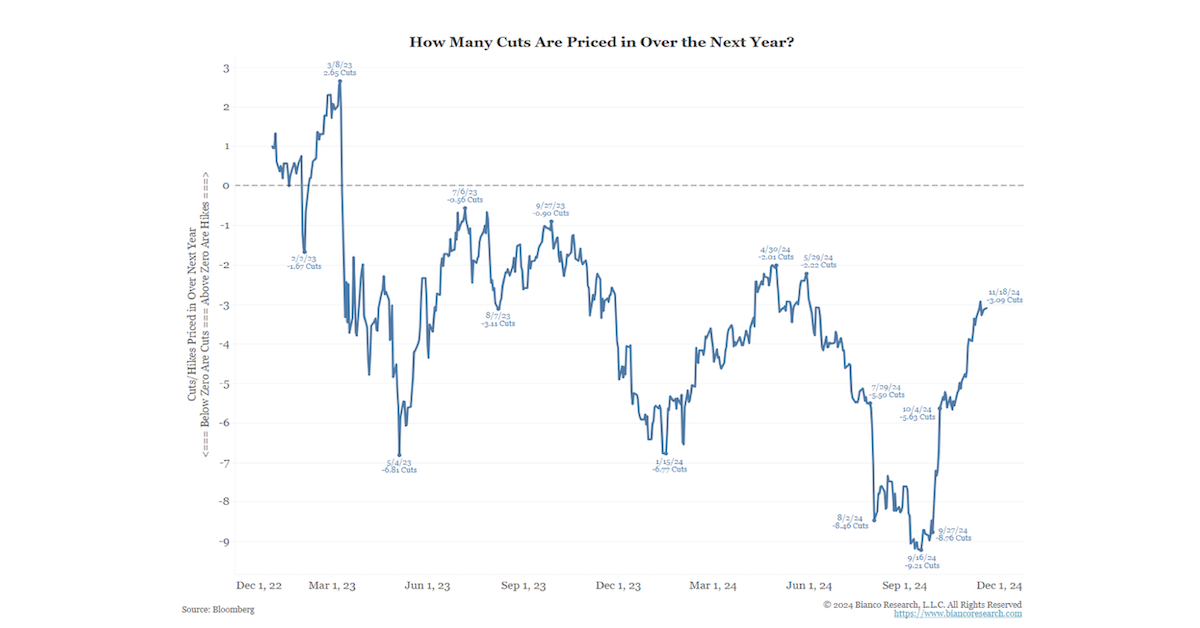

Source: Bianco as of 11.18.2024

Source: Bianco as of 11.18.2024

This puts the Fed in a difficult spot where inflation progress is slowing, and economic growth is bottoming and firming. It’s difficult to see the Fed project more easing in the December dots to offset the recent tightening of the bond market, given firming inflation (more on that in a second) and okay growth. Many market participants are suggesting a Fed pause should be in play for December. All of this suggests that the November jobs report in early December will be a key determinant for the December FOMC meeting given their hyper-focus on the employment mandate.

The Fed’s task is becoming more complex, as inflation progress slows and economic resilience challenges its current estimates of R*. The interplay between rising real yields, tightening financial conditions, a pro-growth President-elect, and the November jobs report will define the trajectory of monetary policy moving forward. Currently, the market is pricing in only 3 more rate cuts over the next 12 months (it was over 9 back in September!). Three cuts would bring the Fed Funds rate to the 3.75%-4% range, our rough guess of the current neutral rate.

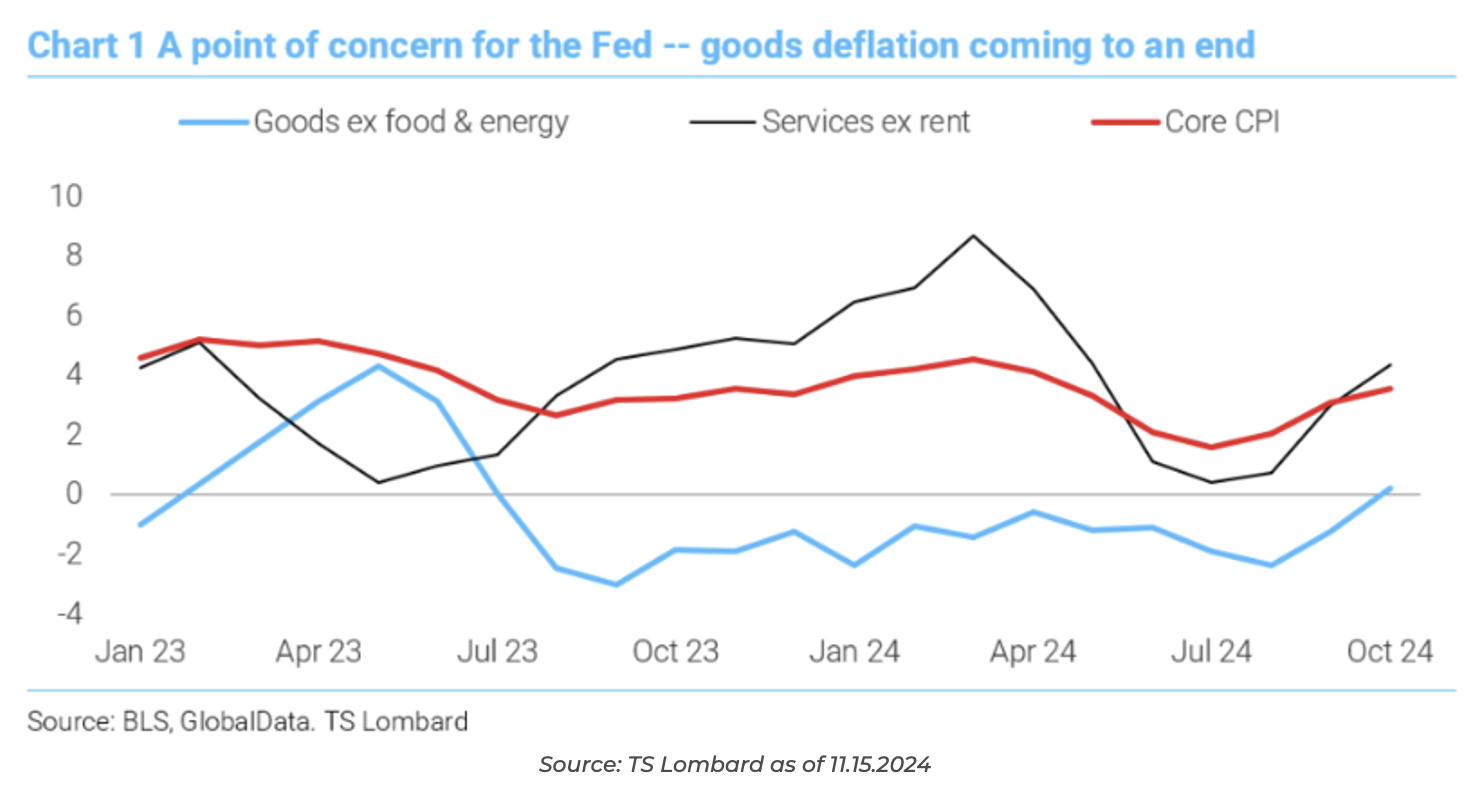

Goods Inflation Turning Higher

The October CPI sent a subtle message to the Fed to tread lightly when guiding for future rate cuts. One of the key points we’ve made in the past couple of years is that prices do not usually decelerate in a full-employment economy. It appears that many of the disinflationary forces are abating. On a rolling three-month basis, core CPI is running at around 3.5%, as is the Atlanta Fed’s sticky inflation index. Sustained high service inflation is to blame.

The pace of deflation in goods ex-food and energy is diminishing, where tariffs will likely pressure these indexes positively, though not necessarily overall inflationary across other parts of the economy.

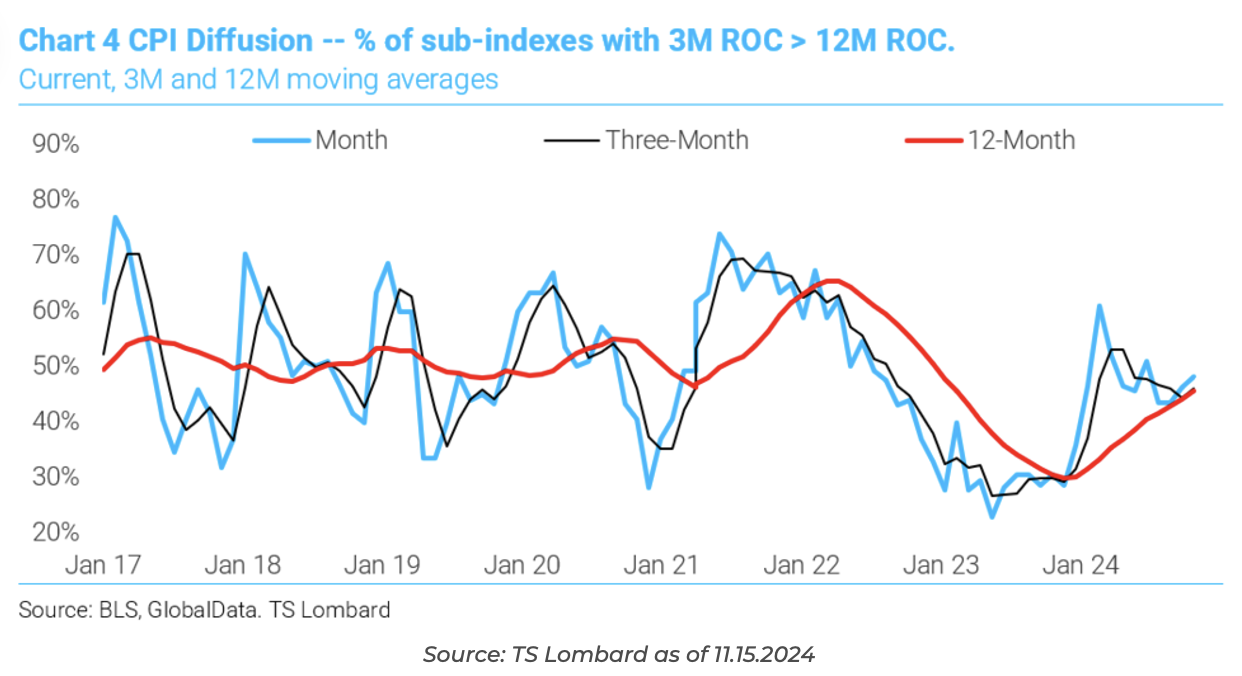

Diffusion Index Points to Stall in Disinflation

TS Lombard runs a diffusion index that digs into the sub-indexes of inflation and sees which ones have three-month inflation rates above their 12-month rate. They calculate around 50% have 3m inflation rates running above their 12m rate. This doesn’t mean inflation is set to resurge, however it is not a circumstance that implies disinflation.

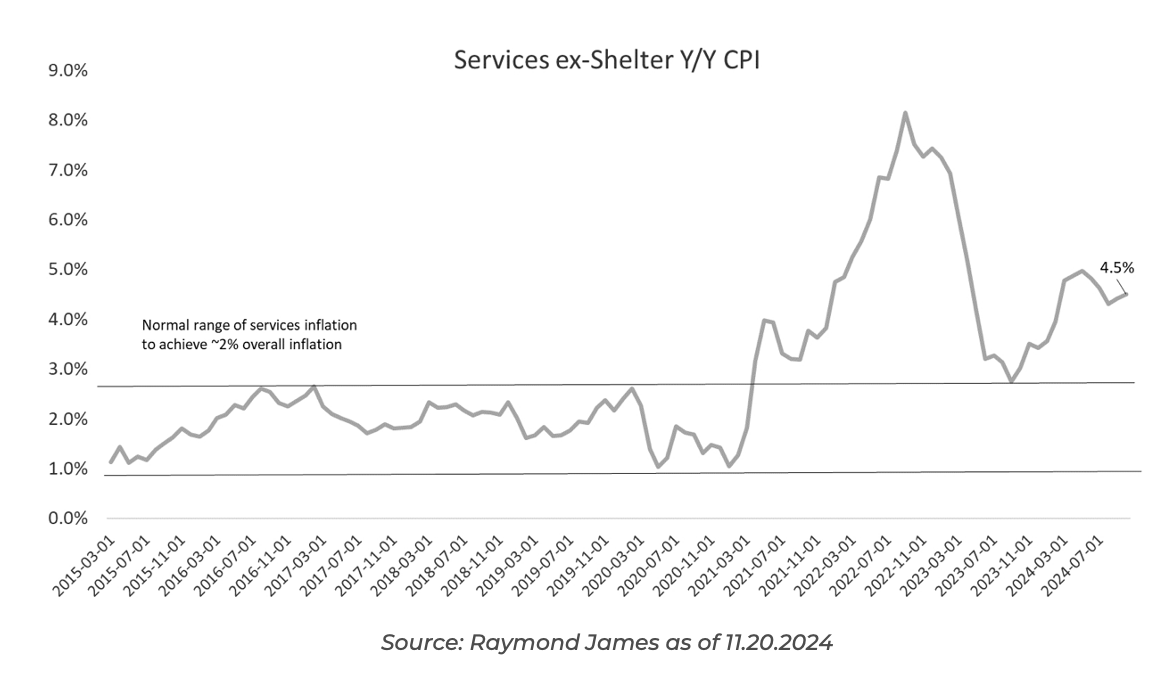

Services and Shelter Inflation, a Thorn in the Fed’s Side

One of the key drivers of sticky inflation has been Services CPI ex-Shelter.

It’s about 1.5% above normal levels, and although some of this is related to insurance and vehicle repair inflation that has been sticker near term (but is expected to come down), some is also related to strong wage growth and full employment. On the shelter front, Powell keeps expecting the CPI for housing to come down. There are a myriad of data sources saying the same, although we have been hearing this for a few years now and it appears we’re going to have to wait a few years more because rents move inversely to unemployment and Fed policy is prioritizing keeping unemployment low.

It appears current rent inflation appears to be settling into a range in line with 4.1% unemployment, though higher interest rates and a potential increase in housing supply from Trump’s deportations could pressure shelter prices lower.

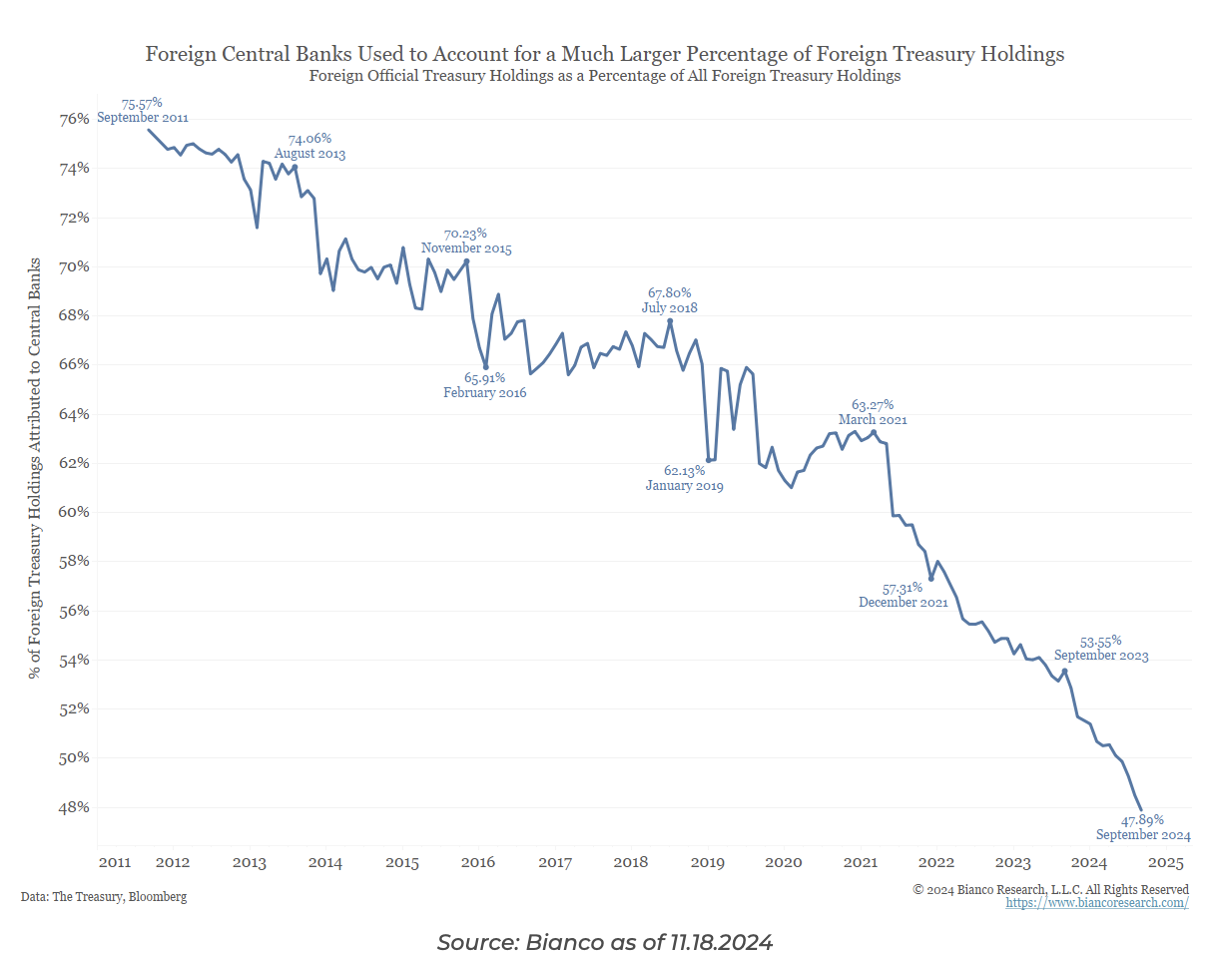

Foreign Central Banks Hold Much Less Treasuries

The Fed and other central banks are largely considered price-insensitive bond buyers. Their purchases become necessary, as the result of monetary policies like QE or massive trade imbalances in the case with China. Prices do not drive purchases for CBs. Private foreigners, on the other hand, are much more influenced by prices.

Price-sensitive buyers make up a larger portion of the Treasury market. Gone are the days when half of all bonds would be bought at any price. While this is good in that it allows for price discovery in the bond market, it may also come with a more volatile market as buyers are more discerning. All in all, this should continue to pressure term premiums higher.

Credit Spreads Showing Little Sign of Stress

Investment-grade spreads measured at 108 basis points (over Treasuries) as of Friday on the BBB/Baa Index. These spread levels are hovering around their lowest points in the past 26 years (spreads were approximately the same level pre-GFC and in 1998).

There have been more credit upgrades than downgrades since the FOMC started its rate-hike cycle in 2022, with a “slower pace of downgrades” likely in the future. Although this is likely distorted due to the increase of downgrades during and immediately following COVID, the overall picture (and sentiment) for corporate earnings and balance sheets remains strong, keeping a lid on credit spreads.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-21.