Insurance Cut in December is Likely…Then a Pause

The jobs forecast from Linkup, a leading provider of labor demand data to the capital markets, indicates a marked slowing in the pace of hiring (and openings). This implies a smaller upward revision to October than the markets expect. I expect the Fed cut at 25 bps at its December meeting, which will put its policy rate very close to what we see as neutral. This will serve as the Fed’s “insurance” cut against further labor market weakening and will give the Fed a chance to pause and see the execution of Trump’s policies.

Source: TS Lombard as of 12.03.2024

Source: TS Lombard as of 12.03.2024

With rates sitting close to neutral and 425 bps above 0, the FOMC leaves itself plenty of bandwidth in both directions to be able to react and impact the economy as conditions warrant. Market participants remain ever optimistic about a return to 2% inflation and are pricing a sub-4% funds rate a year from now — essentially another 50 bps of rate cuts, at least.

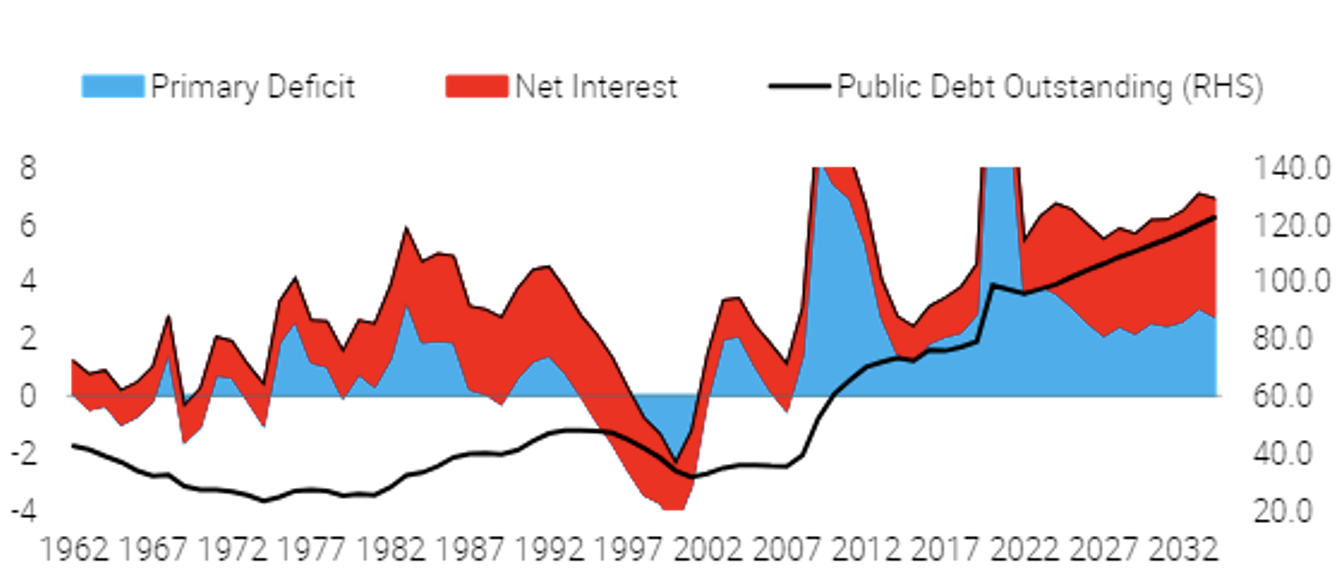

GDP Must Grow Faster Than the Debt Burden

The cost of servicing the debt and structural deficits of 2.5%-3.0% of GDP is becoming problematic. Structural deficits will put increased pressure on the Fed to monetize more of the debt, to keep the real interest cost from weighing on growth and curtailing policy efforts (i.e., Trump’s policy of re-shoring, tax cuts, immigration, tariffs, DOGE, etc.). The intractable growth of entitlements and defense spending, along with the compounding growth of the public debt, will keep the budget deficit too high for a non-recessionary period. On top of that, the deficit grows faster if nominal interest rates end up being higher than the CBO forecast (likely, in our opinion).

Source: TS Lombard as of 12.03.2024

Source: TS Lombard as of 12.03.2024

Although interest on the debt is nominally below US growth, the size of the debt continues to increase faster than GDP because of the structural primary deficit that is about twice the pre-COVID average. Add to this the compounding of the current debt by the average rate of interest, and we see debt/GDP continuing to rise, and with it the debt service as a percent of GDP.

Taking it a step further, the average maturity of Treasury debt is 71 months (5.9 years), about three months shorter than it was before QT began in June 2022. The percentage of debt maturing within one year has risen from 28% to 34%. At present, 68% of the debt matures within five years.

In other words, if Trump’s plans result in higher term yields (more term premium), as we believe they will, the jump in interest payments as the short-term debt reprices will continue to dominate the deficit. This brings us to our next point; the end of QT is likely near.

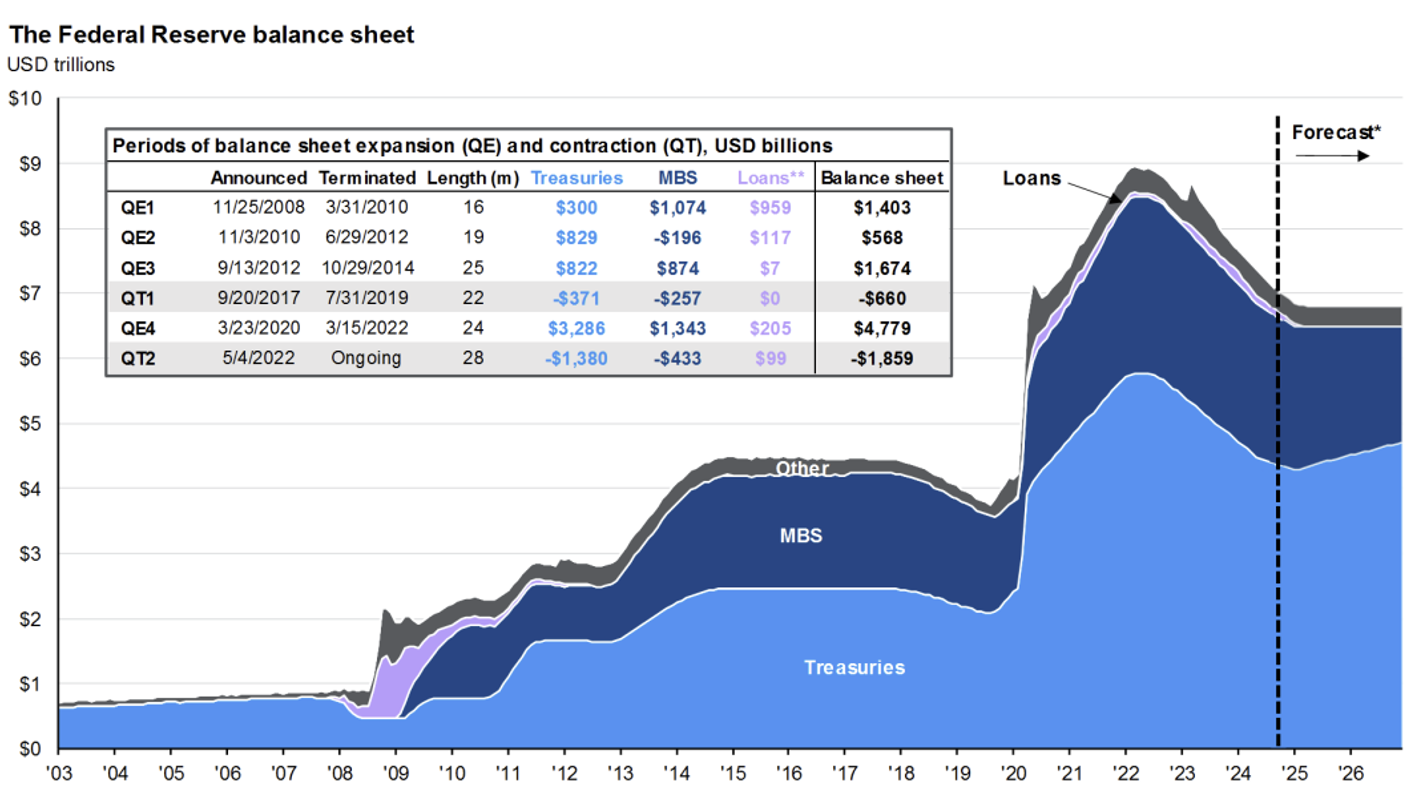

QT Likely Coming to an End Come Early ‘25

As mentioned in our last update, foreign holders of Treasuries have declined substantially since 2008. Currently, ~30% of US debt is held by foreign owners vs. ~57% at the end of 2008. The Fed has filled the void with several massive rounds of QE, to accommodate the big issuance of Treasury debt. During the recent bout of QT2, the Fed has decreased its balance sheet by just shy of $2 trillion albeit from a bloating $9 trillion.

Source: JPMorgan as of 10.31.2024

Source: JPMorgan as of 10.31.2024

We expect the Fed to begin to prepare the market for a halt in QT. The Fed will want to keep financial conditions, namely reserves/liquidity, from becoming overly tight. While that doesn’t indicate a return of QE (at least immediately), it does bring back some Treasury buying by the Fed (to replace roll-off) which can be targeted along the yield curve to impact the slope of the curve and level of interest rates, a version of unofficial Yield Curve Control (YCC).

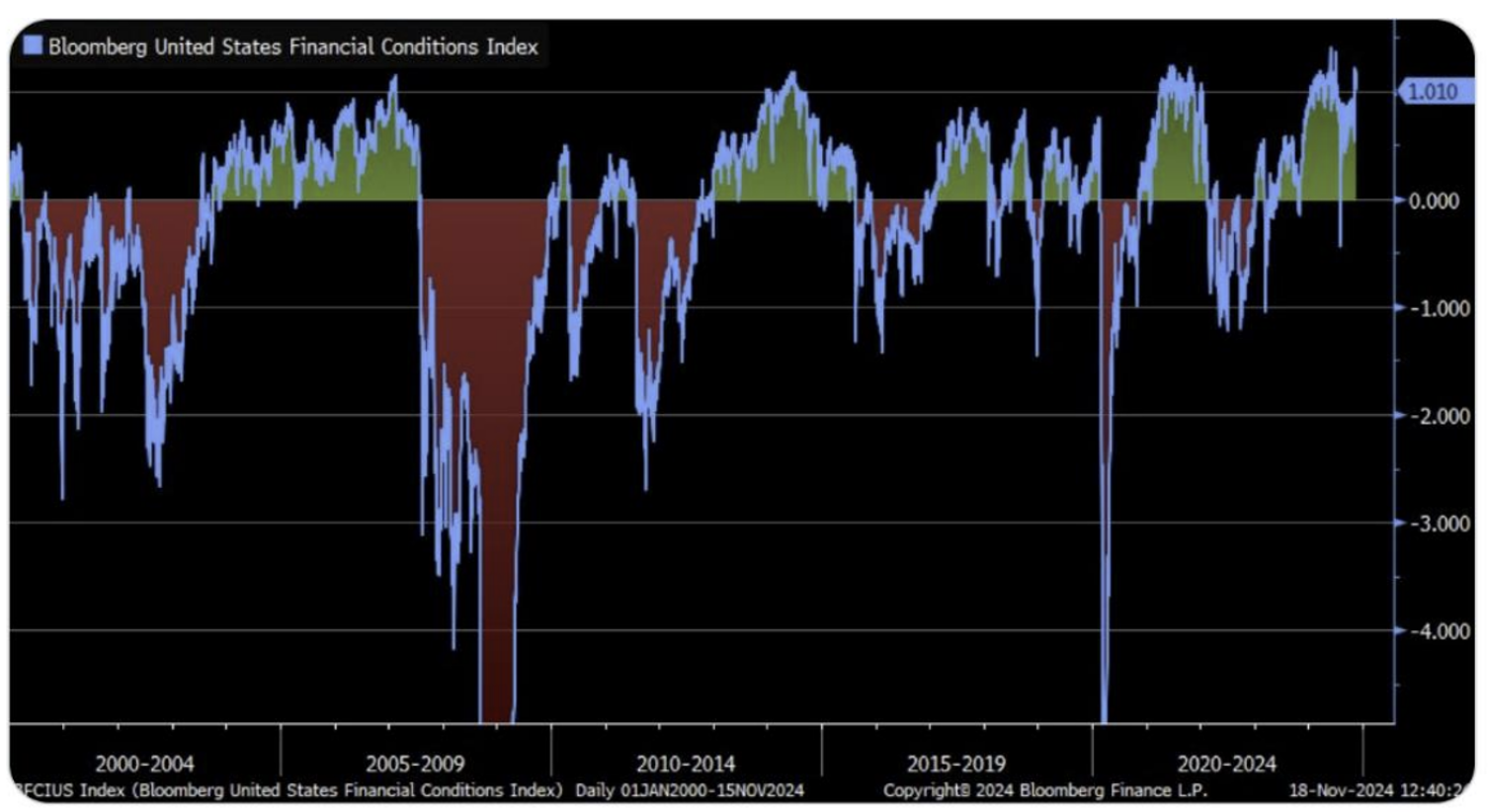

Financial Conditions Appear Very Easy

Looking back over the past 25 years, the Bloomberg US Financial Conditions Index has rarely been looser/easier than now. A big part of the index relates to equity prices and credit spreads, which are currently at all-time highs(stocks) and near all-time lows(spreads). Another big piece of the puzzle is the massive fiscal spend (remember public sector deficit = private sector surplus), given the reoccurring deficits.

Source: Bloomberg as of 12.01.2024

Source: Bloomberg as of 12.01.2024

In our opinion, it might not be a recession that causes stock market softening; more likely, a stock market softening that could cause a recession, given the interconnectedness of the stock market level and the consumer wealth effect. We continue to remain cautious on both a) inflation returning to the 2% target and b) the need for substantially more rate cuts after December.

While this can change quickly, specifically regarding any deterioration in labor market conditions, things continue to look pretty rosy. We will have a close eye on this week’s NFP labor number and any implications it could have on near-term policy decisions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2412-7.