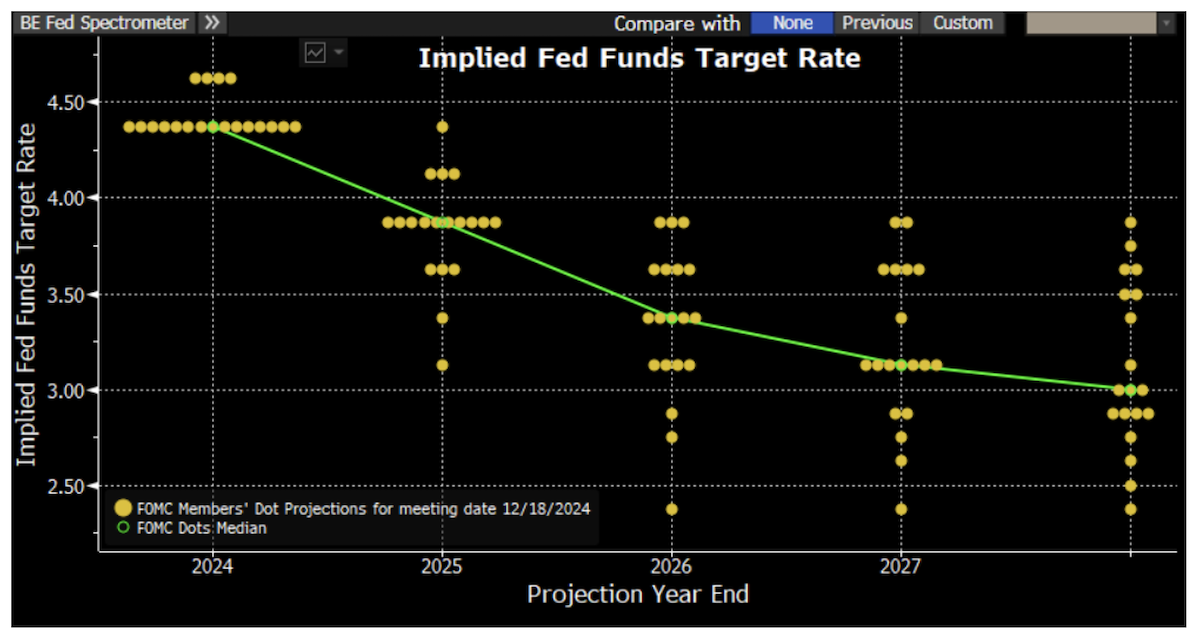

As expected, the Fed cut rates for a third time this year (100bps total), reducing the range for the Federal Funds target to 4.25-4.50%. The Committee signaled a significant reduction in its forecast for additional policy adjustments over the next 24 months as well as an uptick in expectations for inflation and growth (more on this below).

Source: Bloomberg as of 12.18.2024

Source: Bloomberg as of 12.18.2024

According to the dot plot, most Fed officials see just two rate cuts in 2025, another two cuts in 2026 and one more cut in 2027, resulting in a terminal rate of 3.00%, revised up from 2.875% by 2026 from their September forecast.

Revisions to SEP

The Summary of Economic Projections (SEP) indicated a median outlook for inflation to remain stubbornly elevated in 2025 at 2.5%. The unemployment rate forecast was revised down one-tenth to 4.3% next year, holding steady through 2027.

Source: Federal Reserve SEP as of 12.18.2024

Source: Federal Reserve SEP as of 12.18.2024

Officials revised their growth forecasts for the current year up from 2.0% to 2.5% and from 2.0 to 2.1% next year. Longer run, GDP is expected to rise 2.0% in 2026 (unrevised) and 1.9% in 2027 (revised down from the 2.0% projection in September).

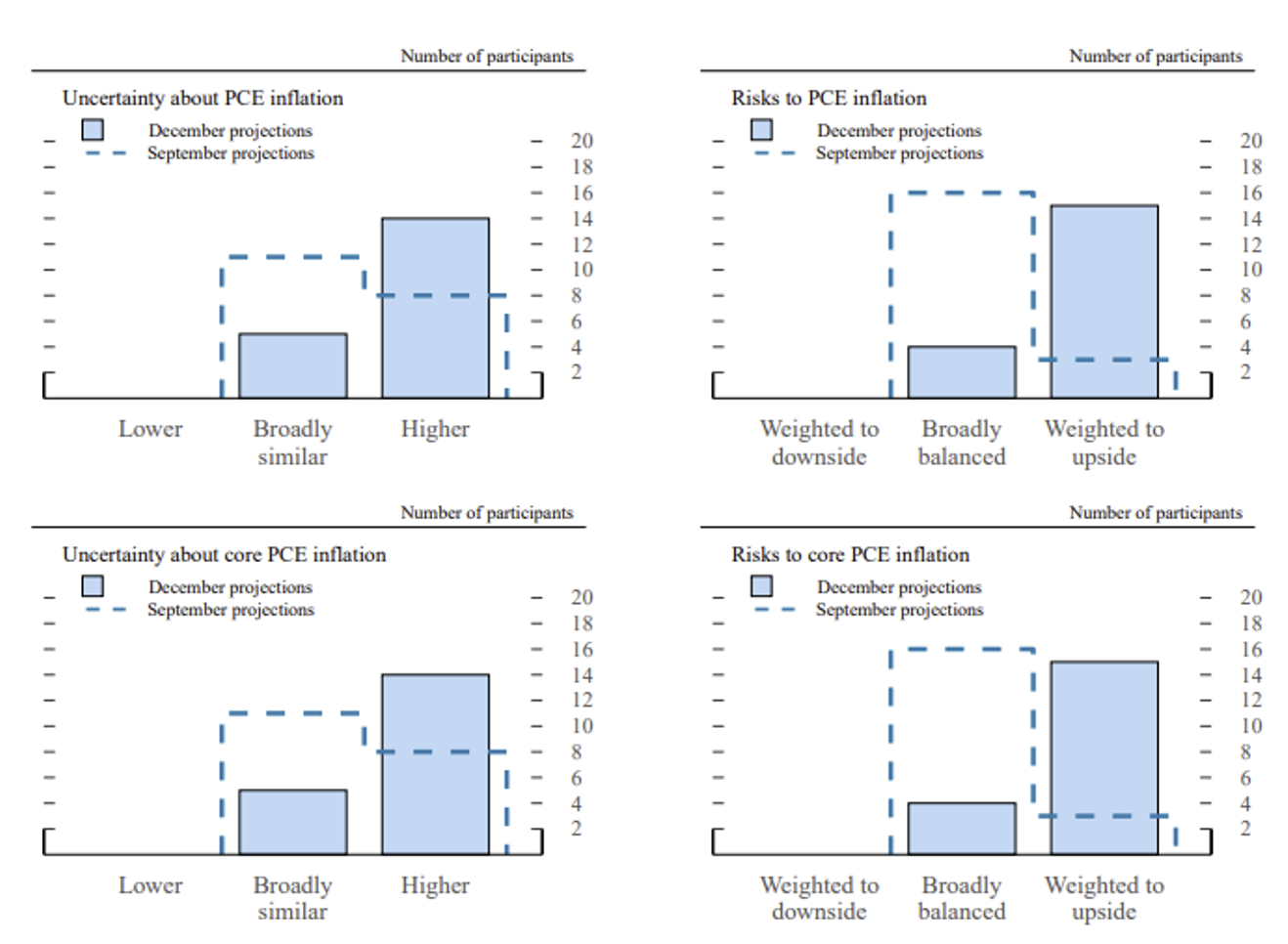

Inflation Uncertainty Shifts to “Weighted to Upside”

The Fed maintained its positive characterization of the economy, noting an ongoing “solid pace,” with unemployment still “low.” And while inflation has made some “progress” towards the Committee’s target, prices remain “somewhat elevated.” There was a notable uptick in the median expectation for inflation and inflation uncertainty.

Source: Federal Reserve SEP as of 12.18.2024

Source: Federal Reserve SEP as of 12.18.2024

Dissent

Cleveland Fed President, Beth Hammack, voted against today’s decision in favor of holding rates steady. As she noted in earlier commentary, given that growth and the labor market were stronger than anticipated, “a slower pace of rate cuts” was needed. Although to note, while Hammack was the only voting dissent, the dot plot indicates three other nonvoting Fed officials were in favor of holding rates unchanged as well.

Market Reaction

Equity markets sold off sharply. The Nasdaq and S&P 500 were down 3.6% and 3.0%, respectively. The dollar jumped to 108, and the 10-year Treasury yield rose 10 bps to 4.50%, back into what has been the “danger zone” for stocks that past 18 months.

Inflation or Employment?

While the Fed was anxious to provide relief in the wake of earlier concerns regarding labor market weakness (hence 100bps of cuts the last 3 meetings), it appears those downside risks have diminished. With the consumer and broader economy remaining “remarkedly good,” and inflation remaining stubbornly sticky, today’s policy pivot seemed inevitable.

At the end of the day, Powell made it clear that employment remains the more important driver of policy rates. If inflation was first, they would not have cut and would indicate no cuts forecast for 2025. However, in the face of stronger data and sticky inflation the Fed has conceded to a materially reduced number of rate cuts in 2025 with a higher neutral rate.

Conclusion

To sum it up, the Fed remains in a rate cutting cycle, but points towards skipping a meeting in January. This would buy additional time to see additional data (jobs, inflation, political moves, fiscal, etc.). As we get closer and closer to the neutral rate, slowing down the current cadence of policy rate cuts makes sense.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2412-17.