Quantitative Tightening Ending Soon

This week’s press about the Fed minutes release were the same: the Fed is worried about tariffs and is in no rush to lower rates. But beneath the headline the Fed signaled Quantitative Tightening (QT) for Treasuries is coming to an end. Halting QT removes $25bn of tightening per month, $300bn annualized, and makes life easier for Treasury Secretary Bessent when the debt ceiling is raised.

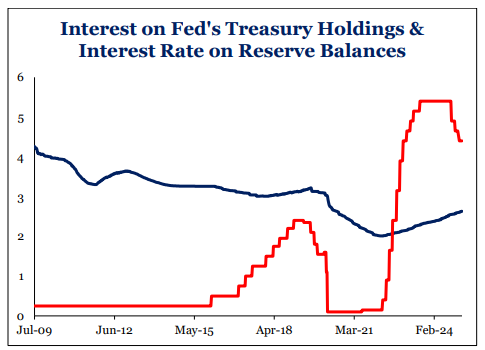

Source: Strategas. As of 2/19/25.

The Fed needs to end QT now, before the debt ceiling is raised given the current nuance of bank reserves being overstated due to debt ceiling dynamics. Keep in mind the Fed is paying 4.4% on short-term liabilities and earning 2.6% on its long-term assets. The Fed has run a cumulative $223bn deficit as it pays out more than it earns on its B/S holdings (red line shows short term funding costs, blue line shows rate of return on Fed’s bond assets).

Inflation Diffusion Index Broadening

Some might quibble with the bits and pieces of last week’s CPI report, suggesting that “one-offs” created the January jump, along with unfavorable seasonal factors, with the year-over-year core CPI up 3.3%, vs 3.2% in December.

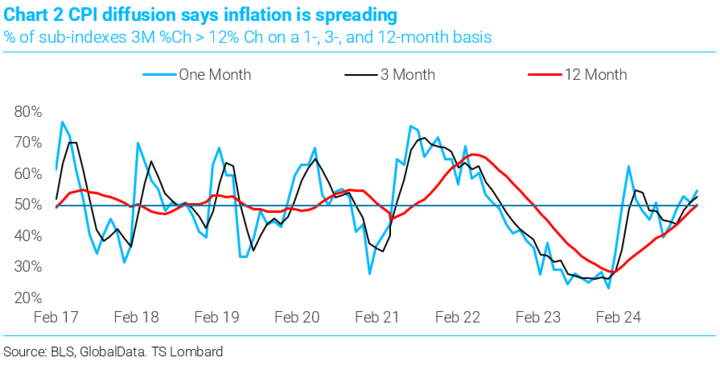

Data as of 2/14/25

But the diffusion index shows more than 50% of the CPI sub-indexes have a 3-month percent change > 12M percentage change. Inflation is becoming more widespread within the economy, further challenging the outlook for rate cuts.

Softening Labor Market Could Help Ease Inflation Pressures

Although the 143k nonfarm payroll gain in January fell short of expectations, other aspects of the report—including a 100k upward revision to November & December in addition to a drop in the unemployment rate to 4.0%—came in stronger than forecasted. The bigger picture is that the US labor market has stabilized at a healthy but not overheated level.

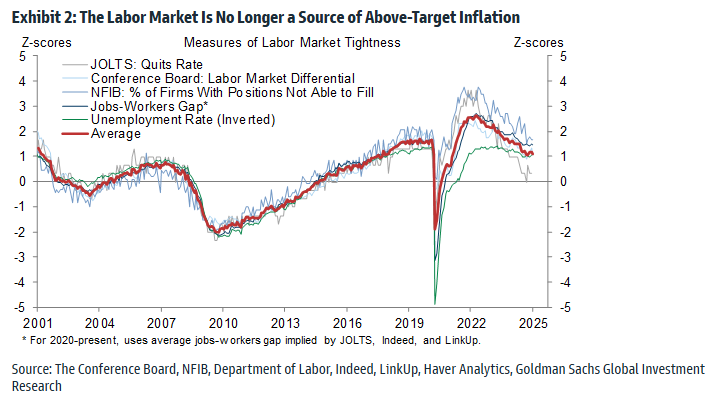

Data as of 2/15/25.

Job openings, quits, and assessments of labor market tightness by workers and firms are hovering at or just below pre-pandemic levels. Wage inflation has returned to the 3.5-4% range that we see as consistent with price inflation of ~2%, meaning the labor market is no longer a source of above-target inflation.

Truflation Inflation Index Hovering in the Mid 2s

We’ve highlighted the Truflation Inflation Index numerous times over the past couple years given its more timely inflation updates (daily vs. monthly on the CPI Index). The Index bottomed out last summer and has held in the 2-3% range since.

Source: Truflation. As of 2/17/25.

Truflation aims to offer a more comprehensive, timely, and transparent measure of inflation that can provide valuable insights and complement government indexes, given its real-time perspective on price changes. That being said, the index (as is the CPI index) is still running above levels that provide a green flag to keep cutting rates.

Shelter Inflation Now Helping Lower Inflation Calculations

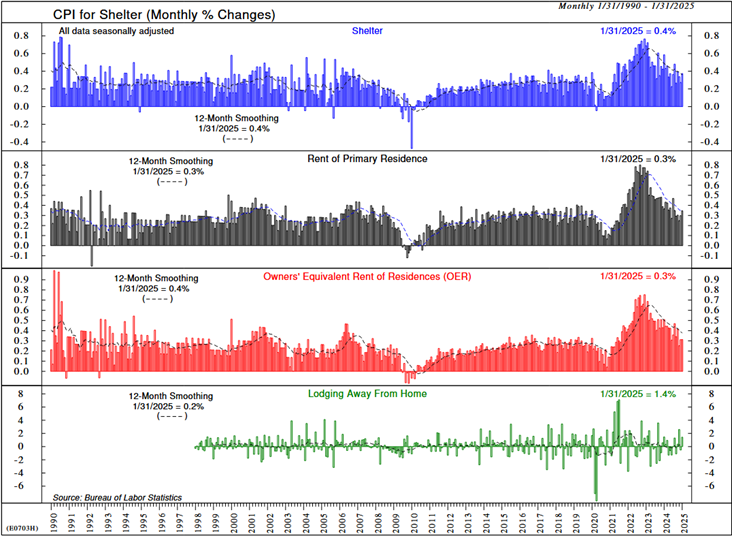

Shelter inflation should continue to weaken over the course of the year (remember shelter inflation has lagging tendencies). Interestingly, lodging away from home (accounting for only about 1% of CPI) jumped 1.4% month over month (per last weeks inflation report). This is likely the result of folks finding somewhere to live following the spate of natural disasters we’ve seen to start the year.

Source: Ned Davis Research. As of 2/18/25.

This may already be self-correcting, as LizAnn Sonders notes that the “U.S. rental vacancy rate from @ApartmentList has now surpassed the July 2020 peak (6.85%).” Given shelter inflation (including OER) accounts for about 35% of headline CPI and 40% of Core CPI, we anticipate lower shelter costs over the course of the year to continue to pull inflation numbers down, closer to target.

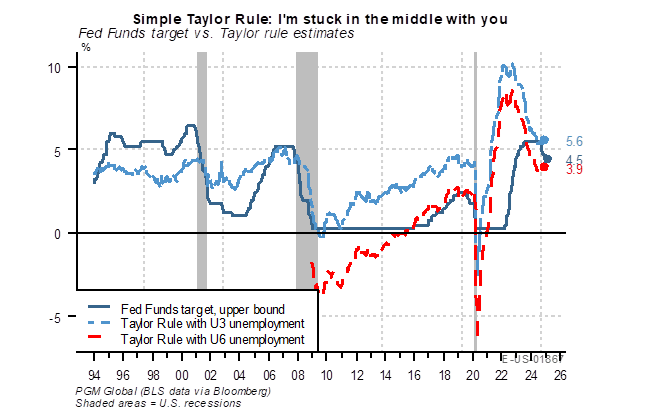

Revisiting the Taylor Rule

While short-term inflation trends can impact the Fed’s policy flexibility, the policy stance itself is heavily influenced by the institution’s models, chief among them the Taylor rule. This measure was introduced by economist John Taylor in 1993, and helps calibrate monetary policy within the context of output and inflation.

Source: Pavillion. As of 2/17/25.

When unemployment is used as a proxy for output/income, the split between Waller and the other Fed Presidents becomes apparent. Depending on how each participant views the labor market, each perceives more, or fewer rate cuts required to balance the Fed’s mandate of price stability and employment. It’s one of many imperfect measures, but one that should be closely watched as the Fed navigates the next steps in the rate-cutting cycle.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-18.