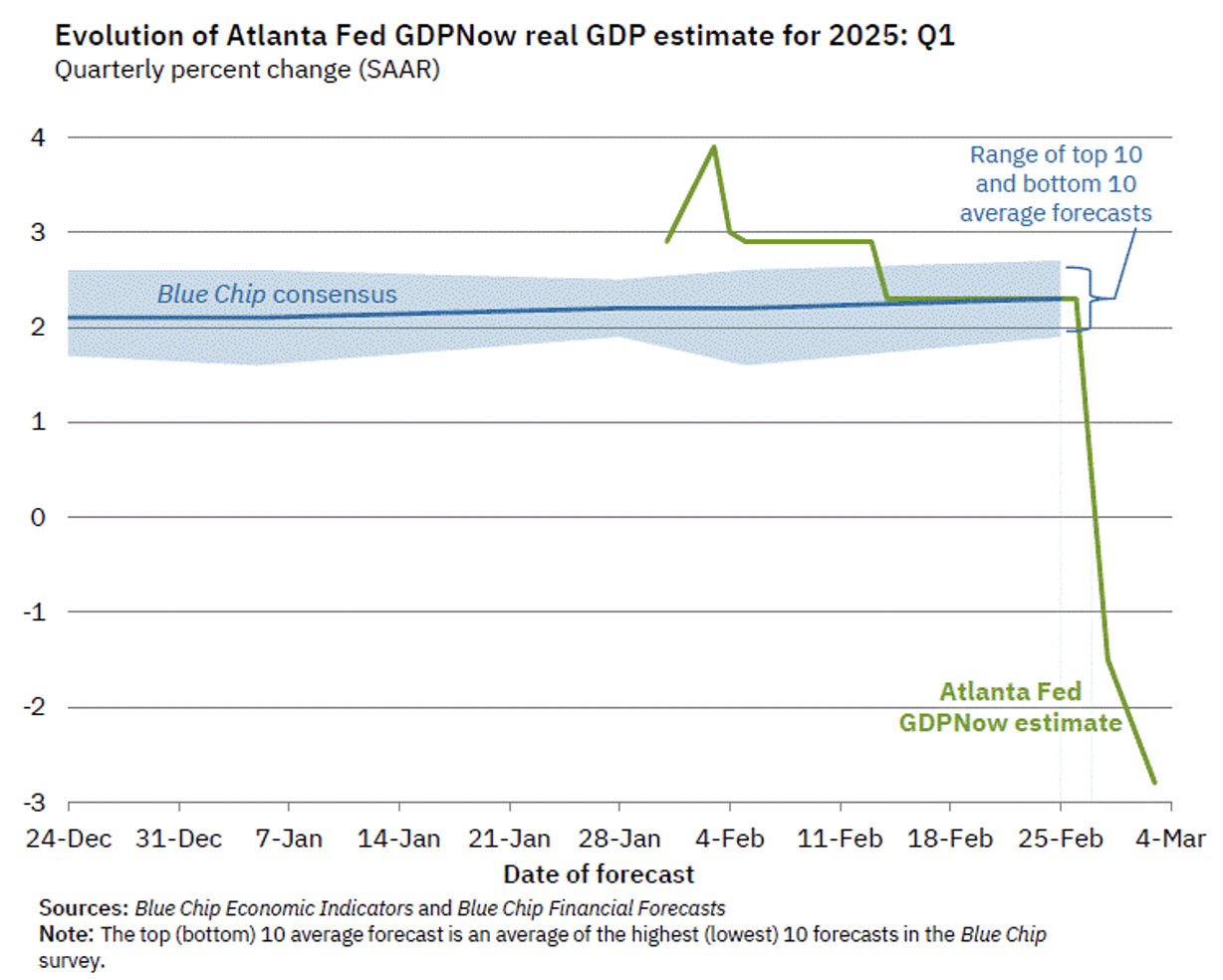

Atlanta Fed GDP Now Shows First Signs of GDP Sputtering in Several Years

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 came in at -2.8% on March 3, down from -1.5% on February 28. Following releases from the US Census Bureau and the Institute for Supply Management, the nowcast of first-quarter real personal consumption expenditures growth and real private fixed investment growth fell from 1.3% and 3.5%, respectively, to 0.0% and 0.1%.

The initial drop on February 28th from +2.3% to -1.5% can largely be attributed to accelerated imports due to potential tariff policy. The U.S. import surge would be expected to reverse over time, as quickened shipments (i.e., higher imports) build up into company’s inventories and eventually turn into sales revenues.

Source: ATL Fed as of 03.04.2025

Source: ATL Fed as of 03.04.2025

In the GDP equation, C+I+G+(X-M) imports have a negative sign, so (pending more data) GDP tracking estimates took quite a hit (thus far) in Q1. This hit likely exaggerates the ultimate economic effect (due to comments above), but it is occurring at an inopportune time, given other data points indicating growth scares from Trump’s economic policy.

GDP Components Defined

GDP = C+I+G+(X-M)

C= Consumption

I= Investment

G= Gov’t Spending

X= Exports

M= Imports

(X-M)= Net Exports, a negative number for the US given our trade deficit

For now, net exports are acting as a 3.57% drag on GDPNow’s -2.8% growth rate. If you are willing to overlook those negative effects for the reasons cited above, GDPNow would be closer to 0.77% growth. That is obviously lower than ideal but not the catastrophic scenario being portrayed by the Atlanta Fed’s model.

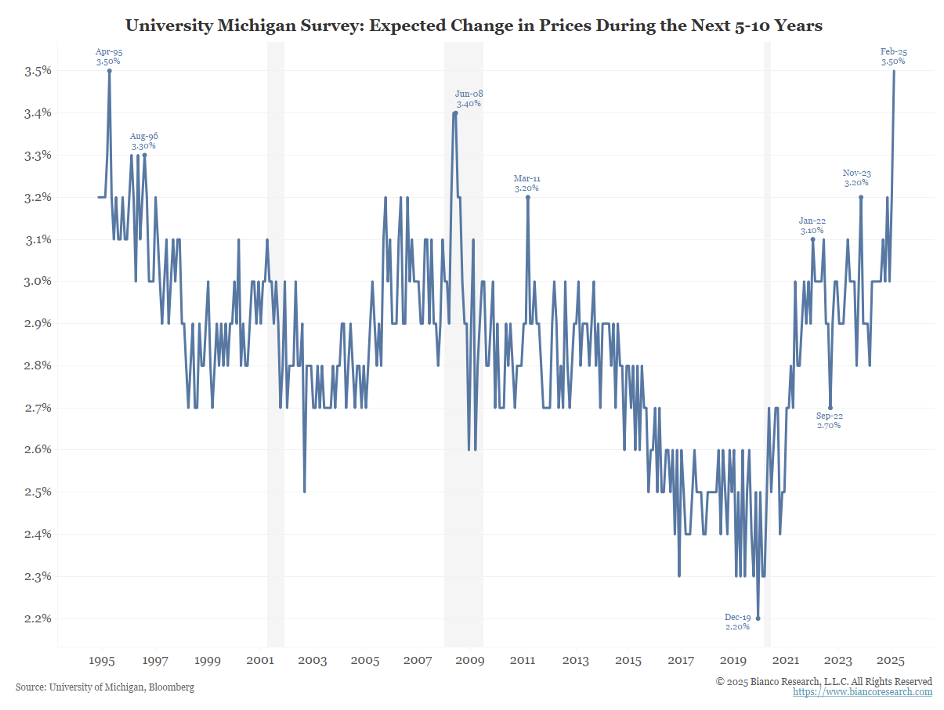

“Fed Put” Teeters on Inflation Outlook

Source: Bianco as of 03.05.2025

Source: Bianco as of 03.05.2025

St. Louis Fed President Alberto Musalem spoke earlier this week on which part of the Fed’s dual mandate he would focus on if stagflation (lower growth/ persistent inflation) became an issue.

“In determining how monetary policy should respond to alternative scenarios, especially when they might involve difficult employment and inflation trade-offs, it will be important that medium- to longer-term inflation expectations remain well anchored.”

Said more simply, sticky inflation could limit the Fed response (i.e., rate cuts) to a weaker economy. While easy to say today, when push comes to shove, we envision this somewhat bold statement could change were employment to meaningfully weaken, especially given that weaker employment would theoretically pressure future prices lower.

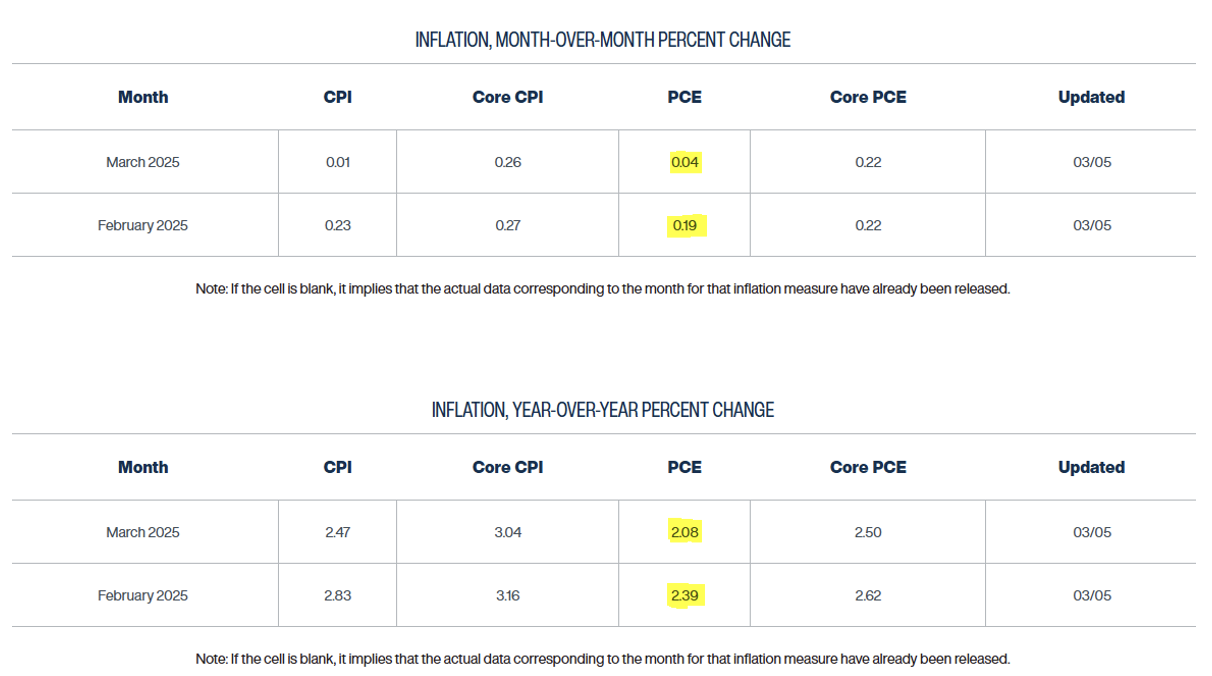

Cleveland Fed’s Inflation Nowcast Shows Closer to Target Inflation Incoming

The Cleveland Fed produces a regularly updated inflation forecast. This has been a useful metric over the past couple of years of heightened inflation to get a grip on the short-term trend. Keep in mind that the Fed’s inflation mandate targets inflation of 2% in Core PCE, not Core CPI. We think we are getting close to the “good enough” … as we’ve frequently said, we believe the mandate is 2 point something versus exactly 2%. While shelter inflation comprises a smaller portion of core PCE compared to CPI (~18% on PCE vs 32% on CPI), it still represents a significant component that has contributed to the persistence of inflation above the Fed’s 2% target.

Source: Cleveland Fed as of 03.05.2025

Source: Cleveland Fed as of 03.05.2025

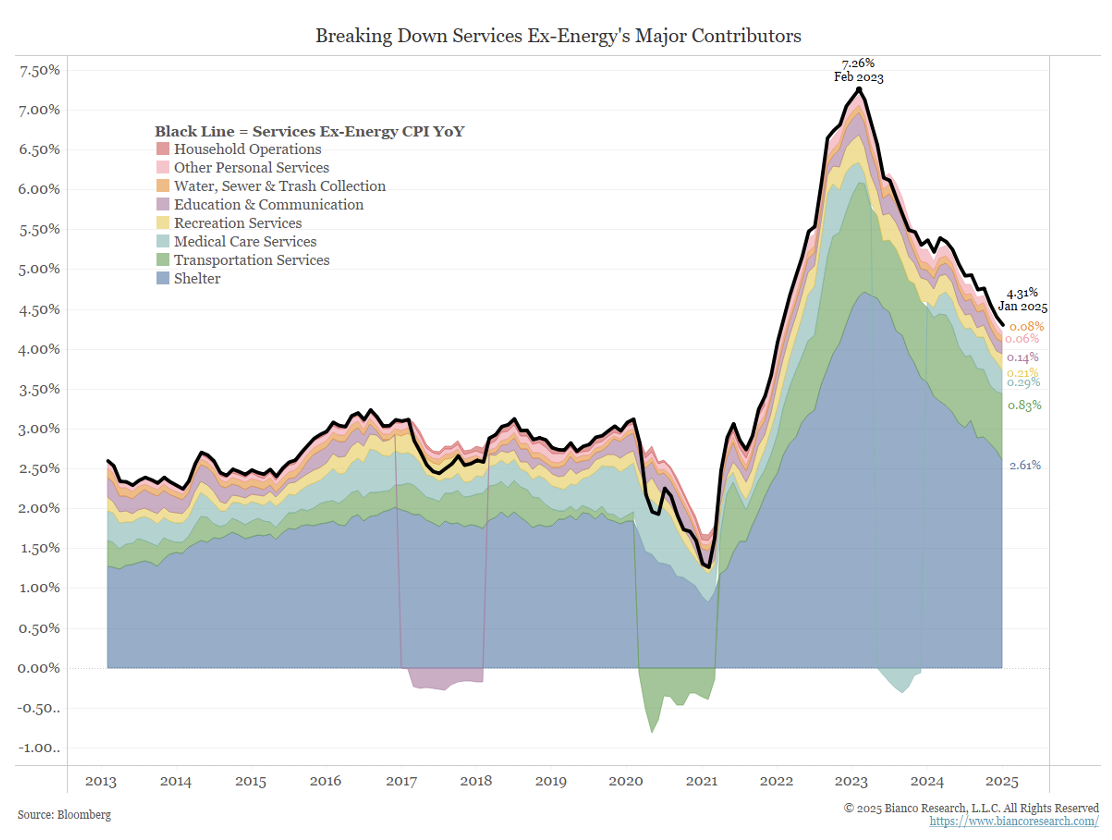

Services Ex-Energy Inflation (Shelter)

Shelter inflation is still contributing much more to inflation than its historical norm.

Source: Truflation as of 02.17.2025

Source: Truflation as of 02.17.2025

Given its lagging nature, we continue to expect stabilizing/declining shelter costs to support lower inflation. This would match the projections from the Cleveland Feds Inflation Nowcast, which calls for closer to target prints the next couple months.

However, as we’ve written about extensively, most of the other contributors (food, energy, goods) have already declined back to historical norms and have squeezed aggregate inflation down about as much as they can. It’s a little like juggling where we need to see shelter continue to tick lower without dropping the other balls (energy, food, goods, etc.).

Update on High Yield

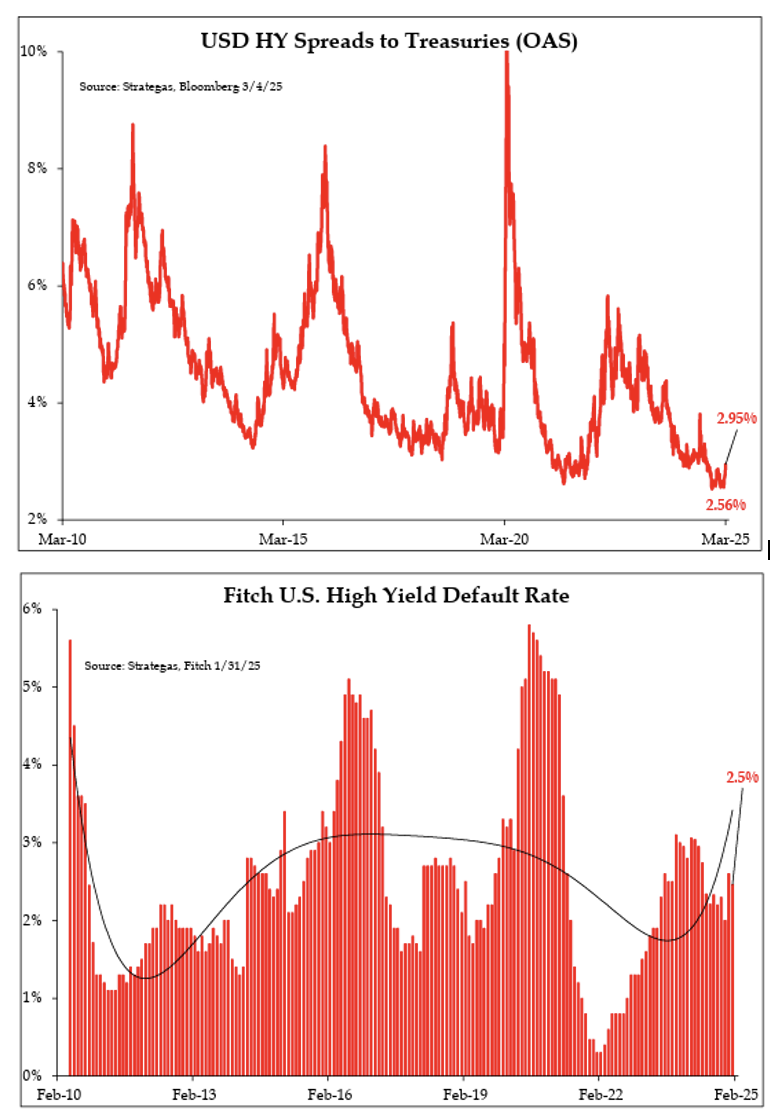

High yield spreads have risen the past couple weeks and are now sitting near 300 bps, after reaching as low as 250 bps 2 weeks ago. From a historical context, high yield spreads are still very low.

Charts Source: Strategas as of 03.04.2025

Charts Source: Strategas as of 03.04.2025

HY defaults, much like HY spreads, are still low, but they’re rising. Typically, HY defaults rise AFTER spreads spike, but in this case, defaults appear to have bottomed last fall at around 2.0% and have begun to inch higher. With defaults still low, we wouldn’t otherwise make an issue of a pickup, but the rise in spreads lends some credibility to the idea that defaults could continue to creep higher in 2025 (as the market prices in some fears of the growth scare).

HY defaults are more of a lagging indicator, at least in most economic cycles. History suggests that defaults should move back above 3.0% even if the economy does no worse than a brief slowdown. Considering HYG is currently yielding ~7.2%, a 2-3% loss rate could impact total returns. Looking at it from that perspective, there appears very little additional compensation for the associated credit risk within the broad high yield bond asset class.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-10.