CPI Update: Softer Than Feared

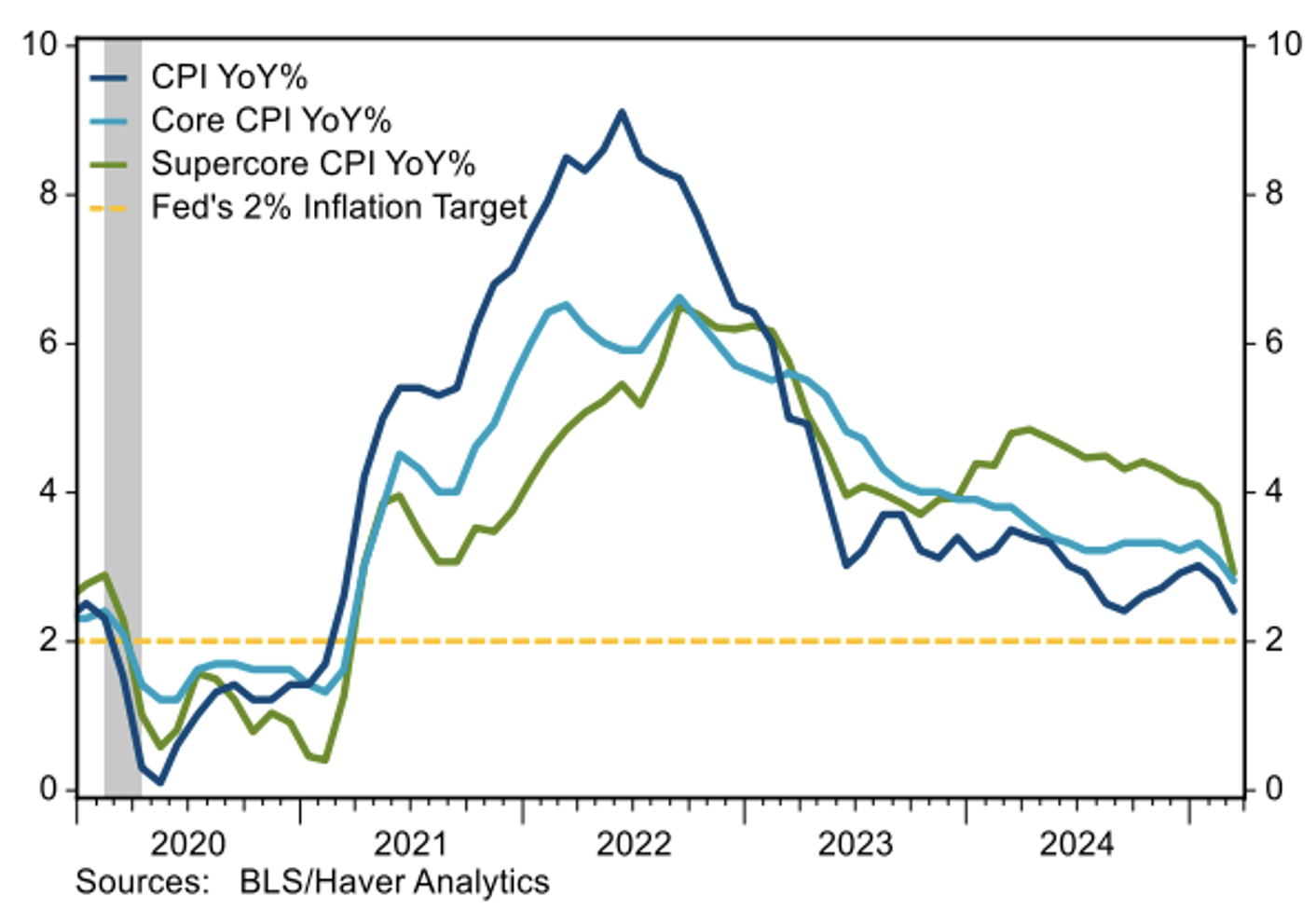

The latest inflation report showed that consumer prices cooled more than expected. The CPI fell -0.1% in March, the first monthly decline since May 2020. The median forecast expected the CPI to rise 0.1% in March. YoY, consumer prices rose 2.4%, a tenth of a percentage point less than expected which marks the second month of cooling following four consecutive months of acceleration. At 2.4%, this marks the smallest annual gain in six months.

Source: Stifel as of 04.10.2025

Source: Stifel as of 04.10.2025

Excluding food and energy costs, core CPI rose 0.1% in March, less than the 0.3% gain expected and down from the 0.2% gain in February. YoY, core CPI increased 2.8%, two-tenths of a percentage point less than expected and marked the smallest annual increase since March 2021.

As expected, energy prices were down sharply, down 2.4% MoM on a 6.2% decline in motor fuel. The drop in oil more than offset an uncomfortably large increase in food CPI, which were up 0.4% MoM, the largest increase in 26 months.

On the core goods side, prices fell 0.1% MoM on fairly broad declines, including a 0.7% drop in used vehicle prices. Prescription drug prices fell 2.0% MoM, the largest drop in records back to 1969. The breadth of declines in core goods prices puts on the back burner, at least for the time bein,g growing concerns about rising goods inflation due to tariffs.

On the services side, core prices rose just 0.1% MoM, the smallest increase in 43 months. This was despite a firmer month for housing. Owners’ equivalent rent CPI, which has finally been showing evidence of cooling, popped 0.4% higher in March. Excluding housing rents, super core services CPI plunged -0.2% MoM, also the largest decline since May 2020. The weakness in services prices was not as broad as seen in goods categories. Contributing to the drop were particularly large declines in travel-related categories. Hotel prices fell 3.5%, airfares sank 5.3%, and rental car prices fell 2.7%. To note, Delta withdrew its forward guidance earlier this week on concerns about consumer travel patterns and uncertainty from tariffs.

Interest Rate Probabilities: Can the Fed Cut Again, Yet?

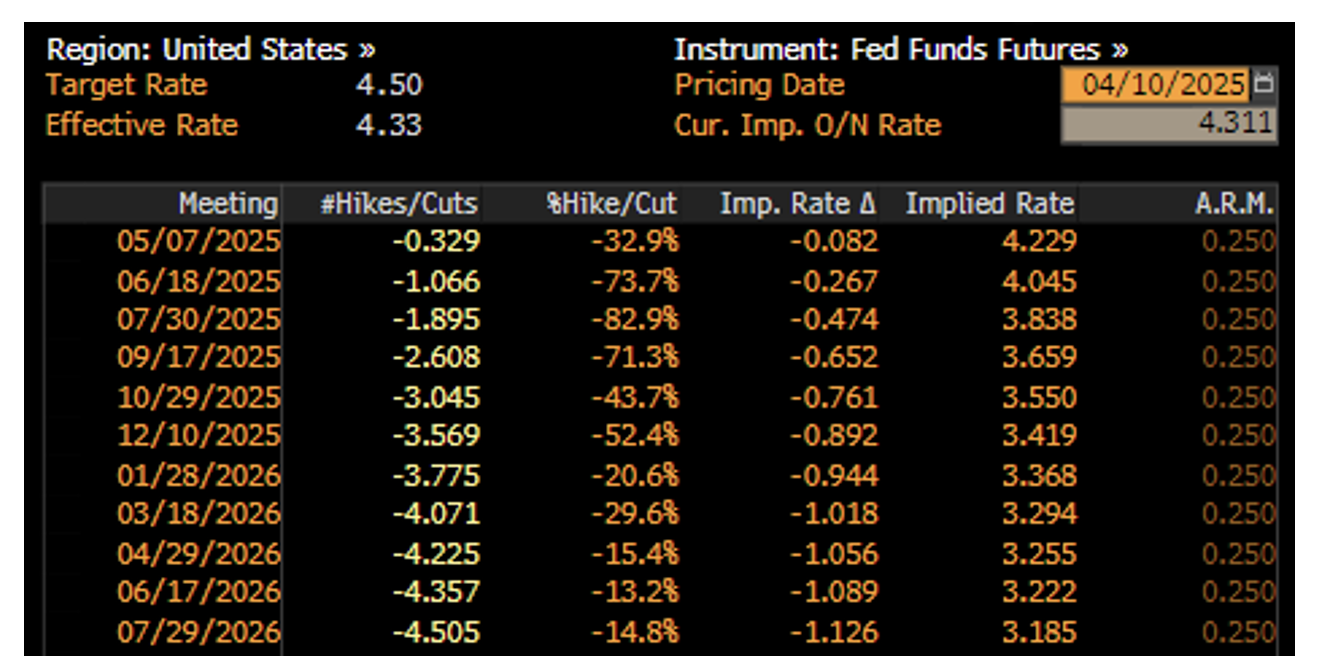

Tariffs are expected to hurt demand and economic growth, which would normally prompt the Fed to lower interest rates. But tariffs will also raise inflation, at least temporarily, which makes it harder to justify rate cuts and puts the Fed in a precarious position.

Source: Bloomberg as of 04.10.2025

Source: Bloomberg as of 04.10.2025

Minneapolis Fed President Neel Kashkari’s states an answer to how Fed policy will affect the impact from tariffs in his latest essay:

“The hurdle to change the federal funds rate one way or the other has increased due to tariffs. Why? Because tariffs are, among other things, a supply shock. There will be fewer goods available. If the Fed eases, effectively adding more money chasing too few goods, the primary effect will not be stronger growth but higher inflation. If there is a cure for tariff-related economic disruption, it is time.”

While this does not mean the Fed cannot cut rates at all, we view the current policy as still restrictive, and the Fed likely can adjust rates down to neutral. However, the adjustment should probably come after any tariff-related inflation. Given that historically, inflation has come in waves, it emphasizes the reason for the Fed to cut to neutral policy and not to stimulative policy. The downside of waiting too long is that the longer the Fed waits, the more they likely must do, which increases the chances of overdoing it.

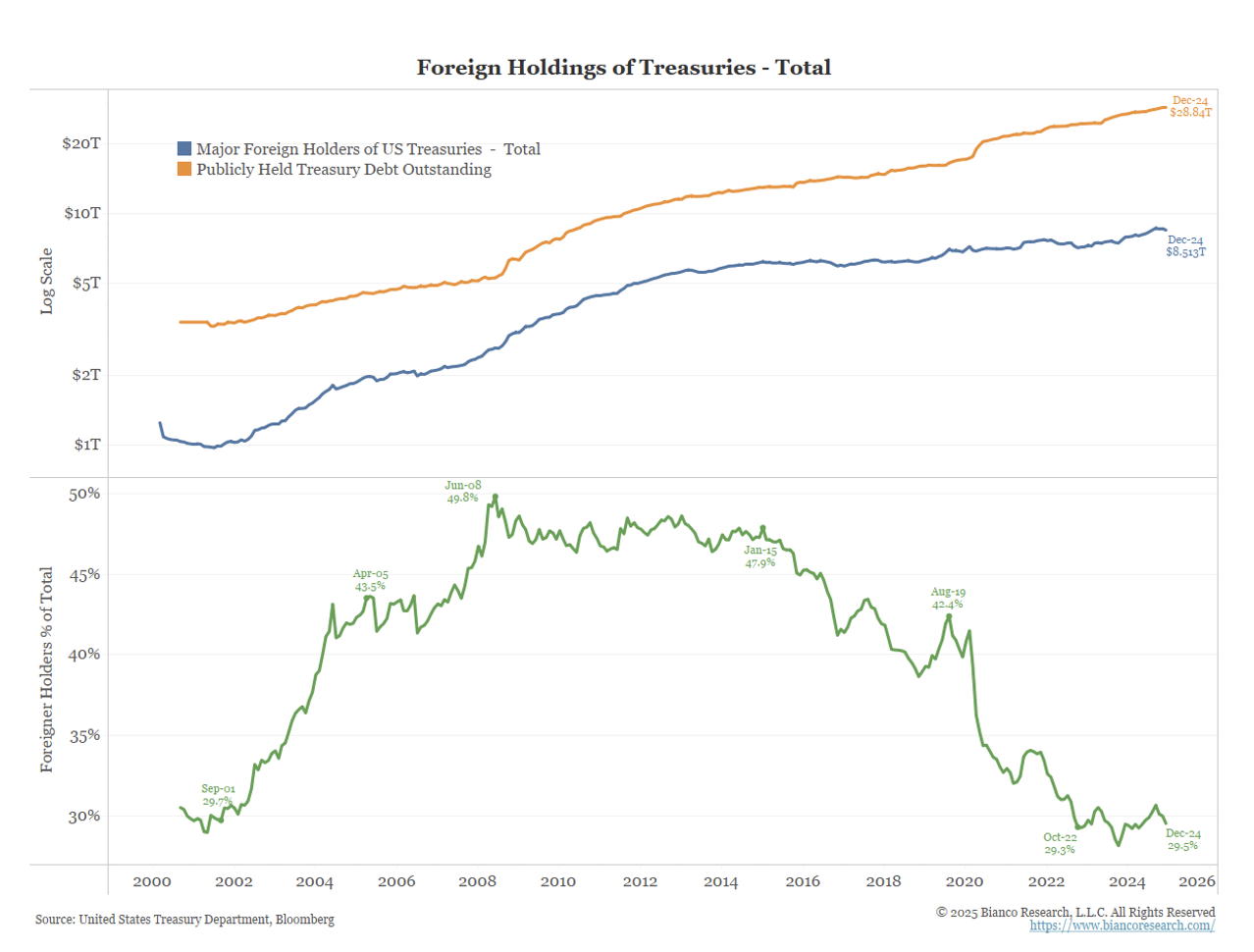

Could Foreigners Have a Buyer’s Strike on USTs?

Were foreigners to shy away from buying Treasuries would it lead to lower prices (and increase yields)? Sure, anything is possible. However, this could also mean unrealized losses in the rest of their holdings (higher yields = lower bond prices). Higher U.S. yields would likely drive their own sovereign yields higher. Would it hurt the U.S.? Yes. Could it hurt foreigners even more? Quite possibly.

Source: Bianco as of 04.10.2025

Source: Bianco as of 04.10.2025

Foreigners currently hold $8.5T (blue) of the $28.8T of publicly held debt (orange) for a total of 29.5% of debt outstanding (green). This ratio fell from 2008 until 2022 as the Fed was a huge buyer via QE.

We’ve had multiple Treasury auctions this week that have thus far proved this fear unnecessary as foreign demand has been impressively higher than expected (or feared).

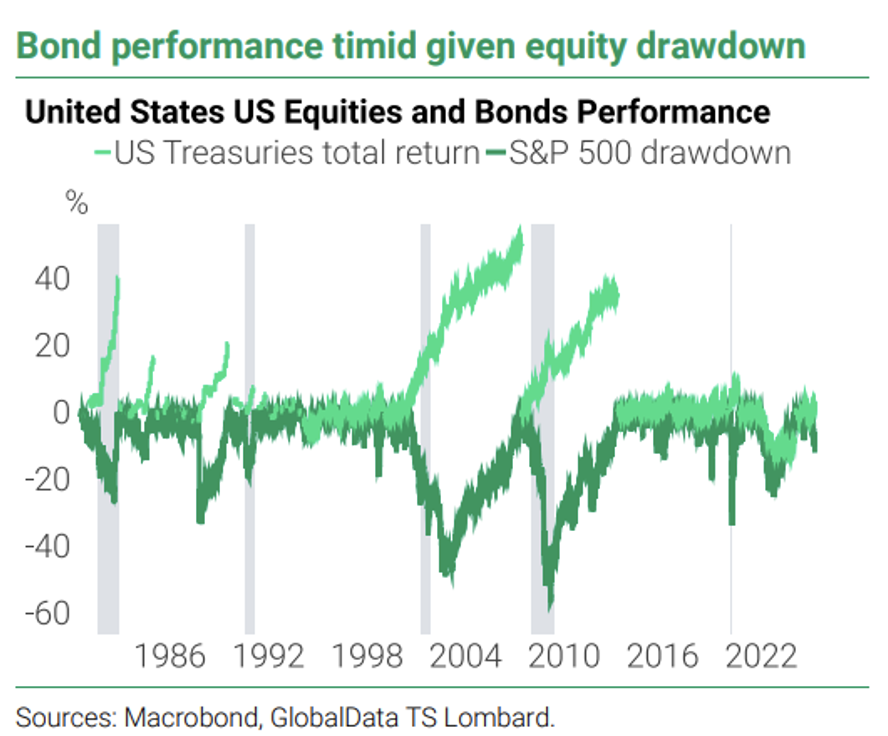

What if Bonds Don’t Hedge Stocks?

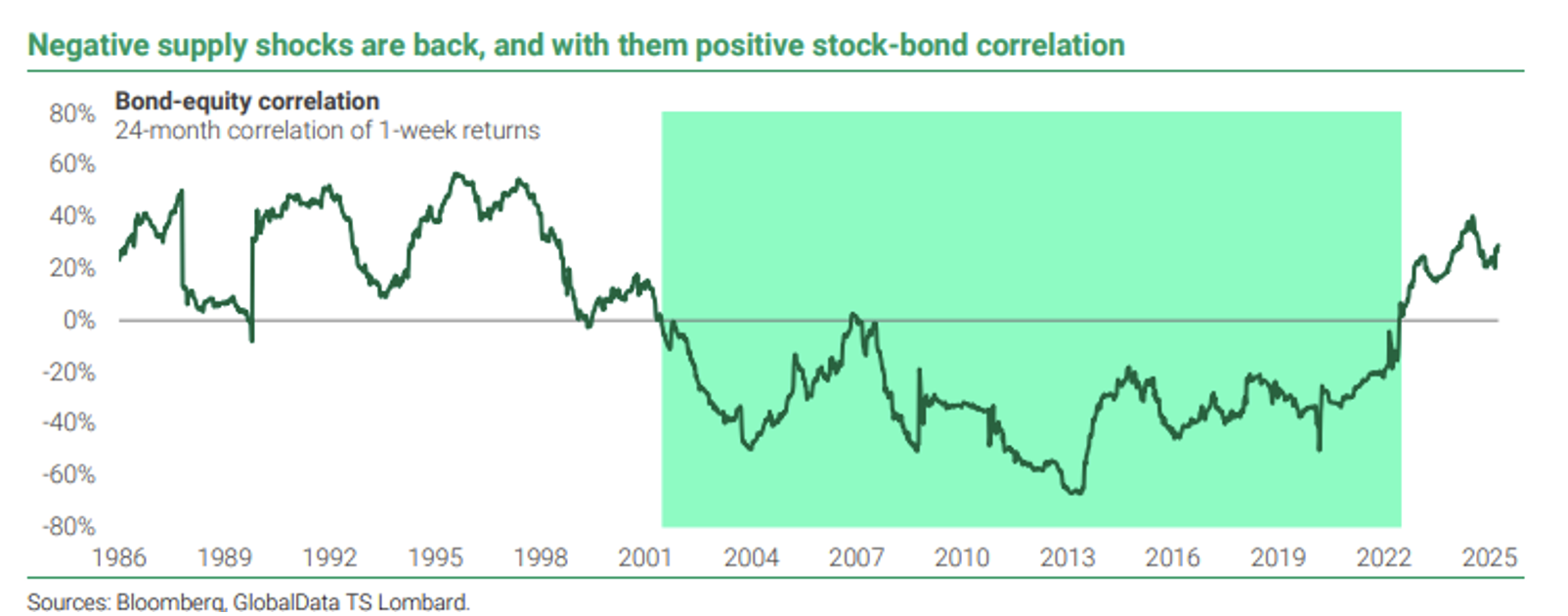

The bond-equity correlation was negative for most of the 2000s but turned positive following COVID-induced supply shocks.

Source: TS Lombard as of 04.10.2025

Source: TS Lombard as of 04.10.2025

The relationship between the asset classes has been choppy since, which has been masqueraded by strong equity markets (except for ’22). The threat of tariffs has pushed the correlation back into positive territory. Ultimately, the bond-stock correlation depends on the nature of inflation. Negative supply shock-type inflation is counter-cyclical (rising inflation = slowing growth), causing equity and bond returns to move in the same direction. The Fed’s hand of a) potentially slower growth and b) higher prices, puts them in murky territory.

Bonds Have Shown Limited Benefit Thus Far in 2025

Source: TS Lombard as of 04.10.2025

Source: TS Lombard as of 04.10.2025

A strong US bond rally has not fully materialized as the market has to balance the prospective hit

to US GDP growth and the inflationary impulse that Trump’s declared renaissance in US manufacturing could bring. While 10yr yields could drop in the event of the dreaded recession, we believe the impact will be muted and after the initial decline, we expect higher yields in reaction to the policy response.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-16.