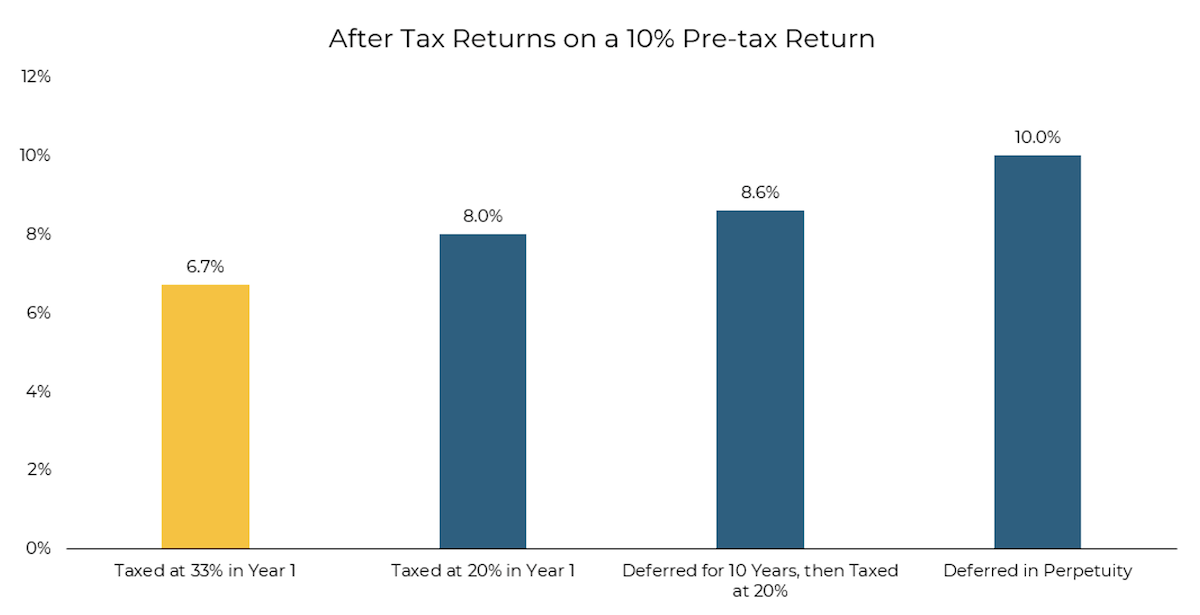

Most discussions about tax efficiency focus on maximizing after tax returns, and for good reason. The math is compelling. Consider a 10% pretax return: at a 33% short term tax rate, it becomes 6.7% after taxes if taxed annually. If held for just over a year and taxed at the 20% long term rate, that same return becomes 8.0%. Defer taxes for a decade, and the 20% rate applied at the end turns the 10% pretax return into an 8.6% annualized post tax return, thanks to tax deferred compounding. And if taxes are deferred indefinitely, a 10% pretax return remains a full 10% post tax.

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

Yet tax aware strategies offer another, often overlooked benefit: they can reduce portfolio volatility, particularly during market downturns. This insight is clearly articulated in Partners Capital’s white paper, The After-Tax Investment Lens: The Key to Tax Efficient Investing. For high tax rate investors, controlling the timing of gains and losses can make after-tax cash flows significantly less volatile than pretax returns. This concept builds on our previous posts about how tax deferral enhances compounding, but here we take it a step further by showing how it also improves the investment experience.

The Symmetry of Traditional Taxation

Under many circumstances, taxes reduce both gains and losses. If you make $100,000 and pay a 33% tax rate, you net $67,000. If you lose $100,000, you have the potential to offset $33,000 of taxes on existing or future gains at the same rate through a tax credit over any subsequent years in which you have realized gains. This symmetry helps soften both sides of the return profile, reducing what you keep in up years, but also cushioning the blow in down years. Partners Capital illustrates this with a taxable California investor. A portfolio with a 13% maximum pre-tax drawdown may only result in a 7% after-tax decline in relative cash flow. That’s a meaningful reduction in felt volatility.

Making the Tax Impact Asymmetric

Tax-deferral strategies can disrupt this symmetry in a favorable way. They allow investors to realize gains at their discretion, often years later or when an investor can offset these gains with harvested losses when they are most beneficial, while taking losses to be used to offset gains elsewhere in a portfolio. This optionality creates an after-tax asymmetry: winners can potentially compound untaxed for years, while losses may provide immediate tax relief. The IRS doesn’t take a share of gains until you sell, but it effectively subsidizes part of your losses the moment you realize them if used to offset gains.

The result is a more balanced risk return profile. Investors retain full upside exposure while receiving tax relief on the downside, tilting the tradeoff in their favor.

A Simple Illustration

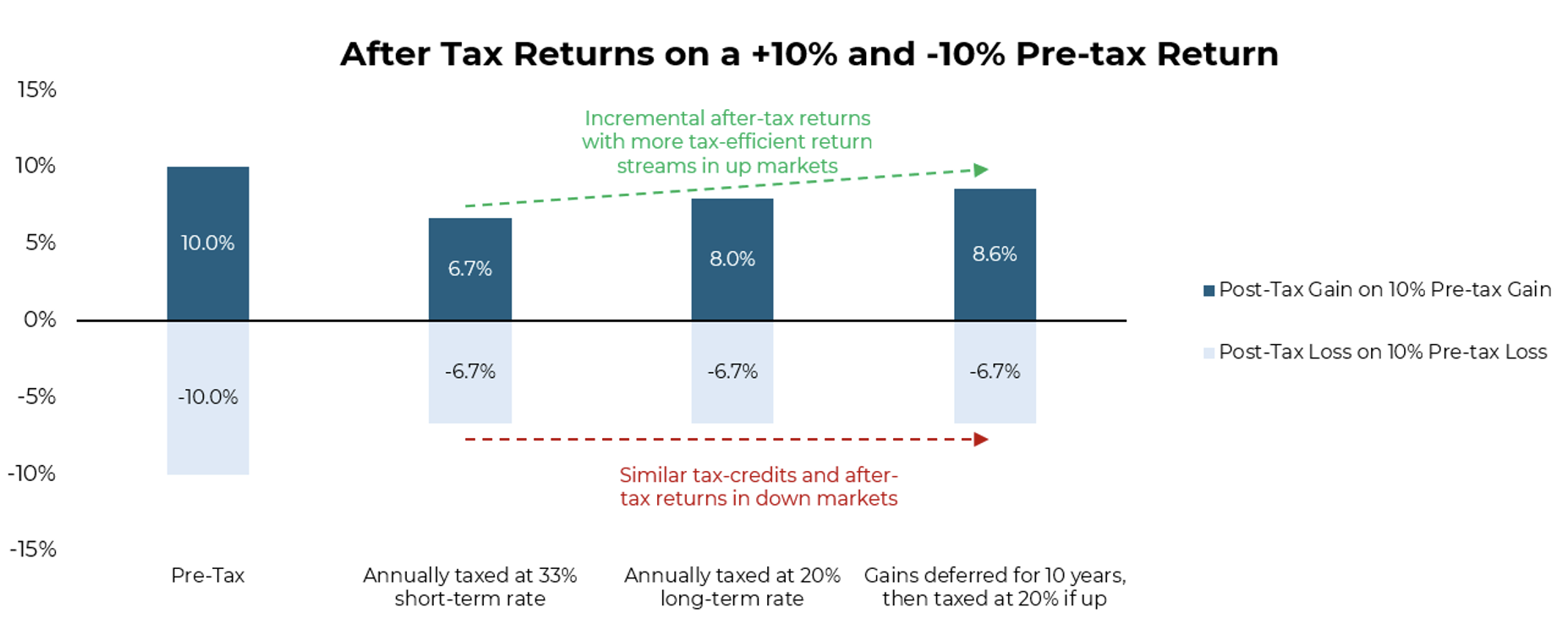

Let’s compare two strategies that each return either +10% or -10% in a given year.

Strategy A: Deferred Gains

-

- Gains are taxed at an assumed 20% rate when realized over a period of more than one year

- Losses used to offset gains that would otherwise be taxed at an assumed 33% rate when realized over a period of less than one year

After tax, a +10% gain becomes +8% if deferred to long-term rates, 8.6% if deferred for 10 years, or 10% if deferred indefinitely. Meanwhile, a 10% loss effectively feels like 6.7% after tax if used to offset short-term gains.

Strategy B: Tax-Inefficient (e.g. Bonds)

-

- 10% yield is taxed annually at 33% when received in a 10% return year

- 10% yield and -20% price return in a -10% return year

Here, a +10% return becomes roughly +6.7% after tax. But in a 10% loss year, the 10% coupon is still taxed at the short-term rate, and given capital losses cannot offset more than $3,000 of income annually the investor must find offsetting gains for the full 20% price decline (versus the 10% loss in the tax efficient scenario) to match Strategy A’s 6.7% after tax impact.

A simplified chart demonstrates how deferring gains while harvesting losses creates an asymmetric benefit: it increases the return on the upside by the tax savings, while on the downside it captures the full tax credit of a loss, even the ability to offset short-term gains that would otherwise be taxed at a higher tax rate).

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

In other words, a strategy that can defer gains can offset similar (or more) of the tax downside than it sacrifices on the upside. That’s the asymmetry.

Why It Matters

For investors, it’s not just about total return. The path matters too. A strategy that generates tax assets in bad years while letting winners run untouched creates a smoother after-tax experience. While pre-tax volatility may remain unchanged, the actual impact on an investor’s wealth is reduced. Partners Capital argues this effect is so powerful that taxable investors can justify a higher equity allocation. The example they use is increasing equity-like exposure from 63% to 80%, given the muted after-tax drawdowns. In other words, taxes may allow for greater risk taking if losses are effectively monetized.

When combined with the compounding benefits of tax deferral, the case for tax-efficient strategies grows even stronger. Investors benefit from both enhanced growth and a potentially smoother ride.

Final Thought

Tax efficiency isn’t just a return enhancer. It’s a way to manage risk more effectively by increasing the control an investor has in taking (or deferring) gains and losses. The ability to defer gains and harvest losses creates a better after-tax outcome on both ends of the spectrum.

Disclosures

Past performance is not indicative of future results. This material is not financial or tax advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed and all calculations may change due to changes in facts and circumstances.

*Aptus Conceptual Illustration: Information presented in the above charts are for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-22.