President Trump Critiques the Fed

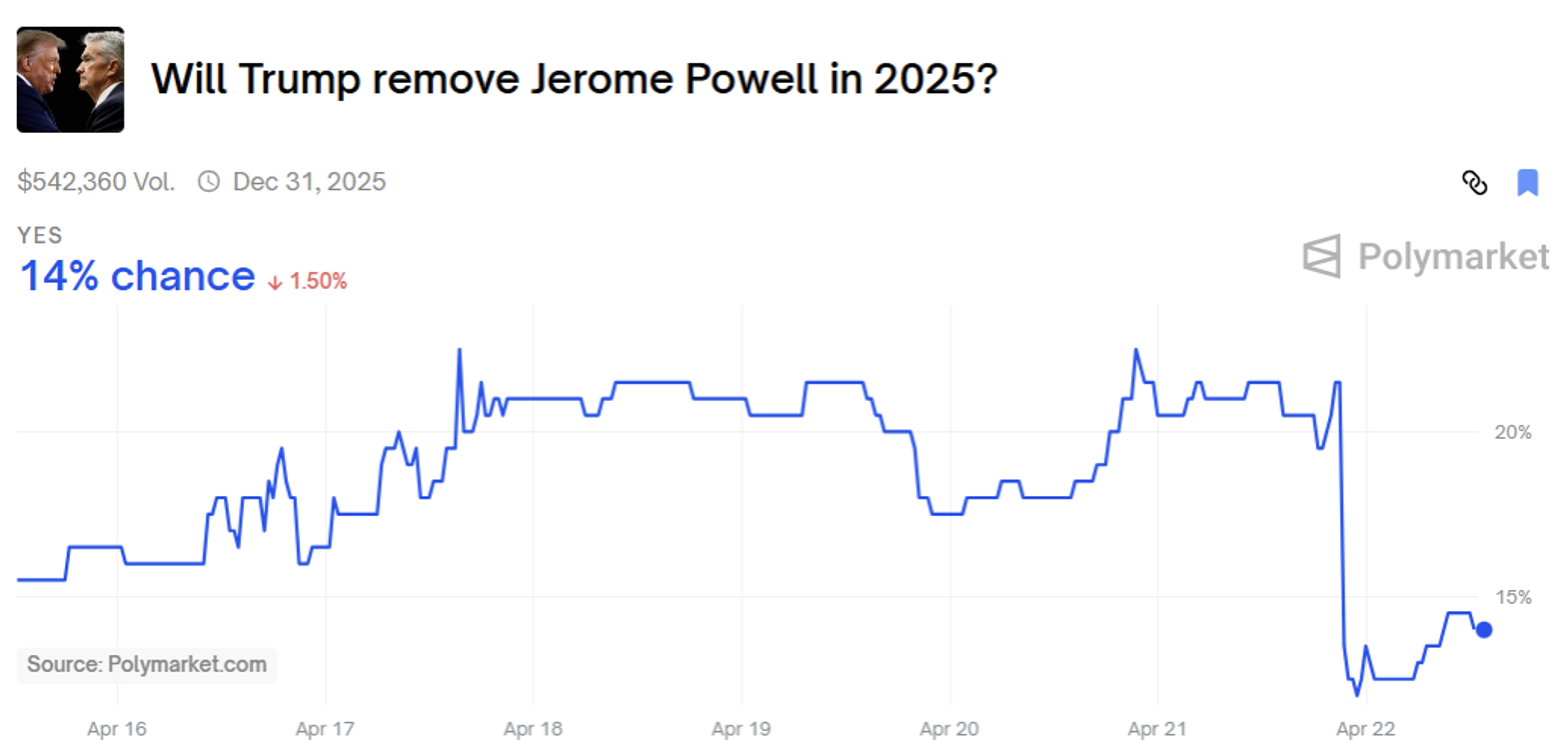

Earlier this week, President Trump indicated he thinks the Fed should be “early, or on time” cutting rates, but not “too late,” adding it is “a perfect time to lower the rate.” Pressed by a reporter asking if the President has the power to remove a Fed Chair, Trump added, “I don’t want to talk about that, because I have no intention of firing him.”

Source: Polymarket as of 04.23.2025

Source: Polymarket as of 04.23.2025

Long and intermediate duration Treasury yields reacted by falling significantly lower, as faith in central bank independence has been (for now) restored. What the change in rhetoric does is give the President the ability to blame the Fed if the economy slows significantly, especially if inflation turns out less severe than feared. There will be no doubt in anyone’s mind the rate path Trump favored, which is why we found the Bloomberg News headline declaring “Powell may have quietly won Trump’s one-sided war with the central bank” as a bit comical.

If, in six months from now, inflation is in retreat and unemployment is low, Powell will clearly have made the right policy decision, and Trump will take a bow for overcoming his gut instincts and backing off from trying to remove Powell a year early. On the other hand, if the economy is in recession, unemployment is high, and inflation falls through 2% because the Fed kept policy restrictive for too long, the President can point to the Fed’s excessive caution under its “too slow” Chairman.

In effect, the President has turned a spotlight on the Fed’s forecast and participants’ repeated reluctance to cut rates. As a result, the FOMC is under immense pressure to get policy right. Remember, the Fed’s own analysis of the 2018 tariffs showed a much bigger negative influence on growth than positive influence on inflation. My take is that the Fed passes on a May cut based on perception but likely cuts again in June.

Fed Commentary on Direction of Policy

Federal Reserve Board Governor Adrianna Kugler warned that the tariff impact is “likely larger than expected” and echoed other participants in calling for rates to be left unchanged until the Fed is certain inflation is contained. Other Fed speakers (Austan Goolsbee, Alberto Musalem, and Beth Hammack) communicated a similar message.

The problem with so many Fed participants repeating the “keep-policy-restrictive-until-certain message, even as each, on an individual basis, qualifies their warnings by underscoring forecast uncertainty, is that it has locked the FOMC into a course of action that (if wrong) will justify the President’s criticism. I think it might be a better strategy to be a little less emphatic. They can still vote to keep rates unchanged, after all, even if they do not paint themselves into a policy corner.

Fed Already Performing a Type of Yield Curve Control (YCC)?

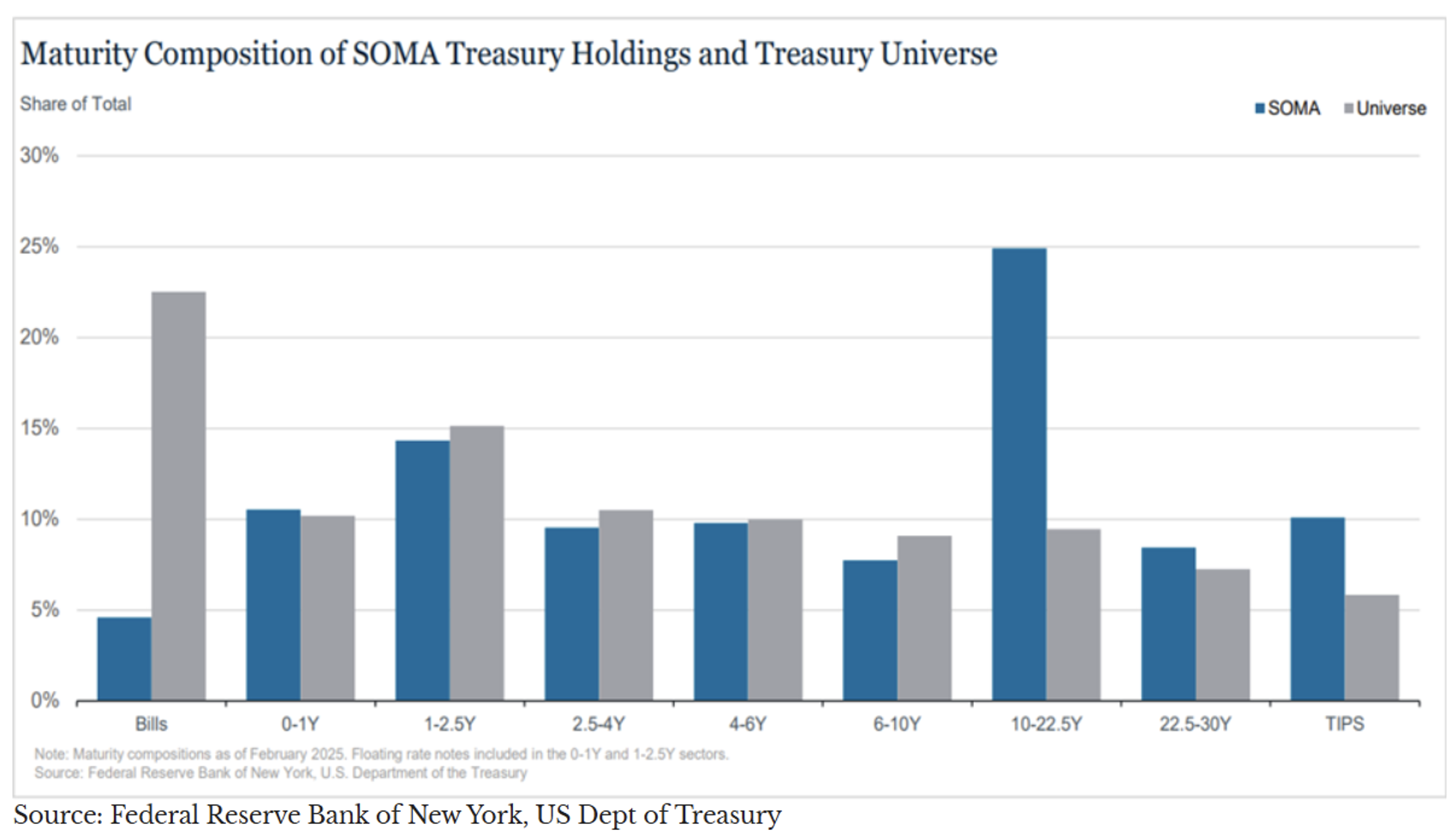

Former Treasury Secretary, Professor Yellen, shifted an increasing share of issuance to the front end of the Treasury curve. This can be seen below with the large, ~22.5%, share of Bills issuance relative to the other tenor buckets.

Data as of 04.20.2025

Data as of 04.20.2025

The Fed, on the other hand, has clearly not matched its holdings to the tenor proportions of the Treasury’s issuance. The Fed has a significantly disproportionate amount of their holdings, ~25%, in the 10 to 22.5 year bucket. The Fed’s Quantitative Tightening has been a dollar-based gradual decline, not a duration-based decline.

One could certainly question whether the Fed has been trying to aid the Treasury in the management of the lack of market appetite for longer duration bonds. We might point to this and claim that the Fed continues to provide a level of support to the Treasury in coping with the problems of excess debt and glimpses of fiscal dominance. These actions have made it easy to think that the Fed (and all the past Quantitative Expansion) has played a key enabler role in getting to this point.

Short and Mid Duration Inflation Swaps Telling a Different Story

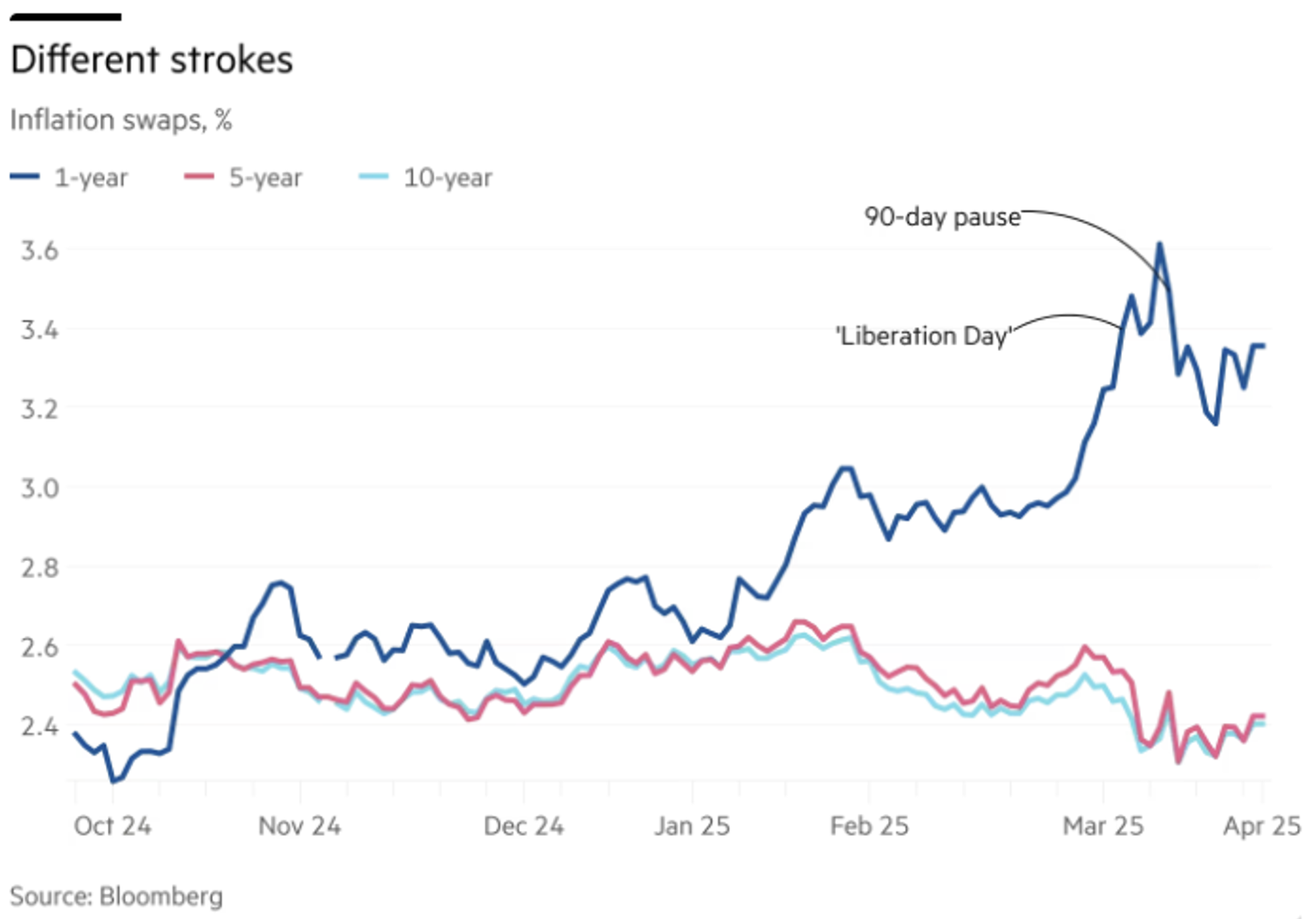

Considering the hotter than hoped CPI readings to start the year and the high level of uncertainty regarding tariff policy on price levels, the market has struggled with the fear of higher price pressures in the short term. While fears have come down since Trump’s “Liberation Day” and ensuing 90-day pause, short-term inflation expectations measured by 1 year inflation swaps remain elevated.

Source: FT as of 04.23.2025

Source: FT as of 04.23.2025

On a positive note, longer term inflation swaps (5 & 10 years) show no worries of elevated inflation lingering into the future. We’d imagine one of these is mispriced, and based on the price impacts from tariffs in Trump 1.0 and the tamer language from Trump in the past couple of weeks, we’d bet inflation fears in the short term could be overdone.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2504-27.