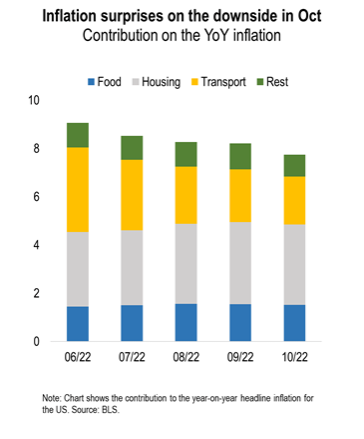

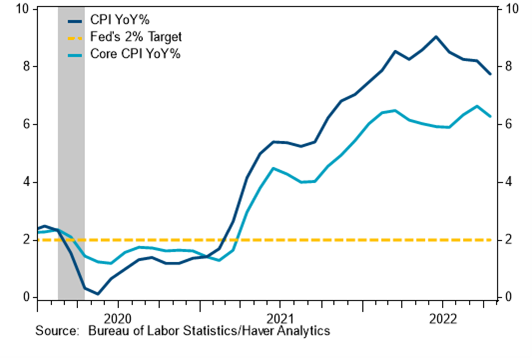

Year-over-year, CPI rose 7.7%, down from the 8.2% pace reported the month prior and the fourth consecutive month of cooling price pressures, albeit still near a four-decade high. It rose 0.4% in October, less than the 0.6% gain expected and following a similar increase in September.

Source: Numera 11.10.2022

Excluding food and energy costs, the core CPI rose 0.3%, less than the 0.5% gain expected after a 0.6% increase in September. Year-over-year, core CPI increased 6.3%, down from the 6.6% gain the month prior.

Source: Stifel. As of 11/10/22.

CPI m/m: +0.4% (vs +0.6% exp)

CPI y/y: +7.7% (vs +7.9% exp)

Core m/m: +0.3% (vs +0.5% exp)

Core y/y: +6.3% (vs +6.5% exp)

Differences between Core and headline CPI m/m were driven by Food +0.6% vs Energy +1.8%.

On the jobs front, initial jobless claims rose 7k from 218k to 225k in the week ending November 5, a four-week high. They were expected to rise to 220k, according to Bloomberg. All in all, a good morning for the Fed.

Our Thoughts

Source: Twitter. As of 11/10/22.

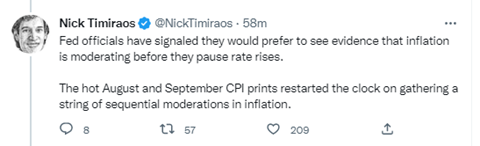

This is an encouraging report for the Fed but doesn’t mean we see a change of plans from the Fed. They’d like to see a series of month-on-month core numbers that annualize to something in the direction of 2%. The past three months still annualize to ~6% and the last two months annualize to 5.4%.

The report will probably cement a 50-bp hike in December, unless we see a monster November jobs report / CPI report December 13th. They’ve expressed a desire for clear slowing, which we haven’t yet seen.

Source: Bloomberg. As of 11/10/22.

From here, we are encouraged by the slower than expected inflation but the biggest question from here is the peak rate, and unless we get several reports like this one, we think ~5% remains a good estimate for the terminal rate.

The Details

We saw a sizable decline in used cars -2.4% and health care services -0.6%. Core goods in general were also soft at -0.4%. Shelter stayed elevated at 0.8%, but OER and Rent lag market rents and are reflecting peaks in those areas this time last year. Market rents have slowed sequentially and thus there is a good runaway for a slowing in OER and Rent in 2023 although we expect elevated prints for the next several months.

The unrounded core increase was +0.27% m/m, which is the softest print since Sep 2021.

We do know year over year comps get easier for a deceleration in inflation. We continue to believe that wage inflation is still a big problem. We also see energy inflation coming back (absent a Russia-Ukraine deal) following the end of SPR releases after the elections.

We will get a number of Fed speakers today and the rest of the week – we will closely watch to see if they continue with the hawkish message or not.

But 50 bps in December is now the base case: @NickTimiraos:

Source: Twitter. As of 11/10/22.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers. The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2211-9.