Jackson Hole

Fed Chair Powell’s message last week at Jackson Hole was direct. The Fed won’t be taking victory laps over inflation just yet. Powell noted “we are navigating by the stars under cloudy skies … we will keep at it until the job is done.” Reminds us of Volckers book, “Keeping at It”.

Source: Amazon.com

Source: Amazon.com

Powell gave minimal guidance on future policy, instead emphasizing the Fed’s data dependence. Powell did not commit to delivering on the dot plot, which calls for one more hike. Instead, he said that the Fed will “proceed carefully” and be guided by the data in terms of whether to tighten further.

One last important point. Market participants had a lingering “hope” that the Fed would use the inflationary policy error to raise the inflation target. This was rightly nixed by Powell as a shift would in our opinion be a massive blow to Fed credibility. While the inflation target isn’t moving in the near term, it does seem likely that “2-point-something” would be tolerated.

Interesting Sentiment Divergence

Source: Bloomberg as of 08.28.2023

Source: Bloomberg as of 08.28.2023

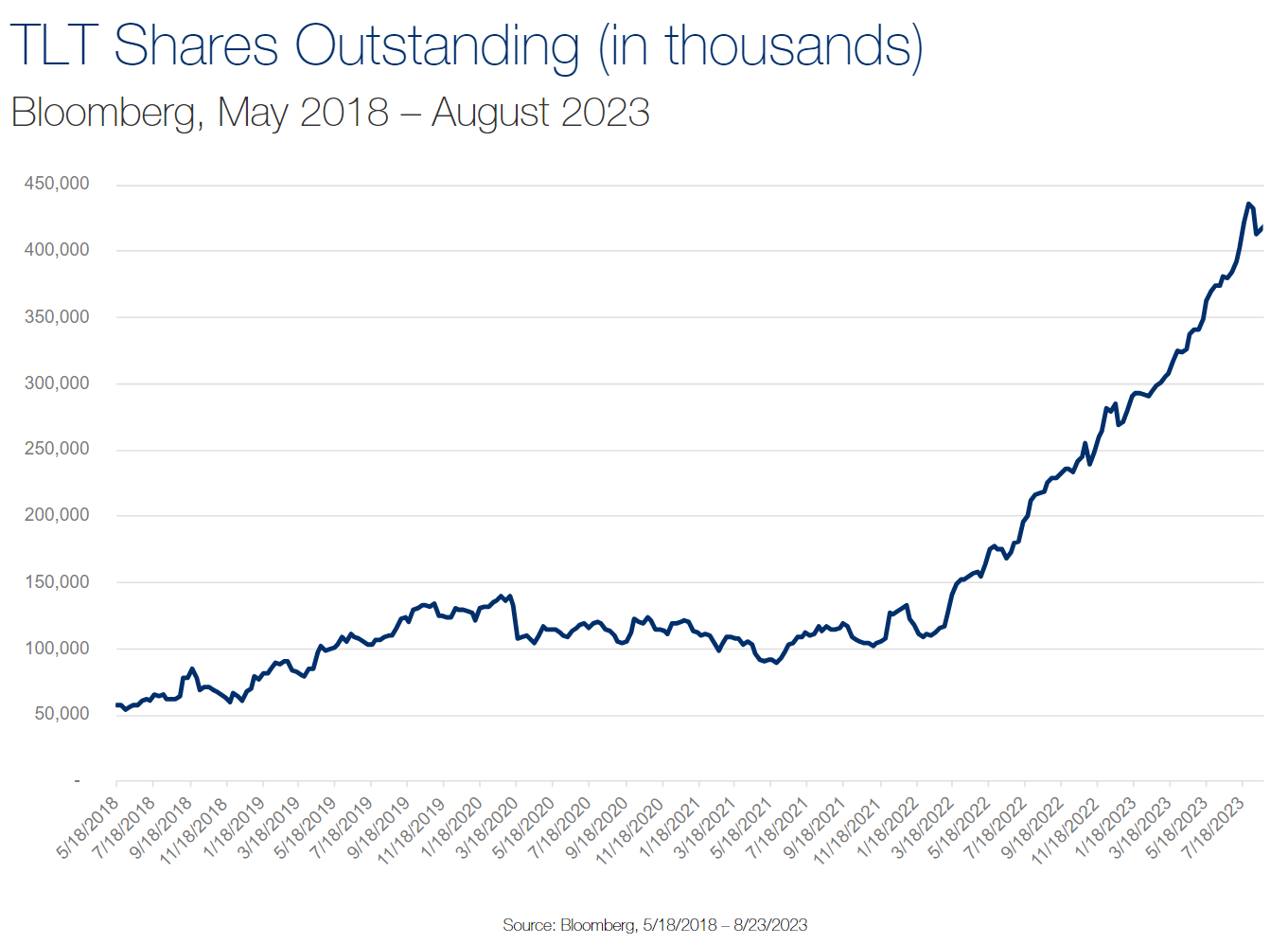

A Few Highlights From Citadel on TLT (20+ year Treasury ETF)

We have seen a significant rise in TLT activity from both retail and institutions as bonds have gotten more volatile.

- TLT shares outstanding have risen by 260%, aka ~300mm shares since the Fed started raising rates in March 2022. Comparatively, shares outstanding in SPY and QQQ are only +1-2%.

- TLT ranks as the #1 name for net retail inflows on Citadels entire platform over the past 6 months.

Source: Bloomberg/Citadel as of 08.24.2023

Source: Bloomberg/Citadel as of 08.24.2023

Thoughts from Aptus Desk

- The trailing 12-month US fiscal deficit hit $2.26 trillion, or nearly 9% of US GDP

- We are running crisis level deficits with Unemployment Rate ~3.5%

- The US Gov’t must print money to pay the deficits with 5+% rates

- ~$1.9 Trillion to be issued into the back half of 2023 with no Central Bank buying

Bottom line: While retail is pouring capital into long-term bonds (expecting price returns in a recession), professional investors aren’t so sanguine.

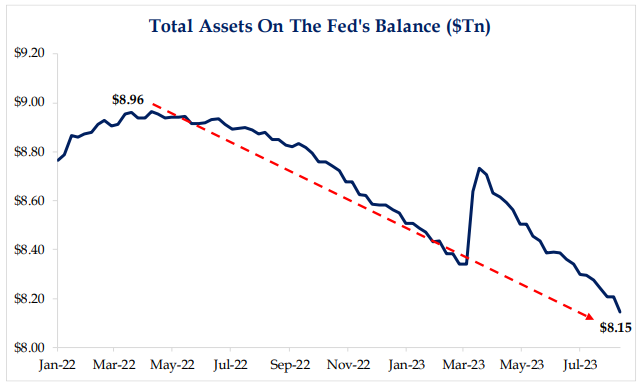

Fed’s Balance Sheet Has Declined by $800 billion+

One of the most interesting lines from the recent FOMC minutes was, “A number of participants noted that balance sheet runoff need not end when the Committee eventually begins to reduce the target range for the Federal Funds rate.”

Source: Bloomberg/Citadel as of 08.24.2023

Source: Bloomberg/Citadel as of 08.24.2023

These comments disconnect the Fed Funds rate direction from their balance sheet policy. This move suggests that the Fed could choose to lower the short end (eventually once inflation is conquered) but keep back-end yields high with the balance sheet.

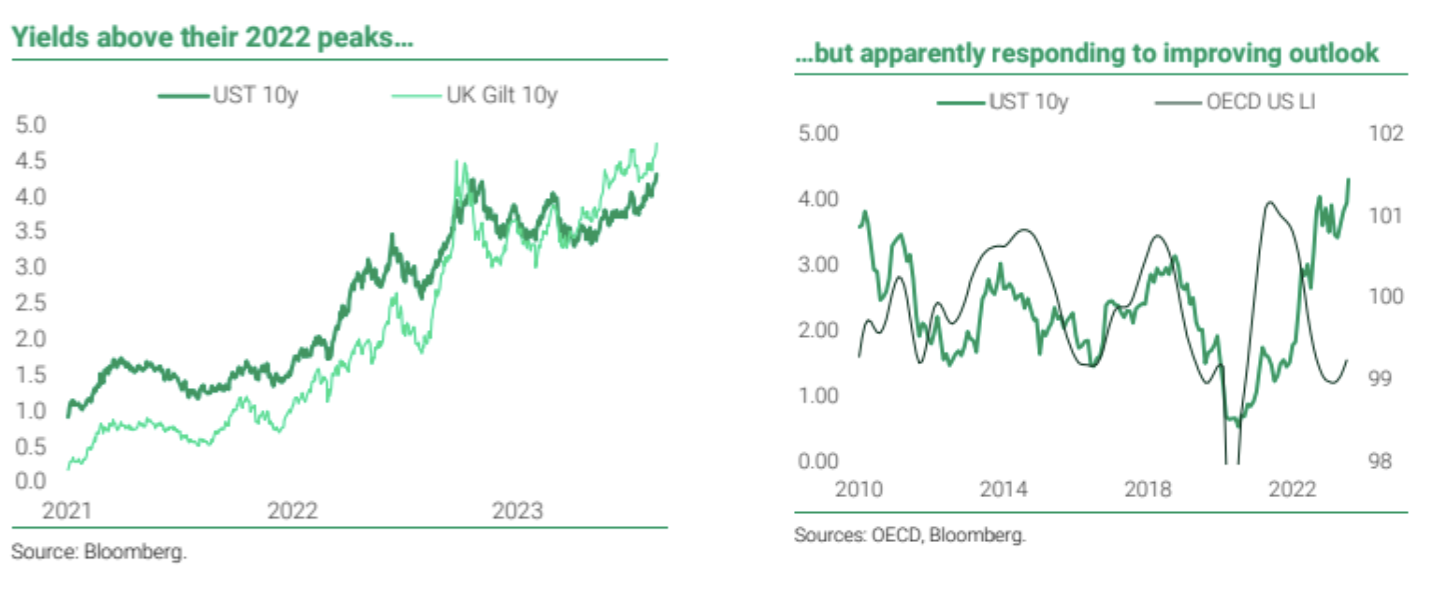

Longer Term Yields Remain Pressured

When yields are rising, the speed of the rise matters. When it is relatively gradual (as it has been in recent months), collateral adjustments can take place without significant disruption.

Source: TS Lombard as of 08.28.2023

Source: TS Lombard as of 08.28.2023

The reason for the rise in yields matters. In 2022 it was mainly the result of sudden changes in monetary policy expectations – combined (UK case, with botched fiscal-policy changes). This time around, the rise in yields appears to be the result, at least in part, of an improving macro outlook (top right chart) even in the face of tighter policy.

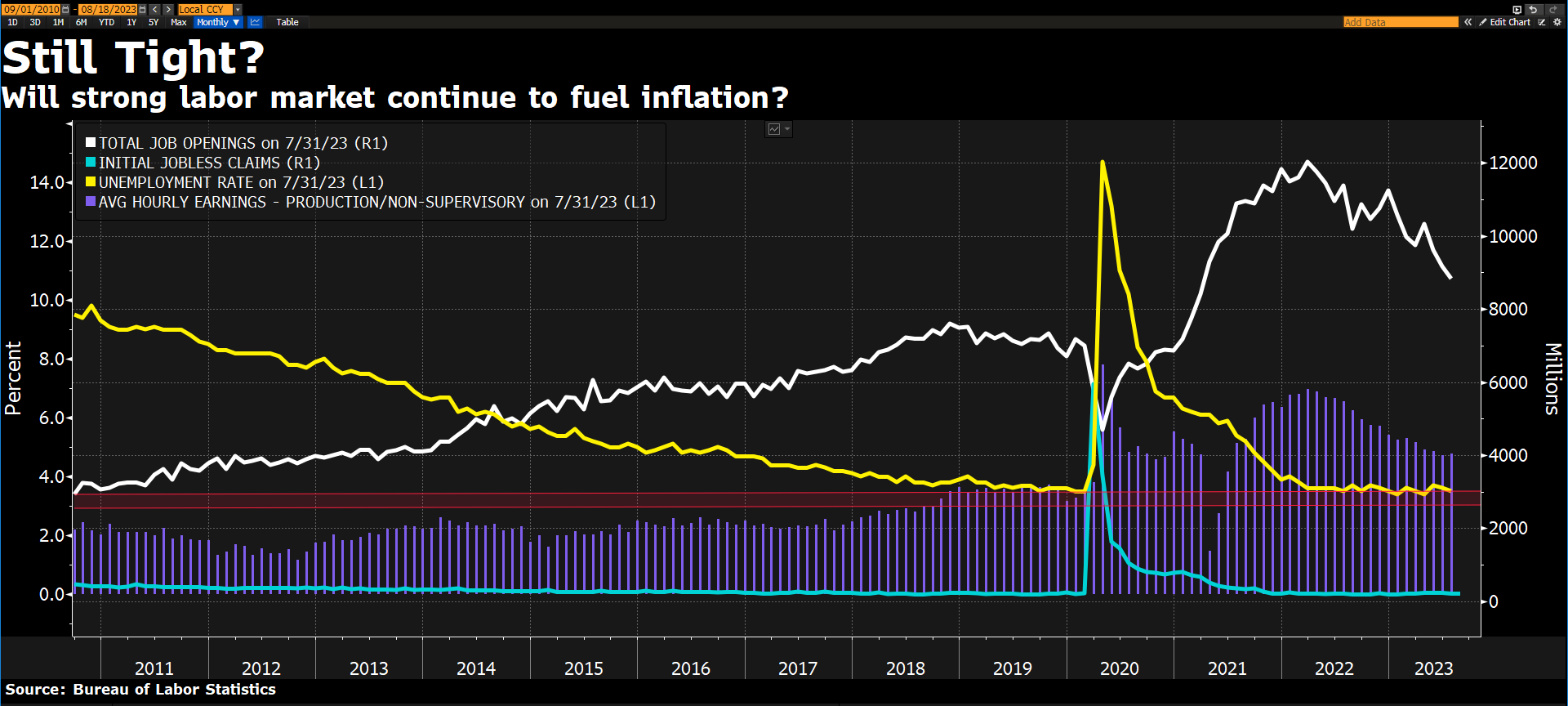

This Month’s JOLTS Point to Lower Yields?

JOLTS data has been getting quite the attention lately. On a certain level, the attention makes sense. This month’s report offered some green shoots but still points to a tight labor market.

Source: Bloomberg as of 08.29.2023

Source: Bloomberg as of 08.29.2023

Job openings declined more than expected, lowering the vacancies-to-unemployed metric the Fed closely monitors. There are 1.51 job openings for every unemployed worker, which is the lowest ratio since Sept 2021. Job openings remain 1.3m above pre-Covid highs.

The quit rate moved down to levels consistent with pre-Covid all-time highs. As for layoffs, those retreated to levels not seen before the Covid disruption. While certainly not a negative report, the reaction yesterday seemed…optimistic. Friday’s NFP Jobs number will be closely monitored by markets as we go into the holiday weekend.

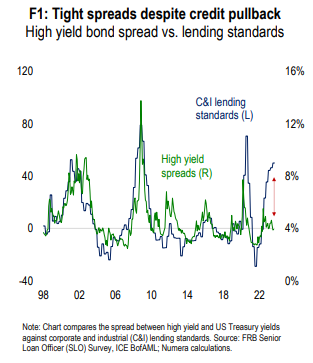

Tight Credit Spreads Despite Tighter Lending Standards

One of the more surprising outcomes throughout the normalization process has been the performance of high-yield bonds. High-yield bonds pay a higher rate of interest compared to investment-grade borrowers due to the lower quality of the borrower (higher default probability). They typically carry a shorter duration, making them less interest rate sensitive and more credit spread sensitive.

Source: Numera as of 08.29.2023

Source: Numera as of 08.29.2023

Throughout the normalization, spreads have remained contained and high-yield paper has outperformed its investment-grade brethren given the strength of the economy. As the Fed’s inflation fight continues, we expect the tightening of lending standards to eventually spill over to the high-yield market.

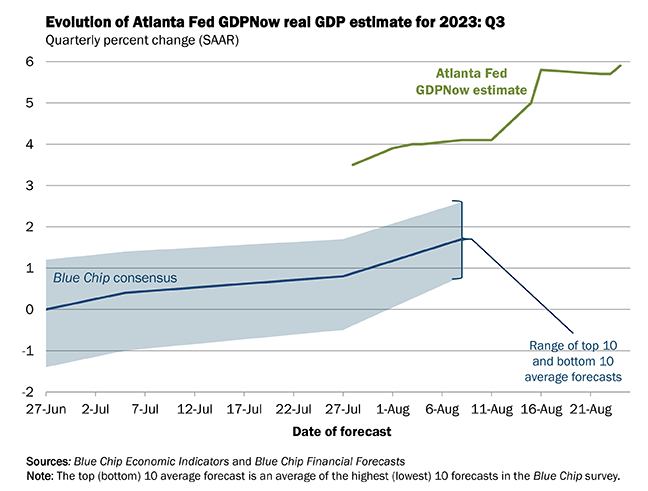

Red Hot Atlanta Fed GDPNow Estimate for Q3

The Atlanta Fed’s GDPNow model estimate for real GDP growth (seasonally-adjusted annual rate) in the third quarter of 2023 is 5.9 percent on August 24, up from 5.8 percent on August 16.

Source: ATL Fed as of 08.24.2023

Source: ATL Fed as of 08.24.2023

While this is an estimate, the economy continues to show more resilience to the Fed’s hiking campaign than economists expected.

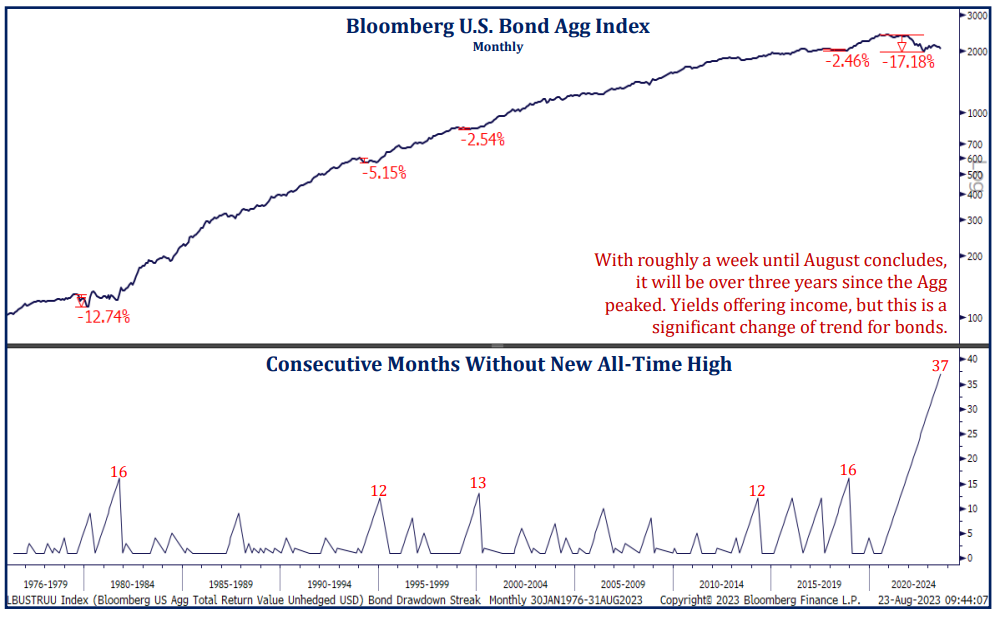

Aggregate Bond Index Dry Spell

The Bloomberg Bond Agg will cross 37-months (following August month end) without a new all-time high, easily the longest streak in its near 50-year history (16-months was the prior record).

Source: Strategas as of 08.29.2023

Source: Strategas as of 08.29.2023

Bonds are offering income today, but price appreciation from bonds remains elusive.

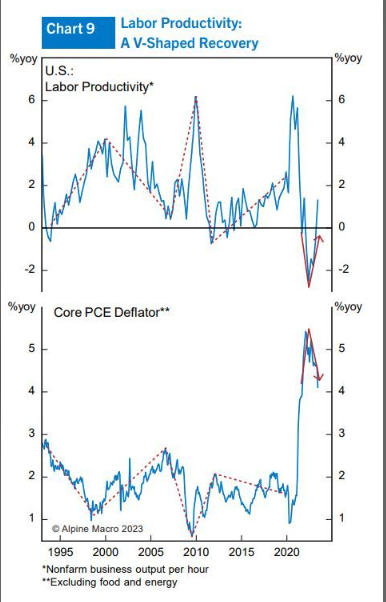

The Fed’s Hope… Improved Productivity to Help Lower Inflation

Productivity matters for inflation. Generally, we expect the productivity rate to grow over time as technology brings improvements. Governments can improve productivity by encouraging companies to invest and grow although this is a longer-term play. When a workforce is more productive it produces more goods and services, and at a lower cost per unit. This means there is a greater supply of what is being produced, putting downward pressure on prices, and lowering inflation.

Source: Alpine Macro as of 08.29.2023

Source: Alpine Macro as of 08.29.2023

Currently, economies are seeing a re-ignition of productivity which historically has helped tame wage inflation pressures, keeping inflation muted. Time will tell if this is a new trend or just a mean reversion from all the hiring the past couple of years (new workers are simply less productive).

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-24.