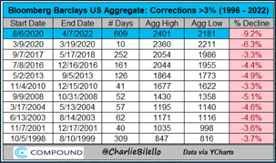

* Bonds… The Rough Stretch Continues: The Bloomberg US Aggregate Index continues the largest drawdown in its history. Since August 6th, 2020 – the end of the most recent bull market in bonds – the index has declined by -9.2%. Even after the drawdown, which was caused by a rise in interest rates, the AGG still only offers a 2.25% yield.

* Fed Minutes update: The week started off with an interview from Lael Brainard, who is considered a policy dove, where she spooked the market with her surprise support for not only a 50-bps hike in May, but also comments on the need for rapid balance sheet reduction – we believe that this was not something priced into the market. Brainard went on to say inflation is far too high with risks to the upside and she expects the combination of rate hikes and QT will move monetary policy close to neutral by the end of the year. To follow that, the FOMC minutes were delivered on Wednesday and while they weren’t a big hawkish surprise, they were overall hawkish, and they reaffirmed (again) that the Fed is serious about breaking inflation. During the last bout of QT (2017-2019) the process was relatively calm and methodical, but recent Fed commentary suggests we can toss that playbook out the window – a more Volckerish-tone. Even with the noise, the S&P 500 is only ~6% off its all-time highs despite a tightening cycle that looks to be the most hawkish we’ve seen in decades, given 40-year high inflation.

* Well Yields Have Risen, Is It Time to Buy Bonds… Updated?! Even after the sell off, we still think stocks are more attractive than bonds. Bonds in our mind have two points in a portfolio: stability & income. Given the inflationary backdrop (remember bonds are fixed cash flow assets) bonds won’t serve as the portfolio hedge most investors expect. On top of that, the income provided by bonds is still historically low. In our opinion, traditional bonds, given their record-high duration, are uninvestable until their nominal rates are > inflation, i.e., real rates are positive.

* Mortgage Rates Make Pre-Covid Highs

Mortgage rates are rising drastically as long-term Treasury rates have climbed to start ’22 making higher borrowing rates and monthly payments more expensive. For every 100bps move in mortgage rates, that requires a 10% adjustment in home prices to keep payments unchanged. This rise in mortgage rates comes in the face of 36 straight months of rising US home prices. Prices have increased by 19% over the last year and doubled over the last 10 years.

*All Data and Charts Sourced from Bloomberg LP. As of 3/24/22.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2204-8