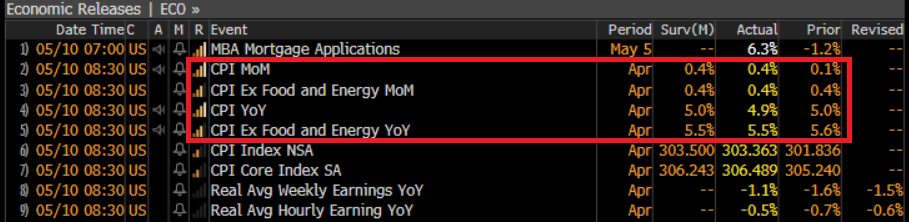

Inline CPI print with Shelter continuing to pull the index higher although some signs of slowing. Used Cars prices came in hotter than expected which have been lagging the Manheim index for most of the year. Food prices were down for the second month in a row which follows the cuts to SNAP benefits back in March. Energy prices are down 5.1% YoY, helping to lower commodity sensitive items.

Source: Bloomberg. As of 5.10.2023.

Source: Bloomberg. As of 5.10.2023.

*Core CPI MoM comes in @ 0.4% vs. 0.4% expected

*Core CPI YoY comes in @ 5.5% vs. 5.5% expected

Overall, vanilla print with nothing glaring. With MoM numbers still annualizing near 5%. It’s a positive that the Fed Funds rate is now greater than inflation. It’s unlikely this number solves much of anything, and reiterates the need to hold rates at current levels.

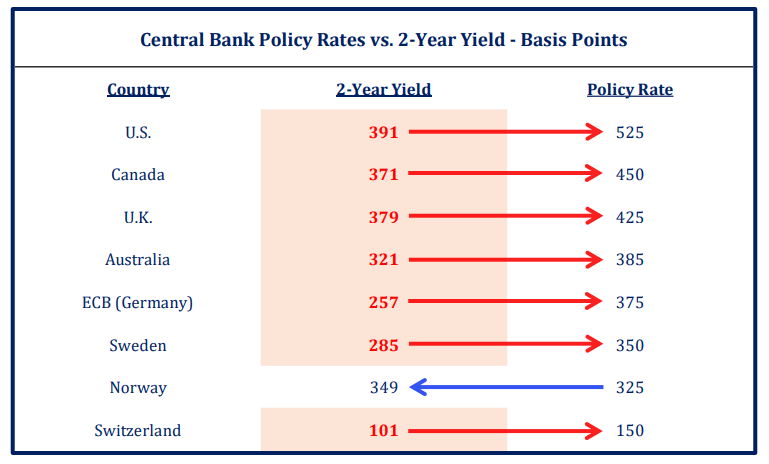

Curves are Really Inverted. 2-Year Yields well Lower than Policy Rates

Source: Strategas. As of 5.10.2023.

Source: Strategas. As of 5.10.2023.

Almost everywhere we look, 2-year yields are trading below Central Bank Policy Rates. As we are nearing the end of most hiking campaigns in the developed world, the real question is ultimately how long will rates stay elevated? Markets think inflation is last year’s problem and will quickly retrace to something more tolerable, allowing for quick rate cuts.

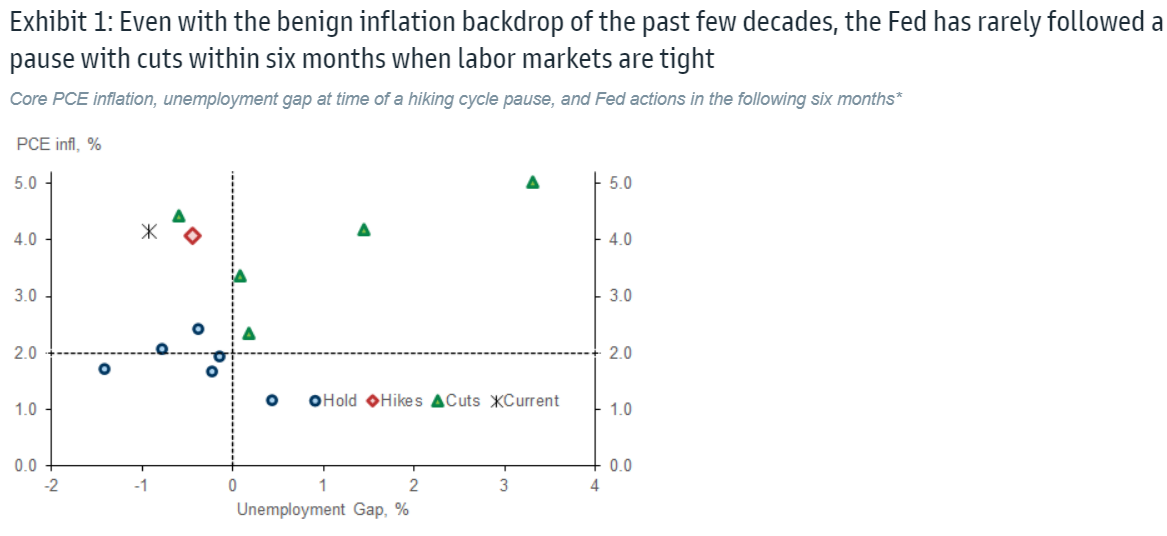

Market and Reality Likely Aren’t Aligned

Source: Goldman. As of 5.08.2023.

Source: Goldman. As of 5.08.2023.

Historically speaking, a Fed rate cut acknowledges their mission is accomplished. The Fed hikes rates to cool the economy and inflation, and cuts rates when they see evidence of their policy dragging down the real economy. Often causing a spike up in unemployment. Rate cuts almost always occur when not only are inflationary pressures not mounting but when fear of deflation creeps in.

Simply reviewing the facts, we continue to draw the conclusion the Fed shouldn’t be cutting interest rates anytime soon. The U.S. unemployment rate fell to 3.4% (matching the cycle low) in April. The participation rate was flat at 62.6%. Average hourly earnings were robust, up +0.5% MoM and 4.4% YoY.

In addition, U.S. productivity was weak in 1Q, falling -2.7% q/q. Unit labor costs (productivity adjusted wages) were up +6.3% q/q annualized (5.8% YoY). This means less work costs more money. These unit labor cost numbers remain too high for comfort.

Given that wage growth and inflation typically move together with a statistically significant relationship, the continued upward pressure on wage growth and the drop in productivity are concerning, and don’t point to imminent rate cuts.

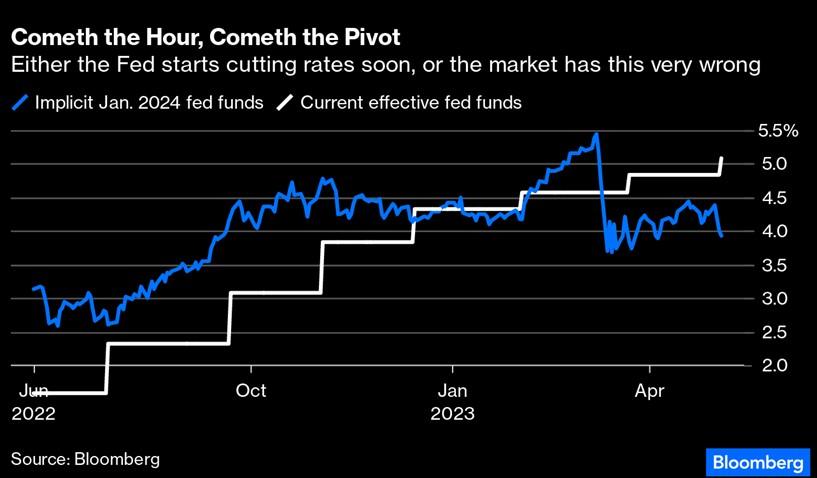

Source: Bloomberg. As of 5.09.2023

Source: Bloomberg. As of 5.09.2023

BUT… none of the above data seems to be resonating with the “Pivot” crowd. Markets continue to price in substantial rate cuts over the next 7-8 months. This is not what the Fed is communicating or what the (current) data reads to us.

While we agree the economy is slowing down, we still think the Fed has more work to do in anchoring inflation back to a 2% level. This very likely means higher for longer.

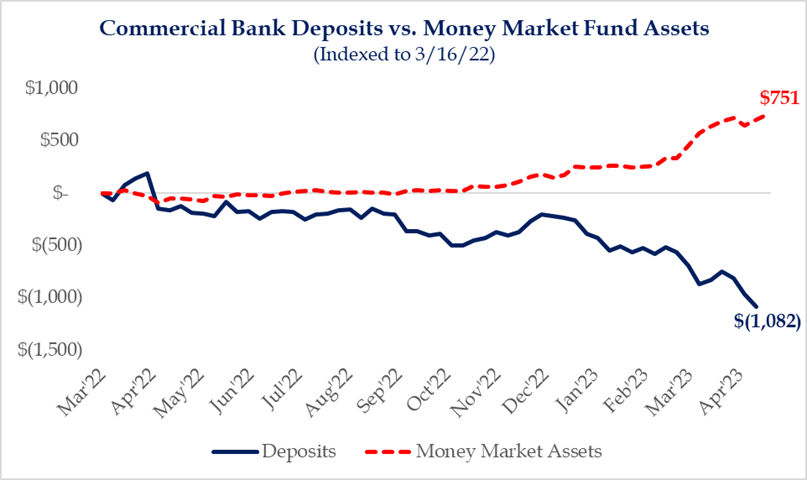

The Deposit Flight Problem Still Has Not Been Solved

Deposit flight still remains a risk for banks, as the weekly Fed data continues to show outflows. Commercial bank deposits, which yield next to nothing, have fallen by roughly -$1,082 bilion, while money market mutual funds, yielding > 4%, have taken in +$751 billion since the hiking cycle started.

With the ability to move money by the click of a button, the search for deposits seeking higher yields (and ultimately the risk of deposit flight) will likely continue. We’ve heard this phenonomon called the “Bank Walk”. While it likely takes longer than most expect to play out, implications are real.

Source: Strategas. As of 5.09.2023.

Source: Strategas. As of 5.09.2023.

BofA published data stating household savings and checking balances shows the median balance continues to be over 40% higher than the average in 2019 across all income cohorts… that is a meaningful level of interest income at a 5% rate!

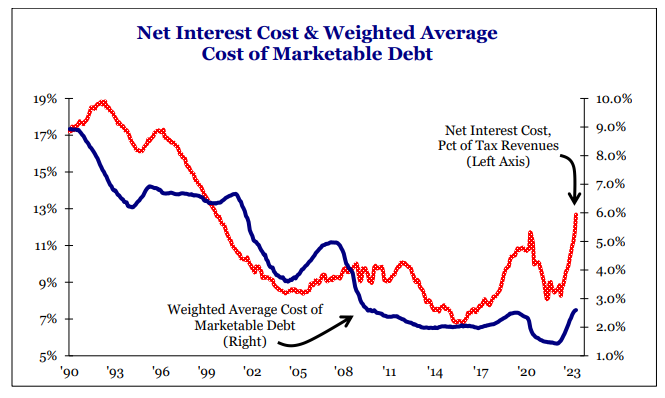

The Growth of the US Debt Load is Unsustainable… Potential Turning Point?

Source: Strategas. As of 5.09.2023.

Source: Strategas. As of 5.09.2023.

US debt servicing cost now sits at its highest level since August 1999. This may sound arcane, but the debt servicing cost is the key indicator for fiscal policy. The current 30-year trend of accommodative fiscal policy is ending.

Historically, once the US government’s net interest cost hits 14 percent of tax revenues, financial markets impose austerity on policymakers. Net interest costs as a percentage of tax revenues surged a full percentage point in April, from 11.7 to 12.7 percent.

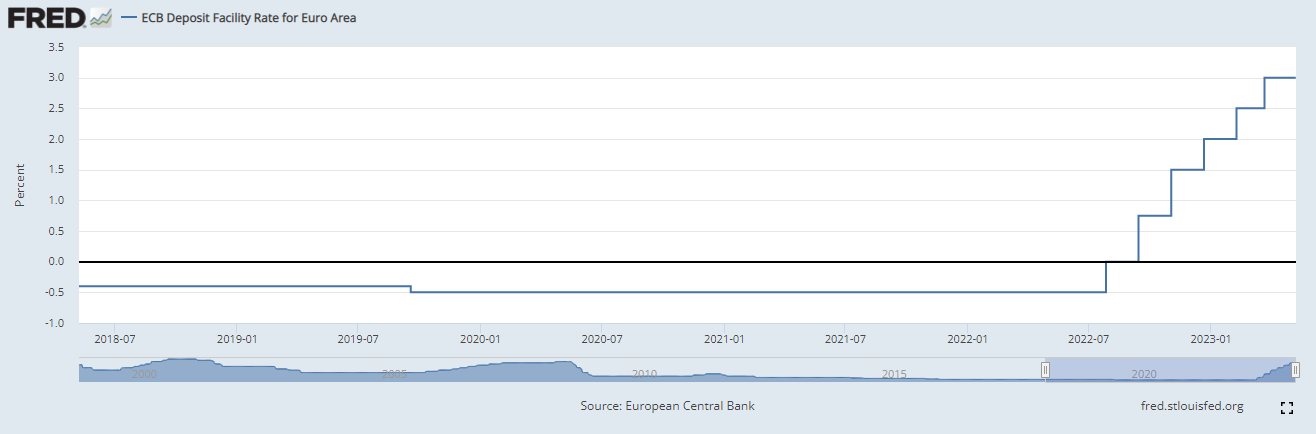

Across the Pond… The ECB Hikes Rates 25bps

Source: FRED. As of 5.07.2023.

Source: FRED. As of 5.07.2023.

The ECB delivered the seventh-rate hike in a row but shifted down to hiking in 25bps increments. The shift down to 25bp hikes does not bring the ECB closer to a pause, as it is clear that the “inflation outlook continues to be too high for too long” and that there is “more ground to cover”. So, the question remains where the ECB will stop.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2305-13.