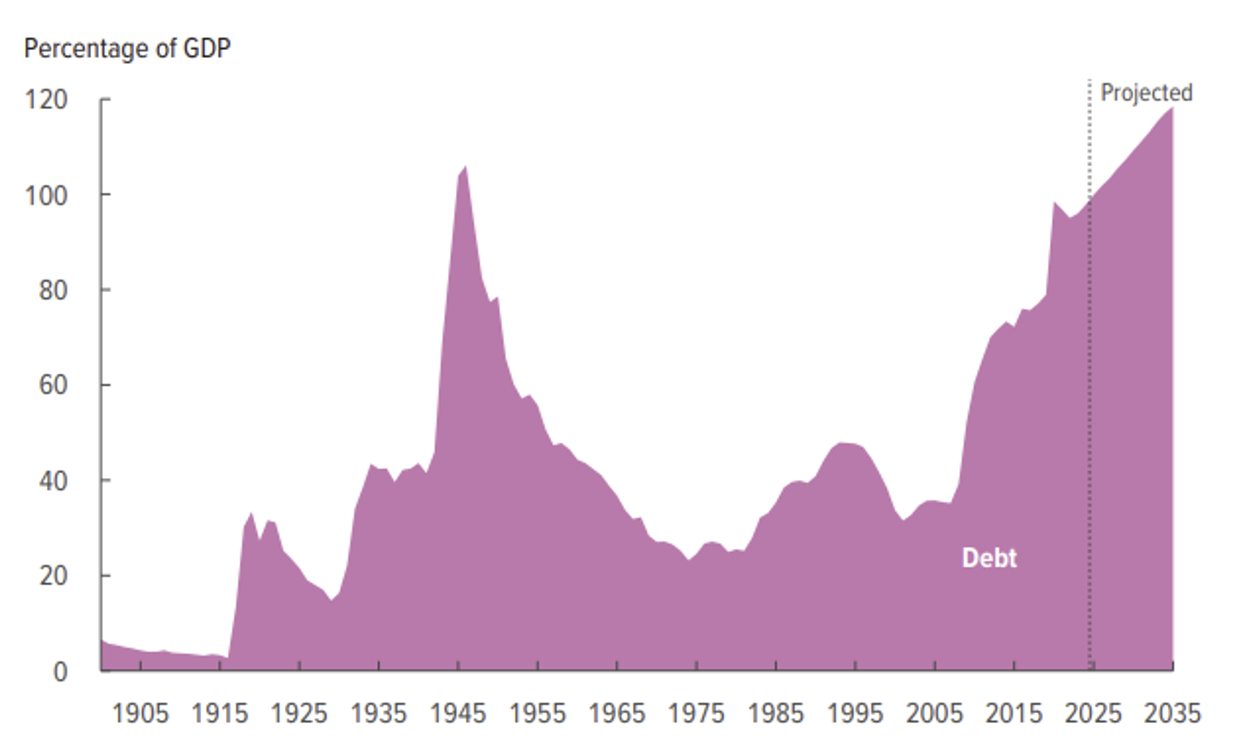

Progress on the Debt to GDP Ratios… Kinda

The CBO, a non-partisan budget agency, updated its forecasts for the U.S. budget deficits for the next 10 years. The report showed a slightly improved fiscal picture compared to its previous outlook published back in June 2024.

Source: CBO as of 01.18.2025

Source: CBO as of 01.18.2025

Debt to GDP, a key metric of a country’s fiscal health, is now estimated by 2035 to grow to 118.5% vs. the 122% in last year’s forecast. Progress maybe, but the number recently sat at 98% so not really. The CBO’s estimates are based on existing laws, and assume that the tax cuts Trump signed into law when he was president in 2017 will expire as planned at the end of this year. This could be overly optimistic given Trump’s desire to cut taxes further.

With that said, any additional deficits created by the Trump administration could reverse the progress shown in the updated CBO report. In addition, we believe the CBO is underpricing the risk of higher for longer rates.

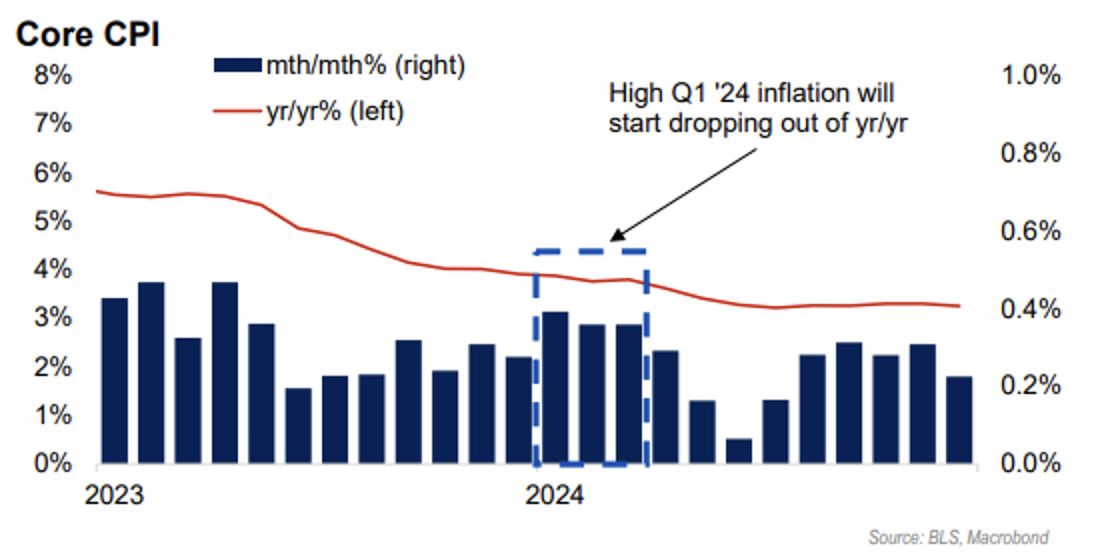

Base Effects Favorable

The Fed considers three-month annualized rates of price changes to smooth out month-to-month fluctuations and focus on the most recent months. Nonetheless, financial markets and the press are attentive to year-over-year changes that show the rate of change vs. one year ago. This calculation can overstate or understate current price pressures if inflation was unusually high or low 12 months prior (I.e., base effects).

Source: FHN Financial as of 01.18.2025

Source: FHN Financial as of 01.18.2025

Because price increases were so high in the first quarter of last year, the next three months of year-on-year changes in the core CPI should slow from December’s 3.25%. Although these so-called “base effects” do not impact the Fed’s 3-month/3-month annualized rates of change, the improvement may be interpreted by market participants as a sign of improving price pressures and potentially push more Fed speakers to temper recent hawkishness.

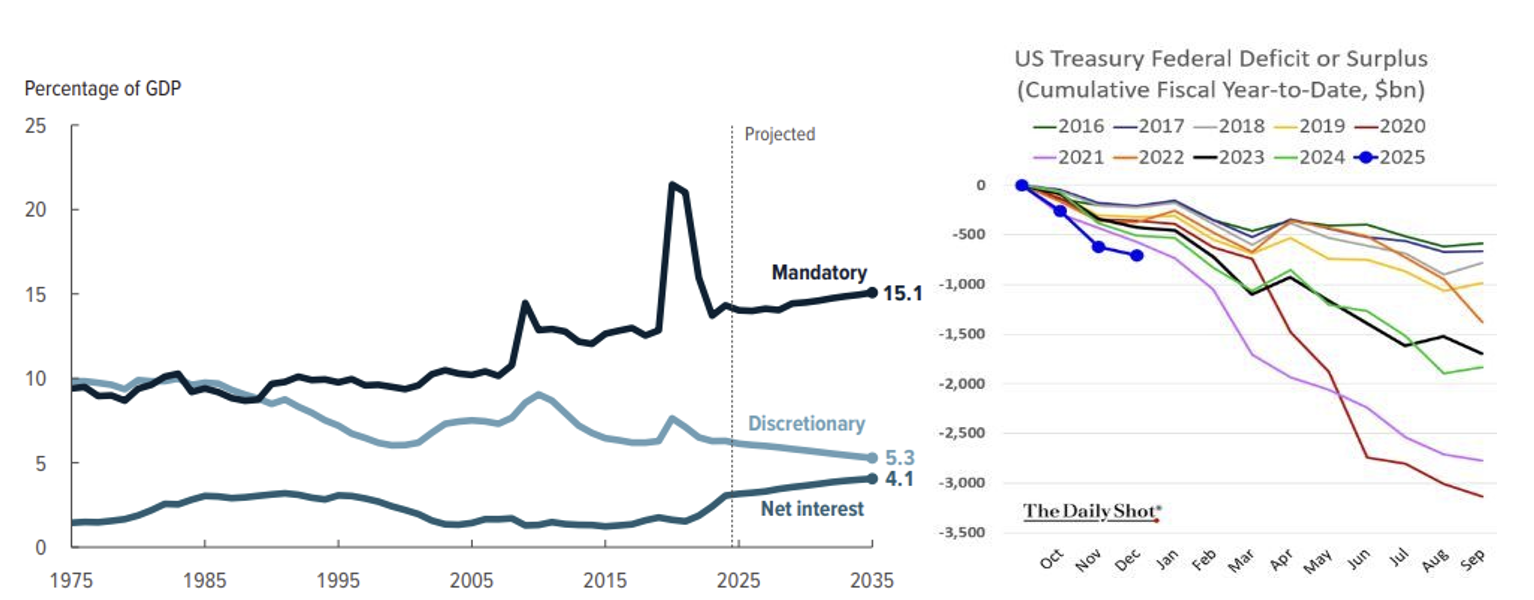

Getting a Fiscal House in Order

Scott Bessent, Trump’s pick for Secretary of Treasury, recently went through his Senate confirmation where he made some interesting points. He emphasized the importance of addressing the budget deficit, saying the US “must work to get our fiscal house in order” by adjusting domestic discretionary spending. He said that discretionary spending — outlays aside from entitlements including Social Security and Medicare — had soared by an “astonishing 40% over the past four years.”

Bessent underscored that the popular entitlement programs for older Americans aren’t going to end up on the chopping board. “I want to emphasize that President Trump has said that Social Security and Medicare will not be touched,” he said. “One of the tragedies of this blowout in the budget deficit is that we have to get our short-term house in order.”

Source: CBO/ The Daily Shot as of 01.18.2025

Source: CBO/ The Daily Shot as of 01.18.2025

This goes back to some points we’ve made on the DOGE (Department of Government Efficiency). While we are all for holding the government accountable in their stewardship of our tax dollars, it doesn’t appear that DOGE can make that big of a dent in the deficit given that much of the overspending comes from mandatory spending (Social Security, Medicare/Medicaid, Defense, Veterans Affairs, etc.) as well as the interest burden.

On a positive note, the recent improvements in projected debt to GDP highlight our thesis that the easiest way out of the backdrop is a combination of growth and inflation. It appears that the playbook will continue.

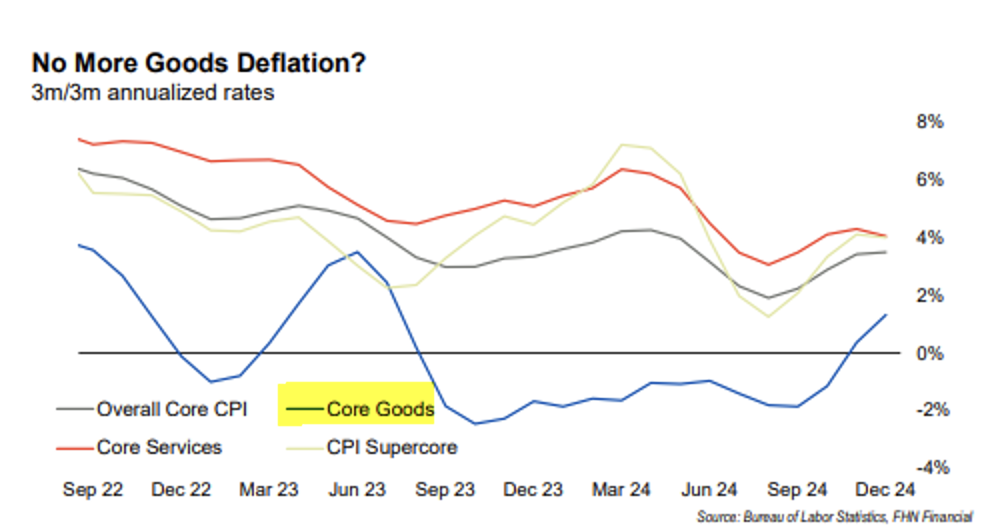

Goods Deflation Thing of the Past – For Now

The December CPI came in cooler than expected, giving bond investors a bit of good news after four straight months of stubbornly high core inflation. The improvement suggests price pressures did not get worse at the end of last year. With widespread expectations for rates to stay unchanged at the January 29 Fed meeting, financial market participants will wait to see if the upcoming months of inflation data look like the December CPI and permit additional policy easing.

The CPI rose 0.39% month-on-month and 2.9% year-on-year in December. More important for Fed policy and financial markets, the core CPI (excluding food and energy) rose just 0.22% on the month, the lowest monthly increase since August, and 3.2% year-on-year. Rising energy prices contributed to the headline rise, something the Fed feels can be volatile and outside the purview of monetary policy.

Source: FHN Financial as of 01.18.2025

Source: FHN Financial as of 01.18.2025

Although the core CPI decelerated from a 0.31% monthly change in November to 0.22% in December, the bigger picture suggests price pressures are still too high. The 3-month/3-month annualized rates of change for most of the broad CPI categories moved horizontally in December, as cool July data dropped out of the math. This measure of core CPI momentum accelerated just slightly from 3.43% to 3.51%, but momentum for core services and the super-core (core services excluding shelter) did tick down slightly.

We think the bigger story could be the acceleration of core goods inflation. These prices were deflationary for a good portion of the last few years as early pandemic capacity issues normalized, putting downward pressure on overall inflation measures. With the blue line in the chart above moving above zero in the last two months, goods prices are now working against the Fed’s mission to bring inflation down to 2%.

Shelter Inflation… Finally a Glimmer of Hope

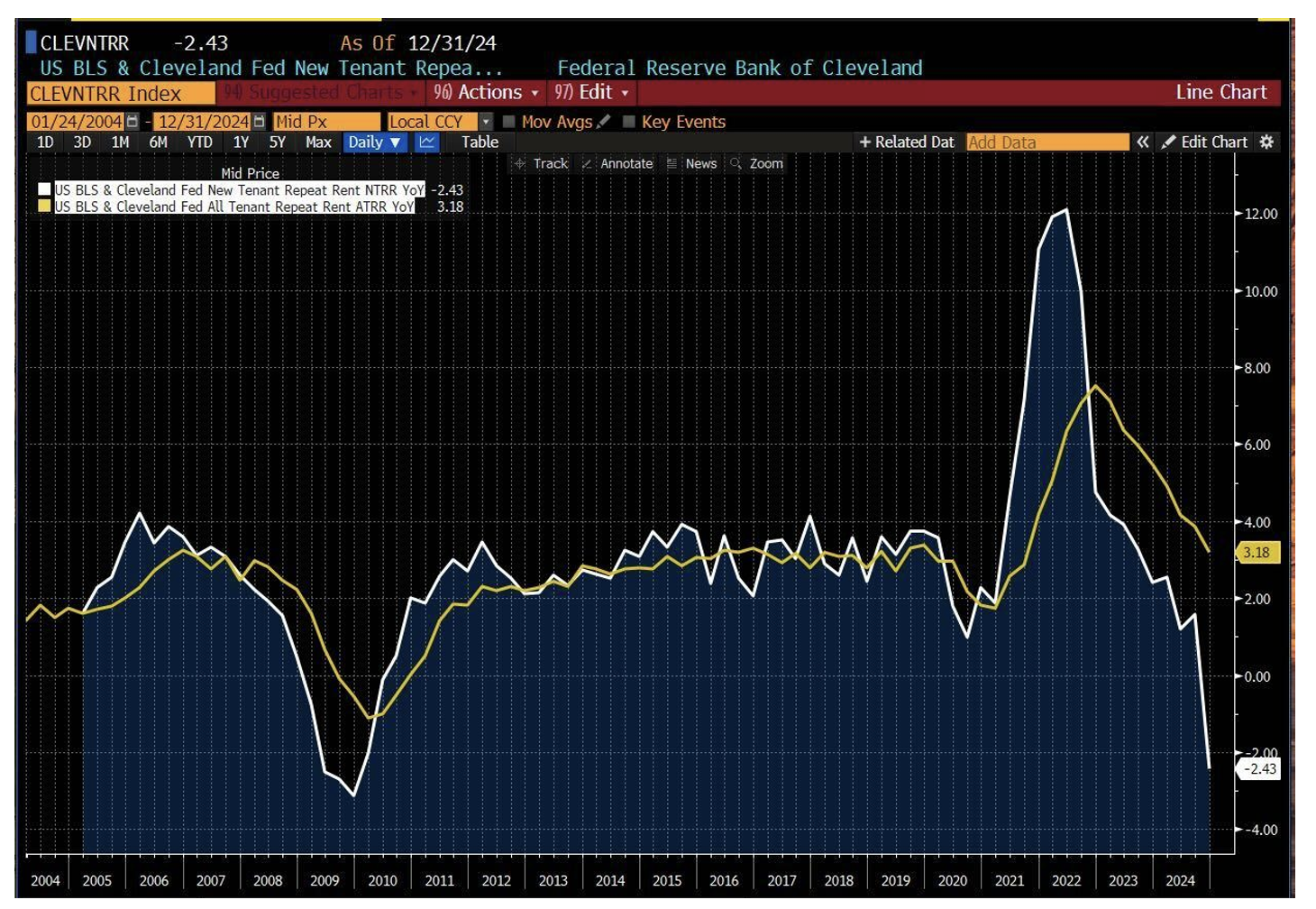

As we’ve seen over the last several years, rent growth indices often give strikingly different measurements of rent inflation. The Cleveland Fed created an index from the Bureau of Labor Statistics (BLS) microdata using a repeat-rent index methodology. They wanted to show that this discrepancy is almost entirely explained by differences in rent growth for new tenants relative to the average rent growth for all tenants.

They found that rent inflation for new tenants leads the official BLS rent inflation by four quarters. As rent is the largest component of the Consumer Price Index, this has implications for our understanding of aggregate inflation dynamics and is likely to guide Fed policy.

Source: Bloomberg as of 01.20.2025

Source: Bloomberg as of 01.20.2025

The Cleveland Fed’s “New” rents just came in at -2.43%. We assume (and per the Cleveland Fed’s 4-quarter lag assumption) that “New” rents will lead to “All” rents. This could be a game changer and reverse the course of the recent Fed hawkishness. If rents are declining, the Fed will certainly be able to lower their policy rate more than markets are currently pricing.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-40.